Aluminum Die Casting Market Size 2025-2029

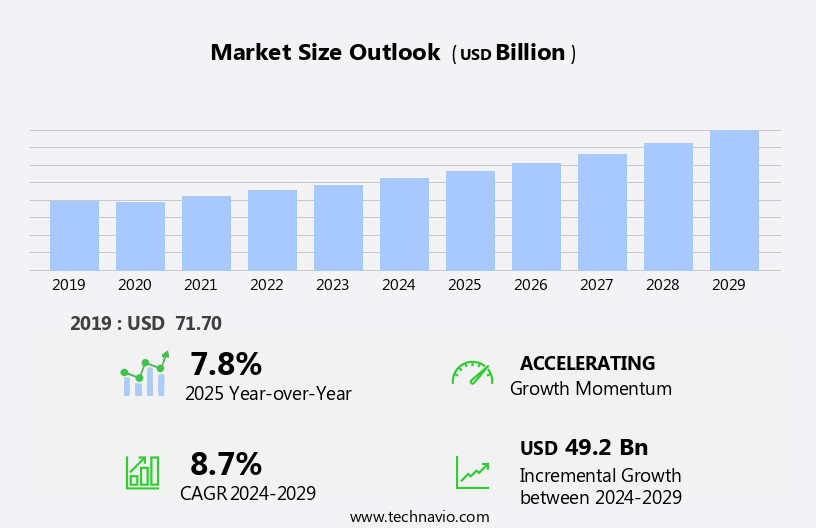

The aluminum die casting market size is forecast to increase by USD 49.2 billion at a CAGR of 8.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by its increasing adoption in the automotive industry. The lightweight and high-strength properties of aluminum die castings make them an ideal choice for automotive applications, leading to a in demand. Furthermore, the emergence of smart manufacturing and Industry 4.0 technologies is revolutionizing the production process, enhancing efficiency and reducing costs. However, the market is not without challenges. Competition from alternative materials, such as magnesium and plastic, poses a threat to aluminum die casting's market share.

- To remain competitive, market participants must focus on innovation, cost optimization, and delivering superior quality products. Companies that successfully navigate these challenges and capitalize on the opportunities presented by the automotive industry and Industry 4.0 technologies stand to gain significant market share and revenue growth.

What will be the Size of the Aluminum Die Casting Market during the forecast period?

- The market in the United States continues to experience significant activity, driven by the growing demand for lightweight and high-performance components in various industries. Thin wall casting, a key trend in this market, enables the production of intricate and complex parts with reduced material usage and improved fuel efficiency. Competitive advantage is achieved through continuous improvement, including the adoption of advanced technologies such as thermal spraying and non-destructive testing. Market intelligence indicates that casting machines with higher productivity and precision, integrated quality management systems, and user-friendly casting software are in high demand. Process optimization through mold flow analysis, lean six sigma, and simulation software also contribute to market growth. . Key applications include the production of housings, brackets, fittings, and various auto parts.

- Sustainability initiatives, such as green manufacturing and supply chain resilience, are increasingly important, with a focus on reducing carbon footprint and minimizing product obsolescence. Intellectual property protection and technology licensing are also key considerations in this competitive landscape. The market is characterized by the use of various inspection equipment, including dimensional inspection, corrosion testing, and material testing, to ensure product quality and meet customer requirements. Surface inspection, shot peening, and powder coating are essential for enhancing product durability and appearance. Market dynamics are influenced by the product life cycle, with a focus on high volume production and the adoption of advanced technologies to meet evolving customer needs. Aluminum die casting is also gaining traction in other industries, including telecommunications, construction, and industrial manufacturing, due to its excellent thermal conductivity and fuel economy benefits.

How is this Aluminum Die Casting Industry segmented?

The aluminum die casting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive

- Heavy machinery and industrial

- Aerospace and defense

- Construction

- Others

- Type

- High pressure

- Low-pressure

- Vacuum

- Gravity

- Squeeze

- Method

- Hot chamber

- Cold chamber

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- North America

- US

- Canada

- Middle East and Africa

- South America

- APAC

By Application Insights

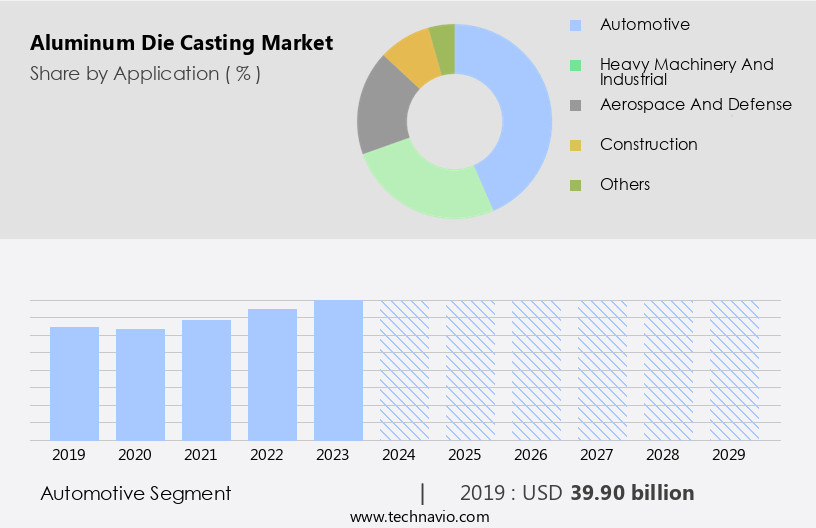

The automotive segment is estimated to witness significant growth during the forecast period. The high-pressure die casting process is a significant contributor to the manufacturing industry, accounting for approximately 30%-35% of components in an automobile, primarily made of aluminum alloys. This process is preferred due to its ability to create lightweight parts with high material strength and dimensional accuracy, making it an ideal choice for producing complex shapes. The demand for aluminum die-cast parts has been on the rise across various sectors, including automotive, aerospace, electronic components, and machinery components, due to their energy efficiency and corrosion resistance. Technological advancements and innovations have further fueled the adoption of high-strength and lightweight aluminum castings, particularly in the automotive sector. The emergence of smart manufacturing and Industry 4.0 is the upcoming market trend. The market is experiencing significant transformation due to the adoption of smart manufacturing and Industry 4.0.

These advancements enable the production of components with enhanced technical specifications and improved design optimization, resulting in value engineering and cost optimization. Key players in the market are focusing on enhancing their product offerings and capturing a larger market share by investing in research and development, quality assurance, and smart manufacturing techniques such as lean manufacturing and just-in-time production. Additionally, the adoption of digital manufacturing, casting process improvements, and industry standards like design for manufacturing and product development are crucial to maintaining manufacturing efficiency and ensuring dimensional accuracy. Environmental regulations also play a role in the market's growth, as aluminum alloys are considered a sustainable alternative to traditional materials like steel and iron.

The market's future outlook is promising, with potential applications in medical devices, consumer products, and 3D printing, among others. However, casting defects and material cost remain challenges that manufacturers must address to ensure consistent product quality and cost optimization. Applications include engine blocks, gearbox cases, structural pieces, housings, brackets, frames, mounting brackets, wind power generating, solar power generating, and various consumer electronics.

Get a glance at the market report of share of various segments Request Free Sample

The Automotive segment was valued at USD 39.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

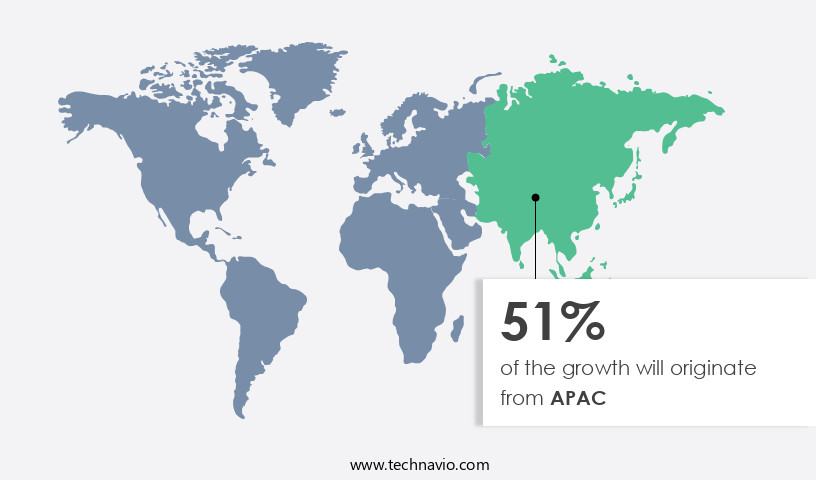

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by several factors, with the Asia Pacific region leading the growth due to the increasing use of aluminum in various industries, particularly transportation and telecommunication. The demand for high-strength and lightweight castings is a significant factor fueling market expansion. In the transportation sector, manufacturers prioritize the production of fuel-efficient vehicles that meet stringent emissions regulations, which can be achieved through the use of aluminum in vehicle components. Additionally, the region's availability of low-cost skilled labor makes it an attractive destination for industrial manufacturing, including automotive production. Other factors contributing to market growth include the emphasis on energy efficiency, surface finishing, and quality assurance.

In the manufacturing process, gravity die casting, just-in-time production, and lean manufacturing are key techniques used to optimize cost and improve manufacturing efficiency. Market dynamics are further influenced by factors such as material cost, design optimization, and value engineering. Environmental regulations also play a role in market growth, with a focus on sustainable manufacturing practices and the adoption of digital manufacturing technologies, such as 3D printing and CNC machining. The market caters to various industries, including aerospace, electronic components, machinery components, medical devices, and consumer products, among others. Casting defects and corrosion resistance are critical concerns in the market, necessitating ongoing research and development in die design, mold design, and heat treatment.

The market is expected to continue growing due to the increasing demand for lightweight design, casting process optimization, production volume, and product standardization. Smart manufacturing and lean manufacturing techniques are also expected to gain traction, enabling increased dimensional accuracy and design for manufacturing. Industry standards and technical specifications continue to evolve, requiring ongoing investment in research and development to stay competitive. Customer service and product lifecycle management are essential components of the market, ensuring that manufacturers meet the evolving needs of their clients.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aluminum Die Casting Industry?

- Growing use of aluminum die casting in automotive industry is the key driver of the market. The global aluminum die-casting market has experienced significant growth due to the increasing demand for energy-efficient and lightweight vehicles in various industries. Aluminum's optimal corrosion resistance, durability, aesthetic appeal, and low weight have made it a popular choice for automotive manufacturers, leading to the replacement of iron and steel with aluminum die-cast products. Furthermore, aluminum's beneficial characteristics, such as good electrical and thermal conductivity, lightweight, complete recyclability, competitive cost, and attractive appearance, have also influenced its demand. Sustainability and energy efficiency are crucial factors driving the market's expansion during the forecast period. The aluminum die-casting process offers several advantages, including reduced production time, improved product quality, and cost savings, making it an attractive option for manufacturers. Overall, the global aluminum die-casting market is poised for continued growth due to these key factors.

What are the market trends shaping the Aluminum Die Casting Industry?

- Emergence of smart manufacturing and industry 4.0 is the upcoming market trend. The market has been significantly influenced by the adoption of smart manufacturing and Industry 4.0 technologies. These advancements have revolutionized the production process by integrating digital technologies and data-driven processes to enhance efficiency, quality, and responsiveness. Real-time data is collected from die casting machines, molds, and production processes using smart sensors and IoT devices. This data is analyzed to monitor variables such as temperature, pressure, and cycle times, enabling proactive adjustments to maintain consistency and optimize production. Smart manufacturing also integrates automated inspection processes with data analysis to detect defects and variations. Algorithms identify deviations from expected outcomes, ensuring high product quality and reducing the need for manual intervention. This digital transformation in the aluminum die casting industry is expected to continue driving market growth and innovation.

What challenges does the Aluminum Die Casting Industry face during its growth?

- Competition from other materials is a key challenge affecting the industry growth. The market encounters stiff competition from other materials, necessitating differentiation and the demonstration of aluminum's unique advantages. Lightweight alternatives such as composites, plastics, and magnesium alloys offer weight reduction benefits, making them appealing in applications where weight savings are crucial. Steel alloys and advanced polymers provide high strength and durability, making them attractive options in applications where structural integrity is essential. Stainless steel and corrosion-resistant polymers are preferred when components are exposed to harsh environments, offering competitive alternatives in situations where aluminum's corrosion resistance is a primary concern. Aluminum die casting must highlight its benefits, including high fluidity, dimensional accuracy, and the ability to produce complex shapes, to maintain its market position.

Exclusive Customer Landscape

The aluminum die casting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aluminum die casting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aluminum die casting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alcast Technologies Ltd. - The company specializes in aluminum die casting, providing innovative solutions for automated flaskless moulding, squeezer moulding, and air set moulding processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcast Technologies Ltd.

- Aludyne Inc.

- Amsted Industries Inc.

- Buhler AG

- BUVO Castings BV

- Chicago White Metal Casting Inc.

- Dynacast

- Endurance Technologies Ltd.

- Georg Fischer Ltd.

- Gibbs International Inc.

- IBEX ENGINEERING Pvt. Ltd.

- Madison Kipp Corp.

- Martinrea Honsel Germany GmbH

- Phb Inc.

- Ryobi Ltd.

- Sandhar Technologies Ltd.

- Sundaram Clayton Ltd.

- Sunrise Metal

- Toyota Motor Corp.

- Walbro LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production of metal parts using a die casting machine. This process involves injecting molten metal into a mold, which is then cooled and solidified to form the desired shape. Aluminum is a popular material for die casting due to its desirable properties, including high material strength, excellent corrosion resistance, and good thermal conductivity. One significant factor influencing the die casting market is the increasing demand for lightweight components in various industries. The aerospace sector, for instance, relies heavily on die casting for manufacturing lightweight yet parts for aircraft structures. Similarly, the automotive industry leverages die casting for producing engine components, transmission housings, and other parts that require high strength and dimensional accuracy.

Another trend shaping the die casting landscape is the emphasis on energy efficiency and cost optimization. Die casting processes like gravity die casting and sand casting are being replaced with more advanced techniques such as smart manufacturing and lean manufacturing. These methods enable significant reductions in energy consumption and raw material waste, making them more cost-effective and environmentally friendly. Quality assurance is another crucial aspect of the market. Ensuring consistent product quality is essential to meet industry standards and customer expectations. Advanced technologies like digital manufacturing and 3D printing are being integrated into the die casting process to improve product development and design optimization.

Supply chain management plays a vital role in the die casting industry. Just-in-time production and global sourcing are common practices that help maintain manufacturing efficiency and reduce costs. However, supply chain disruptions can significantly impact production volumes and delivery schedules. To mitigate this risk, companies are investing in alternative supply sources and implementing contingency plans. The die casting market is also influenced by various regulations, including environmental and technical specifications. Compliance with these regulations can be costly and time-consuming, leading to increased material and production costs. Additionally, the increasing adoption of additive manufacturing and CNC machining for producing complex parts is posing a threat to the traditional die casting industry.

Value engineering and design optimization are essential strategies for companies to remain competitive in the aluminum die casting market. By focusing on cost optimization and product standardization, companies can reduce production costs and improve overall efficiency. Reverse engineering and technical specifications are also crucial for ensuring the highest possible product quality and meeting customer requirements. The die casting market is a dynamic and evolving industry that is influenced by various factors, including material cost, manufacturing efficiency, product development, and regulatory compliance. Companies that can adapt to these trends and challenges while maintaining a focus on quality and innovation will be well-positioned for success.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 49.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

China, India, US, Germany, Japan, South Korea, France, Canada, Australia, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aluminum Die Casting Market Research and Growth Report?

- CAGR of the Aluminum Die Casting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aluminum die casting market growth of industry companies

We can help! Our analysts can customize this aluminum die casting market research report to meet your requirements.