Aluminum Doors And Windows Market Size 2024-2028

The aluminum doors and windows market size is forecast to increase by USD 12.45 billion at a CAGR of 3.86% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The rise in construction activities, both residential and commercial, is driving market demand. Additionally, the increasing trend of renovations in existing buildings is contributing to market growth. However, the market is also facing challenges from the volatility in prices of aluminum, which can impact the cost-effectiveness of these products. Despite this, the long-term outlook for the market remains positive, with increasing adoption of aluminum doors and windows for their durability, energy efficiency, aesthetic appeal, and integration with AI driven smart home technologies. The market is expected to continue its growth trajectory, offering opportunities for manufacturers and suppliers in the coming years.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production, sales, and installation of aluminum framed doors and windows. This market is driven by the growing demand for sustainable materials in building construction projects, with aluminum's recyclable nature making it an attractive choice. Energy efficiency and thermal efficiency are key considerations, with insulating qualities, thermal break technology, low-e glass, and multichambered profiles all contributing to improved performance. Sustainable building methods and energy regulations are also major factors, leading to the increased adoption of solid core aluminum doors and windows. The market spans various product types, including swinging doors and windows, and mechanism types, catering to both new construction and home remodeling projects.

- The tourism sector is a significant end-user, as aluminum's aesthetic appeal and durability make it an ideal choice for high-traffic facilities. Aluminum's low carbon footprint further enhances its appeal In the context of sustainable development.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Residential

- Commercial

- Type

- Doors

- Windows

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- Japan

- South America

- Middle East and Africa

- North America

By End-user Insights

- The residential segment is estimated to witness significant growth during the forecast period.

The residential segment dominates The market, driven by urbanization and the resulting demand for new housing constructions. In regions like APAC and Europe, where urban populations are expanding, the need for sustainable and energy-efficient building solutions, including aluminum doors and windows, is increasing. These products offer several advantages, such as thermal efficiency, insulating qualities, and energy savings through low-e glass and multichambered profiles. Aluminum's recyclability aligns with sustainable building methods and regulations, making it an eco-friendly choice for home remodeling and construction projects. The affordability of aluminum, combined with its strength and versatility, makes it a popular option for various product types, including exterior doors, patio doors, sliding windows, bi-fold windows, and tilt-and-turn windows. Product advancements continue to enhance the performance and aesthetics of aluminum doors and windows, catering to the evolving needs of the home remodeling sector and the tourism industry.

Get a glance at the Aluminum Doors And Windows Industry report of share of various segments Request Free Sample

The residential segment was valued at USD 32.43 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

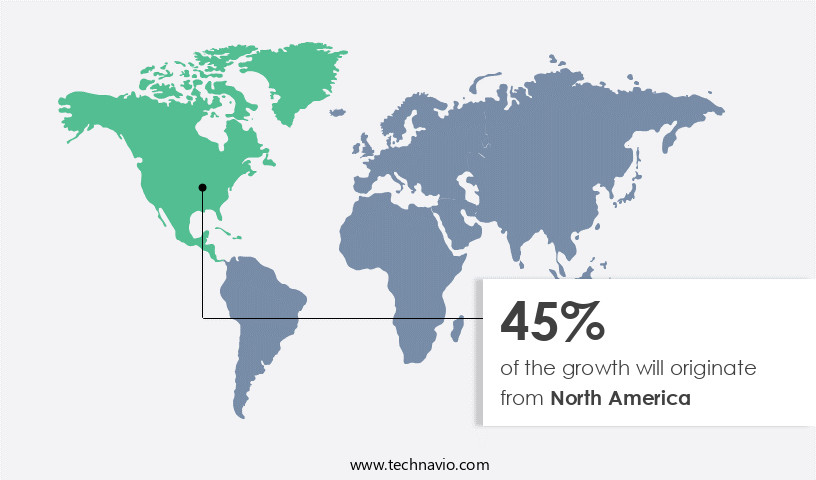

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market expansion is driven by rising consumer disposable income, leading to increased investments in home renovations. This trend is most prominent In the residential sector, where homeowners prioritize durable and visually appealing aluminum products. The preference for aluminum doors and windows is due to their energy efficiency, thermal efficiency, insulating qualities, and the availability of advanced features such as low-e glass and multichambered profiles. Sustainable building methods and energy regulations further boost market growth. Aluminum's affordability, sustainability, and eco-friendliness make it a popular choice for home remodeling projects. Product advancements In the form of the Sheerline Prestige range, Aparna Enterprises' Alteza brand, PGT Innovations, and Eco Window Systems contribute to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aluminum Doors And Windows Industry?

Rise in construction activities is the key driver of the market.

- Rise in construction activities is notably driving market growth. Aluminum doors and windows have gained significant popularity in the building construction industry due to their sustainable properties and energy efficiency. Aluminum Windows and doors offer excellent insulating qualities, making them an ideal choice for both residential and commercial applications.

- Moreover, sustainable materials, such as aluminum, are increasingly being used in sustainable building methods to reduce the carbon footprint of construction projects and infrastructure spending. Aluminum doors and windows come in various product types, including solid core and hollow core, and mechanism types, such as swinging, sliding, bi-fold, and patio doors. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Aluminum Doors And Windows Industry?

Increasing trend of renovations of residential and commercial buildings is the upcoming market trend.

- Increasing trend of renovations of residential and commercial buildings is the key trend in the market. Aluminum doors and windows have gained significant popularity in the building construction industry due to their sustainable materials and energy efficiency. Aluminum windows offer excellent insulating qualities through multichambered profiles and low-e glass, ensuring thermal efficiency and reducing energy consumption.

- Moreover, sustainable building methods have become a priority in today's world, with aluminum doors and windows being eco-friendly and recyclable. In the window market, brands like Marvin, Bradnam's Windows, Fenesta, and Alteza Aluminum Windows lead the way with innovative designs and technology. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does the Aluminum Doors And Windows Industry face during its growth?

Volatility in prices of aluminum is a key challenge affecting the industry growth.

- Volatility in prices of aluminum is the major challenge that affects the growth of the market. Aluminum doors and windows have gained significant popularity in the building industry due to their sustainable properties and energy efficiency. Aluminum Windows and doors offer excellent insulating qualities, making them an ideal choice for sustainable building methods.

- Moreover, these products are manufactured using Low-E glass and multichambered profiles, which enhance thermal efficiency and reduce energy consumption. Sustainability is a key focus in today's construction investments and infrastructure spending, particularly in the tourism sector. Hence, the above factors will impede the growth of the market during the forecast period.

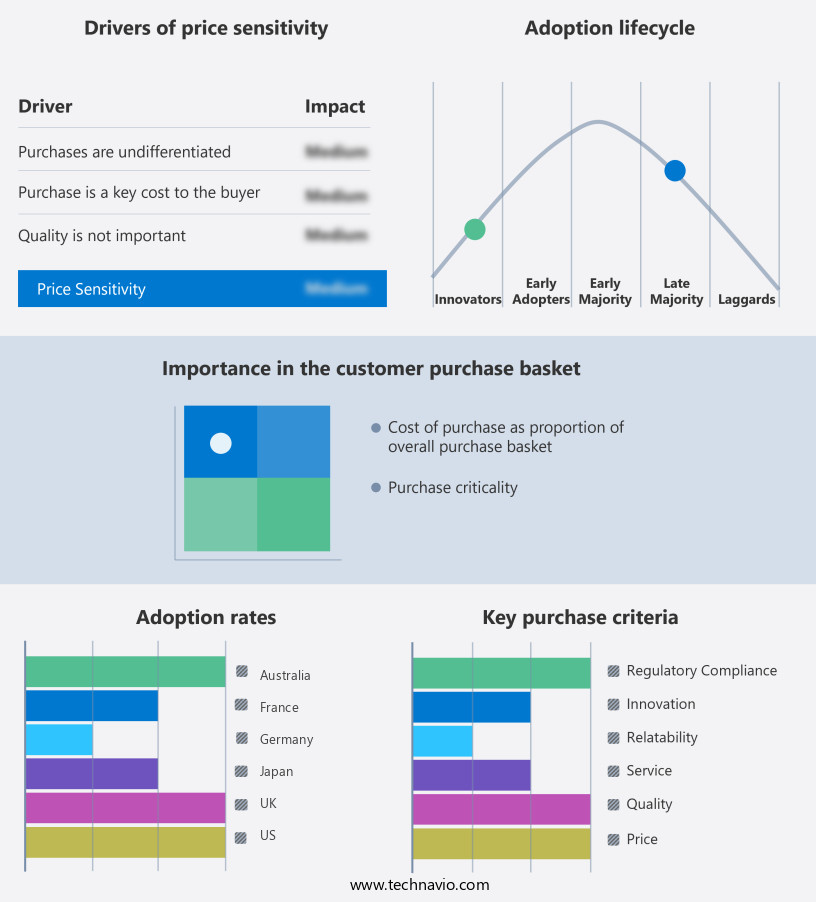

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALUK

- ANDERSEN Corp.

- Aparna Enterprises Ltd.

- Apogee Enterprises Inc

- Arconic Corp.

- Bradnams Windows and Doors

- Fenesta

- Fletcher Building Ltd.

- G.I.T. Portes Et Fenetres Ltd.

- Geeta Aluminium

- GUANGZHOU HOMI ALUMINIUM CO.LTD

- Hindalco Industries Ltd.

- LIXIL Corp.

- Marvin

- Norsk Hydro ASA

- PGT INNOVATIONS

- profine GmbH

- Weru Windows Blackpool Ltd

- Xingfa Aluminium Holdings Ltd.

- YKK Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aluminum doors and windows have gained significant traction In the building industry due to their numerous advantages. These building solutions offer superior sustainability, energy efficiency, and thermal insulation, making them an ideal choice for both residential and commercial applications. Sustainability is a key factor driving the growth of the market. The use of aluminum in construction projects contributes to a smaller carbon footprint, as the material is 100% recyclable. Furthermore, the production of aluminum requires less energy compared to other materials, such as wood or vinyl. This makes aluminum doors and windows a more eco-friendly alternative. Energy efficiency is another critical factor fueling the demand for aluminum doors and windows.

In addition, their insulating qualities, enhanced by low-e glass and multichambered profiles, help maintain consistent indoor temperatures, reducing the need for excessive heating or cooling. This not only leads to energy savings but also contributes to a more comfortable living or working environment. The adoption of aluminum doors and windows is also influenced by energy regulations. As governments and organizations focus on reducing carbon emissions and promoting sustainable building methods, the demand for energy-efficient building solutions is increasing. Aluminum doors and windows, with their excellent insulation properties, are well-positioned to meet these requirements. Affordability is another significant factor contributing to the growth of the market.

Despite their initial investment cost, their long-term benefits, such as energy savings and durability, make them a cost-effective choice for homeowners and businesses. Additionally, the affordability of aluminum makes it an attractive option for affordable housing projects. Product advancements In the market continue to drive innovation. Companies are focusing on developing new product types, such as solid core and hollow core doors, and mechanism types, including swinging, sliding, bi-fold, and tilt-and-turn windows. These advancements cater to the diverse needs of customers and provide better functionality and aesthetics. The home remodeling sector is another key market for aluminum doors and windows.

Furthermore, as homeowners look to update their properties, they are increasingly choosing sustainable and energy-efficient solutions. Aluminum doors and windows offer the perfect blend of style, functionality, and sustainability, making them a popular choice for home remodeling projects. The tourism sector is also embracing the use of aluminum doors and windows. With a focus on sustainability and energy efficiency, hotels and resorts are turning to aluminum doors and windows to reduce their carbon footprint and provide guests with comfortable, energy-efficient accommodations. With continuous product advancements and a focus on innovation, aluminum doors and windows are set to remain a popular choice for both residential and commercial applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.86% |

|

Market growth 2024-2028 |

USD 12.45 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.09 |

|

Key countries |

US, Germany, France, Japan, UK, and Australia |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Aluminum Doors And Windows industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.