Animal Genetics Market Size 2024-2028

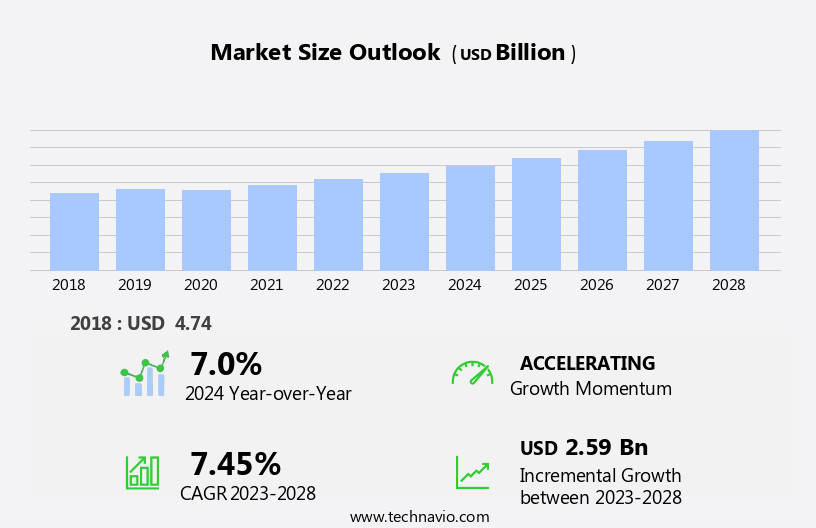

The animal genetics market size is forecast to increase by USD 2.59 billion, at a CAGR of 7.45% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for genetic testing services for companion animals. Companies specialize in advanced animal genetics services, offering a comprehensive range of tests including DNA sequencing, disease diagnostics, and DNA genotyping for exotic avian species. This trend is driven by pet owners seeking to ensure the health and wellbeing of their pets through early detection and prevention of genetic disorders. Additionally, advancements in genetic research and technology are enabling more accurate and accessible testing, further fueling market growth. However, the market faces challenges as well. The animal genetics industry is witnessing a rise in mergers and acquisitions among companies, leading to increased competition and consolidation. Furthermore, stringent regulations on animal genetic products pose significant challenges for market participants.

- Ensuring compliance with these regulations can be costly and time-consuming, requiring substantial resources and expertise. Companies must navigate these regulatory hurdles while also staying abreast of the latest scientific advancements and consumer trends to remain competitive in the market. To capitalize on opportunities and overcome challenges, market players must focus on innovation, regulatory compliance, and strategic partnerships.

What will be the Size of the Animal Genetics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in genomic selection, quantitative genetics, and next-generation sequencing (NGS). These technologies enable the identification and manipulation of polygenic traits, gene expression, and genetic markers, revolutionizing genetic improvement in various sectors. Livestock production, including beef and dairy cattle, benefits from these innovations through gene editing, genetic diversity management, and breeding programs. Genetic engineering, with its applications in transgenic animals and gene mapping, further expands the potential for genetic improvement. Massively parallel sequencing and SNP genotyping facilitate the analysis of large datasets, enhancing marker-assisted selection (MAS) and population genetics. Fish farming and embryo transfer are among the sectors adopting these technologies, with genetic databases and pedigree analysis playing crucial roles in their implementation.

Inbreeding depression is mitigated through embryo cryopreservation, sperm cryopreservation, and artificial insemination. The ongoing unfolding of market activities underscores the continuous dynamism of the animal genetics industry, with its applications shaping the future of livestock production and beyond.

How is this Animal Genetics Industry segmented?

The animal genetics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Research centers

- Hospitals and clinics

- Diagnostic centers

- Solution

- Live animal

- Genetic testing services

- Genetic materials

- Animal

- Bovine

- Porcine

- Bovine

- Porcine

- Technology

- PCR

- NGS

- rDNA

- Microarray Technology

- PCR

- NGS

- rDNA

- Microarray Technology

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South Africa

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

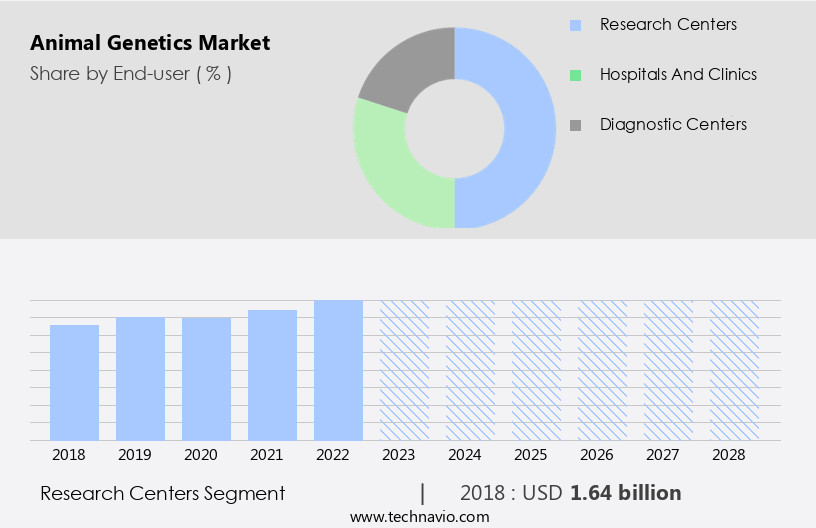

The research centers segment is estimated to witness significant growth during the forecast period.

Animal genetics plays a pivotal role in advancing livestock production and fish farming through diagnostic tests and potential therapies for disease intervention. Genetic research, including genomic selection, genetic engineering, linkage analysis, and gene mapping, contributes to the creation of genomic databases for pathogens, driving demand for genetic testing products. Quantitative genetics, gene expression, and population genetics enable a better understanding of animal health risks and breeding programs. Next-generation sequencing (NGS) and massively parallel sequencing technologies facilitate the discovery of genetic markers for genetic improvement. Transgenic animals and marker-assisted selection (MAS) are essential tools for breeding programs, while pedigree analysis and genotyping-by-sequencing (GBS) enhance genetic diversity.

In livestock production, technologies like embryo transfer, embryo cryopreservation, sperm cryopreservation, and artificial insemination have revolutionized animal breeding. Gene editing, SNP genotyping, and gene expression analysis further expand the potential for genetic research and innovation. In the realm of fish farming, genetic research facilitates the development of disease-resistant strains and improved growth rates. Overall, the market witnesses significant growth due to the increasing focus on cutting-edge animal selection techniques and effective genetic testing solutions.

The Research centers segment was valued at USD 1.64 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant advancements with the integration of genomic selection, genetic engineering, and next-generation sequencing (NGS) technologies. Polygenic traits, linkage analysis, and massively parallel sequencing are key techniques driving genetic improvement in livestock production. Transgenic animals and gene editing are revolutionizing the industry, enabling the manipulation of specific genes for desired traits. Genetic markers, marker-assisted selection (MAS), and gene mapping are essential tools for breeding programs, enhancing genetic diversity and population genetics. In North America, the largest geographical segment, the US is the primary contributor to the market's growth. The demand for animal genetic solutions is increasing due to the adoption of sustainable livestock management practices.

Approximately 40-50% of agricultural revenue in Canada and the US comes from farm gate livestock receipts. Gene expression analysis, embryo transfer, genetic databases, SNP genotyping, embryo cryopreservation, sperm cryopreservation, and artificial insemination are some of the essential applications. Inbreeding depression is a concern in fish farming, leading to the development of new strategies, including selective breeding and genetic engineering. Overall, the market is evolving, with quantitative genetics, pedigree analysis, and genotyping-by-sequencing (GBS) playing crucial roles. Beef cattle and dairy cattle are significant sectors, with DNA microarrays providing valuable insights into their genetics. The integration of these technologies is transforming animal breeding and production, ensuring the continued growth of the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Animal Genetics Industry?

- The increasing demand for genetic testing services is a primary market driver, particularly in the companion animal sector.

- Genetic testing in animal sciences is gaining popularity among pet owners for identifying inheritable diseases and genetic predispositions in companion animals. Early detection of these risks enables proactive management and treatment, enhancing their health and well-being. Genetic testing can also provide insights into an animal's ancestry and breed composition, satisfying the curiosity of pet owners about their pet's background and characteristics. Moreover, genetic testing is being utilized to identify genetic markers linked to behavioral traits such as aggression, anxiety, and trainability in dogs. Understanding the genetic basis of behavior can significantly aid in training and behavior modification programs, thereby strengthening the bond between pets and their owners.

- Advancements in genomic selection, genetic engineering, and next-generation sequencing (NGS) technologies have facilitated the identification of polygenic traits and linkage analysis in animals. Massively parallel sequencing and quantitative genetics are other techniques used to study the genetic makeup of animals, leading to the development of transgenic animals for various applications. These technological advancements have revolutionized the field of animal genetics, offering numerous opportunities for research and development in animal health, breeding, and behavioral studies. Pet owners' growing awareness of the benefits of genetic testing and the availability of user-friendly testing kits are expected to fuel the market's growth.

What are the market trends shaping the Animal Genetics Industry?

- The number of mergers and acquisitions among companies is on the rise, representing a significant market trend. This trend reflects the dynamic business landscape and the continuous efforts of companies to expand their reach and enhance their competitive position.

- The market is experiencing significant growth and development as companies invest in advanced technologies to improve livestock production. Gene expression analysis, gene editing, and the use of genetic markers are key areas of focus for genetic improvement in animal breeding. Companies are leveraging pedigree analysis and marker-assisted selection (MAS) to enhance the efficiency and accuracy of breeding programs. Mergers and acquisitions are a common strategy for animal genetics companies to expand their geographic presence and diversify their offerings. By acquiring complementary businesses or entering new markets, companies can strengthen their competitive position and capture a larger market share. Vertical integration through acquisitions enables companies to control more stages of the value chain, from genetics and breeding to the production and distribution of animal products.

- This integration can lead to increased efficiency, improved quality control, and better supply chain management. For instance, in June 2022, Zoetis Inc. announced its acquisition of a leading animal genetics company to expand its portfolio and enhance its capabilities in genetic testing and analysis.

What challenges does the Animal Genetics Industry face during its growth?

- The stringent regulations governing the production and sale of animal genetic products pose a significant challenge to the industry's growth. This complex regulatory environment requires companies to adhere to strict standards, which can increase costs and limit innovation. Ensuring the safety and ethical treatment of animals is a critical concern, but navigating the intricacies of various regulatory bodies can hinder progress and impede the industry's ability to expand.

- The market is subject to rigorous regulation due to the production of animal-derived food products and the implementation of breeding programs utilizing genetic solutions. Regulatory bodies prioritize ensuring the safety of food products such as beef and dairy, including meat, eggs, and milk. They also verify that these solutions are devoid of genetic modification, adhering to laws and regulations against genetically modified organisms (GMOs) in various countries. For instance, companies involved in egg and poultry production must confirm that their products adhere to non-GMO regulations. Genetic diversity plays a crucial role in breeding programs, with techniques such as genotyping-by-sequencing (GBS) and gene mapping employed to enhance genetic diversity and improve breeding outcomes.

- DNA microarrays are also used for gene expression analysis, providing valuable insights into genetic traits and potential health issues. Inbreeding depression is a significant concern in animal genetics, necessitating the implementation of strategies to minimize its impact on breeding programs.

Exclusive Customer Landscape

The animal genetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the animal genetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, animal genetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

EasyDNA - This company specializes in advanced animal genetics services, providing tests for exotic birds, DNA sexing, disease detection, and genotyping, enhancing agricultural productivity and animal health through scientific innovation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- EasyDNA

- Inguran LLC

- Neogen Corp.

- URUS Group LP

- VikingGenetics F.M.B.A

- Zoetis Inc.

- Animal Genetics Inc.

- Aviagen Group

- DNA Genetics

- Genus Plc

- Groupe Grimaud

- Hendrix Genetics BV

- Koko Genetics

- Sandor Animal Biogenics Pvt. Ltd.

- Superior Animal Genetics

- SWINE GENETICS INTERNATIONAL

- TOPIGS NORSVIN

- Trans Ova Genetics

- Tropical Animal Genetics

- Vaxxinova International BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Animal Genetics Market

- In January 2024, Genus plc, a global leader in animal genetics, announced the launch of its new pig genetics product, PIC BOARVANTAGE, in partnership with Topigs Norsvin. This innovative product combines the strengths of both companies' genetics, aiming to improve the productivity and efficiency of pig farming (Genus plc Press Release).

- In March 2024, Merck Animal Health, a well-known animal health company, acquired Bio-M Pharma, a leading provider of genetics and breeding solutions for dairy cattle. This strategic acquisition expanded Merck Animal Health's portfolio and strengthened its position in the market (Merck Animal Health Press Release).

- In May 2024, the European Commission approved the use of gene editing techniques in farm animals, including those for improving animal genetics. This decision marked a significant regulatory milestone, paving the way for the development and adoption of genetically modified animals in Europe (European Commission Press Release).

- In April 2025, Zoetis, a leading animal health company, announced a major investment in CRISPR Gene Editing technology to enhance its animal genetics offerings. The exact investment amount was undisclosed, but the company stated it would accelerate the development of innovative genetics solutions for livestock producers (Zoetis Press Release).

Research Analyst Overview

- In the dynamic market, welfare indicators and genome annotation play crucial roles in breed improvement. Linkage disequilibrium and statistical modeling are essential tools for disease genomics, enabling the identification of genetic variations associated with diseases and stress tolerance. Reproductive technologies, such as precision breeding and genome editing, facilitate the creation of genetically superior animals with improved milk production, feed efficiency, and egg production. Regulatory frameworks ensure ethical considerations are met while intellectual property protections foster innovation in machine learning, predictive modeling, and data analysis.

- Disease resistance, growth rate, meat quality, and egg production are key performance indicators driving market trends. Evolutionary biology and comparative genomics contribute to a deeper understanding of animal genetics, further fueling advancements in animal health and breeding.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Animal Genetics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.45% |

|

Market growth 2024-2028 |

USD 2.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.0 |

|

Key countries |

US, Germany, UK, France, China, India, Japan, Canada, and South Africa |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Animal Genetics Market Research and Growth Report?

- CAGR of the Animal Genetics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the animal genetics market growth of industry companies

We can help! Our analysts can customize this animal genetics market research report to meet your requirements.