Antacids Market Size 2024-2028

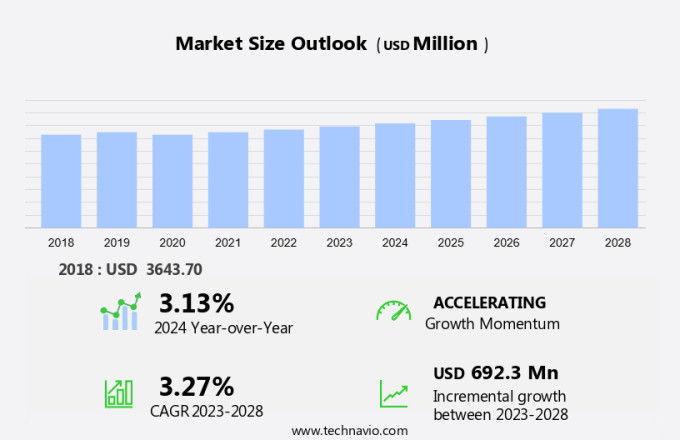

The antacids market size is forecast to increase by USD 692.3 million at a CAGR of 3.27% between 2023 and 2028. The market in the retail pharmacy sector is experiencing significant growth due to the rising prevalence of gastric diseases, such as gastric ulcers, and the increasing demand for over-the-counter (OTC) drugs for the relief of symptoms. The market is driven by the growing population, particularly the elderly, who are more susceptible to these conditions. Additionally, the expanding e-commerce market is providing greater access to antacids, making them more convenient for consumers. However, the prolonged use of antacids can lead to adverse effects, including decreased absorption of essential nutrients and potential kidney damage. To address these concerns, new medical agents are being developed, including alkaline agents such as sodium, aluminum, magnesium, and calcium, which offer effective relief while minimizing side effects. These new drugs aim to meet the evolving needs of consumers and healthcare providers.

What will be the Size of the Market During the Forecast Period?

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Non-symmetric antacids

- Symmetric antacids

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- Rest of World (ROW)

- North America

By Type Insights

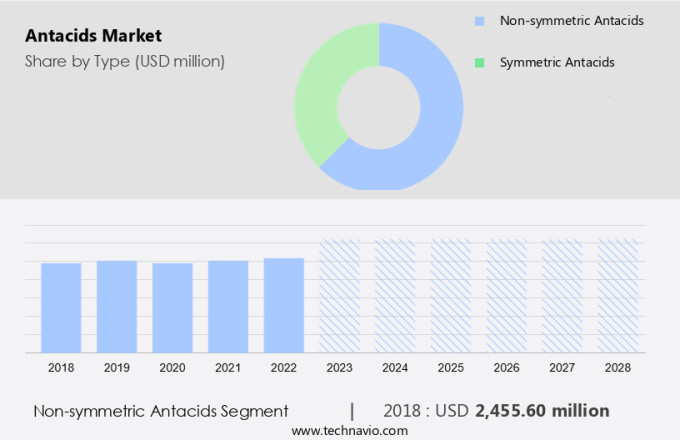

The non-symmetric antacids segment is estimated to witness significant growth during the forecast period. Antacids are over-the-counter (OTC) drugs commonly used in retail pharmacies for the relief of heartburn, acid indigestion, and other gastric diseases. Non-systemic antacids, also known as non-absorbed antacids, are a type of antacid that does not get absorbed into the bloodstream. Instead, they remain in the stomach, where they neutralize stomach acid. Non-systemic antacids are available in various forms, including aluminum-containing antacids, calcium-containing antacids, and magnesium-containing antacids. Aluminum-containing antacids consist of aluminum hydroxide, aluminum phosphate, and other aluminum salts. Calcium-containing antacids contain calcium carbonate and tribasic calcium phosphate. Magnesium-containing antacids consist of magnesium carbonate, magnesium citrate, magnesium hydroxide, magnesium oxide, and magnesium phosphate.

In addition, when used alone, non-systemic antacids provide temporary relief from symptoms. However, when taken in combination, they can offer more significant benefits than a single agent. For instance, the combination of aluminum-containing and magnesium-containing antacids can provide longer-lasting relief from symptoms. These antacids are widely used for the treatment of various acid refluxes, gastroesophageal reflux disease (GERD), and peptic ulcers. In conclusion, non-systemic antacids are essential medications for the relief of gastric discomfort and acidity. Their ability to neutralize stomach acid makes them an effective solution for various gastric diseases. When used in combination, they offer more substantial benefits than a single agent. Retail pharmacies remain a primary source for the purchase of these essential medications.

Get a glance at the market share of various segments Request Free Sample

The non-symmetric antacids segment accounted for USD 2.46 billion in 2018 and showed a gradual increase during the forecast period.

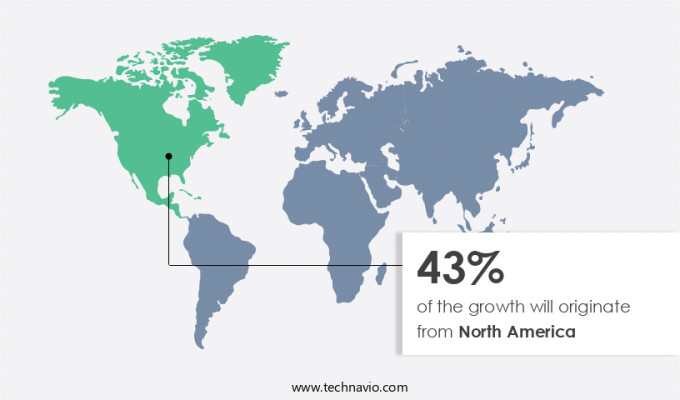

Regional Insights

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth due to the rising prevalence of gastrointestinal disorders, particularly in the geriatric population. Proton pump inhibitors and other over-the-counter digestive products are increasingly being used to manage acidity problems, including oesophageal cancer and Barrett's esophagus. However, the market's expansion is not without challenges. Milk-alkali syndrome and rebound hyperacidity are potential side effects of long-term antacid use, leading to concerns regarding aluminum hydroxide's safety. Moreover, aluminum poisoning, osteomalacia, and hypophosphatemia are risks associated with excessive aluminum intake. In the APAC region, while growth is expected to be the fastest, factors such as low per capita income and a poor distribution network hinder market expansion.

For instance, China and India's per capita income in 2020 was USD10,484 and USD1,928, respectively, compared to USD63,416 and USD40,406 in the US and the UK. Despite these challenges, the market's growth is driven by increasing awareness of treatment options for gastrointestinal disorders and a focus on improving healthcare.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Over-the-counter (OTC) antacids have long been a staple in the US healthcare market, providing relief for millions of individuals suffering from acidity problems. These oral medications, available in both tablet and liquid forms, are designed to neutralize stomach acid and alleviate symptoms of heartburn and indigestion. Gastrointestinal disorders, such as acid reflux, peptic ulcers, and digestive disorders, affect a significant portion of the US population. The prevalence of these conditions increases with age, particularly among the geriatric population. OTC antacids cater to this demographic, offering quick and effective relief for those unable to visit a general practitioner.

In addition, acidity problems can be attributed to various lifestyle factors, including stress, smoking, alcohol consumption, obesity, and certain medications. OTC antacids provide a convenient solution for managing these symptoms, making them an essential part of many households. The market for OTC antacids is diverse, with a range of active ingredients including sodium, calcium, magnesium, and aluminum-based antacids. Commonly used antacids include aluminum hydroxide, which is effective in neutralizing stomach acid, and calcium carbonate, which provides an additional benefit of providing calcium supplementation. The demand for OTC antacids is driven by several factors. The increasing prevalence of gastrointestinal disorders, particularly among the aging population, is a significant growth driver.

Market Driver

Rising geriatric population is the key driver of the market. In the United States, the prevalence of gastrointestinal issues, particularly acidity and heartburn, increases with age. The esophageal sphincter, which prevents stomach acid from flowing back into the esophagus, can weaken over time, leading to acid reflux and heartburn. Additionally, the digestive system's functionality may decline with age, further contributing to these conditions. Gastroesophageal reflux disease (GERD) is another common cause of heartburn, and its prevalence increases with age.

The aging population is a significant factor driving the demand for acid-reducing medications, including antacid products. These medications provide relief from the discomfort and pain associated with acidity and heartburn. Factors such as stress, smoking, and alcohol consumption can exacerbate these conditions and increase the need for antacids. In addition, the pharmaceutical sector continues to innovate, offering various forms of acid-reducing medications, including over-the-counter antacids and injectables, to cater to the diverse needs of consumers.

Market Trends

Growing e-commerce market is the upcoming trend in the market. The market in the United States is witnessing a significant rise in sales through online channels due to the convenience and ease of purchasing over-the-counter (OTC) medications without a prescription. Consumers find it convenient to shop online, as they do not need extensive product knowledge. Retailers have enhanced the online shopping experience by providing better product education and targeted marketing, increasing consumer comfort in buying antacids online. Various organizations have entered this market, contributing to its growth. The strong viability of e-commerce platforms is further driving antacid sales. Sodium antacids, calcium antacids, magnesium antacids, and aluminum antacids are commonly used to alleviate symptoms of heartburn and indigestion.

Furthermore, these antacids are available in both tablet and liquid forms for oral administration. Hospitals, homecare settings, specialty centers, hospital pharmacies, and online pharmacies are major distribution channels for antacids. The market caters to a wide range of consumers, including those suffering from occasional heartburn and indigestion, as well as those with chronic conditions. The market growth is fueled by the increasing prevalence of gastrointestinal disorders and the availability of a diverse range of antacid products to cater to various consumer needs. Online retailers' efforts to improve the shopping experience and the convenience of purchasing antacids from the comfort of one's home have made a significant impact on market growth.

Market Challenge

Adverse effect of prolonged use of antacids is a key challenge affecting the market growth. Antacids are commonly used to alleviate symptoms of heartburn, indigestion, and acid reflux. These medications work by neutralizing excess stomach acid. However, excessive use or high doses of antacids, particularly those containing calcium such as Maalox, Mylanta, Rolaids, and TUMS, can lead to health concerns. Calcium overdose is a potential risk, resulting in side effects like nausea, vomiting, mood swings, kidney stones, gas, belching, and swelling of the feet and ankles. Long-term antacid use can also result in the milk-alkali syndrome, which causes metabolic alkalosis and rebound acidity due to dose dependence. Antacids made with aluminum hydroxide may cause constipation, aluminum intoxication, osteocalcin, and hypophosphatemia.

Furthermore, in contrast, magnesium-containing antacids can lead to diarrhea due to their laxative effect. As obesity rates rise in the US, the demand for antacids has increased. General practitioners and gastroenterologists often prescribe these medications to their patients for symptomatic disorders. With the convenience of e-commerce and online retail channels, antacid consumption has become more accessible. However, it is essential to follow the recommended dosage to avoid potential health risks. Mouth-melting antacids, micro granules, herbal ingredients, liquids, and chewable tablets are available in various forms to cater to diverse consumer preferences. Antacids have become an essential part of many households in the US, providing quick relief from acid reflux and heartburn symptoms.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bayer AG: The company offers antacids that is a naturally made water dissolving formula to cure acidity and heartburn, under the brand name of American Health Packaging.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AmerisourceBergen Corp.

- Advance Pharmaceutical Inc

- Cardinal Health Inc.

- GlaxoSmithKline Plc

- Humco Holding Group Inc.

- inovapharma.com

- Johnson and Johnson Services Inc.

- Neogen Corp.

- Novartis AG

- NuCare Laboratories India

- Pfizer Inc.

- Pharmaceutical Associates Inc.

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- The Procter and Gamble Co.

- United Natural Foods Inc.

- WellSpring Pharmaceutical Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Antacids are oral medications used to provide quick relief from symptoms of heartburn and indigestion, which include pain, inflammation, and acid reflux. These medications work by neutralizing the stomach acid, reducing the production of gastric acid, or coating the esophagus to protect it from acid damage. Antacids come in various forms, including tablets and liquids, and are available over-the-counter (OTC) at retail pharmacies, hospital pharmacies, online pharmacies, specialty centers, and even in hospitals. The market caters to a wide range of gastrointestinal disorders, such as gastric ulcers, GERD (Gastroesophageal Reflux Disease), acid reflux, constipation, diarrhea, and kidney problems. Antacids are also used to treat symptoms of acidity problems, such as heartburn, indigestion, and inflammation, in the geriatric population and those suffering from oesophageal cancer, Barrett's esophagus, milk-alkali syndrome, and rebound hyperacidity.

Furthermore, the pharmaceutical sector offers various antacid products, including sodium antacids, aluminum antacids, magnesium antacids, and calcium antacids. These medications are used to provide relief from symptoms of acidity problems, which can be caused by stress, smoking, alcohol consumption, obesity, and certain medical conditions. Antacids are available in various forms, such as mouth-melting antacids, micro granules, and herbal ingredients, to cater to diverse consumer preferences. The healthcare infrastructure, including hospitals, healthcare facilities, and general practitioners, also plays a crucial role in the market. Gastroenterologists and other healthcare professionals often prescribe antacids to patients suffering from gastrointestinal issues, such as peptic ulcers and digestive disorders.

In addition, the increasing prevalence of these conditions, along with the growing awareness of the importance of managing acidity problems, is expected to drive the demand for antacid products in the coming years. The market is also witnessing the emergence of new drugs and medical agents, such as proton pump inhibitors and acid reducers (famotidine), which offer dual-action relief for various gastrointestinal disorders. These medications are increasingly being used to treat symptoms of acidity problems, such as heartburn, indigestion, and inflammation, in place of traditional antacids. The growing popularity of e-commerce and online retail channels is also expected to boost the sales of antacids, making them more accessible to consumers.

However, the use of antacids is not without risks. Long-term use of antacids, especially aluminum-containing antacids, can lead to aluminum poisoning, osteomalacia, and hypophosphatemia. Dose-dependent rebound hyperacidity is also a concern with some antacids, making it essential for consumers to follow the recommended dosage and consult their healthcare professionals before using these medications. In conclusion, the market is a significant and growing sector within the pharmaceutical industry, catering to the diverse needs of consumers suffering from various gastrointestinal disorders. The market offers a wide range of antacid products, including tablets, liquids, and various forms of herbal ingredients, to provide quick and effective relief from symptoms of acidity problems. The growing awareness of the importance of managing acidity problems, coupled with the increasing prevalence of gastrointestinal disorders and the growing popularity of e-commerce and online retail channels, is expected to drive the demand for antacids in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 692.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 43% |

|

Key countries |

US, Germany, Canada, UK, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Advance Pharmaceutical Inc., AmerisourceBergen Corp., Bayer AG, Cardinal Health Inc., GlaxoSmithKline Plc, Humco Holding Group Inc., inovapharma.com, Johnson and Johnson Services Inc., Neogen Corp., Novartis AG, NuCare Laboratories India, Pfizer Inc., Pharmaceutical Associates Inc., Sanofi SA, Sun Pharmaceutical Industries Ltd., The Procter and Gamble Co., United Natural Foods Inc., and WellSpring Pharmaceutical Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch