Anti-Acne Cosmetics Market Size 2024-2028

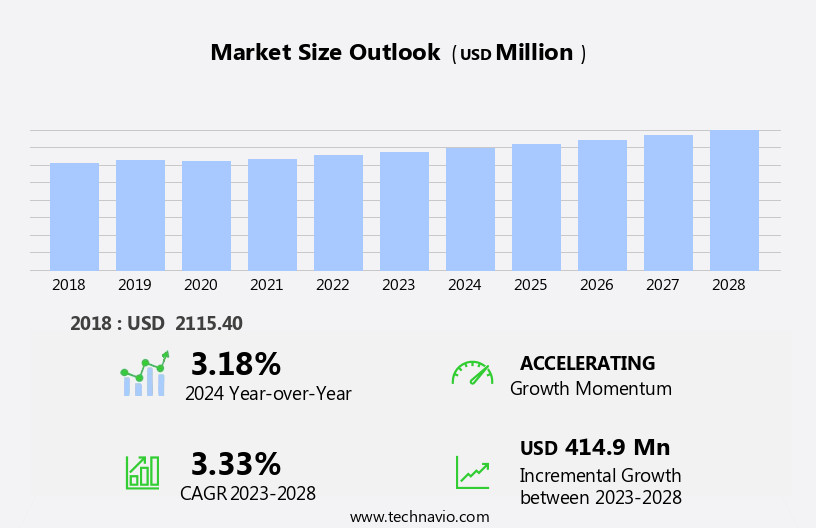

The anti-acne cosmetics market size is forecast to increase by USD 414.9 million at a CAGR of 3.33% between 2023 and 2028.

What will be the Size of the Anti-Acne Cosmetics Market During the Forecast Period?

How is this Anti-Acne Cosmetics Industry segmented and which is the largest segment?

The anti-acne cosmetics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Cleansers

- Emulsions

- Masks

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- UK

- France

- APAC

- China

- North America

- US

- South America

- Middle East and Africa

- Europe

By Product Insights

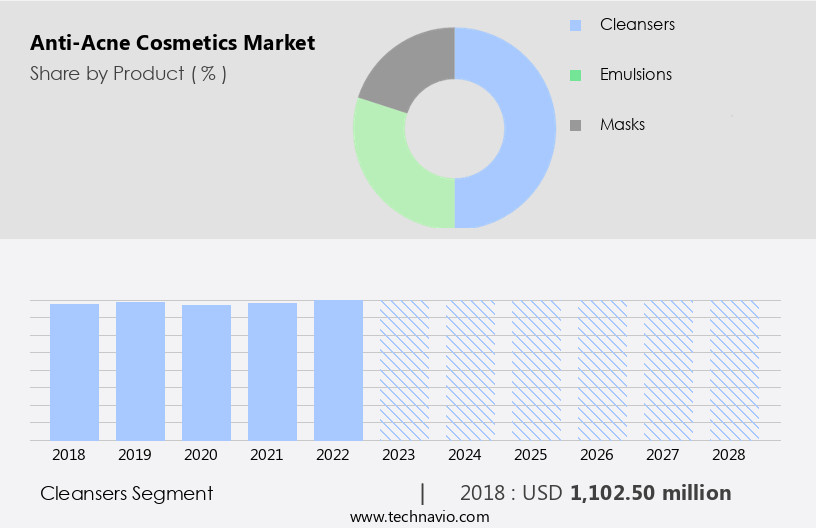

- The cleansers segment is estimated to witness significant growth during the forecast period.

Anti-acne cleansers are essential skincare products designed to address acne issues and purify the skin. These offerings include gels, foams, and face wash, suitable for both men and women. Their use is gentle and frequent, making them popular choices among consumers worldwide. Anti-acne cleansers come in various packaging sizes, allowing for easy portability. They offer convenience for addressing acne growth outside of home environments, such as offices or public spaces. Budget-conscious consumers prefer these cleansers due to their affordability compared to other anti-acne cosmetics. Acne is a common dermatological ailment, leading to anxiety, depression, low self-esteem, and loneliness for many, particularly adolescents.

Anti-acne cleansers are available at beauty salons, med spas, dermatology clinics, retail stores, and online sales platforms. The World Health Organization recognizes acne as a significant health concern, emphasizing the importance of accessible, effective skincare solutions. Pregnant women should consult a licensed medical practitioner before using anti-acne products. Common ingredients include benzoyl peroxide, tretinoin, and salicylic acid, formulated to suit various skin types and absorb well. Clean beauty products, free from parabens, sulfates, and artificial fragrances, are increasingly popular. Essential oils like tea tree oil and sulfur are also used in some formulations. Skin sensitivities should be considered when selecting anti-acne cleansers.

E-commerce platforms and social media influence consumer choices, while side effects like skin irritation may deter some users. Face masks and masks are complementary treatments. Other anti-acne cosmetic types include toners, gels, serums, and creams and lotions.

Get a glance at the Anti-Acne Cosmetics Industry report of share of various segments Request Free Sample

The Cleansers segment was valued at USD 1102.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

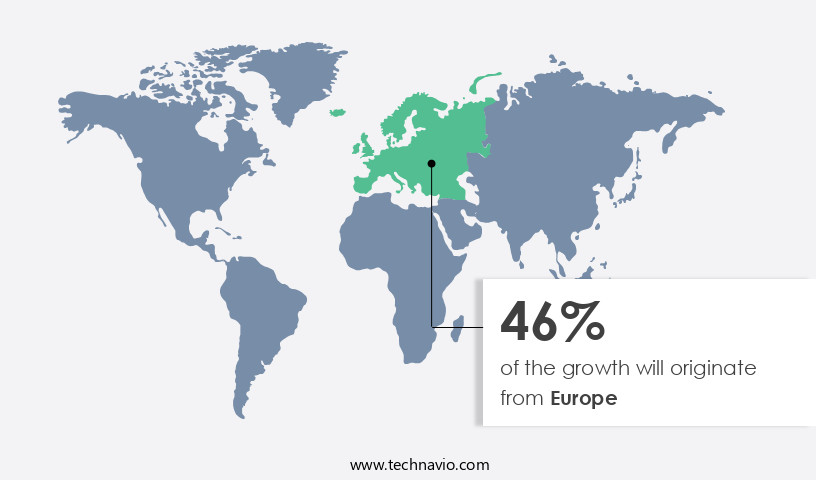

- Europe is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Europe represents a significant market share In the global anti-acne cosmetics industry. The increasing awareness towards personal care and appearance drives the demand for anti-acne cosmetics in this region. Social media campaigns and celebrity endorsements serve as effective marketing strategies for anti-acne cosmetics companies. Key European markets include the UK, Germany, France, Spain, Russia, and Italy. Acne is a prevalent skin condition in Europe, affecting approximately 85% of the population at some point In their lives, with women being more susceptible than men. Consequently, the usage of anti-acne cosmetics among women is anticipated to remain high. In Europe, acne is the second most common skin disease after warts.

Anti-acne cosmetics include various products such as cleansers, toners, gels, serums, essential oils, and masks. Ingredients like benzoyl peroxide, tretinoin, salicylic acid, sulfur, tea tree oil, and sulfur are commonly used in anti-acne cosmetics. Skin sensitivities and side effects, including skin irritation, are potential concerns for consumers. Therefore, the demand for clean beauty products, free from parabens, sulfates, and artificial fragrances, is increasing. The market for anti-acne cosmetics is expected to grow due to the emotional associations and mental health issues, such as anxiety, depression, and low self-esteem, linked to acne. The World Health Organization reports that acne can lead to emotional distress, loneliness, and even suicide in severe cases.

E-commerce platforms and social media have made it easier for consumers to access anti-acne cosmetics, contributing to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Anti-Acne Cosmetics Industry?

Premiumization of anti-acne cosmetic products is the key driver of the market.

What are the market trends shaping the Anti-Acne Cosmetics Industry?

Growing preference for online shopping is the upcoming market trend.

What challenges does the Anti-Acne Cosmetics Industry face during its growth?

Risks associated with chemical preservatives in cosmetic products is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The anti-acne cosmetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anti-acne cosmetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anti-acne cosmetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alchemee LLC - The market encompasses a range of skincare products formulated to address acne and its associated symptoms. These offerings cater to consumers seeking solutions for blemishes, blackheads, whiteheads, and other skin imperfections. The market includes various product types, such as cleansers, toners, masks, and creams, each designed to target the root causes of acne, including excess oil production, bacteria, and clogged pores. Companies specializing in this sector prioritize the use of effective ingredients, such as salicylic acid, benzoyl peroxide, and tea tree oil, to deliver results. The market continues to evolve, with a focus on innovation and addressing diverse consumer needs, including those with sensitive skin or specific acne types.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alchemee LLC

- Ancalima Lifesciences Ltd.

- Beiersdorf AG

- Blossom Kochhar Beauty Products Pvt. Ltd.

- CHOLLEY SA

- DERMAdoctor LLC

- Emami Ltd

- Galderma SA

- Himalaya Wellness Co.

- Hristina Cosmetics

- Johnson and Johnson Services Inc.

- Kose Corp.

- LOreal SA

- LVMH Group.

- Pharmakon Health and Beauty Care Pvt. Ltd.

- ROHTO Pharmaceutical Co. Ltd

- Shiseido Co. Ltd.

- The Estee Lauder Companies Inc.

- Unilever PLC

- Vita Health Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to individuals seeking solutions for managing acne, a common dermatological ailment. Acne affects both men and women, often leading to emotional associations and mental health issues such as anxiety, depression, and low self-esteem. The stigma surrounding acne can lead to feelings of loneliness and isolation. Acne can manifest on various parts of the body, including the face, chest, and back. This condition can affect individuals at any age, with adolescents being a significant demographic. The prevalence of acne is higher in Westernized societies, where societal pressure to maintain a clear complexion is high. The market includes a range of products such as facial cleansers, toners, face washes, gels, serums, essential oils, and masks.

These products are available at beauty salons, med spas, dermatology clinics, retail stores, and online sales platforms. E-commerce platforms and social media have made it easier for consumers to access these products from the comfort of their homes. Acne can be caused by various factors, including genetics, hormonal imbalances, and environmental factors. The use of conventional cosmetic products containing chemicals such as isopropyl myristate, isopropyl palmitate, isopropyl isostearate, decyl oleate, and comedogenic ingredients can exacerbate acne. To address the growing demand for skin-friendly ingredients, the market offers non-comedogenic formulas that do not clog pores. These formulas are free from parabens, sulfates, and artificial fragrances.

Some innovative products In the market include those with cannabidiol, probiotics, sulfur, tea tree oil, and other natural ingredients. Clean beauty products have gained popularity due to their natural and non-toxic ingredients. These products cater to consumers who prefer to avoid harsh chemicals and synthetic fragrances. The market also offers spot treatment products for targeted acne treatment. The use of anti-acne cosmetics can have side effects, including skin irritation. It is essential to consult a licensed medical practitioner before using these products, especially for pregnant women, as some ingredients may be harmful. The market is dynamic, with constant innovation in skincare technology and formulae.

The market caters to various skin types and sensitivities, offering customized solutions for effective acne management. The working female population and female employees, in particular, are a significant demographic, as they often have limited time for extensive skincare routines. In conclusion, the market offers a range of products to cater to the diverse needs of consumers. The market is continually evolving, with a focus on natural and non-toxic ingredients and customized solutions for various skin types and sensitivities. The emotional and mental associations with acne make effective and accessible solutions essential for maintaining healthy and clear skin.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.33% |

|

Market growth 2024-2028 |

USD 414.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.18 |

|

Key countries |

US, China, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anti-Acne Cosmetics Market Research and Growth Report?

- CAGR of the Anti-Acne Cosmetics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anti-acne cosmetics market growth of industry companies

We can help! Our analysts can customize this anti-acne cosmetics market research report to meet your requirements.