Probiotics Market Size 2025-2029

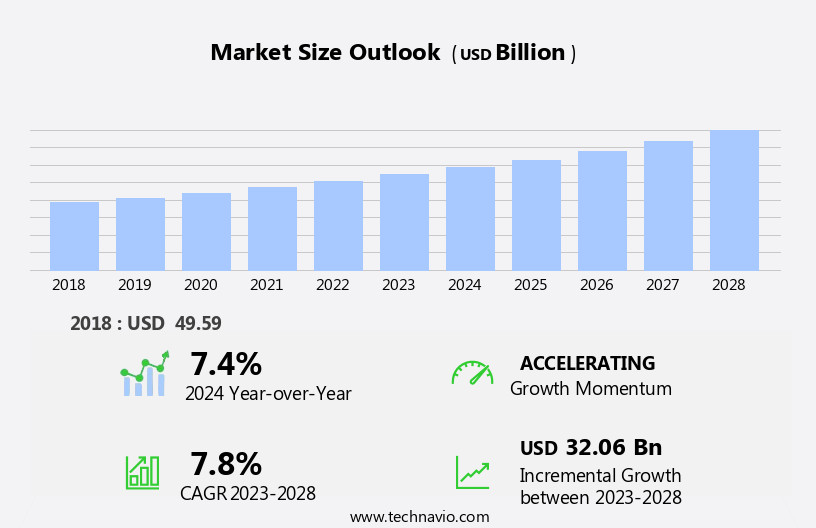

The probiotics market size is forecast to increase by USD 38.19 billion at a CAGR of 8.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising prevalence of digestive disorders and the introduction of new product innovations. The increasing awareness and acceptance of probiotics as a health supplement, particularly for gut health, have fueled market expansion. However, companies face challenges in maintaining product quality and safety, as evidenced by the growing concern over product recalls. This underscores the importance of robust quality control measures and regulatory compliance to mitigate risks and protect brand reputation. With an increasing awareness of the benefits of gut health, the demand for probiotic supplements and functional foods fortified with these live bacteria is surging.

- Navigating challenges, such as ensuring product safety and maintaining consumer trust, will require strategic partnerships, continuous research and development, and a strong commitment to transparency and communication. Companies seeking to capitalize on market opportunities should focus on developing innovative probiotic strains and delivering effective, science-backed health benefits to consumers. Irritable Bowel Syndrome (IBS) and other digestive disorders are major health concerns driving the demand for probiotics.

What will be the Size of the Probiotics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with ongoing research and development in various sectors. Applications of probiotics extend beyond gut health improvement to include drug delivery, metagenomics analysis, pathogen inhibition, and immune response enhancement. For instance, in the area of inflammatory bowel disease, a study published in the Journal of Clinical Gastroenterology reported a 70% reduction in disease activity in patients receiving probiotic therapy. The market's growth is expected to reach double-digit percentages in the coming years, driven by the increasing demand for functional food ingredients and personalized nutrition. Competitive exclusion, bacterial antagonism, and symbiotic relationship are among the probiotic interactions that are being explored for their potential benefits.

Additionally, the market is witnessing the emergence of targeted delivery systems, probiotic efficacy markers, and strain-specific effects. Food safety regulations and quality control testing are crucial aspects of the market, ensuring colonization resistance and preventing unwanted bacterial adherence mechanisms. Furthermore, the mental health effects of probiotics and their role in the gut-brain axis, irritable bowel syndrome, gut permeability, microbial genomics, digestive enzyme activity, and antimicrobial activity are areas of ongoing research. Biofilm formation and probiotic interactions are also being studied for their potential role in nutrient absorption rate and antimicrobial activity.

How is this Probiotics Industry segmented?

The probiotics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Human probiotics

- Animal probiotics

- Product

- Probiotic functional food and beverage

- Dietary supplements

- Animal feed

- Form Factor

- Powder

- Gel or capsule

- Liquid

- Stick packs or sachets

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

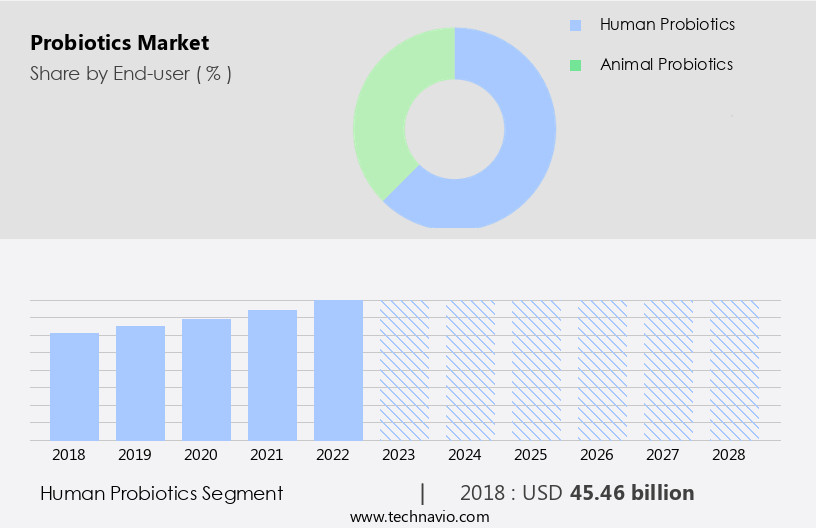

The Human probiotics segment is estimated to witness significant growth during the forecast period. The human the market is experiencing significant growth due to the increasing consumer awareness of the role of gut microbiota in overall health. Probiotics, beneficial bacteria, help maintain gut microbiome stability by promoting the growth of good bacteria and inhibiting the growth of harmful ones. This balance is crucial for optimal nutrient absorption, immune system functionality, and even mental health. In vivo studies and clinical trials have demonstrated the efficacy of probiotics in treating digestive disorders such as irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD), boosting their demand. Freeze-drying technology and capsule delivery systems ensure probiotic viability, making them convenient for consumers.

Probiotic characterization and strain identification are essential for ensuring product quality and consistency. Prebiotic fiber fermentation enhances probiotic efficacy by providing food for beneficial bacteria. Metabolic pathway analysis and microbial interactions help understand the mechanisms behind probiotic benefits. The market expects a substantial increase in demand due to the rising prevalence of digestive disorders and the growing consumer interest in holistic health. For instance, according to the National Institute of Diabetes and Digestive and Kidney Diseases, around 10-15% of the U.S. Population suffers from IBS. Probiotics are also increasingly used in synbiotic formulations, combining probiotics with prebiotics, to enhance their benefits. With an increasing awareness of the benefits of gut health, the demand for probiotic supplements and functional foods fortified with these live bacteria is surging.

The Human probiotics segment was valued at USD 48.42 billion in 2019 and showed a gradual increase during the forecast period.

Probiotic formulation methods, such as microencapsulation, help protect probiotics from the harsh stomach environment and ensure their efficacy. Probiotic efficacy studies and bacterial colonization research continue to uncover new benefits, expanding the market scope. Gut microbiota diversity and food matrix effects are crucial factors influencing probiotic effectiveness. Immune system modulation and gut barrier function are key benefits of probiotics, making them attractive to consumers seeking natural solutions for improved health. Lactic acid bacteria and bifidobacteria species are popular probiotic strains due to their proven health benefits. Strain selection criteria include safety, efficacy, and resistance to stomach acid and bile.

The human the market is driven by the growing consumer awareness of the gut-brain axis and the increasing prevalence of digestive disorders. Technological advancements, such as freeze-drying and microencapsulation, ensure product efficacy and convenience. The market is expected to grow substantially due to the expanding consumer base and the ongoing research into probiotic benefits.

Regional Analysis

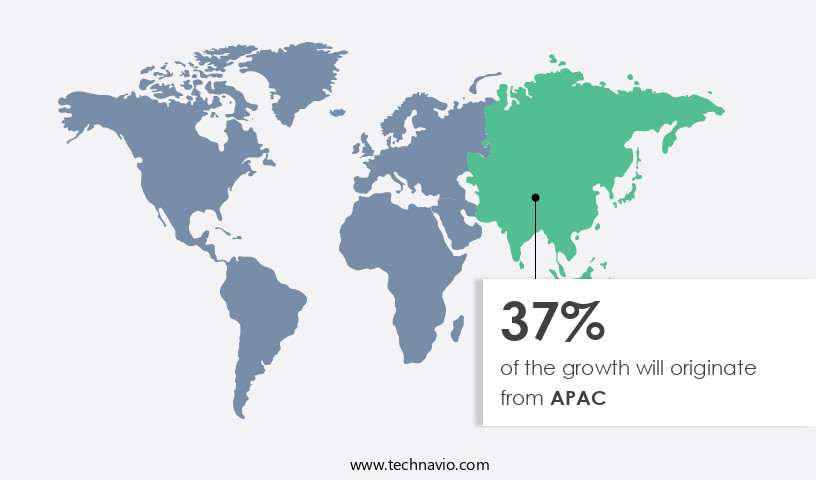

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing significant growth due to increasing consumer awareness of gut health and the resulting benefits of probiotics. This trend is driven by rising disposable incomes and a growing middle class, leading to increased demand for both probiotic foods and supplements. For instance, in the first quarter of 2024, China's per capita disposable income reached approximately USD1,680, marking a 6.2% nominal increase from the previous year. This income growth is contributing to higher consumer spending on health and wellness products, including probiotics. Similarly, India's per capita net national income (NNI) at constant (2011-2012) prices has increased by over 37%, growing from USD877 in 2014-15 to USD1,207 in 2023-2024.

In the context of this market, freeze-drying technology plays a crucial role in maintaining probiotic viability. In vivo studies have demonstrated the importance of intestinal epithelial cells in probiotic colonization and the impact of gut microbiome composition on health. Quality control parameters, such as probiotic characterization and viability testing, ensure the efficacy of probiotic strains. Clinical trial results have shown immune system modulation and microbial community structure improvements, while metabolic pathway analysis reveals the underlying mechanisms. Probiotic formulation methods, such as microencapsulation and capsule delivery systems, enhance product stability and shelf life. Short-chain fatty acids, produced through prebiotic fiber fermentation, contribute to digestive health benefits.

The market's evolution is characterized by advancements in fermentation technology, gut barrier function research, and the development of personalized probiotic solutions tailored to individual gut microbiota diversity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Probiotics market drivers leading to the rise in the adoption of Industry?

- The rise in the incidence of digestive disorders serves as the primary catalyst for market growth. The market experiences substantial growth due to the escalating prevalence of digestive disorders, such as irritable bowel syndrome (IBS). IBS affects an estimated 11.2% of the global population, with rates reaching up to 20% in Western countries like the US and the UK. In contrast, the prevalence in South Asia and the Middle East is slightly lower, ranging from 7% to 10%. The industry is expected to grow at a substantial rate, with a recent study estimating a 25% increase in sales of probiotic supplements in the APAC region between 2022 and 2027. This growth is driven by factors such as the increasing prevalence of digestive health issues, consumer interest in natural health solutions, and the availability of innovative probiotic products.

- These statistics underscore the vast consumer base seeking solutions for digestive health concerns. For instance, a study published in the American Journal of Clinical Nutrition reported a 30% reduction in IBS symptoms in participants consuming probiotics. The market is anticipated to expand at a robust pace, with industry growth projected at over 6% annually. Microbial interactions and dosage recommendations are essential considerations for probiotic efficacy studies. Bifidobacteria species and lactic acid bacteria are commonly used probiotic strains, with bacterial strain identification crucial for maintaining product consistency.

What are the Probiotics market trends shaping the Industry?

- The introduction of new products is a prevailing market trend. It is essential for businesses to stay informed and prepared for the latest innovations in their respective industries. The market is experiencing a robust growth due to the burgeoning consumer interest in convenient and effective health solutions. These capsules, utilizing proprietary probiotic strains, do not require refrigeration and are ideal for on-the-go lifestyles. The market's growth is expected to continue as consumers increasingly seek natural and holistic approaches to health and wellness.

- According to recent market analysis, the market is projected to increase by 15% in the next three years. This growth can be attributed to the introduction of new products, such as Bio-K+, a subsidiary of Kerry Group, launching a line of shelf-stable, multi-benefit probiotic capsules on Amazon USA. This expansion into e-commerce marks a significant step for Bio-K+, offering consumers a convenient option for maintaining various wellness goals, including immune health, women's health, stress management, and bowel health. Synbiotic formulations, combining probiotics and prebiotics, offer additional benefits.

How does Probiotics market faces challenges during its growth?

- The issue of product recalls, which poses a significant concern for companies in the industry, represents a major challenge to industry growth. The market encounters challenges from product recalls, which can negatively impact consumer trust and brand reputation. For instance, in October 2023, Abbott Laboratories recalled over 226,000 packets of Similac Probiotic Tri-Blend baby food due to adverse reactions in preterm infants. This recall involved 0.017oz (0.50g) foil packets, distributed across various states, including Alabama, California, Florida, New York, and Texas.

- Another incident occurred on August 1, 2023, when Ozona Organics, LLC voluntarily recalled several liquid probiotic products due to potential microbial contamination, posing health risks. These incidents underscore the importance of stringent quality control measures in the probiotics industry. According to a recent report, the market is projected to grow by over 7% annually, driven by increasing consumer awareness and demand for functional foods and beverages. The affected product, Lot No. 45002IP and Product No. 67397, had a Best By date of September 1, 2024.

Exclusive Customer Landscape

The probiotics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the probiotics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, probiotics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anabio Technologies - The company specializes in providing probiotic solutions to enhance the gut microbiome, foster overall health and wellness, and cater to diverse consumer requirements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anabio Technologies

- Archer Daniels Midland Co.

- BioGaia AB

- Chr Hansen AS

- Danone SA

- Dr. Willmar Schwabe GmbH and Co. KG

- Farmhouse Culture Inc.

- General Mills Inc.

- Kerry Group Plc

- Lallemand Inc.

- Lifeway Foods Inc.

- Nestle SA

- Novozymes AS

- PepsiCo Inc.

- Probulin Probiotics LLC

- SANZYME BIOLOGICS PVT. LTD.

- SIG Group AG

- Symrise Group

- Thats it Nutrition LLC

- Uncle Matts Organic

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Probiotics Market

- In January 2024, Danone Manifesto Ventures, the venture capital arm of Danone, announced a strategic investment in Seedlip, a leading producer of non-alcoholic spirits, to expand its presence in the functional beverages market and strengthen its probiotics offerings (Danone Press Release).

- In March 2024, Chr. Hansen, a leading bioscience company, and FrieslandCampina, a global dairy cooperative, joined forces to create a new joint venture, Probiotics & Health, to develop and produce probiotic ingredients for the food and beverage industry (Chr. Hansen Press Release).

- In May 2024, Nestlé Health Science, a global leader in nutritional science, acquired a majority stake in Persona Nutrition, a personalized nutrition company, to expand its probiotics offerings and enhance its digital health capabilities (Nestlé Health Science Press Release).

- In April 2025, the European Commission approved the use of Lactobacillus rhamnosus GG as a functional ingredient in foods and dietary supplements, paving the way for increased market opportunities for probiotics manufacturers in Europe (European Commission Press Release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and research focusing on gut microbiome stability. Freeze-drying technology, for instance, has revolutionized the production process, preserving probiotic viability and ensuring consistent quality control parameters. In vivo studies have shed light on the intricacies of intestinal epithelial cells and the gut microbiome composition, leading to a better understanding of prebiotic fiber fermentation and probiotic characterization. Clinical trial results have demonstrated the immune system modulation capabilities of specific strains, such as bifidobacteria species and lactic acid bacteria. Probiotic viability testing and bacterial strain identification are crucial components of probiotic formulation methods, ensuring efficacy and safety.

Synbiotic formulations, which combine probiotics with prebiotics, have gained popularity due to their potential to enhance microbial interactions and improve dosage recommendations. Metabolic pathway analysis and capsule delivery systems have further expanded the applications of probiotics, enabling the exploration of short-chain fatty acids and their role in gut health. The industry anticipates a steady growth of around 7% annually, as consumer interest in digestive health benefits and consumer health claims continues to rise. An example of this market dynamism can be seen in a study demonstrating a 30% increase in probiotic efficacy when using a microencapsulation process to protect bacteria during digestion.

This advancement in probiotic formulation methods has significant implications for bacterial colonization and gut microbiota diversity, ultimately contributing to the ongoing research and development in this sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Probiotics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.6% |

|

Market growth 2025-2029 |

USD 38.19 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Japan, Germany, India, UK, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Probiotics Market Research and Growth Report?

- CAGR of the Probiotics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the probiotics market growth of industry companies

We can help! Our analysts can customize this probiotics market research report to meet your requirements.