Anti-Counterfeit Packaging Market Size 2025-2029

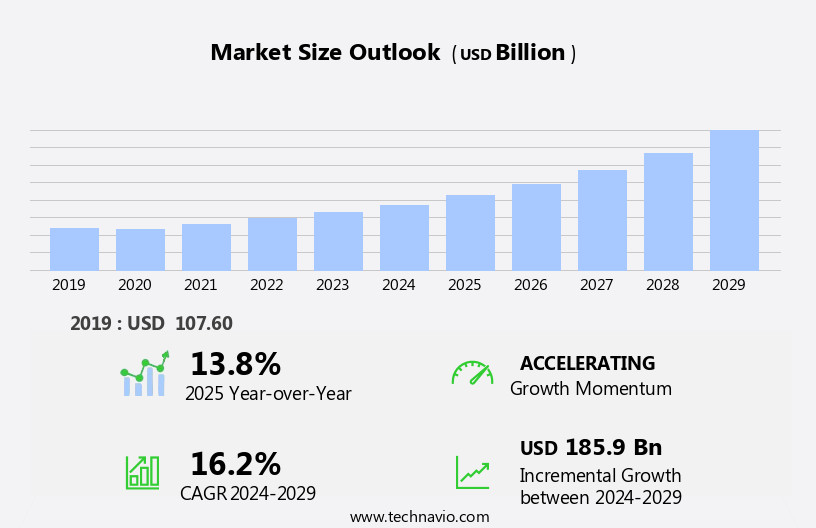

The anti-counterfeit packaging market size is forecast to increase by USD 185.9 billion, at a CAGR of 16.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the burgeoning e-commerce industry and the increasing adoption of smart and intelligent packaging solutions. As online sales continue to surge, the need for robust anti-counterfeit measures to protect brands and consumer trust becomes increasingly crucial. The advent of advanced packaging technologies, such as RFID tags, QR codes, and holograms, is transforming the industry landscape. However, the high cost of implementing these technologies poses a significant challenge for market participants. Companies must carefully weigh the benefits of enhanced security against the financial investment required.

- To capitalize on market opportunities, businesses should focus on developing cost-effective, scalable solutions that cater to the evolving needs of e-commerce platforms and consumers. Navigating this complex market requires a deep understanding of consumer behavior, technological advancements, and regulatory requirements. Strategic partnerships, continuous innovation, and a customer-centric approach will be key differentiators for market success.

What will be the Size of the Anti-Counterfeit Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic nature of global trade and the persistent threat of counterfeit products across various sectors. Anti-counterfeiting technologies, such as laser engraving, security threads, holographic films, and artificial intelligence (AI), are increasingly being integrated into packaging designs to ensure product traceability and maintain data integrity. Pattern recognition, image analysis, and forensic analysis play crucial roles in counterfeit detection, while fraud prevention measures, such as product lifecycle management and compliance standards, help safeguard brand reputation and consumer trust. Digital forensics and near-field communication (NFC) technologies enable real-time authenticity verification and streamline supply chain security.

UV coatings and digital watermarking offer additional layers of protection, while predictive modeling and machine learning algorithms help anticipate potential threats and optimize cost reduction strategies. Industry regulations, material science, and packaging design continue to shape the landscape, with a focus on environmental impact and sustainability. Brand protection and data security remain top priorities, as e-commerce security and consumer education become increasingly essential in the digital age. RFID tags, security inks, and network security measures help maintain product authenticity throughout the supply chain, ensuring consumer confidence and adherence to industry standards. In the ever-evolving market, the integration of advanced technologies and continuous innovation is key to staying ahead of counterfeiters and maintaining the integrity of global trade.

How is this Anti-Counterfeit Packaging Industry segmented?

The anti-counterfeit packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Healthcare products

- Consumer goods

- Others

- Technology

- Authentication

- Traceability

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

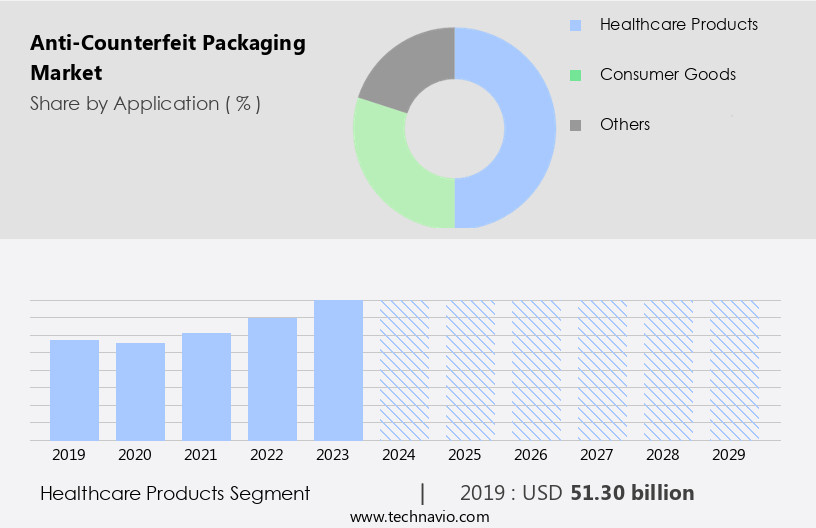

The healthcare products segment is estimated to witness significant growth during the forecast period.

The counterfeit packaging market is a significant concern for various industries, particularly in healthcare, as it poses potential health risks and damages brand reputation. To combat this issue, companies are developing advanced packaging solutions for product authentication, identification, and traceability. These solutions enable consumers to verify the authenticity of products and access crucial product information. For example, in March 2024, Avery Dennison Corp. Introduced a new range of smart labels incorporating Near Field Communication (NFC) technology. Consumers can use their smartphones to authenticate these products and access real-time information through dynamic QR codes. Holographic films, security threads, laser engraving, and tamper-evident labels are other anti-counterfeiting technologies that enhance product security.

Artificial intelligence (AI), machine learning, and predictive modeling are also being integrated into packaging design for improved counterfeit detection and image analysis. Furthermore, data encryption, data integrity, and network security ensure data protection and authenticity verification. Industry regulations mandate compliance with these security features, and companies are investing in digital forensics and consumer education to mitigate the environmental impact of these solutions. Labeling solutions, such as intaglio printing and holographic packaging, offer brand protection and cost reduction through data analytics and security features. The market is continually evolving, with innovations in material science, printing techniques, and supply chain management.

The Healthcare products segment was valued at USD 51.30 billion in 2019 and showed a gradual increase during the forecast period.

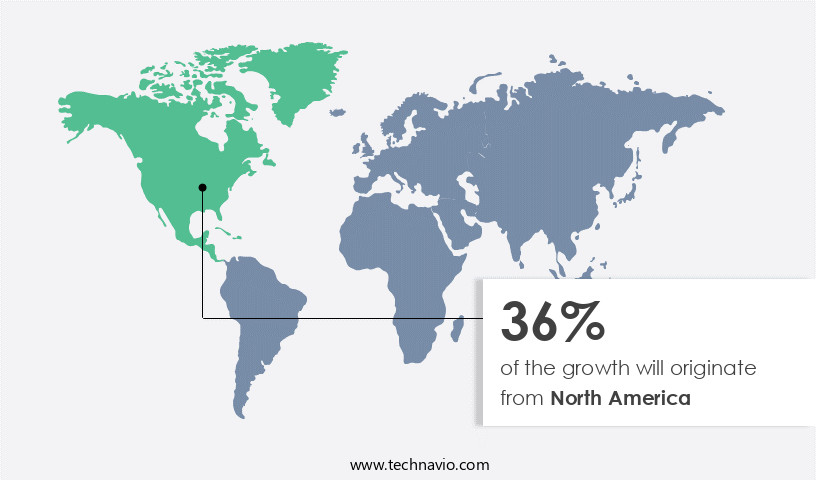

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing prevalence of counterfeit products, particularly those imported from countries such as China. This issue is not limited to the USA, Canada, and Mexico, as counterfeit items have been discovered in various sectors, including apparel, footwear, perfumes, watches, accessories, and electronics. For instance, in November 2024, the Philippine government seized a record USD820 million worth of counterfeit goods, underscoring the intensified campaign against counterfeit merchandise. Similarly, an INTERPOL-led operation, Operation Crete II, resulted in the seizure of over 11 million counterfeit products across 12 South American countries in August 2024.

To combat this challenge, various anti-counterfeiting technologies have emerged, such as laser engraving, security threads, holographic films, and digital watermarking. Artificial intelligence (AI) and machine learning algorithms are being employed for pattern recognition and predictive modeling to enhance product authentication and fraud prevention. Security features, including tamper-evident labels, RFID tags, and NFC, are also being integrated into packaging solutions. Brand protection and consumer trust are crucial aspects of the market. Data security and data integrity are essential to ensure the authenticity of products throughout their lifecycle, from manufacturing to distribution. E-commerce security is another critical area of focus, as online sales channels have become a major avenue for counterfeit goods.

Industry regulations and compliance standards continue to evolve, requiring businesses to invest in advanced labeling solutions and packaging designs. Material science plays a significant role in the development of anti-counterfeit packaging, with innovations in UV coatings, metallic inks, and security inks. The environmental impact of anti-counterfeit packaging is also a consideration, with sustainable and recyclable options gaining popularity. QR codes and barcode technology are widely used for product traceability and supply chain management, ensuring transparency and accountability throughout the supply chain. In conclusion, the market is a dynamic and evolving landscape, driven by the need to protect brands, ensure consumer trust, and combat the prevalence of counterfeit goods.

The integration of various technologies, from AI and machine learning to holographic packaging and RFID tags, is transforming the industry and setting new standards for product security and authenticity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Anti-Counterfeit Packaging Industry?

- The e-commerce sector, characterized by its robust growth, serves as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the expanding e-commerce industry. With the rise of online sales, the distribution of counterfeit products has become a major concern. Consumers and manufacturers have reported receiving and selling counterfeit goods, particularly in sectors such as sporting goods, shoes, and fashion apparel. In response, regulatory bodies, including the US Federal Trade Commission (FTC), have implemented measures to ensure e-commerce platforms provide transparency regarding sellers' anti-counterfeit packaging methods. Anti-counterfeit packaging technologies employ various techniques, such as laser engraving, security threads, holographic films, and pattern recognition, to enhance product traceability and authentication.

- Advanced technologies like artificial intelligence (AI) and printing techniques are also being integrated to improve security and data protection. These technologies enable brand owners to safeguard their intellectual property and maintain consumer trust. E-commerce security and product authentication are crucial aspects of brand protection, as counterfeit products can negatively impact a company's reputation. By implementing robust anti-counterfeit packaging solutions, businesses can secure their supply chains and protect their brand image. In conclusion, The market is essential in addressing the growing issue of counterfeit products in the e-commerce industry. The use of advanced technologies and innovative packaging solutions can help ensure product authenticity, protect data security, and maintain consumer trust.

- The FTC's mandate for e-commerce platforms to disclose their anti-counterfeit measures is a significant step towards combating this issue.

What are the market trends shaping the Anti-Counterfeit Packaging Industry?

- The trend toward smart and intelligent packaging is gaining momentum in the market. This innovative approach to product packaging integrates advanced technologies to enhance functionality and provide valuable consumer information.

- Intelligent packaging plays a crucial role in maintaining data integrity and ensuring product authenticity by combating counterfeit activities. This innovative technology integrates various features such as image analysis, forensic analysis, and digital forensics for counterfeit detection. Product lifecycle management and compliance standards are essential aspects of this packaging, which emphasizes consumer education and trust. Predictive modeling and near-field communication (NFC) technologies further enhance its capabilities. UV coatings provide an additional layer of security, making it challenging for counterfeiters to replicate.

- The market for intelligent packaging is poised for growth due to advancements in microsensors, printed electronics, authentication platforms, and the Internet of Things (IoT). By focusing on fraud prevention and consumer trust, businesses can differentiate themselves and build a strong brand reputation.

What challenges does the Anti-Counterfeit Packaging Industry face during its growth?

- The high cost of implementing anti-counterfeit technologies poses a significant challenge to the industry's growth trajectory. This expense, which is a necessary investment to combat the prevalence of counterfeit goods, can hinder companies from expanding their operations and reaching new markets. Thus, finding cost-effective and efficient solutions to implement these technologies is crucial for the industry's continued growth and success.

- In the business world, maintaining authenticity and ensuring supply chain security are paramount for preserving brand reputation. The market offers various advanced technologies to address these concerns, including machine learning, holographic packaging, intaglio printing, and digital watermarking. These solutions enable real-time authenticity verification, enhancing consumer trust and brand protection. Machine learning algorithms can analyze patterns and detect anomalies in the supply chain, while holographic packaging and intaglio printing provide visual security features. Data encryption and digital watermarking offer digital security, making it difficult for counterfeiters to replicate the packaging. Industry regulations also play a significant role in driving the adoption of anti-counterfeit packaging.

- For instance, the food industry requires stringent traceability regulations to ensure food safety and authenticity. However, the high cost of implementing these technologies can act as a growth inhibitor, especially for small- and medium-sized companies. Material science and packaging design continue to evolve, offering more cost-effective and efficient anti-counterfeit solutions. For example, RFID devices can be integrated into packaging, providing real-time tracking and authentication. While the initial investment for RFID technology can be high, the long-term benefits, such as increased supply chain visibility and improved operational efficiency, can outweigh the costs. In conclusion, the market offers advanced technologies to address the challenges of authenticity verification, supply chain security, and brand reputation.

- While the initial investment can be high, the long-term benefits, such as increased consumer trust and regulatory compliance, make it a worthwhile investment for businesses.

Exclusive Customer Landscape

The anti-counterfeit packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anti-counterfeit packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anti-counterfeit packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Track and Trace - This company specializes in advanced anti-counterfeit packaging solutions, catering to various product sizes and packaging types. Our offerings encompass a broad spectrum, ranging from microns to several millimeters. By utilizing cutting-edge technology, we ensure the highest level of security and authenticity for our clients' brands. Our adaptable solutions safeguard against counterfeiting, maintaining the integrity of products and consumer trust.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Track and Trace

- Alien Technology LLC

- AlpVision SA

- Ampacet Corp.

- Angstrom Technologies Inc.

- Applied DNA Sciences Inc.

- Authentix Inc.

- Avery Dennison Corp.

- CCL Industries Inc.

- EM Microelectronic Marin SA

- Flint Group

- Impinj Inc.

- MicroTag Temed Ltd

- Prooftag SAS

- Savi Technology Inc.

- SICPA HOLDING SA

- Thermo Fisher Scientific Inc.

- TruTag Technologies Inc.

- UFlex Ltd.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Anti-Counterfeit Packaging Market

- In February 2023, Amcor, a global packaging company, announced the launch of its new product, the "Amcor AuthentiQ," an advanced anti-counterfeit packaging solution for pharmaceuticals. This innovative technology utilizes a combination of holographic and microprinting techniques to ensure product authenticity and prevent counterfeiting (Amcor Press Release, 2023).

- In May 2024, Sealed Air, a leading provider of packaging solutions, entered into a strategic partnership with SICPA, a global security solutions company. This collaboration aimed to integrate SICPA's anti-counterfeit technologies into Sealed Air's packaging offerings, enhancing the security and authenticity of various industries, including food, pharmaceuticals, and electronics (Sealed Air Press Release, 2024).

- In August 2024, Thinfilm, a specialist in NFC (Near Field Communication) technology for physical packaging, raised USD20 million in a Series D funding round. This investment will support the company's growth in the market, enabling it to expand its product offerings and strengthen its position in the industry (Thinfilm Press Release, 2024).

- In November 2025, the European Union (EU) implemented a new regulation, EU Falsified Medicines Directive (FMD), mandating the use of anti-counterfeit packaging for all prescription medicines sold in the EU. This regulation is expected to significantly boost the demand for anti-counterfeit packaging solutions in the region (European Commission Press Release, 2020).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing demand for supply chain visibility, sustainability initiatives, and consumer engagement. Smart packaging, a key market trend, integrates IoT technology and big data analytics for real-time monitoring of product life cycles and compliance. Cloud-based solutions enable brand monitoring and risk management, while secure packaging design incorporates biometric authentication and ethical sourcing. Product development is focusing on connected packaging, sustainable packaging materials, and circular economy principles. Sustainability initiatives, such as environmental sustainability and product provenance, are becoming essential for brands seeking to build trust with consumers. Third-party audits and compliance audits ensure ethical sourcing and product integrity.

- Counterfeit monitoring is a critical aspect of risk management, with labeling materials and biometric authentication playing crucial roles. Packaging innovation continues to evolve, with IOT integration and big data analytics enhancing product development and brand protection. The circular economy and product provenance are key considerations in the packaging industry's shift towards a more sustainable future.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Anti-Counterfeit Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.2% |

|

Market growth 2025-2029 |

USD 185.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.8 |

|

Key countries |

US, Germany, UK, Canada, China, France, Japan, Italy, Brazil, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anti-Counterfeit Packaging Market Research and Growth Report?

- CAGR of the Anti-Counterfeit Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anti-counterfeit packaging market growth of industry companies

We can help! Our analysts can customize this anti-counterfeit packaging market research report to meet your requirements.