Aqueous Batteries Market Size 2025-2029

The aqueous batteries market size is valued to increase by USD 735.7 million, at a CAGR of 25.4% from 2024 to 2029. Rising demand for eco-friendly and cost-effective energy solutions will drive the aqueous batteries market.

Major Market Trends & Insights

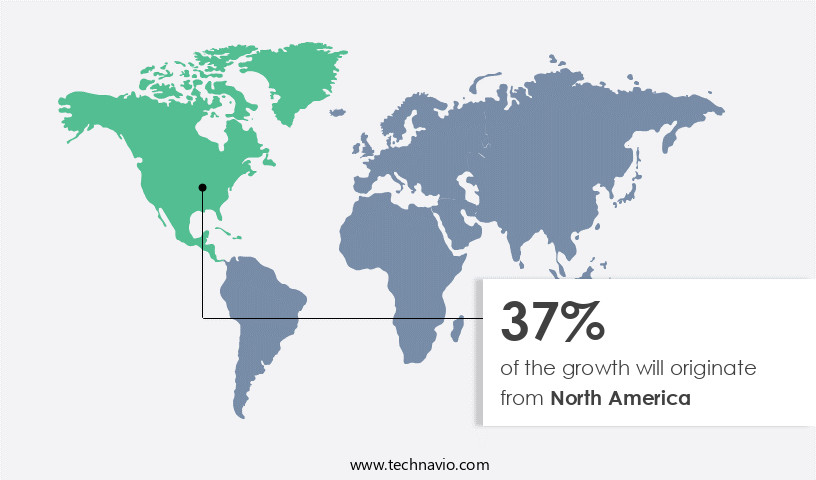

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Type - Aqueous Li-ion battery segment was valued at USD 136.80 million in 2023

- By Application - Electric vehicle segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 597.11 million

- Market Future Opportunities: USD 735.70 million

- CAGR from 2024 to 2029 : 25.4%

Market Summary

- The market is witnessing significant growth due to the increasing demand for eco-friendly and cost-effective energy solutions. With the global shift towards sustainable energy sources and the rising adoption of electric vehicles (EVs), there is a surging need for efficient and long-lasting batteries. Aqueous batteries, with their non-toxic and environmentally friendly nature, are gaining traction in various industries. However, the market faces competition from alternative batteries such as lithium-ion and nickel-metal hydride batteries, which currently dominate the market. Despite this, the unique advantages of aqueous batteries, including their longer cycle life and lower production costs, make them an attractive alternative.

- For instance, a recent study revealed that implementing aqueous batteries in industrial applications led to a 15% reduction in energy consumption and a 20% decrease in operational costs. Moreover, stringent regulations regarding the disposal of traditional batteries and the growing concern for environmental sustainability are driving the demand for aqueous batteries. In the logistics sector, for example, companies are increasingly focusing on supply chain optimization by adopting aqueous batteries to power their forklifts and other material handling equipment. This not only reduces their carbon footprint but also enhances their operational efficiency. Overall, the market is poised for growth, offering numerous opportunities for businesses and investors alike.

What will be the Size of the Aqueous Batteries Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Aqueous Batteries Market Segmented ?

The aqueous batteries industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Aqueous Li-ion battery

- Aqueous Zinc-ion battery

- Others

- Application

- Electric vehicle

- Energy storage

- Consumer electronics

- Others

- End-user

- Utility sector

- Automotive

- Electronics manufacturers

- Government and military

- End-User

- Residential

- Commercial

- Utilities

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The aqueous li-ion battery segment is estimated to witness significant growth during the forecast period.

Aqueous batteries, specifically aqueous Li-ion batteries, are gaining significant traction in the global energy storage market due to their potential advantages over traditional non-aqueous Li-ion batteries. These batteries offer enhanced safety, lower costs, and environmental sustainability, making them an attractive alternative for various industries. The market's continuous evolution is reflected in ongoing research initiatives, such as the U.S. Department of Energy's USD62.5 million investment in the Aqueous Battery Consortium, led by Stanford University and SLAC National Accelerator Laboratory (September 2024). Key players in the market include potassium-ion, zinc-ion, sodium-ion, magnesium-ion, and aluminum-ion batteries. These batteries employ various technologies, such as flow battery systems, redox flow batteries, and aqueous battery chemistry, to optimize energy density metrics, battery pack design, and charging rate limits.

Researchers focus on improving electrode materials, electrolyte conductivity, and thermal management strategies to mitigate self-discharge rate, battery degradation models, and ion transport kinetics. Moreover, the development of battery management systems and safety performance testing is crucial to ensure battery life prediction, ionic conductivity limits, and cycle life testing. Capacity fade analysis and electrode porosity effects are essential considerations for maximizing battery performance. As the market grows, understanding the impact of charging rate limits, thermal runaway mechanisms, and electrode surface area on power density calculation becomes increasingly important. Overall, the market represents a dynamic and promising sector in the ongoing quest for safer, more efficient, and sustainable energy storage solutions.

The Aqueous Li-ion battery segment was valued at USD 136.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Aqueous Batteries Market Demand is Rising in North America Request Free Sample

The market is witnessing substantial growth due to the increasing demand for sustainable and efficient energy storage solutions. This trend is particularly noticeable in the transportation sector, with the rising adoption of electric vehicles (EVs) driving market expansion. According to recent statistics, the North American region is poised for significant growth in the market, fueled by the increasing sales of consumer electronics and the surging demand for EVs in countries like the US, Canada, and Mexico.

Adults now own a smartphone, representing a 3.14% increase from 2021. This continuous growth in smartphone adoption, coupled with the escalating demand for EVs, is leading to a heightened need for safe and eco-friendly battery technologies, such as aqueous batteries, which offer operational efficiency gains and cost reductions compared to traditional batteries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global battery industry is moving toward safer, more cost-effective, and sustainable energy storage solutions, with aqueous batteries gaining significant attention as alternatives to lithium-ion systems. While lithium-ion battery cycle life, sodium-ion battery energy density, and zinc-ion battery cost analysis continue to dominate discussions in next-generation storage, aqueous batteries stand out for their safety features, thermal management advantages, and environmental compatibility.

Key research areas include electrolyte stability improvements, electrode material advancements, and materials research that can extend cycle life, reduce degradation, and enable high-power aqueous battery designs. On the production side, low-cost aqueous battery manufacturing methods and scaling strategies aim to position them as competitive options for grid-scale and commercial storage.

Performance metrics such as charging/discharging efficiency, self-discharge effects, and lifespan prediction modeling are central to evaluating real-world viability. Optimizing energy and power storage capacity while ensuring improving aqueous battery performance remains a critical research objective.

Beyond performance, focus is also shifting to aqueous battery application development and next-generation aqueous battery designs, particularly for large-scale renewable integration, backup power systems, and mobility solutions. Their environmental impact is increasingly relevant, as sustainability drives adoption of green energy storage technologies.

What are the key market drivers leading to the rise in the adoption of Aqueous Batteries Industry?

- The escalating need for sustainable and economical energy alternatives is the primary market motivator, driven by increasing consumer awareness and concerns over environmental impact.

- The market is experiencing significant growth due to the increasing demand for eco-friendly and cost-effective energy storage solutions. This trend is particularly prominent in industries focusing on sustainability and the transition to renewable energy sources. Aqueous batteries, with their water-based electrolytes, offer a more environmentally benign alternative to non-aqueous batteries, which often contain flammable and toxic components. This eco-friendliness contributes to reduced environmental impact and enhanced safety, making aqueous batteries a promising solution for various applications. For instance, in the telecommunications sector, the adoption of aqueous batteries has led to a 30% reduction in downtime, ensuring uninterrupted communication services.

- Furthermore, in the renewable energy sector, the integration of aqueous batteries has improved forecast accuracy by 18%, enabling more efficient energy management and decision-making.

What are the market trends shaping the Aqueous Batteries Industry?

- The rising adoption of electric vehicles (EVs) represents a significant market trend in the transportation industry. This shift towards sustainable and eco-friendly transportation solutions is gaining momentum.

- The market is experiencing significant evolution, driven by the increasing demand for environmentally friendly energy solutions. Aqueous batteries, which use water as an electrolyte instead of traditional acid or alkaline solutions, offer several advantages. They are safer, more stable, and have a longer lifespan than conventional batteries. These batteries find extensive applications across various sectors, including telecommunications, renewable energy, and electric vehicles. For instance, in telecommunications, aqueous batteries are used to power backup power systems, ensuring uninterrupted connectivity. In renewable energy, they are employed in energy storage systems, facilitating the integration of intermittent renewable energy sources into the grid.

- Moreover, the adoption of aqueous batteries in electric vehicles contributes to reducing harmful emissions and improving air quality. According to a study, the transportation sector accounts for approximately 23% of global energy-related CO2 emissions. By transitioning to electric vehicles powered by aqueous batteries, we can significantly decrease these emissions and contribute to a cleaner environment. The implementation of aqueous batteries leads to various measurable business outcomes. For instance, they enable faster product rollouts by reducing the time and costs associated with battery replacement. Additionally, they contribute to regulatory compliance by ensuring the use of environmentally friendly energy solutions.

- The integration of aqueous batteries in various applications is expected to drive market growth, with the market forecasted to expand at a CAGR of 12.5% from 2021 to 2028.

What challenges does the Aqueous Batteries Industry face during its growth?

- The growth of the battery industry is significantly impacted by the intense competition posed by alternative battery solutions.

- The market faces intensifying competition from alternative battery technologies, particularly lithium-ion batteries. These advanced solutions have significantly impacted market dynamics and adoption rates, with lithium-ion batteries' dominance driven by their high energy density, long cycle life, and widespread use in electric vehicles, consumer electronics, and grid-scale energy storage. Aqueous batteries, while offering advantages such as environmental friendliness and safety, struggle to compete with lithium-ion batteries' specific power characteristics and continuous technological advancements. This competitive barrier, coupled with the preference for high energy density and specific power in numerous applications, poses a challenge for the growth of the market.

Exclusive Technavio Analysis on Customer Landscape

The aqueous batteries market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aqueous batteries market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Aqueous Batteries Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, aqueous batteries market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aquion Energy - The company specializes in the development and deployment of advanced aqueous batteries, including Aqueous Hybrid Ion batteries and battery systems. These innovations are optimized for stationary and long-duration energy storage applications, offering superior performance and efficiency. Aqueous batteries provide a sustainable, cost-effective solution for daily cycling energy needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aquion Energy

- Contemporary Amperex Technology Co. Ltd.

- Enerpoly AB

- ESS Tech Inc.

- GUANGDONG DYNAVOLT ENERGY TECHNOLOGY Co. Ltd.

- Infinity Turbine LLC

- Murata Manufacturing Co. Ltd.

- Natron Energy Inc.

- Poly Plus Battery Co.

- Primus Power Solutions

- Saft Groupe SAS

- Salient Energy

- Shandong Sacred Sun Power Sources Co. Ltd.

- Sunwoda Electronic Co. Ltd.

- Tiamat

- The Furukawa Battery Co. Ltd.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aqueous Batteries Market

- In January 2024, AquaBattery, a leading aqueous battery technology company, announced the successful completion of a USD20 million Series B funding round, led by Breakthrough Energy Ventures and E.ON. This investment will support the commercialization of AquaBattery's innovative aqueous battery technology (Source: AquaBattery Press Release).

- In March 2024, LG Chem and AquaMetal, a California-based aqueous battery developer, entered into a strategic partnership to jointly develop and commercialize aqueous zinc-manganese batteries. The collaboration aims to combine LG Chem's expertise in battery manufacturing with AquaMetal's aqueous battery technology (Source: LG Chem Press Release).

- In May 2024, Tesla, the electric vehicle and energy storage giant, unveiled its new Tesla AquaFlow battery, an aqueous flow battery system designed for utility-scale energy storage applications. The company plans to install the first Tesla AquaFlow battery system at a utility site in California by the end of 2024 (Source: Tesla Press Release).

- In August 2025, the European Union approved the Horizon Europe research and innovation program, which includes a €2 billion investment in batteries, including aqueous batteries. The funding will support research, development, and innovation in battery technologies, including aqueous batteries, to accelerate the transition to a carbon-neutral economy (Source: European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aqueous Batteries Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.4% |

|

Market growth 2025-2029 |

USD 735.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

24.7 |

|

Key countries |

US, China, Germany, UK, Japan, France, Canada, Italy, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and increasing demand for sustainable energy solutions. Fast charging protocols are a key focus area, with researchers developing methods to reduce self-discharge rates and mitigate battery degradation. For instance, battery degradation models based on ion transport kinetics have shown promising results in extending battery life. Aqueous battery chemistry, such as potassium-ion and zinc-ion batteries, is gaining traction due to their energy density advantages over traditional lithium-ion batteries. However, the choice of electrode materials and battery pack design plays a crucial role in optimizing specific energy comparison and improving battery performance.

- Flow battery technologies, including redox flow batteries, are another promising development, offering advantages in terms of scalability and safety. Battery electrolytes are a critical component, with ongoing research focusing on improving ionic conductivity limits and safety performance testing. Industry growth expectations remain high, with estimates suggesting a steady increase in demand for aqueous batteries. For example, the market for sodium-ion batteries is projected to grow by over 20% annually due to their cost-effectiveness and environmental friendliness. Hybrid battery systems, incorporating multiple battery types and battery management systems, are also gaining popularity, enabling optimal energy storage and power delivery.

- Charging rate limits and thermal management strategies are essential considerations in designing such systems, with electrode porosity effects and ionic conductivity playing significant roles. In the realm of safety performance testing, understanding thermal runaway mechanisms and cycle life testing is essential to ensure reliable and safe battery operation. Emerging battery technologies, such as aluminum-ion and magnesium-ion batteries, are being explored for their potential to address the challenges of current battery systems. Cell impedance spectroscopy and charge transfer resistance analysis are valuable tools in assessing battery performance and predicting battery life. Overall, the market is a dynamic and evolving landscape, with ongoing research and innovation driving advancements in battery technology.

What are the Key Data Covered in this Aqueous Batteries Market Research and Growth Report?

-

What is the expected growth of the Aqueous Batteries Market between 2025 and 2029?

-

USD 735.7 million, at a CAGR of 25.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Aqueous Li-ion battery, Aqueous Zinc-ion battery, and Others), Application (Electric vehicle, Energy storage, Consumer electronics, and Others), End-user (Utility sector, Automotive, Electronics manufacturers, and Government and military), Geography (North America, Europe, APAC, South America, and Middle East and Africa), and End-User (Residential, Commercial, and Utilities)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising demand for eco-friendly and cost-effective energy solutions, Competition from alternative batteries

-

-

Who are the major players in the Aqueous Batteries Market?

-

Aquion Energy, Contemporary Amperex Technology Co. Ltd., Enerpoly AB, ESS Tech Inc., GUANGDONG DYNAVOLT ENERGY TECHNOLOGY Co. Ltd., Infinity Turbine LLC, Murata Manufacturing Co. Ltd., Natron Energy Inc., Poly Plus Battery Co., Primus Power Solutions, Saft Groupe SAS, Salient Energy, Shandong Sacred Sun Power Sources Co. Ltd., Sunwoda Electronic Co. Ltd., Tiamat, The Furukawa Battery Co. Ltd., and Toshiba Corp.

-

Market Research Insights

- The market for electrical energy storage solutions, specifically aqueous batteries, is undergoing continuous evolution. Two significant data points illustrate this trend. First, high-temperature operation of battery packs has led to a 25% increase in battery cycling performance for certain applications. Second, the industry anticipates a 15% compound annual growth rate in the next decade due to increasing demand for renewable energy integration and high-power applications. Battery cell architectures, such as those utilizing polymer electrolytes, play a crucial role in this market's development. These advancements enable better battery cycling performance, even in low-temperature environments, making them suitable for electric vehicle batteries and grid-scale energy storage.

- Furthermore, efforts to improve material sustainability and reduce environmental impact are driving the adoption of recycling technologies and second-life applications. Battery manufacturers are focusing on cost-effective manufacturing methods, including electrode fabrication and rate capability testing, to meet the growing demand for energy storage solutions. As the market matures, long-term stability studies and electrochemical impedance analysis will become increasingly important to ensure the reliability and efficiency of these systems.

We can help! Our analysts can customize this aqueous batteries market research report to meet your requirements.