Armored Vehicles Market Size 2025-2029

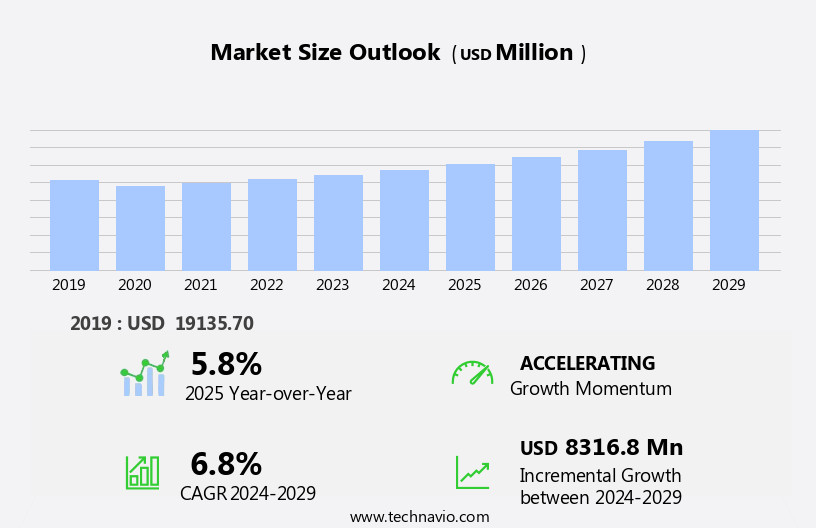

The armored vehicles market size is forecast to increase by USD 8.32 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is witnessing significant growth due to the rising incidences of asymmetric warfare worldwide. This trend is driving the demand for advanced and protective military vehicles. Another key factor fueling market growth is the increased adoption of unmanned combat ground vehicles. However, the high costs of main battle tanks remain a major challenge for market growth. This market is driven by the ongoing need for defense forces to secure personnel, logistics operations, and critical infrastructure against gunfire, explosives, and environmental hazards. To mitigate this challenge, manufacturers are focusing on developing cost-effective armored vehicles that offer similar protection and functionality. Additionally, the integration of advanced technologies, such as remote-controlled weapons systems and electronic warfare systems is expected to provide new opportunities for market growth. Overall, the market is expected to witness steady growth In the coming years, driven by the need for enhanced security and protection in various military applications.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production and sale of protective transport solutions for military and security applications. The demand for armored vehicles continues to grow, fueled by conflicts between nations, border security issues, and the increasing threat of terrorist attacks. Wheeled armored vehicles are a significant segment of this market, with a focus on weight optimization and combat capabilities. Advanced technologies, such as armor plating, bulletproof glass, and surveillance and reconnaissance (ISR) systems, enhance the protection offered by these vehicles.

- Military spending remains a key factor in market growth, with investments in armored vehicles enabling forces to effectively respond to hostile attacks and maintain operational readiness. The market is characterized by continuous innovation, with ongoing research and development efforts aimed at improving protection levels and reducing vehicle weight. As the security landscape evolves, the demand for armored vehicles is expected to remain strong, underpinned by the need to ensure the safety and security of personnel and assets in various operational environments.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Mobility Type

- Wheeled

- Tracked

- Type

- Conventional

- Electric

- Product

- Manned armored vehicles

- Unmanned armored vehicles

- Application

- Drive systems

- Structures and mechanisms

- Weapons and ammunition control systems

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Mobility Type Insights

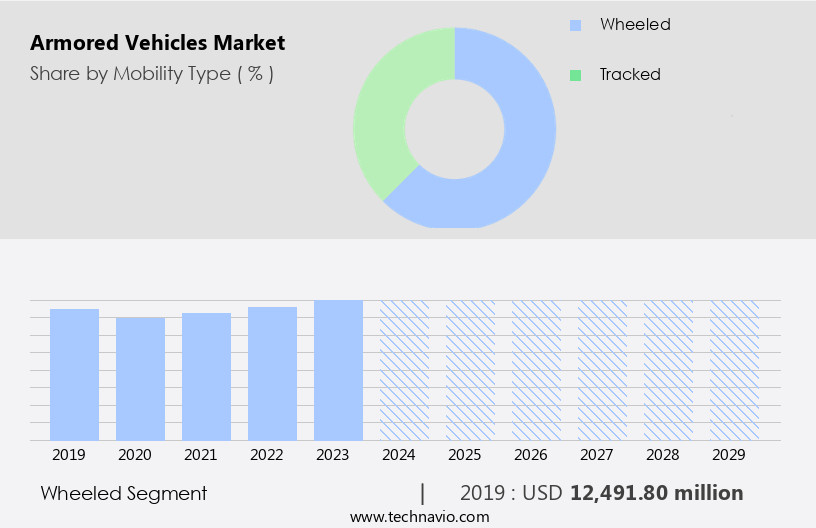

- The wheeled segment is estimated to witness significant growth during the forecast period.

Wheeled armored vehicles offer several advantages over tracked vehicles, including enhanced on-road performance, better fuel economy, and reduced maintenance costs. These vehicles provide superior mobility, particularly on roads and highways, making them indispensable for swift deployment in diverse settings, including urban environments. Examples of combat vehicles include the ASLAV (Australian LAV-25 series), Boxer AFV, armored personnel carriers M113 and Bushmaster IMV. Factors such as lightweight design, improved mobility, and enhanced combat capabilities are expected to fuel the demand for wheeled armored vehicles In the coming years. Furthermore, the escalating threat of terrorist and hostile attacks in urban areas will significantly boost the demand for these vehicles.

Get a glance at the market report of share of various segments Request Free Sample

The wheeled segment was valued at USD 12.49 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

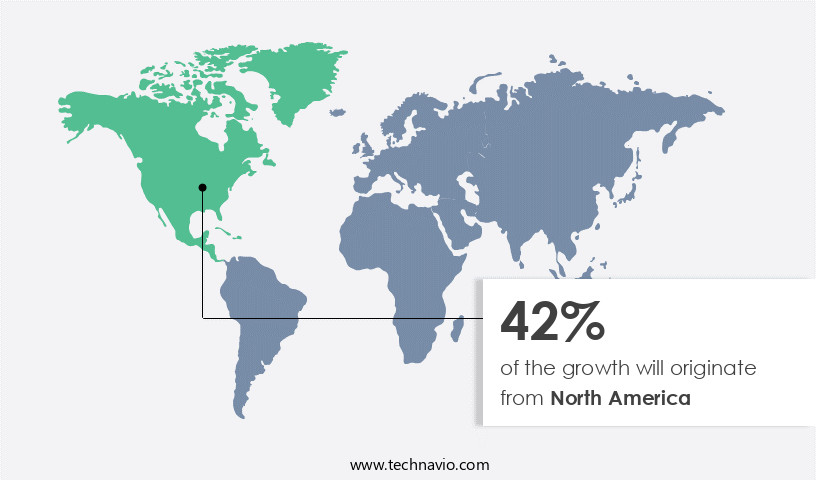

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is driven by the United States' focus on upgrading its defense forces and armored vehicle fleet with advanced technologies. The US is a significant importer and exporter of armored vehicles globally, and the need to ensure national security and military dominance is a primary factor driving market growth. North American countries are investing in defense modernization, including the replacement or enhancement of aging armored vehicles with technologically sophisticated systems. Geopolitical tensions, territorial disputes, and uncertainties have heightened the importance of defense preparedness, leading to the demand for armored vehicles with superior protection against gunfire, explosives, and environmental hazards.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Armored Vehicles Industry?

Rising incidences of asymmetric warfare globally is the key driver of the market.

- Asymmetric warfare, characterized by guerrilla tactics and the use of militant groups, poses unique challenges for defense forces worldwide. In response, the demand for armored vehicles is on the rise. These vehicles provide essential protection against gunfire, explosives, and environmental hazards for personnel and goods during security transport, law enforcement, and crowd control operations in densely populated cities and urban conflict zones. Armored vehicles come in various categories, including combat vehicles, combat support vehicles, and security transport vehicles, each with distinct features such as armor plating, bulletproof glass, and modular design. The market encompasses both wheeled and tracked segments, as well as the armament segment, which includes programmable ammunition and weapon systems.

- Key market dynamics include defense budgets, rapid response, medical support, and armored vehicle modernization. Market players focus on delivering reliable, efficient, and sustainable solutions, incorporating autonomous systems, situational awareness, and electrification. Export opportunities exist in regional conflicts and geopolitical tensions, with Europe and North America being significant markets. Additionally, the integration of UAVs, small drones, and cyber threat countermeasures further enhances the capabilities of armored vehicles.

What are the market trends shaping the Armored Vehicles Industry?

Increased adoption of unmanned combat ground vehicles is the upcoming market trend.

- Unmanned systems, including robots and UAVs, have become increasingly essential for military forces worldwide due to their application in intelligence, surveillance, and reconnaissance (ISR) and combat operations. This trend is particularly significant in advanced economies where defense budgets have decreased, leading to an increase In the purchase of unmanned systems to replace defensive personnel. These systems necessitate a substantial amount of supplies and logistical support, thereby driving the adoption of unmanned combat ground vehicles by defense forces. The growth of this market is further fueled by the integration of advanced technologies such as programmable ammunition, situational awareness, and modular design.

- The market is also witnessing the emergence of electric armored vehicles, electrification, and autonomous systems, offering opportunities for export and addressing concerns related to urbanization, cyber threats, and regional conflicts. The market dynamics are influenced by factors such as military spending, procurement, and the need for rapid response, medical support, and armored vehicle modernization. The market encompasses a wide range of vehicles, including combat vehicles, combat support vehicles, and security transport vehicles, catering to the protection needs of personnel, goods, and critical infrastructure. The market is segmented into the wheeled and tracked segments, with the wheeled segment dominating due to its mobility and lighter weight.

What challenges does the Armored Vehicles Industry face during its growth?

High costs of main battle tanks is a key challenge affecting the industry growth.

- The market encompasses a diverse range of defense and security transport solutions, including combat vehicles, combat support vehicles, and surveillance and reconnaissance (ISR) platforms. Key market participants include Northrop Grumman Corporation, IAI, and Textron Inc. The market is driven by the need for protection against gunfire, explosives, and environmental hazards for military and law enforcement personnel, as well as the transportation of goods and personnel in urban areas. The market is segmented into the wheeled and tracked segments, with the former gaining traction due to its mobility and lighter weight. The armament segment is a significant contributor to market growth, with the integration of programmable ammunition, UAVs, and small drones enhancing combat capabilities.

- The North America market dominates the global landscape due to its large defense budgets and rapid response capabilities. However, Europe is a growing market, driven by border conflicts and terrorism activities. The market is also witnessing a shift towards autonomous systems, situational awareness, and modular design for improved reliability and delivery. Defense spending, procurement, and critical infrastructure protection are key drivers for the market. Key challenges include the high costs associated with developing advanced technology for combat vehicles and the need for export opportunities in regions with geopolitical tensions. The market is also witnessing the emergence of electric armored vehicles, electrification, and anti-drone capabilities to address cyber threats and urban warfare.

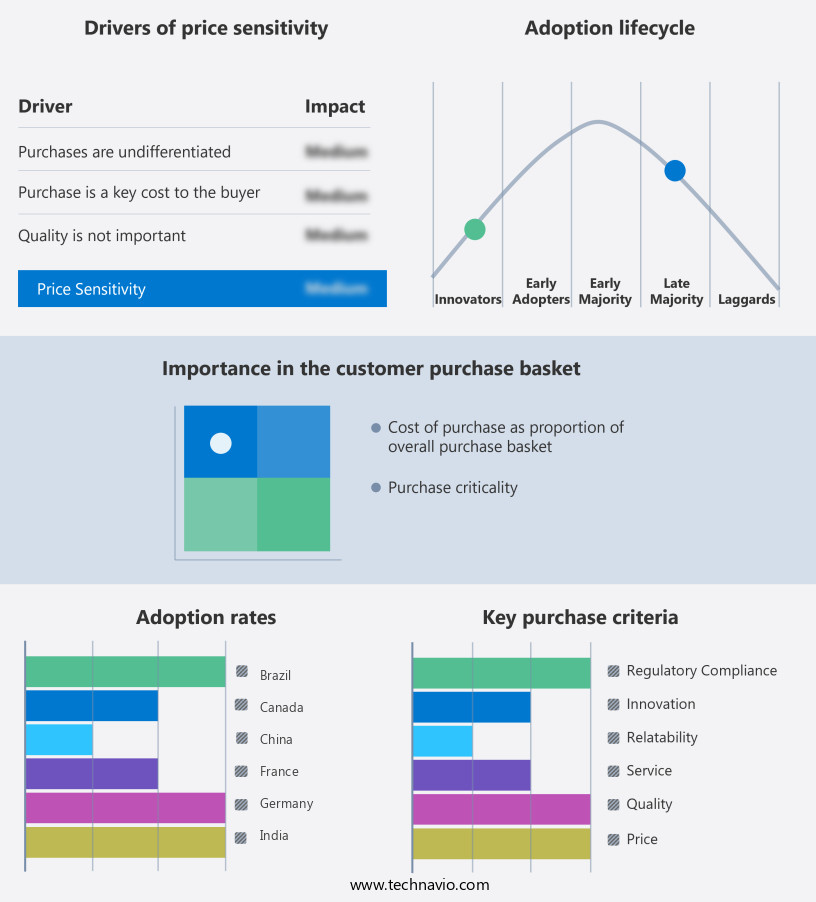

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AB Volvo - The company offers armored vehicles such as Scarabee, VAB MK 3, and Higuard vehicles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpine Armoring Inc.

- Armormax

- BAE Systems Plc

- Denel SOC Ltd.

- General Dynamics Corp.

- International Armored Group

- Iveco Group N.V

- KNDS N.V.

- Lockheed Martin Corp.

- Mahindra and Mahindra Ltd.

- Milkor Pty Ltd.

- Oshkosh Corp.

- Otokar Automotive and Defense Industry Inc.

- Rheinmetall AG

- Rostec

- STREIT Group

- SVI ENGINEERING

- Textron Inc.

- Traton SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of land-based platforms engineered to provide protection against various threats for military forces and security applications. These vehicles cater to the needs of defense forces and law enforcement agencies in executing surveillance, reconnaissance (ISR), intelligence gathering, and combat missions. The market comprises both combat vehicles and combat support vehicles, with the former designed for direct engagement in hostile environments and the latter providing essential logistical and support functions. The market is segmented into the wheeled and tracked segments based on mobility. The wheeled segment offers superior mobility and agility, making it suitable for urban environments and rapid response situations.

In contrast, the tracked segment provides enhanced ground clearance and off-road capability, making it ideal for terrestrial combat and logistics operations. The armament segment of the market includes vehicles equipped with weapon systems, communication and navigation systems, and protection features such as armor plating and bulletproof glass. These vehicles are designed to withstand gunfire, explosives, and environmental hazards, ensuring the safety of personnel and goods during defense, security transport, and law enforcement operations. The market dynamics are influenced by several factors, including defense budgets, rapid response capabilities, medical support, armored vehicle modernization, and electrification. The increasing trend towards autonomous systems, situational awareness, and modular design is driving innovation In the market.

Moreover, lightweight materials and mobility are essential considerations In the design of armored vehicles, ensuring optimal performance and operational efficiency. Security concerns, regional conflicts, and geopolitical tensions continue to fuel demand for armored vehicles in various applications. Urbanization and the proliferation of densely populated cities have increased the need for vehicles capable of operating in urban environments, including armored cars and border monitoring systems. The rise of cyber threats and cyberattacks has led to the development of anti-drone capabilities and vehicle systems designed to counteract these threats. The market presents significant export opportunities for industry players, particularly in regions experiencing conflict and instability.

Furthermore, the market is expected to grow as defense spending increases and procurement of critical infrastructure protection solutions continues to be a priority. The integration of electric propulsion and electrification in armored vehicles is also gaining traction, with a focus on reducing emissions and improving operational efficiency. The market is characterized by a diverse range of applications, including urban warfare, hybridization, and environmental concerns. The increasing importance of sustainability and climate change has led to the development of electric armored vehicles, which offer reduced emissions and improved performance. Maintenance costs and torque control are essential considerations In the design of armored vehicles, ensuring their reliability and operational readiness.

Therefore, the market is a dynamic and evolving industry that caters to the diverse needs of military and security applications. The market is driven by a range of factors, including defense budgets, operational efficiency, and emerging threats. The integration of advanced technologies and the focus on sustainability are key trends shaping the future of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 8.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, Germany, Canada, UK, France, Japan, South Korea, Brazil, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Armored Vehicles industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.