Artificial Fur Market Size 2025-2029

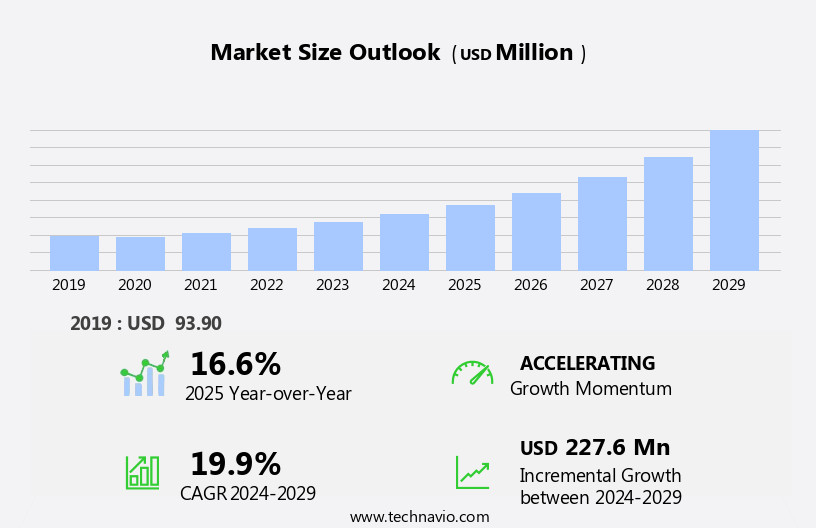

The artificial fur market size is forecast to increase by USD 227.6 million at a CAGR of 19.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of online shopping and the availability of high-quality artificial fur alternatives to real animal fur. This shift in consumer preferences is a key trend shaping the market, as more individuals seek ethical and sustainable alternatives to traditional fur products. Market companies are responding to this demand by investing in product innovations, such as advanced manufacturing techniques and improved textures and colors, to create realistic and desirable artificial fur options. However, challenges remain, including the need to maintain affordability and accessibility for consumers, as well as addressing concerns around the environmental impact of artificial fur production.

- The proliferation of the Internet and smartphones worldwide has positively impacted the sales of artificial fur, encompassing apparel and home textiles. Companies seeking to capitalize on this market opportunity must stay abreast of consumer trends and invest in research and development to offer competitive and sustainable products. By focusing on these strategic areas, businesses can effectively navigate challenges and capitalize on the growing demand for artificial fur solutions.

What will be the Size of the Artificial Fur Market during the forecast period?

- The market in the United States continues to experience significant growth, driven by increasing consumer demand for eco-friendly and ethical alternatives to real fur. This trend is reflected in the expanding range of faux fur products, including coats, scarves, hats, cushions, throws, rugs, and even fashion accessories. Innovations in fur technology have led to the development of advanced materials, such as microfiber fur, which offer superior colorfastness, durability, and authenticity. Fur-conscious consumers are also driving the market through their preference for fur-responsible sourcing and ethical practices. Brands are responding by implementing traceability initiatives and collaborating on sustainable, recycled fur projects.

- Digital marketing and influencer collaborations are key strategies for engaging customers and promoting fur-positive messaging. Fur certification bodies play a crucial role in ensuring product quality and authenticity, while also addressing concerns around flammability and care instructions. As the market continues to evolve, expect further advancements in fur technology, as well as a focus on transparency, innovation, and customer engagement.

How is this Artificial Fur Industry segmented?

The artificial fur industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Apparel

- Upholstery and home textiles

- Other accessories

- Distribution Channel

- Online

- Offline

- Type

- Long pile

- Medium pile

- Short pile

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- UK

- North America

- US

- Canada

- South America

- Middle East and Africa

- APAC

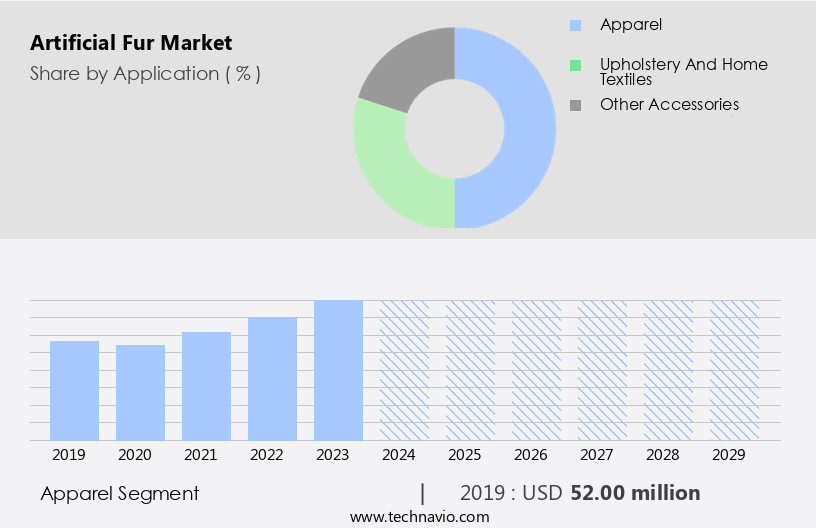

By Application Insights

The apparel segment is estimated to witness significant growth during the forecast period. Artificial fur, also known as faux fur, continues to innovate and evolve in the apparel industry, offering consumers comfortable and stylish alternatives to real fur. The market for fur-made garments, including coats, jackets, vests, and dresses, is thriving, with a focus on luxury and sustainability. Short fur coats and jackets, such as boleros, vests, and cropped jackets, are popular choices for those seeking fashionable and versatile options. Extreme weather conditions drive demand for fur-lined coats and jackets in regions with cold climates. However, ethical concerns and regulations have led to a shift towards synthetic fur and vegan alternatives. Fur technology trends include printing, embroidery, and blending, which allow for intricate designs and textures.

Fur maintenance, such as shearing, cleaning, and storage, is essential for preserving the longevity of these garments. Fur's softness, warmth, and comfort make it a preferred choice for fashion brands and influencer marketing. Fur's future trends include upcycling, design trends, and sustainability, as consumers prioritize ethical and eco-friendly options. Fur's fiber, density, and weight offer various possibilities for fashion and home decor, such as rugs, cushions, and throws. Fur's ethical sourcing, branding, and certification are crucial factors in consumer behavior and purchasing habits. Fur's ethical implications and environmental impact are significant considerations for the industry, with regulations and standards playing a crucial role in its future.

Fur's marketplace continues to grow, with a focus on quality, durability, and value. Fur's future outlook is promising, with continued innovation and trends shaping its role in fashion and home decor.

Get a glance at the market report of share of various segments Request Free Sample

The Apparel segment was valued at USD 52.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Artificial fur, a popular alternative to real fur, is experiencing innovation and trends in both style and technology. Faux fur's maintenance requirements are minimal compared to real fur, making it a preferred choice for consumers. Fur printing, embroidery, and filament techniques add texture and artistry to the material, expanding its application beyond clothing to home decor items such as cushions, rugs, and throws. Fur branding and consumer behavior influence the market, with preferences leaning toward ethical sourcing and sustainability. Fur recycling and upcycling are emerging trends, contributing to the industry's environmental impact. Faux fur's longevity, warmth, and softness make it a valuable investment for consumers.

Fur retailers and wholesalers prioritize quality and pricing, offering a wide range of styles, from jackets and vests to scarves and gloves. Fur trim, embellishment, and pattern diversity cater to various design trends. The industry outlook is positive, with increasing demand for faux fur in the US, Europe, and Asia. Fur production involves shearing, dyeing, and weaving processes, ensuring consistent fiber quality. Fur cleaning and storage solutions cater to the needs of consumers and retailers. Synthetic fur's ethical considerations and animal welfare concerns are essential factors shaping the market landscape. Fashion trends, including color and density preferences, influence the industry.

Fur's future trends include knitting, blending, and filament technology. The marketplace offers various options for consumers, from online stores to physical retailers. Fur's environmental impact and regulations are essential considerations for brands and retailers. Sustainability and ethical sourcing are key factors in consumer purchasing habits. The future of the market lies in innovation, quality, and consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Artificial Fur Industry?

- Growing prominence for online shopping is the key driver of the market. The market has experienced notable growth over the past decade, driven by the influence of online distribution channels and e-commerce platforms. E-commerce enables various end-users, including clothing manufacturers and home furnishing service providers, to access a wide range of regional and global artificial fur brands.

- Furthermore, the availability of diverse artificial fur products, such as plain and textured fur, has augmented demand for natural fiber-based fur, particularly from developing countries like China and India. This digital transformation has significantly expanded market reach and convenience for consumers, contributing to the market's continued expansion.

What are the market trends shaping the Artificial Fur Industry?

- Product developments by market operator is the upcoming market trend. The global shift towards sustainable and ethical fashion practices has led to an increased focus on the use of artificial fur in apparel manufacturing. Ecopel, a leading innovator in this field, recently introduced Flur, a 100% plant-based, chemical-free material, at Paris Fashion Week in October 2023. This groundbreaking fabric, created by combining DuPont's Sorona corn-based fibers with a recycled polyester blend, is both biodegradable and natural in appearance. The addition of a polymer derived from regenerated vegetable oil further enhances its eco-friendly attributes.

- As more fashion retailers and brands adopt artificial fur, the market for this sustainable alternative is poised to grow significantly. This trend is driven by consumer preferences for ethical and environmentally-friendly products, as well as the availability of advanced technologies for producing high-quality artificial fur.

What challenges does the Artificial Fur Industry face during its growth?

- Availability of animal fur as artificial fur is a key challenge affecting the industry's growth. The global market for artificial fur is experiencing growth due to the rising consumer preference for cruelty-free alternatives to real fur. Major fashion brands have publicly committed to using synthetic fur in their products, citing ethical concerns. However, there have been allegations that some artificial fur products are actually made from real animal fur. In a notable instance in April 2024, an undercover investigation by the Humane Society revealed that several retailers in California were selling fur products in violation of the state's fur sales ban.

- This incident underscores the need for stricter enforcement and penalties to ensure compliance with regulations. The report suggests that increased monitoring and higher fines could deter retailers from engaging in such illegal practices. Overall, the demand for artificial fur is expected to continue growing as consumers become increasingly conscious of animal welfare issues.

Exclusive Customer Landscape

The artificial fur market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial fur market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial fur market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ambassador Textiles Ltd. - The company offers faux fur of various types which has been approved by PETA.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambassador Textiles Ltd.

- Aono Pile Co. Ltd.

- Bartfeld

- DealTask Pty Ltd.

- Donna Salyers Fabulous Furs

- ECOPEL

- EZ Fabric

- JiangSu Unitex Co. Ltd.

- Kolunsag Muflon Sanayi Ltd.

- Nanjing Eastsun Textiles Co. Ltd.

- Pahwa Fur Fabrics Pvt. Ltd.

- Peltex Fibres Sarl

- Ramtex Inc.

- Shannon Fabrics Inc.

- Sommers Plastic Products Co.

- Trims Lannd

- USA Knit Products

- Wayfair Inc.

- Youngman Woollen Mills Pvt. Ltd.

- Zhejiang Fur Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Artificial fur has long been a popular alternative to real animal fur in the fashion and home decor industries. This material, often made from synthetic fibers, offers numerous benefits that cater to modern consumer preferences and market dynamics. Fur innovation continues to advance, with new technologies and techniques emerging to enhance the look, feel, and durability of artificial fur. Fur printing, for instance, enables the creation of intricate patterns and textures, while shearing techniques ensure a natural appearance. Moreover, advances in fiber technology have led to the development of fur that closely mimics the texture and pile of real fur.

Fur maintenance is another crucial aspect of the market. Proper care and cleaning are essential to maintain the longevity and quality of fur garments and home decor. Consumers increasingly seek out information on how to care for their fur items, leading to a growing demand for educational resources and specialized cleaning services. Fur advertising and marketing strategies have evolved to cater to changing consumer attitudes and ethical concerns. Influencer marketing and social media campaigns have become popular channels for promoting fur brands and products, with a focus on sustainability, ethical sourcing, and animal welfare. Fur trends continue to shift, with a growing emphasis on vegan and eco-friendly alternatives.

The faux fur and vegan fur market is experiencing a dynamic transformation driven by sustainability, ethical sourcing, and innovation. Consumers are increasingly turning to cruelty-free fur, eco-friendly fur, and sustainable fur options such as acrylic fur and polyester fur, favoring alternatives that align with the fur-free fashion and fur-free lifestyle movements. Popular items like faux fur coats, faux fur jackets, faux fur vests, faux fur scarves, and faux fur hats reflect the growing demand for fur-alternative products that combine style, fur comfort, and fur warmth. In home décor, products like faux fur rugs, faux fur throws, and faux fur cushions enhance aesthetics and comfort using fur-like fabrics, fur-effect materials, and fur-look textiles. Innovation in fur technology advancements, fur fabric development, and fur dyeing processes ensures high-quality, fashionable, and ethical offerings. Brands now focus on fur transparency, with fur traceability, fur quality assurance, and fur authenticity backed by fur testing methods, including fur durability testing, fur flammability testing, and fur colorfastness testing.

As fur-aware brands adopt fur-ethical practices and promote fur sustainability, they engage with audiences through fur digital marketing, fur influencer collaborations, and fur brand storytelling. Channels like fur e-commerce, fur online stores, and fur marketplaces are key to connecting with fur target audiences, shaping fur consumer behavior, and cultivating fur brand loyalty. Design-wise, fur color palettes, fur style trends, fur design trends, and fur innovation trends are leading the way, with artisans showcasing intricate fur embroidery, fur applique, and fur embellishment in seasonal fur collections. As the fur industry outlook shifts toward ethical and innovative production, workshops, fur industry conferences, and fur publications serve as platforms for sharing best practices and advancing the fur innovation pipeline.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.9% |

|

Market growth 2025-2029 |

USD 227.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

China, US, UK, Germany, France, Japan, India, South Korea, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Fur Market Research and Growth Report?

- CAGR of the Artificial Fur industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial fur market growth and forecasting

We can help! Our analysts can customize this artificial fur market research report to meet your requirements.