Artificial Intelligence In Diagnostics Market Size 2024-2028

The artificial intelligence in diagnostics market size is forecast to increase by USD 3.06 billion, at a CAGR of 37.9% between 2023 and 2028.

- The Artificial Intelligence (AI) in Diagnostics market is experiencing significant growth due to the increasing application of AI in the healthcare industry. The integration of AI in diagnostics offers numerous benefits, including improved accuracy, efficiency, and cost savings. One of the key drivers is the increasing demand for e-diagnostic services, as patients seek convenient and accessible healthcare solutions. However, the market faces challenges that require careful navigation. Cybersecurity issues pose a significant threat, as the use of AI in diagnostics involves handling sensitive patient data.

- Ensuring data security and privacy is essential to build trust and maintain regulatory compliance. Companies must invest in robust cybersecurity measures to protect against potential breaches and mitigate risks. This strategic focus on data security will be crucial for market success in the evolving healthcare landscape.

What will be the Size of the Artificial Intelligence In Diagnostics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The artificial intelligence (AI) in diagnostics market continues to evolve, with innovative applications emerging across various sectors. Image recognition algorithms are revolutionizing medical imaging analysis, enhancing diagnostic accuracy and enabling early disease detection. Regulatory compliance AI ensures adherence to regulatory standards, streamlining regulatory processes and reducing compliance costs. Explainable AI diagnostics is gaining traction, providing transparency and interpretability to AI-driven diagnoses, enhancing trust and acceptance among healthcare professionals. AI-driven pathology is transforming laboratory diagnostics, offering faster and more accurate results. Drug discovery AI is revolutionizing pharmaceutical research, accelerating the development of new treatments and drugs. Cardiology AI applications are improving heart disease diagnosis and management, while neurology AI applications are enabling earlier and more accurate detection of neurological conditions.

Radiology workflow optimization is enhancing efficiency and productivity, reducing wait times and improving patient care. Remote patient monitoring, genomic data integration, natural language processing, and deep learning imaging are also driving growth in the market. Medical image segmentation, multimodal data fusion, diagnostic accuracy metrics, disease progression prediction, oncology diagnostic support, wearable sensor integration, healthcare data security, and predictive diagnostic models are some of the key areas of focus in the market. The ongoing unfolding of market activities reveals a dynamic and evolving landscape, with AI-powered diagnostic tools and risk stratification models becoming increasingly important.

How is this Artificial Intelligence In Diagnostics Industry segmented?

The artificial intelligence in diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and clinics

- Diagnostics laboratory

- Homecare

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By End-user Insights

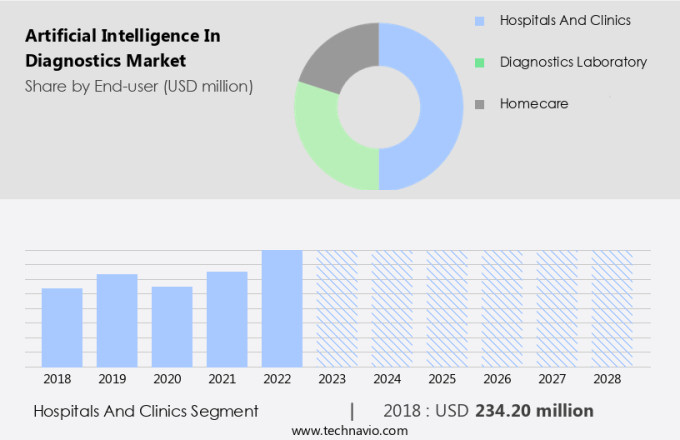

The hospitals and clinics segment is estimated to witness significant growth during the forecast period.

Artificial intelligence (AI) is revolutionizing healthcare, offering significant efficiencies in various applications. In hospitals and clinics, AI is utilized beyond administrative tasks, such as claims processing and clinical documentation. Machine learning algorithms, for instance, facilitate data pairing across databases to ensure the accuracy of the millions of claims submitted daily. This saves time, money, and resources for insurers and providers. AI's role extends to medical diagnosis, with applications in cardiology, neurology, and radiology. In cardiology, AI-driven pathology and oncology diagnostic support aid in the detection and prediction of diseases. Neurology benefits from AI in diagnosing neurological disorders through medical image segmentation and multimodal data fusion.

Radiology workflow optimization is another area where AI excels, improving diagnostic accuracy metrics and disease progression prediction. Wearable sensors and remote patient monitoring are integrated with AI for personalized medicine and risk stratification models. Genomic data integration and diagnostic biomarker discovery are facilitated by AI, enabling predictive diagnostic models and clinical trial optimization. Computer vision healthcare and object detection algorithms contribute to medical imaging analysis, enhancing the overall diagnostic process. Healthcare data security is a critical concern, and AI plays a role in maintaining patient data privacy through encryption and access control. Natural language processing (NLP) is employed to understand and classify clinical documentation, improving diagnostic accuracy and streamlining workflows.

Deep learning imaging and explainable AI diagnostics provide insights into complex medical data, ensuring regulatory compliance and enhancing patient care. In summary, AI's influence in healthcare is profound, impacting various aspects from claims processing and clinical documentation to medical diagnosis and drug discovery. Its applications include cardiology, neurology, radiology, remote patient monitoring, and genomic data integration, among others. AI's role in maintaining healthcare data security, medical imaging analysis, and regulatory compliance further underscores its importance in the healthcare sector.

The Hospitals and clinics segment was valued at USD 234.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

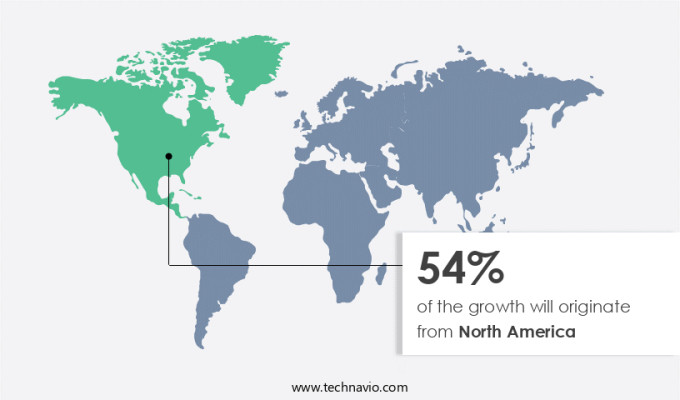

North America is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the artificial intelligence (AI) in diagnostics market experienced significant growth in 2023, with the US leading the regional contribution. Factors driving this expansion include increased insurance coverage, rising research and development expenditure, a growing geriatric population with chronic diseases, and high healthcare spending. According to the Centers for Disease Control and Prevention (CDC), approximately 60% of US adults suffer from chronic diseases, making them the leading cause of death and disability. Furthermore, the availability of numerous AI diagnostics companies in the US, including those specializing in image recognition algorithms, regulatory compliance AI, explainable diagnostics, AI-driven pathology, drug discovery AI, cardiology AI applications, neurology AI applications, radiology workflow optimization, remote patient monitoring, genomic data integration, natural language processing, deep learning imaging, personalized medicine AI, machine learning diagnostics, medical image segmentation, multimodal data fusion, diagnostic accuracy metrics, disease progression prediction, oncology diagnostic support, wearable sensor integration, healthcare data security, medical imaging analysis, computer vision healthcare, object detection algorithms, patient data privacy, diagnostic biomarker discovery, predictive diagnostic models, clinical trial optimization, and AI-powered diagnostic tools, have significantly influenced the market's dynamics.

Additionally, risk stratification models and efforts towards integrating these advanced technologies into clinical practice have further propelled the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Artificial Intelligence In Diagnostics Industry?

- The application of artificial intelligence is driving the growth of the healthcare industry market significantly. This technology's increasing utilization in areas such as medical diagnosis, patient monitoring, and drug discovery is revolutionizing the sector and enhancing efficiency and accuracy.

- Artificial intelligence (AI) is revolutionizing the diagnostics industry by enhancing patient care, reducing machine downtime, and lowering diagnostic costs. The global market for AI in diagnostics is experiencing significant growth due to several factors. These include the demand for quick and efficient diagnostic data generation, effective report analysis, and the need for accurate risk stratification models. Furthermore, AI-powered diagnostic tools are increasingly being used in emergency medical procedures to minimize the time delay between trauma and diagnosis, leading to prompt interventions and improved patient outcomes. Predictive diagnostic models and diagnostic biomarker discovery are also key areas where AI is making a significant impact.

- Clinical trial optimization is another area benefiting from AI, as it enables researchers to analyze large datasets and identify patterns that may not be apparent through traditional methods. Overall, the integration of AI in diagnostics is expected to lead to more accurate diagnoses, faster turnaround times, and improved patient care.

What are the market trends shaping the Artificial Intelligence In Diagnostics Industry?

- The rising demand for e-diagnostic services represents a significant market trend. This trend is driven by the increasing preference for convenient, remote healthcare solutions.

- Artificial intelligence (AI) is revolutionizing the diagnostic industry by enhancing accuracy and efficiency. Beth Israel Deaconess Medical Center Cancer Research Institute's AI system, utilizing deep learning algorithms, achieved a 92% success rate in differentiating between cancerous and non-cancerous cells. Regulatory compliance in AI diagnostics is crucial, ensuring explainable AI (XAI) is implemented for transparency. In cardiology and neurology, AI applications are streamlining diagnosis and treatment plans. Radiology workflow optimization is another significant application, reducing wait times and increasing productivity. Furthermore, AI is expediting drug discovery, enabling researchers to analyze vast amounts of data and identify potential treatments.

- The integration of AI in pathology is improving diagnostic precision and reducing human error, which is responsible for approximately 10% of patient deaths and 15% of hospital complications. AI-driven systems can manage medical records, providing practitioners with easily accessible and formatted patient data, ultimately leading to effective and timely treatment.

What challenges does the Artificial Intelligence In Diagnostics Industry face during its growth?

- Cybersecurity challenges significantly hinder the growth of industries by posing a critical threat to digital security and confidentiality. It is essential for organizations to prioritize and invest in robust cybersecurity measures to mitigate risks and protect their digital assets.

- Artificial intelligence (AI) is revolutionizing diagnostics by processing vast amounts of data from remote patient monitoring, genomic data integration, and medical images. Natural language processing and deep learning imaging enable AI to analyze complex data, leading to more accurate diagnoses. AI's role in personalized medicine is significant, as it facilitates the integration of multimodal data, including lab results and medical histories, to provide customized treatment plans. Machine learning diagnostics and medical image segmentation are critical applications, improving diagnostic accuracy and efficiency. Security and data privacy are paramount in this sector, necessitating robust authorization techniques and monitoring systems to protect sensitive information.

- Confidentiality and data security are essential to build trust with end-users, ensuring that their data is used constructively for decision-making, budgeting, and strategic planning. It is crucial that companies prioritize these aspects to gain the trust and confidence of healthcare providers and patients.

Exclusive Customer Landscape

The artificial intelligence in diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence in diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial intelligence in diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aidence B.V. - Artificial intelligence diagnostics from this company serves overburdened medical professionals with accurate support, reducing workload pressure and enhancing practitioner efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aidence B.V.

- Aidoc Medical Ltd.

- AliveCor Inc.

- Alphabet Inc.

- Butterfly Network Inc.

- Digital Diagnostics Inc.

- General Electric Co.

- HeartFlow Inc.

- Imagen Technologies Inc.

- Intel Corp.

- International Business Machines Corp.

- NovaSignal Corp.

- Prognos Health Inc

- Quibim SL

- Riverain Technologies

- Siemens AG

- Therapixel SA

- Viz.ai Inc.

- VUNO

- Zebra Medical Vision Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Intelligence In Diagnostics Market

- In January 2024, IBM Watson Health announced the FDA clearance of its AI-powered diagnostic solution, IBM Watson for Clinical Trial Matching. This system assists clinicians in identifying potential clinical trials for their patients based on their medical history and demographics (IBM Press Release, 2024).

- In March 2024, Google's DeepMind Health collaborated with the UK's National Health Service (NHS) to deploy Streams, an AI-powered app for early detection and prevention of acute kidney injury (DeepMind Health Press Release, 2024).

- In May 2024, Siemens Healthineers raised ⬠1.3 billion in a bond issuance to finance the expansion of its portfolio in AI-driven diagnostics and therapeutic solutions (Siemens Healthineers Press Release, 2024).

- In April 2025, Roche Diagnostics and Microsoft entered into a strategic partnership to integrate Microsoft's Azure AI platform with Roche's diagnostic offerings, aiming to enhance diagnostic accuracy and efficiency (Microsoft News Center, 2025).

Research Analyst Overview

- The Artificial Intelligence (AI) in diagnostics market is witnessing significant advancements, with a focus on enhancing the clinical utility and integrating AI models into medical devices. The interpretability of AI models is crucial for gaining trust in the healthcare industry, as negative predictive value and sensitivity and specificity metrics are evaluated for model retraining strategies. Cloud-based diagnostics are gaining popularity due to their accessibility and scalability, with performance evaluation metrics such as positive predictive value and accuracy guiding their implementation. AI applications in pathology, neurology, cardiology, oncology, and radiology are revolutionizing early disease detection and precision diagnostics. Prognostic modeling and data augmentation techniques are essential for improving the predictive capabilities of AI in healthcare.

- Federated learning healthcare and edge computing diagnostics are emerging trends, enabling AI regulatory landscape compliance and enhancing data interoperability. Model retraining strategies and diagnostic algorithm validation are ongoing priorities to ensure the continuous improvement of AI performance in healthcare.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Intelligence In Diagnostics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.9% |

|

Market growth 2024-2028 |

USD 3062.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

27.6 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Intelligence In Diagnostics Market Research and Growth Report?

- CAGR of the Artificial Intelligence In Diagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial intelligence in diagnostics market growth of industry companies

We can help! Our analysts can customize this artificial intelligence in diagnostics market research report to meet your requirements.