Artificial Organs And Bionic Implants Market in Spain Size 2024-2028

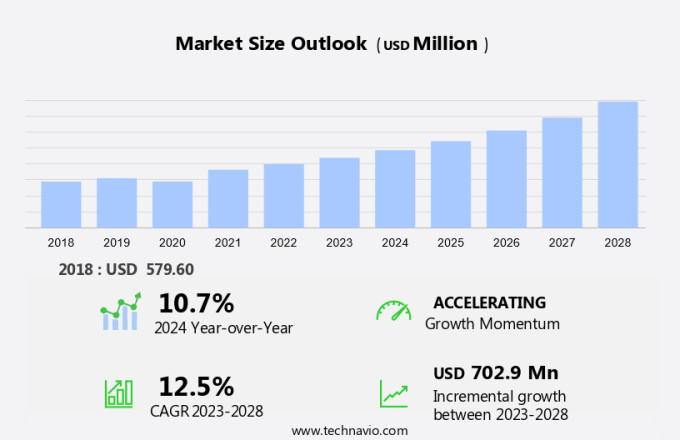

The artificial organs and bionic implants market in Spain size is forecast to increase by USD 702.9 million, at a CAGR of 12.5% between 2023 and 2028.

- The Spanish market for Artificial Organs and Bionic Implants is shaped by several key drivers and trends. The scarcity of organ donors poses a significant challenge, fueling the demand for advanced bionic implants as viable alternatives. Simultaneously, the rise of medical tourism in Spain attracts patients from abroad seeking affordable yet high-quality artificial organ and bionic implant solutions. However, the high expense of these technologies remains a significant barrier to entry for many potential patients, necessitating innovative financing models and collaborations between stakeholders.

- Companies in this market must navigate these challenges while capitalizing on the growing demand for life-enhancing technologies. Strategic partnerships, research collaborations, and cost-effective production methods will be essential for market success.

What will be the Size of the Artificial Organs And Bionic Implants Market in Spain during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in medical technology and the growing prevalence of organ failures. Electronic technology plays a pivotal role in this sector, with smart wearables and mechanical bionics revolutionizing the way we approach organ transplant procedures and prosthetics. Organ failures, such as those caused by hypertension, diabetes, and age-related macular degeneration, are major catalysts for market growth. Clinical trials for innovative solutions, including 3D bioprinting and organ implants, are underway, offering promising prospects for the future. The healthcare system is adapting to these advancements, with hospitals integrating electronic bionics and mechanical technology into their services.

Orthopedic bionics, including cochlear and ear implants, are transforming the lives of individuals with hearing loss and vision impairment. Live donor programs and organ transplantation remain crucial components of the market, with ongoing efforts to reduce the donor waiting list and improve organ transplanting procedures. The ongoing dynamism of the market is influenced by various factors, including lifestyle disorders, road accidents, and chronic kidney failure. The role of artificial intelligence and machine learning in the development of bionic implants and organ transplantation is increasingly significant. Medical devices, including dialysis machines and ambulatory surgical centers, are essential components of the market, providing vital support for individuals with organ failures and undergoing transplant procedures. The continuous unfolding of market activities and evolving patterns underscores the importance of staying informed and adaptable in this ever-changing landscape.

How is this Artificial Organs And Bionic Implants in Spain Industry segmented?

The artificial organs and bionic implants in Spain industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Artificial organs

- Bionic implants

- End-user

- Hospital and clinics

- Specialty centers

- Others

- Technology

- Mechanical

- Electronic

- Application

- Organ Replacement

- Sensory Restoration

- Mobility Enhancement

- Geography

- Europe

- Spain

- Europe

By Product Insights

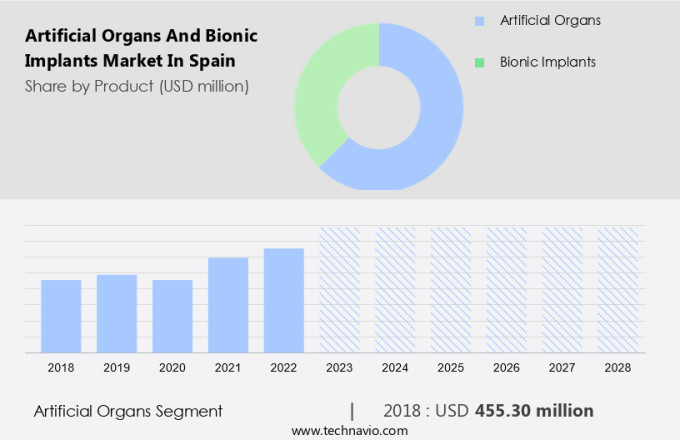

The artificial organs segment is estimated to witness significant growth during the forecast period.

Artificial organs, such as wearable artificial kidneys and bionic implants, are revolutionizing healthcare by offering solutions for various health conditions, including heart diseases, chronic kidney failure, and organ transplantation. These advanced medical devices, which include 3D bioprinted organ implants and mechanical bionics for orthopedic applications, are designed to interface with living tissue and perform specific functions, enabling patients to lead normal lives. While artificial organs offer significant benefits, their construction and installation are complex and costly procedures, often requiring clinical trials and ongoing maintenance. Heart diseases, such as hypertension and heart failure, are major targets for artificial organ development.

For instance, mechanical heart pumps and electronic bionic hearts are used to support patients awaiting transplants. Similarly, smart wearables, including cochlear implants and retinal implants for vision impairment, are transforming the lives of patients with age-related macular degeneration and retinitis pigmentosa. Organ failures, including kidney failure and diabetes-related complications, are also addressed through artificial organ technology. Dialysis, a common treatment for kidney failure, can be supplemented with wearable artificial kidneys. Diabetes patients benefit from insulin pumps and continuous glucose monitoring systems. Orthopedic bionics, such as prosthetic limbs and joint replacements, have become increasingly sophisticated, allowing for more natural movement and improved functionality.

Live donor programs and transplant procedures offer alternatives to artificial organs, but the donor waiting list remains a significant challenge. Advancements in electronic technology, artificial intelligence, and machine learning are driving innovation in the field of artificial organs. Surgical professionals are leveraging these technologies to develop more effective and efficient organ transplantation procedures. As the healthcare system continues to evolve, artificial organs will play an increasingly important role in addressing organ failures, lifestyle disorders, and injuries resulting from road accidents.

The Artificial organs segment was valued at USD 455.30 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

What are the key market drivers leading to the rise in the adoption of Artificial Organs And Bionic Implants in Spain Industry?

- The scarcity of organ donors serves as the primary driver for the organ market's existence and growth. The scarcity of available organ donors in Spain has become a significant concern due to the rising demand for organ transplantation. The prevalence of essential organ failure and improved post-transplant outcomes have led to a rapid increase in the number of people requiring organ transplants. However, the current supply of organs is insufficient to meet the growing demand, resulting in a dramatic increase in the number of people on transplant waiting lists and unfortunate deaths while waiting. It is estimated that only approximately 10% of those in need of organ transplantation actually undergo the procedure. This disparity highlights the urgent need for innovative solutions to address the organ shortage crisis.

- The advancements in artificial organs and bionic implants offer promising alternatives to traditional organ transplantation, providing potential lifesaving solutions for those in need. These technologies have the potential to revolutionize the healthcare landscape and significantly reduce the reliance on organ donors, ultimately saving countless lives.

What are the market trends shaping the Artificial Organs And Bionic Implants in Spain Industry?

- Medical tourism is gaining significant popularity as an emerging market trend. The increasing number of individuals seeking affordable and high-quality healthcare services from other countries is driving this trend.

- Artificial organs and bionic implants are gaining significant attention in Spain's medical tourism industry. The country's advanced healthcare infrastructure and favorable climate make it an attractive destination for patients seeking organ failures treatment, particularly for heart diseases and chronic kidney failure. The Spanish market for artificial organs and bionic implants is witnessing growth due to the increasing number of clinical trials for wearable artificial kidneys and organ implants using innovative technologies like 3D bioprinting. Smart wearables are becoming increasingly popular, offering immersive and harmonious solutions for patients undergoing organ transplant procedures. The market is also driven by the emphasis on vaccination and kidney transplant procedures to improve patients' quality of life.

- Organ implants and orthopedic bionics are transforming healthcare, providing long-term solutions for patients and reducing the need for frequent hospital visits. Despite the advancements, ongoing research and development efforts are essential to address the challenges of organ rejection and compatibility issues.

What challenges does the Artificial Organs And Bionic Implants in Spain Industry face during its growth?

- The exorbitant costs associated with the production and implementation of artificial organs and bionic implants pose a significant challenge to the growth of the industry.

- Artificial organs and bionic implants play a crucial role in addressing various medical conditions, including prosthetics for amputations, neurological support, and blood cell and tissue replacement. The demand for these medical devices significantly outpaces the supply, with the number of individuals in need far surpassing those who receive the treatment each year. This trend is expected to continue, as conditions such as organ failure, hypertension, and amputation procedures continue to be prevalent. Cost is a significant barrier to entry for many patients seeking artificial organs and bionic implants. However, the potential benefits of these treatments, including improved mobility and enhanced quality of life, make the investment worthwhile for many.

- As healthcare providers increasingly focus on preventive interventions, the use of artificial organs to restore normal organ functions before reaching end-stage failure is becoming more common. Live donor programs and electronic technology are advancing the field of organ transplantation, offering new possibilities for those in need. Despite these advancements, the high cost of procedures and limited availability of organs remain significant challenges for the market.

Exclusive Customer Landscape

The artificial organs and bionic implants market in Spain forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial organs and bionic implants market in Spain report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial organs and bionic implants market in Spain forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Asahi Kasei Corp. - The company specializes in advanced medical technology, producing artificial organs and bionic implants, including innovative artificial kidneys for renal replacement therapy. These solutions cater to patients suffering from chronic kidney disease, offering life-enhancing alternatives to traditional treatments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Kasei Corp.

- Baxter International Inc.

- Berlin Heart GmbH

- Boston Scientific Corp.

- Edwards Lifesciences Corp.

- Ekso Bionics Holdings Inc.

- F. Hoffmann La Roche Ltd.

- Johnson and Johnson Inc.

- Medtronic Plc

- Ossur hf

- Ottobock SE and Co. KGaA

- Sonova AG

- Terumo Medical Corp.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Organs And Bionic Implants Market In Spain

- In January 2024, Spanish biotech company, Biosence Technologies, announced the successful implantation of its first bionic ear in a patient at Hospital ClÃnic in Barcelona. This breakthrough marked a significant milestone in the Spanish artificial organs and bionic implants market (Source: Biosence Technologies Press Release).

- In March 2024, Medtronic and Spanish healthcare provider, Hospital Quirón, signed a strategic partnership to expand access to advanced bionic implants and artificial organs. The collaboration aimed to improve patient care and outcomes through innovative technology and expertise sharing (Source: Medtronic Press Release).

- In May 2024, Spanish biotech firm, Orgenesis, secured â¬15 million in Series B funding to further develop its proprietary tissue engineering platform for the production of artificial organs. This investment will support the expansion of its production capacity and accelerate the commercialization of its products (Source: Orgenesis Press Release).

- In February 2025, the Spanish Ministry of Health announced the implementation of a new regulatory framework to streamline the approval process for artificial organs and bionic implants. This initiative is expected to boost market growth by reducing approval times and encouraging innovation (Source: Spanish Ministry of Health Press Release).

Research Analyst Overview

- The Spanish market for artificial organs and bionic implants witnesses significant activity, driven by the increasing prevalence of conditions such as hearing loss from road accidents and age-related macular degeneration. Transplants, particularly kidney and heart, remain a critical focus in organ transplantation. Mechanical bionics and organ implants offer alternatives to live donor programs, reducing the reliance on the healthcare system and donor waiting lists. Heart failure patients benefit from advanced heart devices, while amputation procedures lead to an uptick in demand for bionic limbs.

- Artificial intelligence and bionics collaborate to enhance organ implants and medical devices, addressing organ failures and heart diseases. Vaccination and 3D bioprinting hold promise for future advancements in organ transplanting. Lifestyle disorders, including vision impairment from retinitis pigmentosa and diabetic amputations, further fuel market growth. The HRSA prioritizes organ failures and organ failure prevention efforts, aligning with the industry's focus on improving patient outcomes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Organs And Bionic Implants Market in Spain insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.5% |

|

Market growth 2024-2028 |

USD 702.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

10.7 |

|

Key countries |

Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Organs And Bionic Implants Market in Spain Research and Growth Report?

- CAGR of the Artificial Organs And Bionic Implants in Spain industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Spain

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial organs and bionic implants market in Spain growth of industry companies

We can help! Our analysts can customize this artificial organs and bionic implants market in Spain research report to meet your requirements.