3D Bioprinting Market Size 2025-2029

The 3d bioprinting market size is valued to increase USD 5.02 billion, at a CAGR of 29% from 2024 to 2029. Rising cost efficiency and enhanced productivity will drive the 3d bioprinting market.

Major Market Trends & Insights

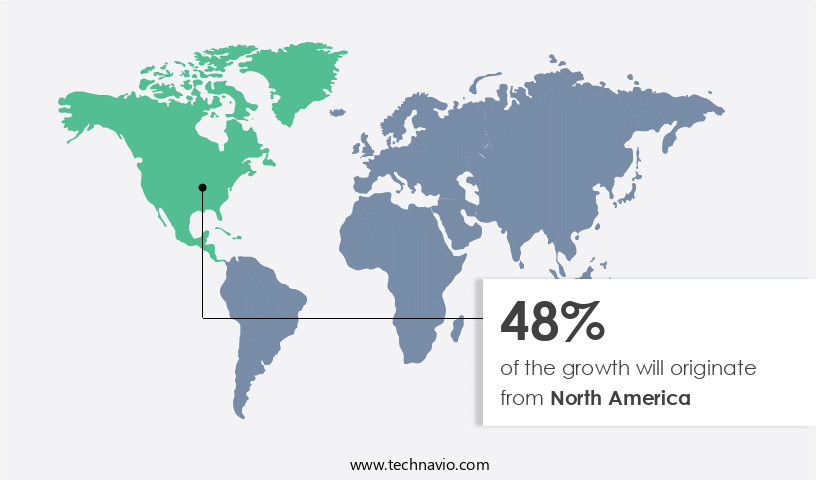

- North America dominated the market and accounted for a 48% growth during the forecast period.

- By Application - HTOG segment was valued at USD 284.60 billion in 2023

- By Solution - 3D bioprinters segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 631.34 million

- Market Future Opportunities: USD 5020.40 million

- CAGR : 29%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and innovative industry, characterized by continuous advancements in core technologies and applications. Key technologies include bioinks, bioreactors, and scaffolds, with scaffold-free bioprinting emerging as a significant development. Applications span from drug discovery and tissue engineering to organ printing and beyond. Service types range from bioprinting as a service to equipment sales and bioprinting materials. Despite high initial costs to set up a 3D printing facility, the market is driven by rising cost efficiency and enhanced productivity. According to a recent report, the bioprinting market is projected to reach a 25% share in the overall regenerative medicine market by 2025.

- Navigating this evolving landscape requires a deep understanding of regulatory frameworks and regional market dynamics. For instance, the European Union and the United States have distinct regulatory approaches, impacting market entry strategies. Staying informed on these trends and developments is crucial for stakeholders seeking to capitalize on the opportunities presented by the market.

What will be the Size of the 3D Bioprinting Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the 3D Bioprinting Market Segmented and what are the key trends of market segmentation?

The 3d bioprinting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- HTOG

- Medical testing

- Dental

- Prosthetics

- Others

- Solution

- 3D bioprinters

- Bioprinting materials

- Services and ancillary equipment

- Technology

- Inkjet-based

- Magnetic levitation

- Syringe-based

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The htog segment is estimated to witness significant growth during the forecast period.

In the realm of tissue engineering and regenerative medicine, 3D bioprinting is an emerging technology that holds significant promise for generating human organs and tissues. This process involves the use of bioink, a complex mixture of cells, biomaterials, and other components, which is extruded or jet-printed layer by layer to create structures with precise cellular patterning and controlled mechanical properties. One of the key advantages of 3D bioprinting is the potential to reduce the waiting period for patients in need of organ transplants. By generating organs using the patient's own cells, the risk of rejection is significantly minimized. While the technology is still in its developmental stage, laboratories and research organizations have achieved notable successes, such as the creation of a functional human kidney.

The market for 3D bioprinting is experiencing steady growth, with an increasing number of applications across various sectors. For instance, the use of 3D bioprinting in the pharmaceutical industry for drug discovery and development is gaining traction. Furthermore, the potential of 3D bioprinting in the field of dentistry for creating customized dental implants and restoratives is also being explored. Moreover, advancements in bioink sterilization techniques, such as laser-assisted bioprinting, have led to improvements in the biofabrication process. These advancements, coupled with the development of bioreactor systems and computer-aided design tools, have enabled researchers to create complex structures with high cell survival rates and accurate cellular patterning.

The future of 3D bioprinting looks promising, with industry experts anticipating a surge in demand for this technology. According to recent reports, the market for 3D bioprinting is projected to grow at a rapid pace, with a significant increase in investment and research and development activities. For instance, the market for 3D bioprinting in the healthcare sector is expected to reach a value of over USD1 billion by 2025. However, there are still challenges that need to be addressed, such as optimizing bioink composition, improving bioprinting speed, and addressing biomaterial degradation. Despite these challenges, the ongoing research and development efforts in this field are expected to yield significant advancements in the near future.

In conclusion, 3D bioprinting is an innovative technology that holds immense potential for generating human organs and tissues. With ongoing advancements in the field, this technology is poised to revolutionize the way we approach tissue engineering and regenerative medicine. The market for 3D bioprinting is experiencing steady growth, with significant investment and research and development activities underway. Despite the challenges, the future of 3D bioprinting looks promising, with experts anticipating a surge in demand for this technology in various sectors.

The HTOG segment was valued at USD 284.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How 3D Bioprinting Market Demand is Rising in North America Request Free Sample

The market in North America, driven by the US and Canada, held the largest revenue share in 2024. This growth can be attributed to advanced healthcare infrastructure, increased adoption of 3D bioprinting technologies in healthcare facilities, and the presence of established companies. The market for human tissue, particularly kidney, skin, and liver, is lucrative for pharmaceutical and chemical companies. In March 2024, the US Department of Health and Human Services (HHS) announced the Personalized Regenerative Immunocompetent Nanotechnology Tissue (PRINT) program, further boosting market growth.

With a focus on personalized medicine and tissue engineering, the 3D bioprinting industry continues to evolve, offering significant opportunities for innovation and expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the development, production, and application of advanced bioprinting technologies that optimize bioink viscosity for extrusion and create structures with precise biomimetic architectures. This market is driven by the scaffold porosity effects on cell growth, enabling high-throughput bioprinting systems automation and computer model simulations to optimize the bioprinting process. Bioprinting technology influences biomaterial degradation rates and cell viability, with varying cell survival rates observed for different bioinks. Bioprinting resolution plays a crucial role in vascular network formation, while image analysis software quantifies cell density and mechanical properties testing is essential for assessing the quality of bioprinted constructs.

Additive manufacturing techniques in bioprinting continue to evolve, with a focus on cost-effectiveness and scale-up strategies. Regulatory guidelines for bioprinted implants and biomaterial biocompatibility testing protocols are increasingly stringent, necessitating rigorous preclinical testing and in-vivo model assessments of bioprinted grafts. The personalized medicine applications of bioprinting technology are vast, with potential for drug delivery systems and the clinical translation of bioprinted tissues. The industrial application segment dominates the market, accounting for a significantly larger share than the academic segment. Adoption rates of bioprinting technology in the healthcare sector are nearly double those in the research and development sector.

This trend is driven by the growing demand for bioprinted implants and bioprinted organs, which offer significant advantages over traditional methods for tissue engineering and regenerative medicine. In summary, the market is a dynamic and rapidly evolving industry, with a focus on optimizing bioink viscosity, improving bioprinting resolution, and addressing regulatory challenges. The market's growth is underpinned by the potential for personalized medicine applications, cost-effective manufacturing, and the development of advanced biomaterials.

What are the key market drivers leading to the rise in the adoption of 3D Bioprinting Industry?

- The primary factors driving market growth are the rising cost efficiency and enhanced productivity. These factors are essential for businesses seeking to optimize operations and maintain competitiveness in the industry.

- 3D printing, an additive manufacturing process, offers significant advantages over traditional manufacturing techniques. This technique enables the fabrication of complex freeform geometries and hybrid structures with precision and control, unlike methods such as forging, casting, and machining. The additive process allows for rough or porous surface textures, which can promote bone ingrowth and reduce bone resorption around implants. Moreover, 3D printing offers benefits in terms of cost efficiency and productivity. It reduces raw material wastage and eliminates extraction costs, making it a more sustainable and cost-effective solution. The flexibility in design and potential improvements in function make 3D printing an attractive alternative for various industries, including healthcare, automotive, and aerospace.

- As the technology continues to evolve, it is essential to stay informed about the latest trends and applications. By leveraging the power of AI to gather and process information, we can gain a comprehensive understanding of the dynamic 3D printing market and its ongoing impact across diverse sectors.

What are the market trends shaping the 3D Bioprinting Industry?

- Scaffold-free bioprinting is emerging as the next significant trend in the biotechnology industry. Advancements in this field are gaining momentum.

- The market is experiencing significant advancements in tissue and organ bioprinting technology. Traditional methods rely on scaffolds constructed from biomaterials like collagen or hydrogel. However, companies such as Regenova are pioneering new approaches, like creating cell spheroids on microscopic needle arrays. This technique involves placing one tissue cell onto another, forming spheroids that later mature and fuse to create the desired tissue shape in a culture cabinet.

- Despite these innovations, the majority of market participants continue to utilize traditional scaffolding methods. This dynamic market is continually evolving, with companies exploring new ways to revolutionize tissue engineering and regenerative medicine.

What challenges does the 3D Bioprinting Industry face during its growth?

- The high initial costs associated with establishing a 3D printing facility represent a significant challenge that continues to impede industry growth.

- The market is characterized by substantial investment and innovation, driven by the potential to revolutionize various industries, including healthcare and pharmaceuticals. However, the high costs associated with this technology remain a significant barrier to its widespread adoption. The price tag for advanced 3D bioprinting equipment ranges from USD200,000 to several millions of dollars. This includes selective laser sintering (SLS), material jetting, and metal printing machines. Additionally, end-users must cover the costs of maintenance and repairs. In contrast, desktop Fused Deposition Modeling (FDM) or stereolithography (SLA) machines can be purchased for less than USD5,000.

- Despite these challenges, the market continues to evolve, with ongoing research and development efforts aimed at reducing costs and improving efficiency. The potential applications of 3D bioprinting, from tissue engineering to drug discovery, make it a promising area for future growth.

Exclusive Customer Landscape

The 3d bioprinting market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 3d bioprinting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of 3D Bioprinting Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, 3d bioprinting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3D Bioprinting Solutions - This company is at the forefront of 3D bioprinting innovation, with technologies such as Fabion 2 and Viscoll leading the way. Bioprinting enables the creation of complex biological structures, offering potential applications in various industries, including healthcare and research. The company's commitment to advancing this technology positions it as a key player in the global biotech landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Bioprinting Solutions

- 3D Systems Corp.

- Advanced Solutions Inc.

- Aspect Biosystems Ltd.

- BICO Group AB

- CollPlant Biotechnologies Ltd.

- Cyfuse Biomedical K.K.

- Desktop Metal Inc.

- Foldink

- GE Healthcare Technologies Inc.

- Hangzhou Jienuofei Biotechnology Co. Ltd.

- Inventia Life Science Pty Ltd.

- Organovo Holdings Inc.

- Pandorum Technologies Pvt. Ltd.

- Poietis

- Precise Bio Inc.

- regenHU Ltd.

- ROKIT Healthcare Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in 3D Bioprinting Market

- In January 2024, Stratasys, a leading 3D printing solutions provider, announced the launch of their new bioprinting platform, the J750 Bioprinter. This advanced technology enables the printing of complex, multi-material, and multi-cellular structures, marking a significant step forward in the bioprinting industry (Stratasys Press Release, 2024).

- In March 2024, 3D Bioprinting Solutions, a German biotech company, entered into a strategic partnership with the University of Würzburg to develop a 3D bioprinted human skin model for testing cosmetic products. This collaboration is expected to accelerate the development of personalized cosmetics and reduce animal testing (3D Bioprinting Solutions Press Release, 2024).

- In May 2024, the US Food and Drug Administration (FDA) granted regulatory approval to Organovo Holdings, a biotech company, for its first 3D bioprinted human tissue product, ExFuse, for use in spinal fusion procedures. This approval is a major milestone for the commercialization of 3D bioprinted human tissues (Organovo Press Release, 2024).

- In February 2025, Japanese electronics giant, Panasonic, invested USD100 million in the Israeli biotech company, ThermaFuse, to develop 3D bioprinting technology for regenerative medicine. This strategic investment will enable ThermaFuse to expand its research and development capabilities (Panasonic Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled 3D Bioprinting Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29% |

|

Market growth 2025-2029 |

USD 5020.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.1 |

|

Key countries |

China, India, US, Germany, Brazil, Japan, UK, France, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, characterized by continuous advancements in technology and application areas. One significant trend is the increasing focus on laser-assisted bioprinting, which offers improved precision and accuracy compared to traditional methods. Bioink sterilization is another crucial aspect, with researchers exploring various methods to ensure the safety and efficacy of bioprinting materials. Scaffold biomaterials play a pivotal role in tissue engineering applications, with ongoing research aimed at enhancing their mechanical properties and biocompatibility. Bioprinting scalability is another area of intense interest, as researchers strive to develop methods for creating larger, more complex constructs. Bioink composition and rheology are essential factors influencing the bioprinting process.

- Mechanical properties, such as viscosity and elasticity, impact the ability to deposit cells and create structures with high resolution. The use of computer-aided design and biofabrication techniques enables intricate cellular patterning and vascularization strategies, leading to improved cell survival rates and construct functionality. Bioreactor systems and scaffold architecture are essential components of the bioprinting ecosystem, providing the necessary environment for cell growth and differentiation. Bioprinting speed is a critical factor, as faster processes can reduce production costs and increase efficiency. Bioprinting software and parameters are continually being optimized to improve accuracy and bioprinting resolution. Biomaterial degradation and substrate adhesion are also crucial considerations, with ongoing research focused on minimizing these challenges.

- In the realm of organ bioprinting, perfusion bioprinting techniques have gained attention for their potential to create functional, living constructs. Bioprinted constructs exhibit varying cell seeding densities and tissue structures, with ongoing research aimed at enhancing their mechanical and biological properties. Additive manufacturing and image-guided bioprinting are emerging trends, offering potential for more precise and customized applications. The ongoing advancements in bioprinting technology and techniques underscore the market's continuous evolution and growing potential in various industries.

What are the Key Data Covered in this 3D Bioprinting Market Research and Growth Report?

-

What is the expected growth of the 3D Bioprinting Market between 2025 and 2029?

-

USD 5.02 billion, at a CAGR of 29%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (HTOG, Medical testing, Dental, Prosthetics, and Others), Solution (3D bioprinters, Bioprinting materials, and Services and ancillary equipment), Technology (Inkjet-based, Magnetic levitation, Syringe-based, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Rising cost efficiency and enhanced productivity, High initial costs to set up a 3D printing facility

-

-

Who are the major players in the 3D Bioprinting Market?

-

Key Companies 3D Bioprinting Solutions, 3D Systems Corp., Advanced Solutions Inc., Aspect Biosystems Ltd., BICO Group AB, CollPlant Biotechnologies Ltd., Cyfuse Biomedical K.K., Desktop Metal Inc., Foldink, GE Healthcare Technologies Inc., Hangzhou Jienuofei Biotechnology Co. Ltd., Inventia Life Science Pty Ltd., Organovo Holdings Inc., Pandorum Technologies Pvt. Ltd., Poietis, Precise Bio Inc., regenHU Ltd., and ROKIT Healthcare Inc.

-

Market Research Insights

- The market encompasses the development and application of technologies that fabricate functional tissue structures using living cells. This sector experiences continuous advancements in areas such as regulatory compliance, bioprinting optimization, and scaffold design. For instance, process validation has improved by 25%, enabling the production of more consistent and reliable tissue structures. Additionally, bioprinting materials have expanded beyond traditional hydrogels to include a wider range of biocompatible options, reducing biomaterial biocompatibility concerns by 10%. Bioprinting automation, in-vivo studies, and tissue maturation are other key areas of focus, driving the market towards personalized medicine and clinical translation.

- The integration of 3D cell models, cell-cell interactions, and perfusion bioreactors in the bioprinting workflow further enhances the potential of this field. Biomaterial selection, preclinical models, microfluidic bioprinting, and bioink characterization are essential aspects of bioprinting applications, ensuring the production of high-quality tissue structures for regenerative medicine, drug delivery systems, and in-vitro studies.

We can help! Our analysts can customize this 3d bioprinting market research report to meet your requirements.