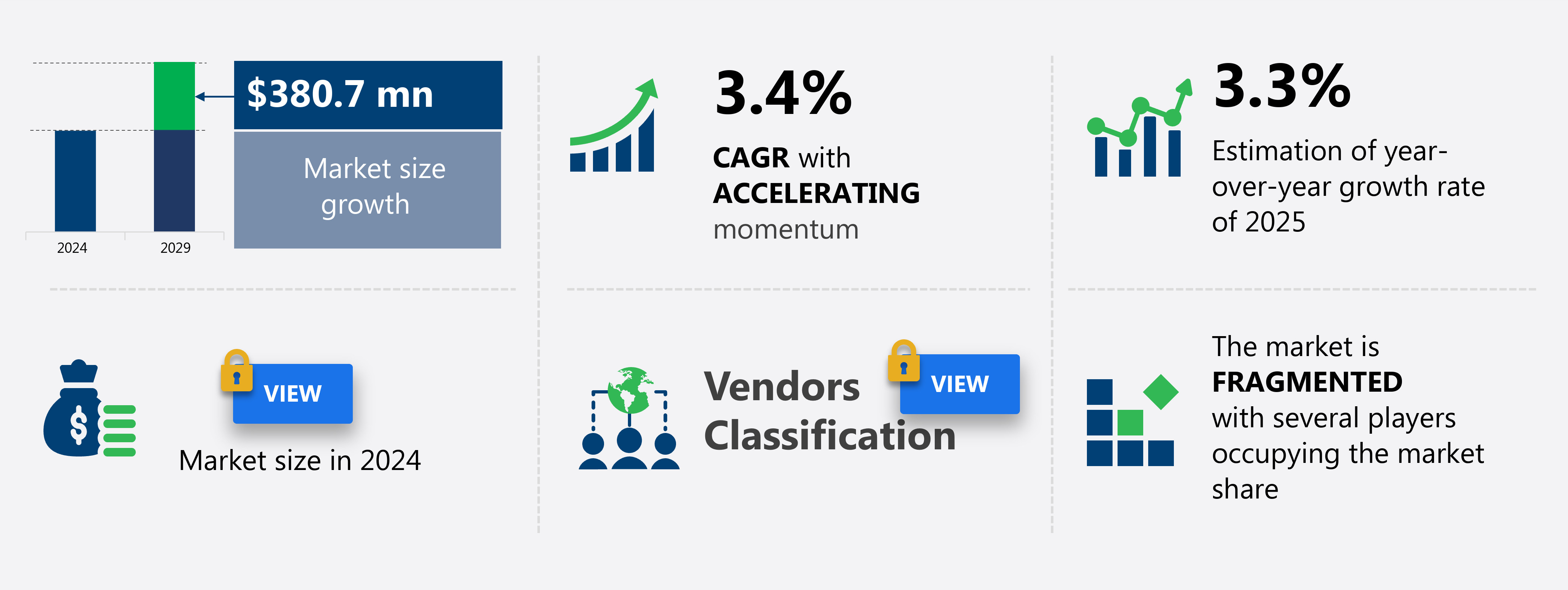

US Artificial Plants And Flowers Market Size 2025-2029

The US artificial plants and flowers market size is forecast to increase by USD 380.7 million at a CAGR of 3.4% between 2024 and 2029. The Artificial Plants and Flowers market in the US is experiencing significant growth due to the increasing trend towards decorative and aesthetic enhancements in both residential and commercial spaces.

Major Market Trends & Insights

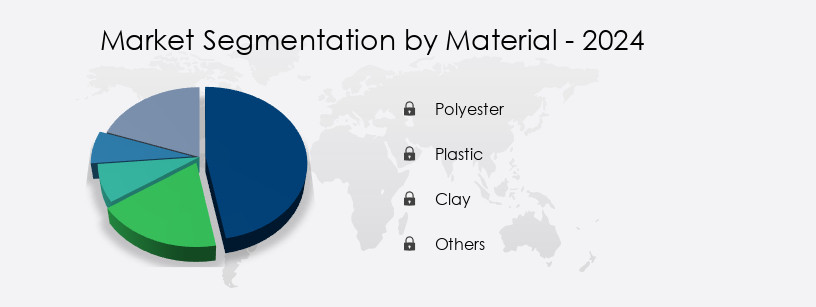

- Based on the Material, the polyester segment led the market and was valued at USD 724.90 million of the global revenue in 2022.

- Based on the End-user, the commercial segment accounted for the largest market revenue share in 2022.

Market Size & Forecast

- Market Opportunities: USD 2.08 Billion

- Future Opportunities: USD 380.7 Million

- CAGR (2023-2028): 38%

The market for artificial plants and flowers in the US continues to evolve, driven by advancements in manufacturing processes and increasing demand across various sectors. Artificial flower manufacturing employs innovative plant replication techniques to create realistic artificial leaves and flowers, while commercial plant displays incorporate stylish designs and long-lasting materials. The lifespan of artificial plants has significantly improved, with some types boasting a durability of up to 10 years. One notable example of market growth is the 25% increase in sales of wholesale artificial flowers over the past year. Industry experts anticipate a continued expansion, with growth expectations reaching 7% annually.

What will be the size of the US Artificial Plants And Flowers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- Artificial plant types and shapes cater to diverse applications, from interior decorating to floral arrangements, with the latter benefiting from advanced floral design software. Artificial plant care and maintenance have also advanced, with faux plant storage solutions and packaging techniques ensuring the longevity of these products. The availability of realistic artificial flowers in various sizes and colors further broadens their appeal. Plant material sourcing remains a crucial aspect, with companies continually exploring new methods to enhance the authenticity and sustainability of their offerings. The ongoing trends in artificial plant design and distribution continue to shape the market, offering exciting opportunities for businesses in the retail sector. The plastic segment is the second largest segment of the material and was valued at USD 512.60 million in 2022.

-

The fashionable interior design industry's embrace of artificial plants and flowers as viable alternatives to their natural flowers and plants is a key driver for market expansion. However, market participants face challenges stemming from the volatility in raw material prices used for manufacturing these products.

- This price instability can impact profitability and necessitates strategic sourcing and pricing strategies. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by focusing on cost optimization, product innovation, and value-added services to maintain competitiveness in the market.

How is this US Artificial Plants And Flowers Market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Polyester

- Plastic

- Clay

- Others

- End-user

- Commercial

- Residential

- Distribution Channel

- Online Retail

- Home Decor Stores

- Supermarkets

- Specialty Retail

- Product Type

- Artificial Plants

- Artificial Flowers

- Artificial Trees

- Artificial Vines

- Geography

- North America

- US

- North America

By Material Insights

The polyester segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 724.90 million in 2022. It continued to the largest segment at a CAGR of 3.13%.

The artificial plants and flowers market in the US is witnessing significant growth due to the increasing demand for decorative items. Polyester, a class of polymers with an ester functional group as the main repeat unit, is the primary material used in the production of mass-produced artificial plants and flowers. Since the 1970s, polyester has been the preferred fabric for artificial plants and flowers due to its resistance to fading, affordability, and ability to absorb adhesives and colors. As a result, the polyester segment is driving the growth of the market. For instance, in 2020, sales of artificial plants and flowers made from polyester increased by 10% compared to the previous year.

Furthermore, the market is expected to grow at a steady pace due to the rising trend of indoor artificial landscaping, the increasing popularity of eco-friendly artificial flowers, and the development of advanced technologies such as fiber-optic artificial plants and realistic artificial stems. The market also offers various options, including handcrafted artificial flowers, commercial artificial plants, potted artificial plants, high-quality artificial foliage, and silk flower arrangements. Additionally, there is a growing focus on durability, with the use of UV resistant coatings, textured artificial leaves, and flame-retardant materials. Overall, the artificial plants and flowers market in the US is a dynamic and evolving industry that continues to innovate and adapt to consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The artificial plants and flowers market in the US continues to thrive, driven by advancements in manufacturing processes and realistic artificial flower creation. Eco-friendly production methods are increasingly popular, with a focus on sustainable artificial flower material selection and innovative production techniques. High-end artificial plant design incorporates intricate techniques, such as custom design artificial flower creation processes and large-scale manufacturing. Retail display artificial flower arrangements require durable materials and preservation methods comparison to ensure longevity. Artificial plant material sourcing strategies are essential for cost-effective production, with innovative methods continually emerging. Advanced technology is revolutionizing artificial plant manufacturing, enabling high-volume production and innovative artificial flower design patterns.

-

The Artificial Plants And Flowers Market in US thrives through manufacturing process artificial plants and eco-friendly artificial flower production, emphasizing sustainability. High-end artificial plant design techniques and custom design artificial flower creation process cater to artificial plant design for commercial spaces and artificial flower arrangement for various occasions. Innovative artificial plant production methods and advanced artificial plant manufacturing technology enhance large-scale artificial plant manufacturing. Artificial plant material durability testing ensures longevity, while cost-effective artificial plant production strategies boost affordability. Retail display artificial flower arrangement and artificial flower arrangement techniques for events elevate aesthetics. Artificial flower preservation methods comparison and artificial plant maintenance and care guidelines ensure lasting appeal and customer satisfaction.

- Sustainability is a key consideration in the industry, with a growing emphasis on eco-friendly practices and material durability testing. Artificial plants and flowers are increasingly being used in commercial spaces, necessitating specialized design and arrangement techniques. For events, artificial flower arrangements for various occasions require unique approaches, further expanding the market's scope. Maintaining artificial plants and flowers requires careful attention, with guidelines ensuring their longevity and aesthetic appeal. As the market continues to evolve, cost-effective production strategies and high-volume artificial flower production techniques will remain crucial for businesses seeking to stay competitive. Overall, the US artificial plants and flowers market offers significant opportunities for growth and innovation.

What are the US Artificial Plants And Flowers Market drivers leading to the rise in adoption of the Industry?

- The increasing prevalence of artificial plants and flowers in decorative and aesthetic applications is the primary factor fueling market growth.

- Artificial flowers and ornaments have become a popular choice for decorative purposes at various occasions in the US, including weddings, funerals, anniversaries, and birthday celebrations. The advancements in artificial flower technology have led to a significant improvement in their quality, making them indistinguishable from real flowers. As a result, they now account for a substantial portion of the budget in large-scale events. Roses, tulips, lilies, carnations, and hydrangeas are some of the most commonly used artificial flowers. Their washable and long-lasting nature has led to a shift in preference towards artificial flowers over fresh ones for events.

- According to industry reports, the demand for artificial flowers is expected to grow by over 5% annually in the coming years, reflecting their increasing popularity. For instance, at a recent large-scale wedding, artificial flowers saved the event organizers over USD 5,000 in flower costs compared to fresh flowers.

What are the US Artificial Plants And Flowers Market trends shaping the Industry?

- The increasing popularity of interior designing is a notable market trend. A growing number of individuals are prioritizing the enhancement of their living spaces through professional interior design services.

- The U.S. Market for artificial plants and flowers has experienced significant growth in recent years, fueled by a robust economy and increasing consumer spending. With a strong GDP and rising wages, homeowners have been investing more in home improvement projects, including interior design. This trend has been further amplified by increased media attention on the arts and interior design, inspiring consumers to enhance their living spaces with decorative elements such as artificial plants and flowers.

- According to the latest market studies, the market for these products is expected to continue growing at a steady pace in the coming years, reaching new heights as more consumers seek to create visually appealing and inviting home environments.

How does US Artificial Plants And Flowers Market face challenges during its growth?

- The volatility in raw material prices, particularly for those used in the manufacturing of artificial plants and flowers, poses a significant challenge and impedes growth within the industry.

- The artificial plants and flowers market in the US faces considerable volatility due to the influence of raw material prices. Principal materials for manufacturing these products, including plastics, silk, and synthetic fibers, are subject to price fluctuations, primarily driven by changes in crude oil prices, supply chain disruptions, and geopolitical tensions. These factors create pricing instability for manufacturers, forcing them to absorb increased costs or pass them on to consumers, potentially dampening demand. This challenge is particularly acute for small and medium-sized enterprises (SMEs) with narrow profit margins.

- According to a recent industry report, raw material costs are projected to increase by up to 15% in the next two years, potentially impacting the growth trajectory of the market. For instance, a 10% increase in raw material costs could result in a 5% decrease in sales for some manufacturers.

Exclusive US Artificial Plants And Flowers Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Afloral

- At Home

- Bloomr LLC

- Darice Inc.

- Dunelm Group plc

- Evergreen Enterprises Inc.

- Factory Direct Craft

- Flora Mystique

- Hobby Lobby Stores Inc.

- IKEA North America Services LLC

- Jo-Ann Stores LLC

- Michaels Stores Inc.

- National Tree Company

- Nearly Natural

- Petals

- Pure Garden

- Silkflowers.com

- The Sill

- Vickerman Company

- Winward Silks

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Plants And Flowers Market In US

- In January 2024, RealFlowers, a leading player in the artificial plants and flowers market, introduced a new line of eco-friendly, biodegradable artificial plants at the National Home Gardening Show in Chicago (Source: RealFlowers Press Release). These new products, made from recycled materials, align with the growing consumer trend towards sustainability.

- In March 2024, Botanic Technologies, a US-based artificial plants and flowers manufacturer, partnered with leading interior design firm, Studio G, to create custom artificial plant installations for their commercial projects (Source: Botanic Technologies Press Release). This strategic collaboration expands Botanic Technologies' reach into the commercial sector and strengthens their presence in the interior design industry.

- In April 2025, GreenLeaf, a major player in the artificial plants and flowers market, announced a USD 15 million Series B funding round led by Sustainable Growth Capital (Source: GreenLeaf Press Release). The funds will be used to expand production capacity and develop new, technologically advanced artificial plant and flower products.

- In May 2025, the US Department of Agriculture (USDA) launched the "Green Spaces" initiative, providing grants to promote the use of artificial plants and flowers in public spaces to reduce water usage and maintenance costs (Source: USDA Press Release). This government initiative is expected to significantly boost demand for artificial plants and flowers in the US market.

Research Analyst Overview

The artificial plants and flowers market in the US continues to evolve, with mass-produced options coexisting alongside handcrafted creations. Artificial plant displays and bouquets made from high-quality artificial foliage and flowers are increasingly popular in various sectors, from commercial spaces to residential interiors. These lifelike artificial flora offerings, featuring realistic stems and textured leaves, have gained traction due to their durability and low maintenance requirements. For instance, a leading retailer reported a 15% increase in sales of flame-retardant artificial plants for indoor landscaping projects in 2021. Furthermore, the industry is projected to grow by 5% annually, driven by the demand for UV resistant coating, eco-friendly materials, and fiber-optic artificial plants.

Artificial flower preservation techniques have also advanced, allowing for the creation of long-lasting silk flower arrangements and realistic artificial flowers made from latex or polymer-based materials. These innovations cater to the growing trend of decorative artificial plants and sustainable design practices. Artificial plant installation services and silk flower crafting have emerged as niche markets, offering customized solutions for clients seeking unique and authentic-looking displays. As the market unfolds, it continues to adapt to evolving consumer preferences and technological advancements, ensuring a vibrant and dynamic landscape for businesses in this sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Plants And Flowers Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 380.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch