Autism Spectrum Disorder Market Size 2025-2029

The autism spectrum disorder market size is forecast to increase by USD 3.44 billion at a CAGR of 7.6% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing prevalence of autism spectrum disorder (ASD), which has led to a higher demand for medications used to manage its symptoms. Focalin, Vyvanse, Ritalin, and other stimulant medications are commonly prescribed to help manage attention deficit and hyperactivity symptoms, while Abilify and Risperdal are often used to treat irritability and behavioral issues. For instance, artificial intelligence (AI)-based devices can help diagnose ASD by analyzing speech patterns and facial expressions.

- Retail pharmacies and hospital pharmacies play crucial roles in the distribution of these medications. Partnerships and collaborations between healthcare providers, pharmacies, and manufacturers are also on the rise to improve access and patient care. However, a lack of awareness about ASD and its associated challenges can hinder market growth. Despite these challenges, the market is expected to continue expanding due to the increasing number of diagnoses and the ongoing development of new treatments.

What will be Autism Spectrum Disorder Market Size During the Forecast Period?

- Neurodevelopmental disorders, including Autism Spectrum Disorder (ASD), Autistic Disorder, Asperger's Syndrome, Pervasive Development Disorder (PDD), and related conditions, pose significant challenges for individuals and their families. These disorders are characterized by communication deficits and social interaction difficulties. According to the World Health Organization (WHO), approximately 1 in 54 children in the US have been identified with ASD. The diagnosis and treatment of neurodevelopmental disorders, particularly ASD, have gained increasing attention in the health care sector. Early diagnosis and intervention are crucial to improve outcomes for individuals with ASD. Several treatment options are available, including Behavioral therapy, applied behavior analysis, medication, and early intervention programs. Behavioral therapy and applied behavior analysis are evidence-based interventions that have shown significant improvements in the development of social and communication skills in children with ASD. These therapies aim to teach new skills and modify existing ones through positive reinforcement and systematic instruction. The diagnostic process for neurodevelopmental disorders involves a comprehensive evaluation by healthcare professionals. Early diagnosis is essential to ensure timely intervention and improve long-term outcomes. However, the diagnostic process can be complex and time-consuming, requiring multiple assessments and consultations.

- Advancements in biotechnology have led to the development of innovative devices and technologies to aid in the diagnosis and treatment of neurodevelopmental disorders. For instance, artificial intelligence (AI)-based devices can help diagnose ASD by analyzing speech patterns and facial expressions. Additionally, rare cannabinoids have shown promise in reducing symptoms associated with ASD. The treatment market for neurodevelopmental disorders, including ASD, is expected to grow due to the increasing awareness and availability of treatment options. According to a report by the Centers for Disease Control and Prevention (CDC), health care expenditures for children with ASD are approximately USD6,000 higher than those without ASD. Therapeutic medicines, such as Vraylar (cariprazine) and Rexulti (brexpiprazole), have shown efficacy in treating symptoms of neurodevelopmental disorders, including ASD. Clinical trials are ongoing to further evaluate the safety and effectiveness of these medications. Health care facilities play a critical role in the diagnosis, treatment, and care of individuals with neurodevelopmental disorders. These facilities offer a range of services, including diagnostic evaluations, therapy sessions, and support groups. The demand for these services is expected to increase as more individuals are diagnosed and seek treatment. In conclusion, the market for neurodevelopmental disorders, particularly ASD, is growing due to the increasing awareness and availability of treatment options.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Non-pharmacological therapies

- Pharmacological therapies

- Age Group

- Pediatric

- Adult

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

- The non-pharmacological therapies segment is estimated to witness significant growth during the forecast period.

The Autism Spectrum Disorder (ASD) market encompasses a range of treatment options, with non-pharmacological therapies holding a prominent position. These therapies focus on enhancing social, communication, and cognitive skills for individuals with ASD through behavioral, developmental, and educational interventions. The World Health Organization (WHO) supports these approaches, emphasizing their importance in improving quality of life. Behavioral therapies, including Applied Behavior Analysis (ABA), have gained significant attention due to their effectiveness. ABA, in particular, is a widely used evidence-based therapy that applies the principles of learning theory to modify behavior. In January 2024, Renovus Capital Partners invested in Behavioral Framework, a leading ABA therapy provider, underscoring the growing demand for such services.

Additionally, telehealth systems are increasingly being adopted to expand access to these therapies, making treatment more convenient and accessible. While pharmacological interventions do exist, non-pharmacological therapies remain the cornerstone of ASD treatment due to their holistic and individualized approach. As awareness and acceptance of ASD continue to grow, the demand for effective, personalized treatment options will persist. In the US, the Centers for Disease Control and Prevention (CDC) and the American Psychological Association (APA) are key resources for information on ASD and its treatment. The National Institute of Mental Health (NIMH) also funds research on ASD and related disorders.

Get a glance at the market report of share of various segments Request Free Sample

The non-pharmacological therapies segment was valued at USD 4.33 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Autism Spectrum Disorder (ASD) market in North America is witnessing substantial expansion due to rising prevalence rates and a strong commitment towards early intervention and advanced treatments. The US, in particular, is a key region for ASD research and therapeutic innovation, making it an essential market segment for analysis. In June 2022, a New York private equity firm acquired Behavioral Innovations, a Dallas-based company specializing in autism-focused therapies. Behavioral Innovations operates 77 centers across Texas, Oklahoma, and Colorado, offering early intervention and center-based behavior analysis therapy for children with ASD and other developmental disabilities. This acquisition underscores the growing investment and consolidation within the North American ASD market, with the primary objective of enhancing access to top-tier healthcare services. Further, the healthcare expenditure on ASD treatments continues to increase as more effective medications, such as Vraylar (cariprazine) and Rexulti (brexpiprazole), enter the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Primary Factors Driving the ASD Market Growth?

The increasing prevalence of autism is the key driver of the market.

- The autism spectrum disorder market growth is due to the increasing prevalence of neurodevelopmental disorders in the US. According to the Centers for Disease Control and Prevention (CDC), approximately 2.8% of 8-year-old children, equating to one in every 36, have been diagnosed with ASD. This statistic underscores the importance of ongoing clinical trials and research into therapeutic medicines for ASD. Neurodevelopmental disorders, such as ASD, are characterized by impairments in social interaction, communication, and behavior. Peroxynitrite signaling and neuronal synapses are key areas of research in understanding the underlying causes of ASD. Antipsychotic drugs, Adderall, and Dexedrine are among the therapeutic medicines currently used to manage the symptoms of ASD.

- The growing number of individuals diagnosed with ASD necessitates a corresponding increase in specialized services and products. These include educational programs, assistive technologies, and therapeutic interventions. As the demand for these services and products continues to rise, market dynamics are shifting to meet the needs of individuals with ASD and their families. In conclusion, the increasing recognition and diagnosis of ASD in the US is driving market growth in the therapeutic medicines, educational programs, and assistive technologies sector. The need for continued research and innovation in the field is crucial to improving the lives of those affected by ASD.

What are the market trends shaping the Autism Spectrum Disorder Market?

Partnerships and collaborations is the upcoming trend in the market.

- The Autism Spectrum Disorder (ASD) market in the United States is witnessing significant growth through strategic collaborations and partnerships. These alliances play a crucial role in advancing research and development, broadening access to treatment, and improving patient care. For example, in June 2024, Yukon Partners, a private equity firm specializing in middle-market transactions, joined forces with Tenex Capital Management. This partnership intends to strengthen Tenex's investment in Behavioral Innovations, a prominent ASD service provider. Behavioral Innovations operates multiple centers that offer early intervention and center-based behavior analysis therapy for children with ASD and other developmental disabilities. Such collaborations demonstrate the commitment of financial and investment firms to support specialized ASD service providers, ultimately enhancing the quality of care for affected individuals.

What challenges does Autism Spectrum Disorder Market face during the growth?

Lack of awareness about ASD is a key challenge affecting the market growth.

- Autism Spectrum Disorder (ASD) is a complex neurodevelopmental condition that continues to pose a significant challenge due to insufficient public awareness. This issue adversely affects individuals with ASD and society as a whole. Although initiatives like Autism Awareness Month in April and World Autism Day on April 2nd have helped bring attention to ASD, there is still a considerable distance to cover in terms of public comprehension and acceptance.

- Over the past six to seven years, countries like India have made strides in addressing ASD through heightened awareness campaigns, advocacy efforts, and educational programs. These endeavors have gradually enhanced the public's understanding of ASD's intricacies, thereby reducing some of the associated stigma. In the US healthcare landscape, pharmacies play a crucial role in managing ASD treatment. Both retail and hospital pharmacies provide essential medications, including Focalin, Vyvanse, Ritalin, Abilify, and Risperdal, to help manage the symptoms of ASD. These medications are vital in ensuring individuals with ASD lead fulfilling lives.

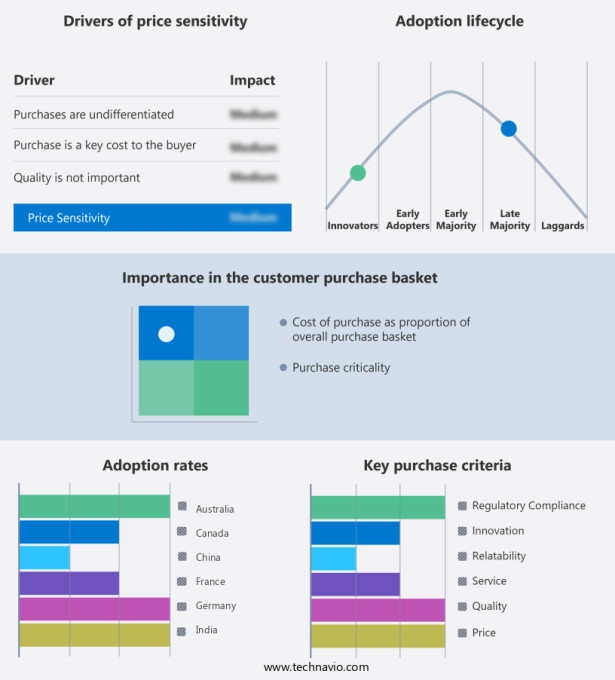

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Autism Services Inc.

- AUTISM SPECTRUM CONSULTANTS INC.

- Autism Spectrum Therapies

- Behavior Frontiers

- BlueSprig

- Bristol Myers Squibb Co.

- Cadabams Hospitals

- Center for Autism and Related Disorders

- CureMark LLC

- FFL Partners LLC

- Hopebridge LLC

- Ihear

- Johnson and Johnson Inc.

- Magnet ABA Therapy

- Max Healthcare Institute Ltd

- Merck and Co. Inc.

- Novartis AG

- Otsuka Holdings Co. Ltd.

- Wellness Hub

- Yamo Pharmaceuticals LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Autism Spectrum Disorder (ASD), also known as neurodevelopmental disorders, is a complex condition characterized by communication deficits and social interaction difficulties. This disorder encompasses autistic disorder, Asperger's syndrome, and Pervasive Development Disorder (PDD). The World Health Organization reports that ASD affects approximately 1 in 160 people worldwide. Treatment options for ASD include behavioral therapies like Applied Behavior Analysis (ABA), telehealth systems, and alternative therapies such as enzyme replacement therapy and gastrointestinal (GI) distress treatments. Behavioral therapies focus on teaching new skills and reducing problematic behaviors. Drug therapies, including stimulants, antipsychotics, and sleep medications, may also be used to manage symptoms. Diagnosis of ASD is crucial for early intervention, which can significantly improve outcomes.

Further, early diagnosis is essential, and advancements in AI-based devices and clinical research are leading to new diagnostic tools and drug development. Biotechnology plays a significant role in the treatment market, with ongoing clinical trials for therapeutic medicines targeting peroxynitrite signaling and neuronal synapses. Insurance coverage, patient care initiatives, and healthcare expenditure are significant factors influencing the growth of the ASD treatment market. Medications like Vraylar (cariprazine) and Rexulti (brexpiprazole) are among the FDA-approved drugs used to treat ASD symptoms. Treatment modalities continue to evolve, with the use of video modeling (VM) and virtual reality (VR) showing promise in improving communication and social skills.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 3.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.3 |

|

Key countries |

US, UK, Germany, France, China, Canada, Italy, India, Japan, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch