Automotive Airbag Sensor Market Size 2024-2028

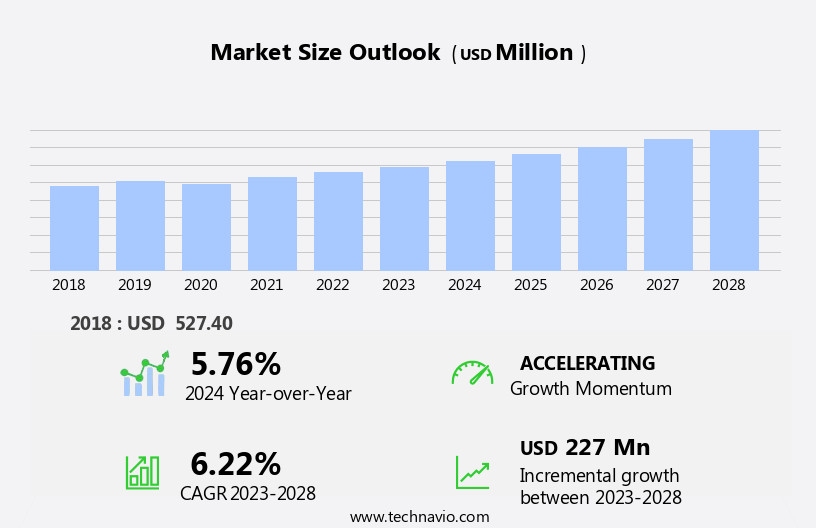

The automotive airbag sensor market size is forecast to increase by USD 227 million, at a CAGR of 6.22% between 2023 and 2028.

- The market is witnessing significant growth due to advancements in sensor technology, particularly In the use of microelectromechanical systems (MEMS) sensors. MEMS sensors offer advantages such as miniaturization, high precision, and low power consumption, making them ideal for automotive airbag applications. Additionally, the increasing adoption of autonomous vehicles is driving the demand for advanced safety systems, including airbags, which in turn is boosting the market growth. However, the market is facing challenges such as the sharp decline in automobile production and sales due to the COVID-19 pandemic. The semiconductor industry is also experiencing supply chain disruptions, which may impact the availability and pricing of sensors used in airbag systems. Despite these challenges, the long-term outlook for the market remains positive, with light vehicles and passenger cars continuing to be the primary end-users.

What will be the Size of the Automotive Airbag Sensor Market During the Forecast Period?

- The market is experiencing significant growth due to increasing demand for enhanced safety features in vehicles. Fatal accident rates continue to be a major concern, driving the adoption of advanced airbag systems. These systems incorporate various types of sensors, including mechanical and electrical, to detect collisions and deploy airbags effectively. The market encompasses a range of airbag types, such as side, knee, and rear, all designed to protect passengers in different parts of the vehicle.

- Impact sensors and pressure sensors are commonly used to initiate airbag deployment, while brake sensors provide additional safety by deploying airbags during sudden stops. Semiconductor devices play a crucial role In the functionality and accuracy of these sensors. Overall, the market is expected to continue expanding as the transportation industry prioritizes safety and innovation.

How is this Automotive Airbag Sensor Industry segmented and which is the largest segment?

The automotive airbag sensor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- LCVs

- MCVs and HCVs

- End-user

- OEMs

- Aftermarket

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

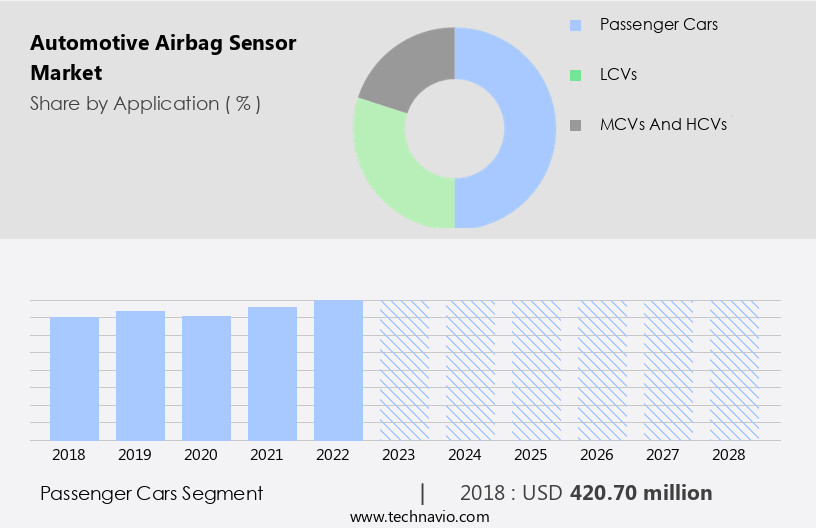

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the passenger cars segment, which accounts for a significant market share. These sensors, integrated into the vehicle system, detect sudden deceleration or impact, initiating the deployment of airbags to safeguard occupants during accidents. The high penetration of frontal airbags in passenger cars is notable. Furthermore, the adoption of side airbags, knee airbags, and rear airbags is increasing in passenger cars, contributing to market expansion. Fatal accident rates, influenced by factors such as last-mile connectivity, transportation of lightweight construction materials, per capita income, and traffic regulations, necessitate the implementation of advanced vehicle safety features, including airbags.

Types of sensors, such as mechanical and electrical, and their modes, including impact and pressure sensors, as well as brake sensors, are integral to airbag functionality. Airbag sensors, utilizing semiconductor devices, accurately detect accident intensity and sudden acceleration, ensuring precise sensing technologies. The market is expected to experience steady growth due to increasing road accidents, stringent vehicle safety regulations, and the demand for enhanced passenger vehicle safety.

Get a glance at the Automotive Airbag Sensor Industry report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 420.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

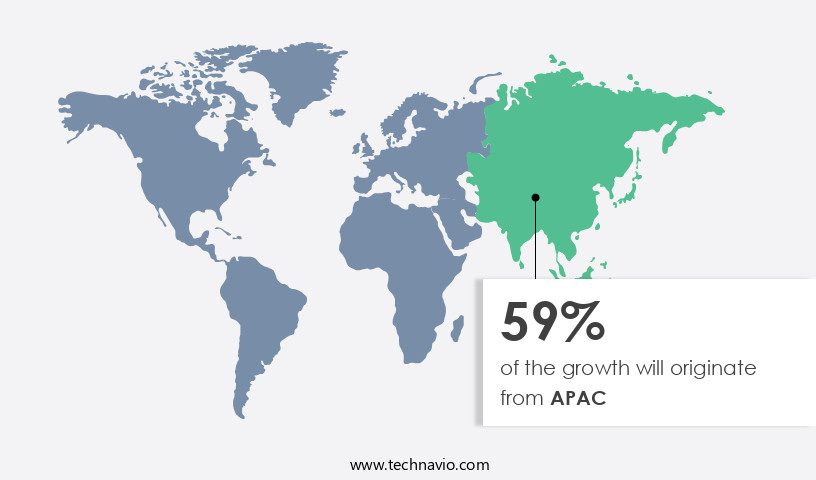

- APAC is estimated to contribute 59% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Airbag Sensor Market In the Asia Pacific region is projected to experience significant growth due to increasing sales of commercial vehicles and stringent safety regulations. Governments in countries like India and China are implementing safety standards to reduce road fatalities, which has led to the widespread adoption of safety equipment such as side airbags, knee airbags, and electronic brakeforce distribution systems. The New Car Assessment Program (NCAP) safety rating is becoming increasingly important, leading to the faster integration of advanced safety technologies. Factors such as the growing per capita income and the transportation of lightweight construction materials have also contributed to the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Airbag Sensor Industry?

Production shift to low-cost countries is the key driver of the market.

- The market is influenced by various factors. Fatal accident rates remain a significant concern, driving the demand for advanced airbag sensors. Last-mile connectivity and the transportation of lightweight construction materials have led to the integration of airbag sensors in various types of vehicles, including passenger cars, light commercial vehicles, and heavy commercial vehicles. Per capita income and the sensitization of vehicles to ensure passenger safety have also contributed to the market's growth. Airbag sensors come in various types, such as mechanical and electrical sensors, including impact sensors, pressure sensors, and brake sensors. Semiconductor devices are increasingly being used to enhance the accuracy and efficiency of these sensors.

- Sudden acceleration and accident intensity are crucial factors in impact detection, which is a primary function of airbag sensors. The market dynamics are influenced by factors such as accidental deaths and road crashes, which have led to stringent traffic regulations and vehicle safety features. Auto manufacturers are investing in production capacity expansion to meet the high demand for these safety features. However, pandemic restrictions and supply chain disruptions, including semiconductor shortages, have led to a decline in demand and component contracts. Vehicle electrical architectures continue to evolve, requiring accurate sensing technologies for optimal performance. Faulty electrical systems can compromise the effectiveness of airbag sensors, affecting product adoption.

What are the market trends shaping the Automotive Airbag Sensor Industry?

Advancements in sensor technology is the upcoming market trend.

- The market is witnessing significant advancements in sensor technology, driving safety standards and providing superior protection for vehicle occupants. Manufacturers like Robert Bosch GmbH and Analog Devices Inc. Are at the forefront of innovation, developing more efficient and sophisticated airbag sensors. For example, Robert Bosch GmbH offers an airbag control unit for heavy commercial vehicles, integrating advanced technologies such as AI, machine learning, and sensor fusion for improved accuracy and response times during accidents. The push for miniaturization and sensor integration results in compact and lightweight designs that do not compromise safety but rather enhance overall vehicle efficiency.

- Fatal accident rates continue to be a concern, with road crashes resulting in a substantial number of accidental deaths. As per capita income rises and traffic regulations become stricter, the demand for vehicle safety features, including side airbags, knee airbags, and rear airbags, is increasing. Types of sensors, such as mechanical sensors and electrical sensors, play a crucial role in impact detection and measurement range. Semiconductor devices, including impact sensors, pressure sensors, and brake sensors, are essential components in airbag systems. The automotive industry's focus on vehicle electrical architectures, sensitization of vehicles, and accurate sensing technologies is essential for addressing sudden acceleration, accident intensity, and faulty electrical systems.

What challenges does the Automotive Airbag Sensor Industry face during its growth?

The sharp decline in automobile production and sales is a key challenge affecting the industry growth.

- The market is experiencing a notable challenge due to the decrease in automobile production and sales. This decline directly influences the demand for airbag sensors, creating a substantial hurdle for manufacturers and suppliers In the industry. With passenger cars and commercial vehicles incorporating windshields and windows, the overall production and sales of automobiles significantly impact the market. Since 2017, automotive production in countries like Germany, the UK, and China has been declining. Despite the economic disruption caused by the COVID-19 pandemic in 2020, automotive sales in China only experienced a 1% decline. To mitigate this challenge, innovative strategies are required to adapt to the evolving market dynamics.

- Fatal accident rates continue to be a concern, emphasizing the importance of vehicle safety features such as side airbags, knee airbags, and rear airbags. Types of sensors, including mechanical sensors and electrical sensors, play a crucial role in accurate sensing technologies for impact detection. Semiconductor devices, such as impact sensors, pressure sensors, and brake sensors, are essential components in airbag systems. Per capita income influences the adoption of advanced vehicle safety features, with high-demand vehicle types including passenger cars, light commercial vehicles, and heavy commercial vehicles. Traffic regulations and vehicle safety regulations are essential in reducing road fatalities, making the sensitization of vehicles a priority.

Exclusive Customer Landscape

The automotive airbag sensor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive airbag sensor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive airbag sensor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Aptiv Plc

- Ashimori Industry Co. Ltd.

- Autoliv Inc.

- Continental AG

- Daicel Corp.

- DENSO Corp.

- Dorman Products Inc.

- HELLA GmbH and Co. KGaA

- Hyundai Motor Group

- Infineon Technologies AG

- Magna International Inc.

- Mitsubishi Electric Corp.

- Nihon Plast Co. Ltd.

- Ningbo Joyson Electronics Corp.

- NXP Semiconductors NV

- Robert Bosch GmbH

- TaiHangChangQing Automobile Safety System Co. Ltd.

- Toyoda Gosei Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vital segment of the vehicle safety technology industry. These sensors play a crucial role in detecting and responding to various collision scenarios, ensuring the protection of vehicle occupants. This market is driven by the increasing demand for advanced safety features in passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The integration of airbag sensors in modern vehicles is a significant development in automotive safety technology. These sensors are designed to detect accident intensity and initiate the deployment of airbags in a timely and effective manner. The market for airbag sensors is influenced by several factors, including the advancement of accurate sensing technologies and the sensitization of vehicles to various collision scenarios.

Further, two primary types of sensors are used in airbag systems: mechanical sensors and electrical sensors. Mechanical sensors, such as the spring/mass system, are activated by the force of a collision and trigger the airbag deployment. Electrical sensors, on the other hand, utilize low power levels to monitor various vehicle parameters and initiate airbag deployment based on predetermined thresholds. Impact sensors and pressure sensors are essential components of airbag systems. Impact sensors detect the severity of a collision and trigger the airbag deployment mechanism. Pressure sensors monitor the inflation and deflation of airbags, ensuring proper deployment and function. Brake sensors also play a role in airbag systems, as they can detect sudden acceleration and initiate airbag deployment In the event of a rear-end collision.

In addition, the market is influenced by several market dynamics. The increasing focus on vehicle safety regulations and traffic laws is driving demand for advanced safety features, including airbag sensors. The adoption of these sensors is also influenced by the high demand for passenger cars, light commercial vehicles, and heavy commercial vehicles, as well as the private vehicle ownership rates in various regions. The production capacity of airbag sensors is influenced by various factors, including pandemic restrictions and semiconductor shortages. These challenges have led to delays In the supply chain and increased component contracts for airbag sensor manufacturers. The vehicle electrical architectures of modern vehicles also impact the demand for airbag sensors, as these systems require sophisticated sensing technologies to ensure accurate and timely deployment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.22% |

|

Market Growth 2024-2028 |

USD 227 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.76 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Airbag Sensor Market Research and Growth Report?

- CAGR of the Automotive Airbag Sensor industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive airbag sensor market growth of industry companies

We can help! Our analysts can customize this automotive airbag sensor market research report to meet your requirements.