Automotive Alternator Market Size 2024-2028

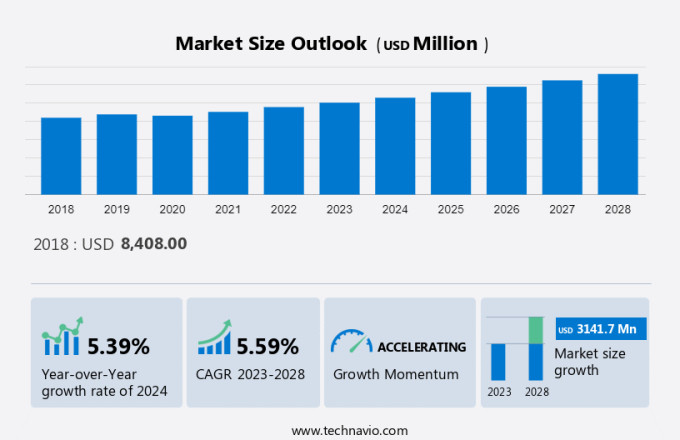

The global automotive alternator market size is estimated to grow by USD 3.14 billion, at a CAGR of 5.59% between 2023 and 2028. The market's expansion hinges on several factors, notably the escalating integration of electronic components in vehicles, growth of automotive aftermarket, the uptake of either new or upgraded emission standards, and the strategic shift in production to countries offering lower costs. These dynamics collectively propel the automotive industry forward, fostering innovations in vehicle technology, emission control technologies, and cost-effective manufacturing strategies. As electronic systems become more integral to vehicle functionalities, the market responds by enhancing electronic component accessibility and efficiency. Likewise, the pursuit of environmentally friendly practices via stricter emission standards drives advancements in eco-conscious vehicle designs. Lastly, the strategic relocation of production facilities to cost-efficient regions contributes significantly to maintaining market competitiveness and optimizing production expenses.

What will be the Automotive Alternator Market Size During the Forecast Period?

To learn more about this Automotive Alternator market report, View Sample PDF

Automotive Alternator Market Segmentation

The Automotive Alternator market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- IC engine vehicles

- Hybrid & electric vehicles

- Application Outlook

- Passenger cars

- LCVs

- M&HCVs

- Region Outlook

- APAC

- China

- India

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- North America

- The U.S.

- Canada

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- APAC

The market is a diverse landscape driven by various factors such as vehicle type, including IC engine vehicles, hybrid and electric vehicles, passenger cars, and commercial vehicles. As the automotive industry progresses toward sustainability and addresses environmental concerns, the demand for efficient electrical components like rectifier circuits, stators, and output diodes is on the rise. In the realm of electric vehicles and hybrid powertrain systems, alternators play a crucial role in ensuring optimal performance while adhering to emission norms. They are integral components of electrical systems, working in conjunction with the engine and battery to power various vehicle functionalities. The market also sees influences from economic conditions impacting automotive players and automotive manufacturing industries, fostering joint ventures and strategic alliances. Technological advancements have led to the development of three-phase generators and innovative diode trios that enhance the efficiency of alternators in modern automobiles.

Type Analysis

The IC engine vehicles segment will account for a major share of the market's growth during the forecast period.? An internal combustion engine vehicle (ICEV) is a vehicle that is powered by a regular internal combustion engine (ICE). Since the demand and production of vehicles are high in APAC, the demand for ICEVs and advanced technologies is also high. The drastic shift in the income of the middle class and rapid urbanization are driving the demand for vehicles.

Get a glance at the market contribution of various segments. View Sample PDF

The IC engine vehicles segment was valued at USD 6.13 billion in 2018. The rising focus of consumers and companies on adopting low-emission and fuel-efficient vehicles has also brought HEVs into the limelight and increased their penetration rate. Moreover, constant government support in the form of grants and subsidies to companies and incentives to consumers has helped in increasing the adoption rate of HEVs. For instance, France, the UK, California, and the US have declared that they will stop the sales of ICE vehicles by 2040.

Application Analysis

The market is constantly undergoing changes in terms of technological development. Technological upgrades are primarily driven by the dynamic nature of emission regulations, fuel efficiency standards, safety standards, and the pressure to decrease production costs. Vehicle makers are focusing on adopting 48V electrical systems to meet the technological advances of automotive electronics used within passenger cars. For instance, Kia Motors launched a diesel 48V mild hybrid powertrain called EcoDynamics+. LCVs are commercial carriers used for transporting goods over short distances, especially within cities and between cities. The compact nature of these vehicles allows easier maneuvering within city limits. LCVs are mainly used by parcel delivery companies, goods transport companies, and passenger transport agencies. 48V electrical systems are increasingly being adopted within LCVs to power the onboard electronics.

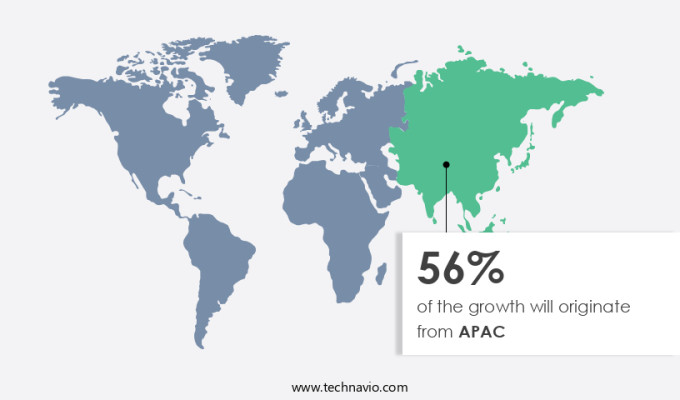

Geographical Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, View Sample PDF now!

The market in APAC is mainly characterized as a developing market with a large scope of development in terms of vehicle ownership and technological adoption. The heightened sensitivity toward cost is restricting vehicle makers from adopting advanced automotive technologies, especially within the automotive market in India, China, and Japan. The production of automotive alternators in APAC depends on the production and sales of passenger cars and commercial vehicles and the rising demand for export-oriented production of automotive components. India and China accommodate a large manufacturing industry, mainly organized for export-oriented production. Lower wages, the ready availability of human resources, the availability of raw materials and associated transportation services, and the lower value of local currency further drive the manufacturing industry in these countries.

Take a quick look at various segments. View Sample PDF now!

Automotive Alternator Market Dynamics

The market is driven by diverse factors such as the rising demand for electric vehicles and hybrid powertrain systems, necessitating efficient electrical components like generators, rectifier circuits, and stators. The market caters to a wide range of vehicle types, including IC engine vehicles, passenger cars, and commercial vehicles while addressing sustainability and environmental concerns through adherence to emission norms. Challenges lie in adapting to evolving economic conditions and fostering joint ventures and strategic alliances within the automotive manufacturing industries to meet the demands of modern automobiles and their intricate electrical systems and engines.

Our researchers analyzed the data with 2023 as the base year and the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Automakers are moving their manufacturing hubs to countries with cheaper labor, materials, and facilities which drives the market growth. China is a significant market, but trade tensions with North America and Europe are shifting focus to other low-cost countries in Asia.

Moreover, the COVID-19 pandemic has also increased demand for low-cost personal transportation, creating an opportunity for entry-level cars. Shifting production to low-cost countries will reduce costs and allow for lower prices, increasing demand and supporting the growth of automotive components.

Significant Market Trends

Various industries are rapidly developing 3D printing or additive manufacturing technologies, which is a primary trend in the market. The automotive industry is actively contributing to the additive manufacturing industry, accounting for approximately one-eighth of the revenue generated. The potential for additive manufacturing is immense, especially for products with complex designs and low volumes, due to the increasing manufacturing costs.

Furthermore, automotive manufacturers are adopting the latest manufacturing technologies, like additive manufacturing, to reduce their costs. For instance, SLM Solutions Group partnered with Audi to launch a 3D printing center in Germany. Rolls Royce is also adopting additive manufacturing to increase production rates, with BMW 3D printing 10,000 components for the Rolls Royce Phantom model. As the popularity of additive manufacturing increases, it is expected to attract automotive actuator manufacturers, positively impacting the market during the forecast period.

Major Market Challenge

Windshields and windows are standard in all passenger cars and commercial vehicles, which means that the global market is impacted by overall automobile production and sales which is hindering the market. Since 2018, the automotive market has been experiencing a slump in sales and production, resulting in decreased demand for various automotive components, including alternators. Sales of light vehicles in the US dropped by 3.1% during January-March 2019, and automotive production has been declining in several countries such as Germany, the UK, and China.

Moreover, the slowdown in vehicle sales growth rate in 2019 has led to inventory costs for OEMs, forcing them to reduce or stop production temporarily. This has resulted in unsold passenger vehicles worth around USD 5 billion from various OEMs in India, such as Maruti Suzuki India Ltd., Tata Motors Ltd., Honda Motor Co. Ltd., and Mahindra and Mahindra Ltd. Such factors adversely affect automotive sales and production, reducing the demand for automotive components like alternators and hampering the growth of the global market.

Get a detailed analysis of drivers, trends, and challenges. View Sample PDF now!

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the Automotive Alternator Market. One of the major companies in the market include:

- MAPCO Autotechnik GmbH - The company offers automotive alternators such as MAPCO 113600, and MAPCO 113601.

The market forecast report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- ALANKO GmbH

- AS PL Sp. z o.o.

- BBB Industries LLC

- BluePrint Engines

- BorgWarner Inc.

- Cummins Inc.

- DENSO Corp.

- Hitachi Ltd.

- Jumps Auto Industries Ltd.

- MAHLE GmbH

- Minda Corp. Ltd.

- Mitsubishi Electric Corp.

- Motorcar Parts of America Inc.

- Ningbo Zhongwang Auto Fittings Co. Ltd.

- Prestolite Electric Inc.

- Robert Bosch GmbH

- Stellantis NV

- TVS Motor Co. Ltd.

- Valeo SA

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified. Furthermore, it is also quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In November 2024, Valeo launched a new range of high-efficiency automotive alternators designed to reduce fuel consumption and emissions in hybrid and electric vehicles. This product release responds to the growing demand for energy-efficient components in the automotive industry, especially in the shift toward greener technologies.

-

In October 2024, Bosch expanded its automotive alternator portfolio with a new line featuring integrated power electronics, which offer improved performance and reliability. This launch aims to cater to the increasing requirements for more sophisticated alternators in modern vehicles, including those with advanced electrical systems.

-

In September 2024, Continental introduced a next-generation alternator that features smart charging capabilities for electric vehicles. The alternator is designed to optimize battery charging during braking, helping to extend battery life and improve energy efficiency in electric cars, aligning with the market's shift toward sustainable solutions.

-

In August 2024, Denso Corporation unveiled an upgraded version of its automotive alternators with enhanced thermal management, aimed at improving vehicle durability and overall system performance. The new design addresses the rising demand for more durable and high-performance components as vehicles increasingly incorporate complex electrical systems.

Market Analyst Overview

The automotive alternator market is experiencing a surge due to several factors. Firstly, the demand for Electric Vehicles (EVs) and Hybrid powertrain systems is escalating, driving the need for high-output automotive alternators. Moreover, the focus on environmental concerns and carbon emissions is pushing automotive players towards sustainable solutions, including green initiatives and long-lasting battery life. Collaborations and joint ventures between Original Equipment Manufacturers (OEMs) are fostering innovation in charging systems and electrical components. Furthermore, advancements in alternating current (AC) power technology, Stator such as three-phase generators and salient pole type alternators, are enhancing efficiency in vehicle electrical machinery. However, challenges like drag on electrical systems and meeting stringent emission norms are areas of concern that the market continues to address through strategic collaborations and modern automobiles designs focused on sustainability.

Moreover, the Market is a critical component of the automotive manufacturing industries worldwide. It caters to various vehicle types, including hybrid and electric vehicles known for their eco-friendly operation. One notable trend is the shift towards high output automotive alternators that can efficiently power modern vehicles' electrical systems. These alternators often feature advanced technologies such as cylindrical rotor type designs and diode trio configurations, ensuring optimal performance and durability. Factors like economic conditions and the rise of e-commerce platforms impact the market dynamics, influencing the demand for conventional product variants and innovative solutions. As vehicles become more sophisticated, with increased reliance on electrical components and advanced instrument panels, the need for reliable voltage regulators and rectifier circuits becomes paramount.

Furthermore, with the growing popularity of off-road vehicles and the emphasis on lightweight cars, alternators are evolving to meet these specific requirements. They play a crucial role in supplying electricity and converting mechanical energy into electrical power, supporting essential functions like emergency vehicle operations and powering interior and exterior lights efficiently. The market's future lies in enhancing product efficacy, addressing challenges like electromagnetism interference, and fostering collaborations to combat issues such as parts cartels. As the automotive industry continues to innovate, the automotive alternator sector remains integral to vehicle functionality and performance. Similarly, in the realm of power generation, Low Voltage (LV) diesel generators are gaining prominence for their efficiency and reliability in providing backup power solutions. Their adoption in various sectors underscores their role in ensuring continuous electricity supply, aligning with increasing demands for reliable power in diverse applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.59% |

|

Market Growth 2024-2028 |

USD 3.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.39 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 56% |

|

Key countries |

China, US, Germany, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALANKO GmbH, AS PL Sp. z o.o., BBB Industries LLC, BluePrint Engines, BorgWarner Inc., Cummins Inc., DENSO Corp., Hitachi Ltd., Jumps Auto Industries Ltd., MAHLE GmbH, MAPCO Autotechnik GmbH, Minda Corp. Ltd., Mitsubishi Electric Corp., Motorcar Parts of America Inc., Ningbo Zhongwang Auto Fittings Co. Ltd., Prestolite Electric Inc., Robert Bosch GmbH, Stellantis NV, TVS Motor Co. Ltd., and Valeo SA |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our market forecasting report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Alternator Market Forecasting Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch