Automotive Battery Recycling Market Size 2024-2028

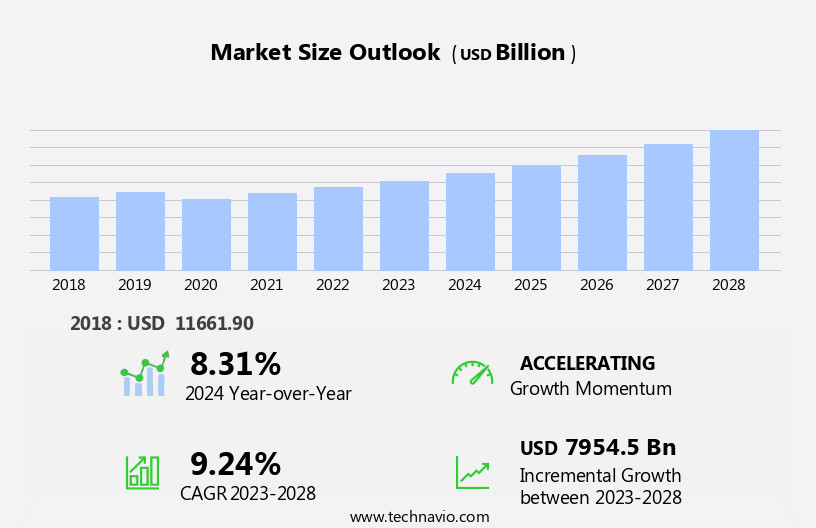

The automotive battery recycling market size is forecast to increase by USD 7954.5 billion at a CAGR of 9.24% between 2023 and 2028.

What will be the Size of the Automotive Battery Recycling Market During the Forecast Period?

How is this Automotive Battery Recycling Industry segmented and which is the largest segment?

The automotive battery recycling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Battery Type

- Lead acid batteries

- Lithium-ion batteries

- Nickel-Metal Hydride (NiMH) batteries

- Others

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Electic vehicles (EV)

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Battery Type Insights

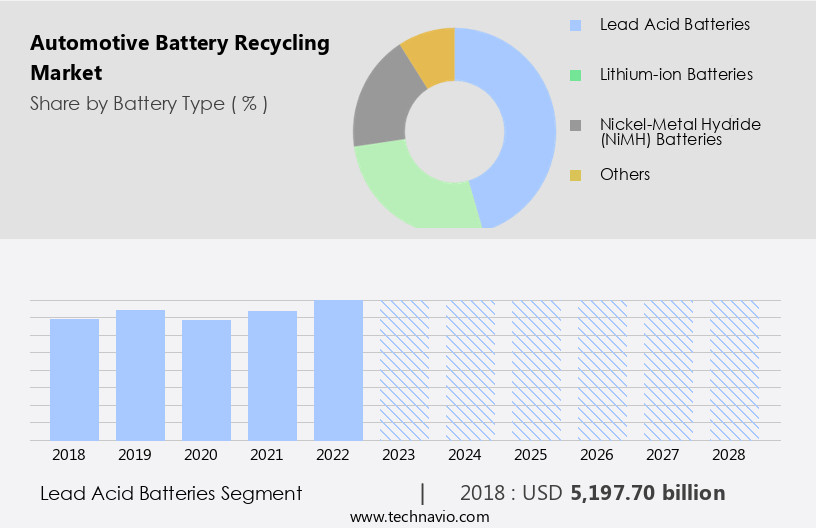

- The lead acid batteries segment is estimated to witness significant growth during the forecast period.

Lead-acid batteries, a key component in various applications such as stationary power, automotive, and deep-cycle systems, are gaining significance due to their use in renewable energy storage for solar and wind power. The automotive sector, specifically, is witnessing a shift towards electric vehicles (EVs), which necessitates an increase In the production and adoption of advanced battery technologies like lithium-ion batteries (LIB). However, lead-acid batteries continue to dominate the market due to their energy efficiency, cost-effectiveness, and environmental benefits. The recycling of spent batteries is a crucial aspect of the battery ecosystem, addressing concerns related to pollution control and sustainable transportation.

With nearly 100% of lead being recyclable, the lead-acid battery recycling market plays a vital role in minimizing hazardous waste and environmental risks. The recycling process includes collection and sorting, followed by the recovery of valuable materials such as nickel, cobalt, and rare earth metals. This closed-loop system contributes to the circular economy, reducing the dependence on primary resources and promoting a more sustainable approach to battery manufacturing. Incorporating

Get a glance at the Automotive Battery Recycling Industry report of share of various segments Request Free Sample

The Lead acid batteries segment was valued at USD 5197.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

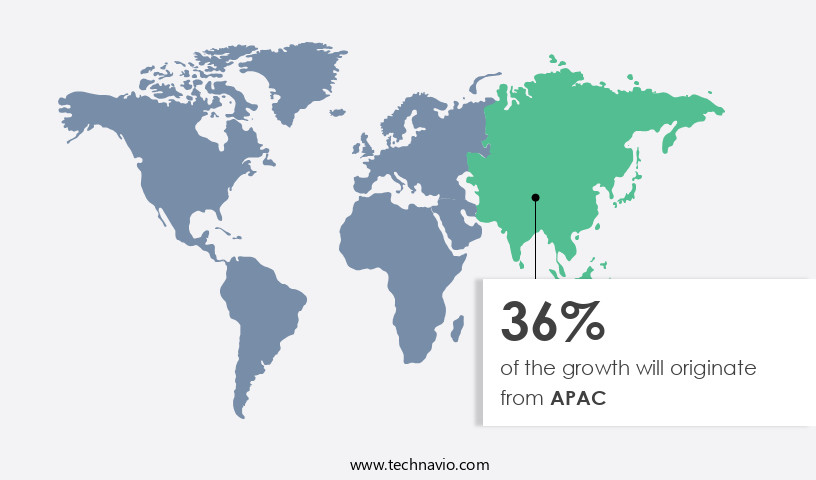

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is significantly driven by the increasing adoption of electric vehicles (EVs) and the need for sustainable transportation. With the shift towards renewable energy sources like solar and wind power, the demand for energy storage solutions, including automotive batteries, is on the rise. The market is particularly prominent In the Asia Pacific region due to the presence of numerous battery manufacturing companies and the growing market for electric vehicles. China, as the world's largest automotive market, is a key contributor to The market, driven by stringent regulations on hazardous waste disposal and the push for a circular economy.

Japan, known for its advanced technological capabilities, is also making significant strides in battery recycling, supported by government initiatives promoting eco-friendly initiatives and the EV market. Automotive batteries, primarily Lithium-ion, Lead-acid, and Nickel-cadmium, contain valuable materials such as Nickel, Cobalt, and Rare earth metals. Proper recycling of these batteries is essential to mitigate environmental risks associated with hazardous materials, including toxic chemicals, heavy metals, and potential soil pollution from landfills. Advanced battery technologies, such as Lithium-ion batteries, require specialized recycling processes, including Hydrometallurgical and Pyrometallurgical processes, to recover valuable materials and reduce the environmental impact of battery disposal. The automotive battery recycling industry is expected to grow as electric vehicle adoption increases, contributing to the reduction of greenhouse gases and the transition towards sustainable fuels.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Battery Recycling Industry?

Widening lithium supply demand gap is the key driver of the market.

What are the market trends shaping the Automotive Battery Recycling Industry?

Increasing demand for electric vehicles is the upcoming market trend.

What challenges does the Automotive Battery Recycling Industry face during its growth?

Involvement of high costs in automotive battery recycling is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The automotive battery recycling market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive battery recycling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive battery recycling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Accurec Recycling GmbH - The market encompasses the collection and processing of spent lithium-ion, nickel metal hydride, and nickel cadmium batteries sourced from various applications, including electric vehicles and e-bikes. This market caters to the growing demand for sustainable solutions In the automotive industry, ensuring the efficient recovery of valuable metals and reducing the environmental impact of battery disposal. By implementing advanced recycling technologies, this sector contributes significantly to the circular economy, minimizing the need for virgin raw materials and promoting resource conservation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accurec Recycling GmbH

- Call2Recycle Inc.

- Contemporary Amperex Technology Co. Ltd.

- Duesenfeld GmbH

- East Penn Manufacturing Co. Inc.

- Ecobat LLC

- ENGITEC TECHNOLOGIES SPA

- Exide Industries Ltd.

- Fortum Oyj

- Glencore Plc

- Li Cycle Holdings Corp.

- Redwood Materials Inc.

- SK Inc.

- SNAM Groupe

- SungEel Hi Tech Co. Ltd.

- Umicore SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive battery market encompasses a significant portion of the global energy storage sector, with a substantial focus on sustainable transportation and the increasing adoption of electric vehicles (EVs). The shift towards energy efficiency and pollution control has led to an escalating demand for advanced battery technologies, such as lithium-ion batteries (LIB), lead-acid batteries, sodium-sulfur batteries, and others. As the market for EVs expands, so does the generation of spent batteries. These batteries, often containing valuable materials like nickel, cobalt, and rare earth metals, pose environmental risks if not disposed of properly. The hazardous materials within spent batteries, including toxic chemicals, heavy metals, flammable, corrosive materials, and even radioactive materials, necessitate the development of a robust battery recycling ecosystem.

The recycling industry plays a crucial role in mitigating the environmental impact of battery disposal. The process involves collection and sorting of spent batteries, followed by the application of various recycling technologies to recover valuable materials. Hydrometallurgical and pyrometallurgical processes are commonly used to extract nickel, cobalt, and other valuable metals from spent batteries. The recycling of spent batteries is not only essential for the circular economy but also for the reduction of greenhouse gas emissions. The production of batteries, particularly LIBs, contributes significantly to gasoline production and the associated carbon emissions. By recycling batteries, the need for raw material extraction is reduced, thus minimizing the carbon footprint.

The battery recycling market is a complex ecosystem that involves various stakeholders, including automotive manufacturers, battery producers, recycling facilities, and regulatory bodies. The industry faces numerous challenges, including the development of cost-effective and efficient recycling technologies, the collection and sorting of spent batteries, and the safe handling and disposal of hazardous materials. Renewable energy storage, such as solar power and wind power, also relies on batteries for energy storage and grid stability. The recycling of spent batteries from renewable energy applications is crucial to ensure a sustainable and circular economy for these energy sources. The battery recycling industry is an evolving landscape, with ongoing research and development (R&D) investments in new recycling technologies and processes.

The circular economy is becoming increasingly important as the world transitions towards sustainable fuels and electric vehicles. The recycling capacity for batteries is expected to grow as the market for EVs continues to expand, making battery recycling a key focus area for businesses and governments alike. In conclusion, the market plays a vital role In the sustainable production and disposal of batteries. The recycling of spent batteries is essential for reducing environmental risks, minimizing the carbon footprint, and ensuring a circular economy for batteries used in various applications, including passenger vehicles, commercial vehicles, and renewable energy storage. The industry faces numerous challenges but also presents significant opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.24% |

|

Market growth 2024-2028 |

USD 7954.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.31 |

|

Key countries |

China, US, Germany, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Battery Recycling Market Research and Growth Report?

- CAGR of the Automotive Battery Recycling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive battery recycling market growth of industry companies

We can help! Our analysts can customize this automotive battery recycling market research report to meet your requirements.