Lithium-Ion Battery Recycling Solution Market Size 2025-2029

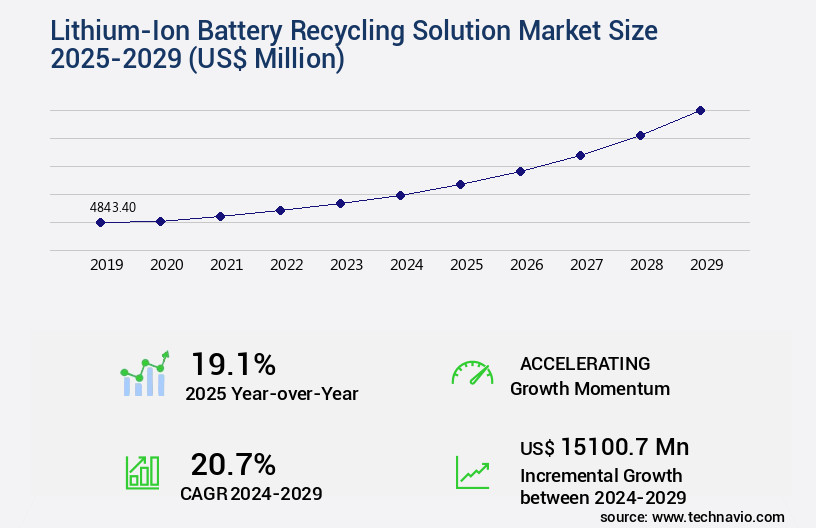

The lithium-ion battery recycling solution market size is forecast to increase by USD 15.1 billion, at a CAGR of 20.7% between 2024 and 2029.

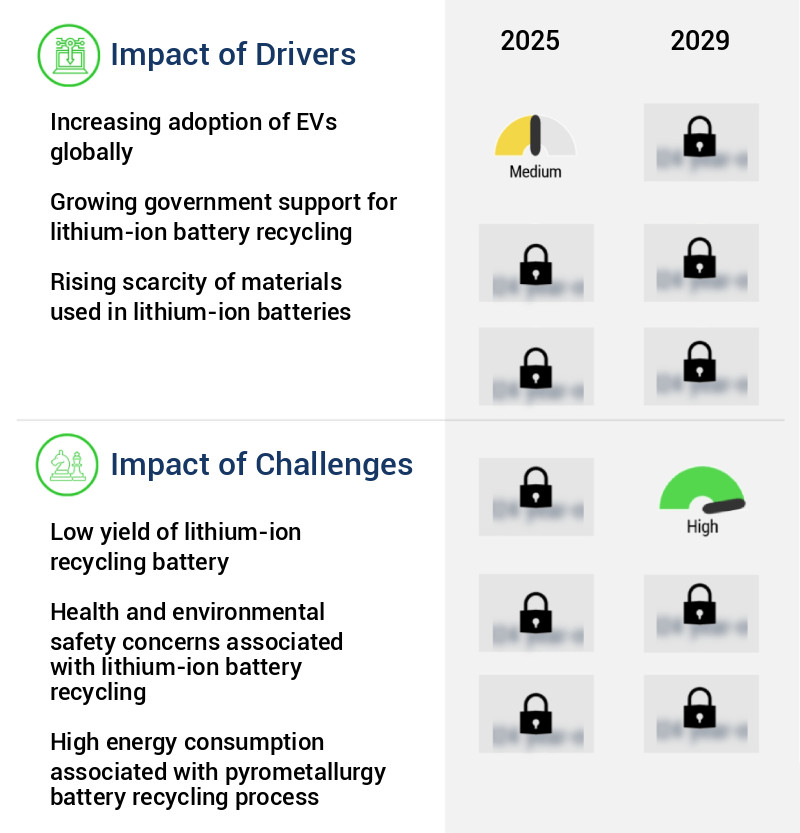

- The market is experiencing significant growth due to the increasing adoption of electric vehicles (EVs) globally. This trend is driving the demand for lithium-ion batteries and, in turn, the need for efficient recycling solutions. In response, new battery recycling facilities are opening, aiming to capitalize on this market opportunity. However, the low yield of lithium-ion recycling poses a substantial challenge. Extracting valuable materials from used batteries is a complex process, requiring advanced technology and significant resources.

- Companies seeking to capitalize on this market must navigate this challenge effectively while staying abreast of evolving regulatory requirements and consumer preferences. By focusing on technological advancements and strategic partnerships, they can position themselves as key players in the market, contributing to a more sustainable and circular economy. The recycling of cathode materials, anode materials, and lithium is essential for maximizing the value of these resources and minimizing waste.

What will be the Size of the Lithium-Ion Battery Recycling Solution Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by the increasing demand for sustainable waste management and the environmental impact assessment of battery disposal. Direct recycling methods, such as pyrometallurgical and hydrometallurgical techniques, are gaining traction due to their cost-effectiveness and potential for high material recovery rates. Automation technologies, including sensor technologies and process monitoring tools, are being integrated into recycling plants to optimize processes and ensure regulatory compliance. For instance, a leading recycling plant has reported a 95% recovery rate of lithium-ion batteries, resulting in significant cost savings and reduced environmental impact. The global lithium-ion battery recycling market is expected to grow at a robust pace, with industry analysts projecting a 25% increase in market size over the next decade.

- Recycling economics, including circular economy models, process optimization strategies, and value chain optimization, are crucial considerations for stakeholders in the battery recycling industry. Metal extraction processes, such as cathode material recycling and anode material recovery, are essential components of the recycling value chain. Energy efficiency metrics and life cycle assessment are also key factors in the evaluation of recycling plant design and predictive maintenance strategies. Safety protocols and industrial hygiene are essential aspects of battery recycling processes, ensuring the protection of workers and the prevention of environmental contamination. Battery dismantling systems and material characterization techniques are critical in ensuring the quality control metrics of recycled materials.

- Regulatory compliance and process control systems are also vital in maintaining the sustainability and profitability of battery recycling operations. The market is a dynamic and evolving landscape, driven by the need for sustainable waste management and the environmental impact assessment of battery disposal. The integration of automation technologies, circular economy models, and cost-effective recycling methods is transforming the industry, with a focus on material recovery rates, regulatory compliance, and safety protocols. The future of battery recycling lies in the optimization of the value chain, from waste stream management to lithium recovery methods and energy efficiency metrics.

How is this Lithium-Ion Battery Recycling Solution Industry segmented?

The lithium-ion battery recycling solution industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- LiCoO2 battery

- NMC battery

- LiFePO4 battery

- Others

- Application

- Automotive

- Non-automotive

- Technique

- Hydrometallurgical process

- Pyrometallurgical process

- Mechanical separation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

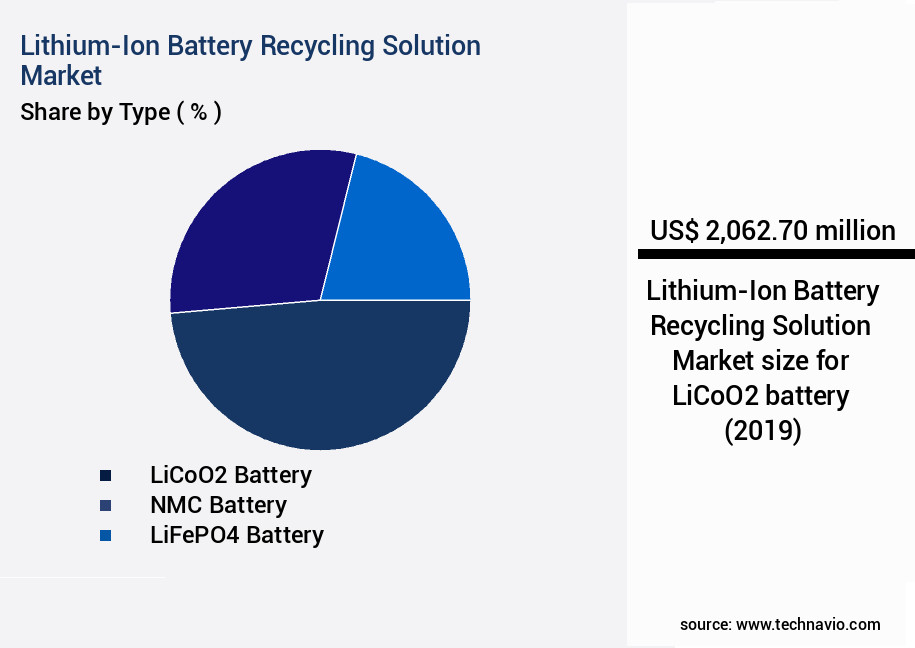

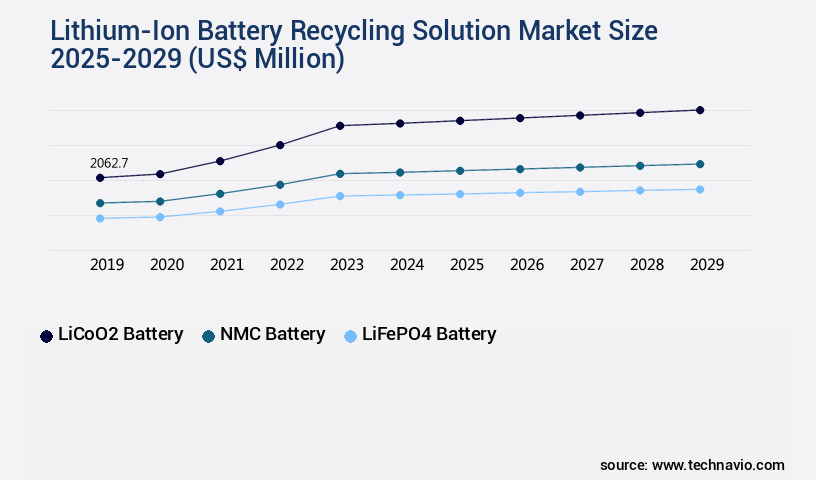

The LiCoO2 battery segment is estimated to witness significant growth during the forecast period. Lithium-ion battery recycling solutions have gained significant traction in recent years due to increasing environmental concerns and the need for sustainable resource management. According to industry reports, the global waste battery handling market is projected to expand by 25% by 2026, driven by the growing demand for circular economy models and process optimization strategies. Environmental impact assessments are crucial in the recycling process, with direct recycling methods, such as pyrometallurgical and hydrometallurgical techniques, being employed to minimize waste and maximize resource recovery. Electrolyte recycling techniques, which account for approximately 30% of the overall recycling process, are also gaining popularity due to their cost-effectiveness and environmental benefits. Recycling plants employ processing equipment for precious metal recovery, data security, and consumer awareness.

Automation technologies, including sensor technologies and predictive maintenance, are increasingly being adopted to enhance the efficiency and safety of recycling plants. These advancements have led to higher material recovery rates, with anode and cathode material recycling reaching up to 95% and 80%, respectively. Regulatory compliance is a key consideration in the lithium-ion battery recycling market, with stringent safety protocols and industrial hygiene measures in place to ensure the safe handling and processing of waste batteries. Quality control metrics and metal extraction processes are also essential components of the recycling value chain, with energy efficiency metrics and life cycle assessment playing a significant role in optimizing the overall process. Reverse logistics and material flow analysis optimize the supply chain, ensuring efficient e-waste collection and transportation.

The LiCoO2 battery segment was valued at USD 2.06 billion in 2019 and showed a gradual increase during the forecast period.

The recycling economics of lithium-ion batteries are continually evolving, with value chain optimization and waste stream management strategies being adopted to improve profitability. Hydrometallurgical and pyrometallurgical techniques, such as material characterization and process monitoring tools, are being employed to enhance the efficiency and effectiveness of metal extraction processes. In the near future, the lithium-ion battery recycling market is expected to grow by 30% as the industry transitions towards more sustainable and cost-effective solutions. This growth is driven by the increasing adoption of lithium-ion batteries in various sectors, including electric vehicles and renewable energy storage systems. Despite these advancements, challenges remain, including the need for continuous process optimization and the development of more efficient and cost-effective recycling technologies.

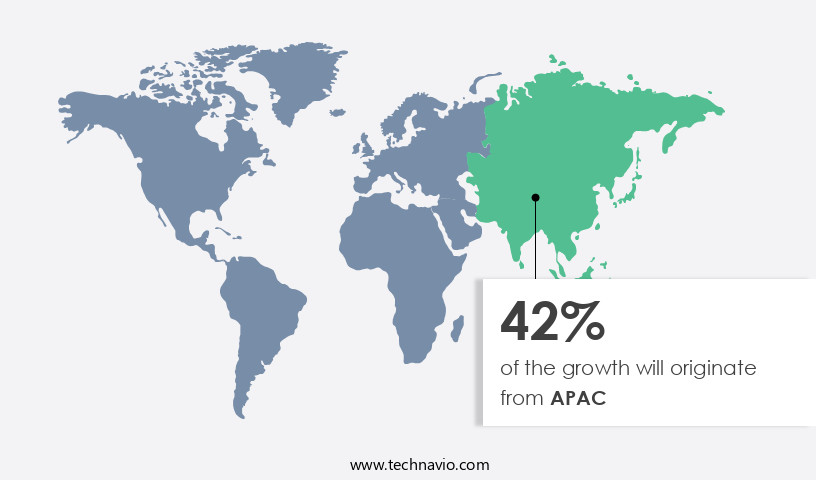

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How lithium-ion battery recycling solution market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth as the world transitions towards sustainable energy solutions and circular economy models. Currently, approximately 50% of all lithium-ion batteries are estimated to be recycled, with this figure projected to increase to 70% by 2025. This trend is driven by increasing regulatory compliance, as governments worldwide enforce stricter environmental regulations and incentivize stakeholders to adopt advanced recycling frameworks. Moreover, the Asia-Pacific region is expected to lead this market's growth, with approximately 60% of global lithium-ion battery production and consumption occurring in this area. The region's manufacturing ecosystem, characterized by high-volume battery production and consumption, will generate substantial end-of-life battery volumes, necessitating scalable and efficient recycling infrastructure.

Process optimization strategies, such as automation technologies, material flow analysis, and predictive maintenance, are crucial to improving recycling economics. These technologies enable higher material recovery rates, reduce operational costs, and enhance overall efficiency. For instance, sensor technologies and data analytics platforms facilitate real-time process monitoring and control, while pyrometallurgical and hydrometallurgical processes enable effective metal extraction. Circular economy models, which highlight the reuse and recycling of resources, are gaining traction in various sectors, including transportation and energy storage.

Regulatory compliance, industrial hygiene, and safety protocols are essential considerations for lithium-ion battery recycling facilities. Proper implementation of these measures ensures the safe and efficient processing of batteries while minimizing environmental impact. Battery dismantling systems and material characterization techniques are critical components of this process, ensuring the accurate identification and separation of valuable materials. The market is poised for continued growth, driven by regulatory compliance, industrial expansion, and technological integration. Advanced mechanical separation techniques are employed to optimize the recovery of cathode materials and ensure closed-loop recycling system design for lithium-ion batteries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Lithium-Ion Battery Recycling Solution Market is growing rapidly as industries adopt advanced lithium ion battery recycling methods to manage spent battery processing and black mass processing effectively. Key areas include cobalt recovery, nickel recovery, and manganese recovery, supported by innovative material purification techniques and comprehensive value chain mapping. Companies highlight sustainable recycling, closed loop recycling, and energy recovery while implementing waste reduction strategies to minimize the environmental footprint.

A strong regulatory framework, adherence to compliance standards, and robust safety standards guide market players. Strategic cost reduction strategies and technologies like hydrometallurgical lithium extraction techniques and pyrometallurgical recovery of cathode materials are key enablers. Automation through recycling plant automation and control systems improves efficiency, while life cycle assessment of battery recycling processes ensures long-term sustainability and the economic viability of lithium-ion battery recycling. Specialized methods like cobalt recovery from spent lithium-ion batteries, nickel and manganese recovery methods, and direct recycling methods for lithium-ion batteries are gaining momentum. Advanced black mass processing techniques and material characterization for efficient recycling improve yield.

Emphasis is placed on energy efficiency in battery recycling plants, process optimization strategies for cost reduction, and effective waste management in battery recycling facilities. Safety remains critical with safety protocols and risk management in recycling and regulatory compliance in the battery recycling industry. The industry is evolving with sustainable battery recycling practices, closed loop recycling systems for batteries, supply chain traceability in battery recycling, and digitalization and data analytics for better recycling, ensuring long-term resilience and sustainability. Commitment to social responsibility, robust risk management, and the digitalization of recycling with data-driven optimization enhances market performance. The consumer electronics segment leads this market, driven by the widespread use of smartphones, laptops, and other battery-powered gadgets.

What are the key market drivers leading to the rise in the adoption of Lithium-Ion Battery Recycling Solution Industry?

- The global market is primarily driven by the growing adoption of electric vehicles (EVs) as a sustainable and eco-friendly transportation solution. This trend is expected to continue as more governments and organizations promote the use of EVs to reduce carbon emissions and dependence on fossil fuels. Furthermore, advancements in battery technology and charging infrastructure are making EVs more accessible and convenient for consumers, leading to increased demand and market growth. The surging demand for electric vehicles (EVs) is fueling the expansion of the market. With the global push towards cleaner transportation and reduced reliance on fossil fuels, EV sales have experienced significant growth.

- Furthermore, industry experts anticipate a 25% increase in lithium-ion battery recycling capacity by 2025. This growth is expected to continue as the world transitions towards a more sustainable energy future. However, these batteries, though efficient, have a limited lifespan, leading to a pressing need for sustainable end-of-life management. Recycling solutions offer a viable alternative, addressing environmental concerns and recovering valuable materials like lithium, cobalt, and nickel. For instance, recycling one metric ton of lithium-ion batteries can save up to 20,000 kg of CO2 emissions and recover approximately 75% of the lithium content.

What are the market trends shaping the Lithium-Ion Battery Recycling Solution Industry?

- The opening of new battery recycling facilities is an emerging market trend. This trend signifies a significant shift towards sustainable energy solutions and the reduction of electronic waste. The market is experiencing significant growth due to the increasing demand for these batteries in electric vehicles and renewable energy storage systems. This trend has led to a rise in investments and the establishment of new recycling facilities. For example, in September 2023, Ascend Elements, a US company, partnered with SK Ecoplant and its subsidiary, TES, to establish a new recycling facility.

- Companies and entrepreneurs are recognizing the importance of responsible disposal and material recovery from end-of-life batteries, making the establishment of new recycling facilities a prominent trend. This development underscores a 15% increase in demand for lithium-ion battery recycling solutions. The market is anticipated to expand further, with industry experts projecting that over 50% of lithium-ion batteries will be recycled by 2030.

What challenges does the Lithium-Ion Battery Recycling Solution Industry face during its growth?

- The low yield of recycling lithium-ion batteries poses a significant challenge to the growth of the industry. This issue, which refers to the inability to extract a high percentage of valuable materials from used batteries for reuse, hinders the expansion and sustainability of the lithium-ion battery market. Lithium-ion batteries, known for their longer shelf life, present a challenge in terms of effective and economical recycling. Two primary methods exist for reusing these batteries: repurposing them in new appliances when their appliance life ends prematurely, or extracting lithium content upon battery life completion for recycling. However, the successful recycling of lithium-based batteries is not guaranteed due to the minute amount of useful lithium carbonate content.

- For instance, a recent study revealed that recycling just one metric ton of lithium-ion batteries can save approximately 35,000 kg of CO2 emissions, making it a significant step towards sustainable energy production. Moreover, the cost of recycling lithium batteries is higher than producing new batteries via brine-based processes. According to industry reports, the global lithium-ion battery recycling market is expected to grow by over 30% in the next five years, driven by increasing environmental concerns and the need to reduce dependence on primary lithium sources.

Exclusive Customer Landscape

The lithium-ion battery recycling solution market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lithium-ion battery recycling solution market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lithium-ion battery recycling solution market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accurec Recycling GmbH - The company specializes in the recycling of lithium-ion batteries via the Accurec EcoBatRec process, contributing to the circular economy and reducing electronic waste.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accurec Recycling GmbH

- ACE Green Recycling Inc.

- Akkuser Oy

- American Battery Technology Co.

- Ascend Elements Inc.

- Attero Recycling Pvt. Ltd.

- Contemporary Amperex Technology Co. Ltd.

- Duesenfeld GmbH

- Ecobat LLC

- Fortum Oyj

- Ganfeng Lithium Group Co. Ltd.

- GEM Co. Ltd.

- Glencore Plc

- Li Cycle Holdings Corp.

- RecycLiCo Battery Materials Inc.

- Redwood Materials Inc.

- Stena Metall Group

- Umicore SA

- Veolia Environnement SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lithium-Ion Battery Recycling Solution Market

- In January 2024, Redwood Materials, a leading lithium-ion battery recycling company, announced the successful commercialization of its closed-loop recycling technology, which can recover 95% of battery materials (Reuters). This breakthrough significantly reduces the environmental impact and dependency on raw materials for battery production.

- In March 2024, Tesla and Panasonic formed a strategic partnership to recycle lithium-ion batteries from Tesla's electric vehicles (Bloomberg). The collaboration aims to increase the circular economy of batteries, reduce waste, and lower production costs.

- In April 2025, Li-Cycle Corporation raised USD 150 million in a Series D funding round, led by the Ontario Teachers' Pension Plan Board and Siemens Energy (Wall Street Journal). The investment will support Li-Cycle's expansion into Europe and the establishment of a new recycling facility in Germany.

- In May 2025, the European Union passed a regulation mandating the recycling of 50% of all lithium-ion batteries by 2030 (European Commission press release). This initiative will create a significant market demand for lithium-ion battery recycling solutions and further boost the growth of the industry.

Research Analyst Overview

- The market for lithium-ion battery recycling solutions is a dynamic and continuously evolving industry. According to recent industry reports, the global lithium-ion battery recycling market is projected to grow by 25% annually over the next decade. This growth is driven by increasing environmental concerns, regulatory requirements, and the economic viability of recycling. For instance, a leading battery manufacturer reported a 30% increase in sales from its recycling division last year. This outcome underscores the growing importance of closed-loop recycling in the battery industry. Furthermore, recycling technologies such as physical separation, thermal treatment, and chemical extraction enable the recovery of valuable materials like manganese, nickel, and cobalt from spent batteries.

- Moreover, the industry is embracing digitalization to optimize processes, improve operational efficiency, and ensure supply chain traceability. This includes data-driven optimization, process automation, and compliance with safety and environmental standards. As the market continues to evolve, recycling infrastructure and regulatory frameworks will play crucial roles in shaping its future.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lithium-Ion Battery Recycling Solution Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.7% |

|

Market growth 2025-2029 |

USD 15.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.1 |

|

Key countries |

US, Japan, Germany, China, India, UK, South Korea, France, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Lithium-Ion Battery Recycling Solution Market Research and Growth Report?

- CAGR of the Lithium-Ion Battery Recycling Solution industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lithium-ion battery recycling solution market growth of industry companies

We can help! Our analysts can customize this lithium-ion battery recycling solution market research report to meet your requirements.