Automotive Body Control Module Market Size 2024-2028

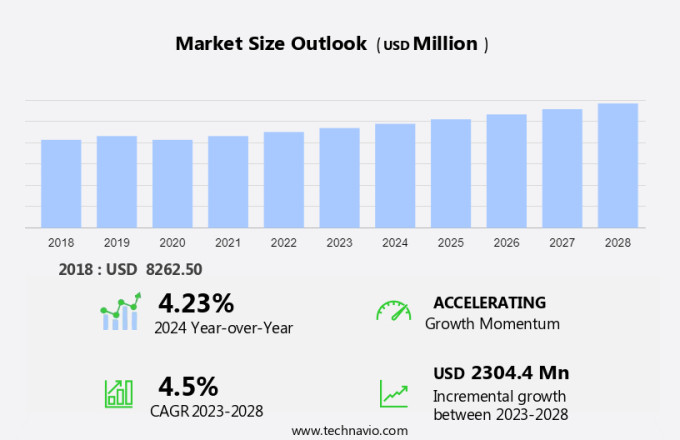

The automotive body control module market size is forecast to increase by USD 2.30 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One major trend is the increasing focus on safety features, with smart infrastructure and autonomous driving technologies driving demand for advanced BCMs. These systems enable features such as keyless entry, automatic wipers, adaptive lighting, and proximity sensing, enhancing both convenience and safety for consumers.

- Additionally, the integration of telematics, infotainment systems, and gesture recognition technologies in BCMs is leading to personalized in-car experiences. Despite these opportunities, Original Equipment Manufacturers (OEMs) face cost pressure, necessitating the development of multiple scalable BCMs for various vehicle categories. Overall, the market is poised for continued growth as technology advances and consumer expectations evolve.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment within the automotive electronics industry. This market encompasses various electronic control devices that manage and regulate functions related to a vehicle's body, including lighting, windows, door locks, wipers, switches, sensors, and safety systems. Body control modules play a crucial role in enhancing the overall driving experience by providing comfort, convenience, and safety features. These modules are essential components in both conventional internal combustion engine vehicles and electric vehicles. They include electronic control units (ECUs) for lights, power windows, central locking, climate control, horn, voice recording, vehicle connectivity, security, access, comfort controls, gateway, remote modules, and loads.

- Furthermore, the market growth can be attributed to several factors. First, the increasing demand for advanced driver assistance systems (ADAS) and electric vehicles (EVs) is driving the need for sophisticated body control modules. These systems require more complex electronic control units to manage various functions, such as adaptive lighting, power windows, and climate control in EVs. Second, the growing focus on vehicle safety is another significant factor fueling market growth. Advanced safety systems, such as lane departure warning, blind spot detection, and automatic emergency braking, rely on sensors and body control modules to function effectively. These systems help prevent accidents and ensure passenger safety, making them increasingly popular among consumers.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

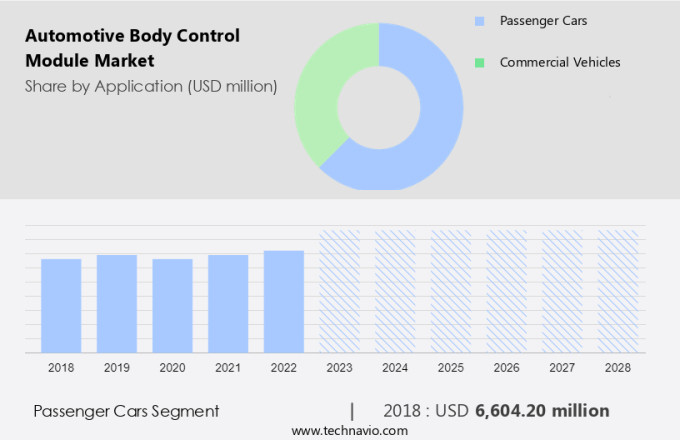

The passenger cars segment is estimated to witness significant growth during the forecast period. The Automotive Body Control Module (BCM) market holds significant importance in the passenger car sector. BCMs in passenger vehicles manage and control various electronic components and systems, including lighting, windows, door locks, seat adjustments, air conditioning, and more. These modules ensure the seamless functioning of these systems, improving the overall driving experience and enhancing vehicle safety. The increasing preference for advanced and connected cars is fueling the growth of the automotive BCM market. Modern passenger cars are integrating advanced electronics, necessitating sophisticated BCMs to effectively manage the complexity of these systems. Moreover, the emergence of electric vehicles (EVs) and hybrid vehicles is further boosting the demand for advanced BCMs, as these vehicles require more intricate control modules to manage their electronic and power systems.

Furthermore, safety features, such as smart infrastructure, autonomous driving, keyless entry, automatic wipers, adaptive lighting, gesture recognition, and proximity sensing, are increasingly becoming standard in passenger cars. BCMs play a vital role in enabling these features by managing the communication between various vehicle systems and external sensors. The telematics, infotainment systems, and other advanced technologies in passenger cars rely on BCMs to function optimally. As the automotive industry continues to evolve, the demand for advanced BCMs is expected to increase, driven by the need for personalized in-car experiences, improved safety features, and the integration of various connectivity options.

Get a glance at the market share of various segments Request Free Sample

The passenger cars segment accounted for USD 6.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

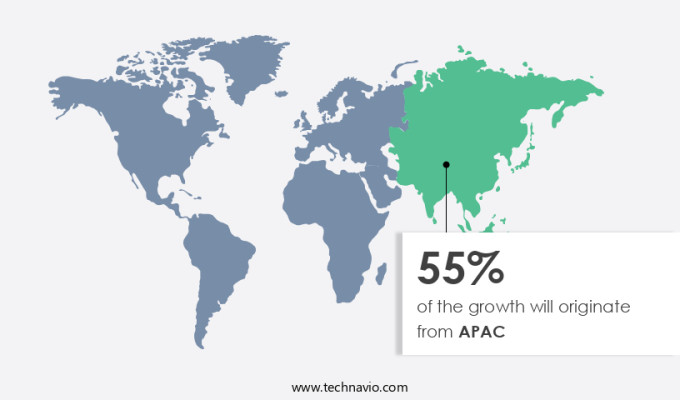

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is marked by significant growth potential, driven by increasing vehicle connectivity and the adoption of advanced technologies. BCMs are essential components of modern vehicles, controlling various functions such as horns, voice recording, and vehicle connectivity features like Bluetooth, Wi-Fi, Near Field Communication (NFC), CAN, and Ethernet. The market's growth in APAC is influenced by factors like the increasing popularity of the Internet of Things (IoT) and cloud services, as well as the widespread use of smartphones. Vehicle manufacturers in this region are focusing on integrating these technologies into their vehicles to cater to evolving consumer preferences.

However, the market's development in countries like India, China, and Japan is restrained by cost considerations. Despite the growing demand for advanced automotive technologies, the affordability factor remains a significant concern for vehicle buyers in these markets. The production of BCMs in APAC is primarily driven by the manufacturing industries in countries like India and China, which are known for their export-oriented production of automotive components. Lower labor costs, abundant human resources, easy access to raw materials, and a favorable currency exchange rate make these countries attractive destinations for automotive component manufacturing. In conclusion, the market in APAC is experiencing steady growth, fueled by the increasing adoption of advanced technologies and the rising demand for vehicle connectivity.

Market Dynamic

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Multiple scalable automotive BCMs for different vehicle categories is the key driver of the market. The market in passenger cars is witnessing significant growth due to the increasing integration of security, access, and comfort controls in vehicles. Automakers are focusing on developing scalable BCMs to accommodate various functions in a single module. Central body control modules are gaining popularity as they can manage functions such as exterior and interior lighting, relay control, and comfort features within a compact design.

Furthermore, these modules offer high levels of integration and scalability, making them suitable for different vehicle categories. High-feature and low-cost BCMs are also available, catering to diverse market requirements. The use of advanced technologies like LIN and CAN bus systems, as well as the integration of hardware components like ECUs, enable seamless communication and efficient functioning of these modules. The integration of remote modules and gateways further enhances the capabilities of body control modules, allowing for increased connectivity and convenience.

Market Trends

Increasing demand for small and reliable automotive BCMs is the upcoming trend in the market. The Automotive Body Control Module (BCM) market has witnessed significant advancements in recent years, with these systems becoming more intricate in design to accommodate the growing electronic content in vehicles. While multiple BCMs are utilized to compensate for this increase, there is a rising demand for compact and dependable BCMs. Manufacturers are addressing this need by producing small and efficient BCMs for automotive applications.

Furthermore, these BCMs utilize advanced technologies like Application-Specific Integrated Circuits (ASIC) and Surface Mount Devices (SMD) to link inputs and outputs through compact yet powerful microprocessors. This results in smaller and more reliable electronic body components for vehicles. These BCMs are integral to various automotive systems, including lighting, windows, door locks, wipers, switches, and sensors. Their implementation in electric vehicles and autonomous vehicles further enhances their significance. As the automotive industry continues to innovate, the demand for efficient and compact BCMs is expected to grow.

What challenges does Automotive Body Control Module Market face during the growth?

Increasing cost pressure faced by OEMs is a key challenge affecting the market growth. In the automotive industry, Original Equipment Manufacturers (OEMs) face significant cost pressure due to various factors. These factors include stringent emission regulations, substantial investments in research and development, market competition, and evolving customer demands. As a result, OEMs pass on the cost burden to their tier-1 suppliers and component manufacturers.

The latter are under immense pressure to deliver high-performing and cost-effective components, such as microcontrollers, printed circuit boards, input-output devices, and bus transceivers. These components are essential for the body control module, which plays a critical role in managing various vehicle functions. Failure or recall of these components can significantly impact the OEM's bottom line, making it essential for them to maintain high-quality standards.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aptiv Plc - The company offers Automotive Body Control Modules that provide safety, comfort, and convenience functionalities through power, data, and integration capabilities.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Continental AG

- DENSO Corp.

- FEV Group GmbH

- HELLA GmbH and Co. KGaA

- Hitachi Ltd.

- Hyundai Motor Co.

- Infineon Technologies AG

- Information Technologies Institute Intellias LLC

- Lear Corp.

- Mitsubishi Electric Corp.

- Nidec Corp.

- NXP Semiconductors NV

- OMRON Corp.

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Samvardhana Motherson International Ltd.

- STMicroelectronics International N.V.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various electrical systems in vehicles that manage functions such as lighting, windows, door locks, wipers, switches, sensors, and more. These systems are integral to both passenger and commercial vehicles, including electric and autonomous ones. The integration of advanced technologies like AI, energy efficiency, safety features, smart infrastructure, and autonomous driving is driving market growth. Electric vehicles and autonomous vehicles require sophisticated body control modules to manage their unique power and control requirements. These systems include smart components like adaptive lighting, gesture recognition, proximity sensing, ambient lighting control, and more. The body control module market caters to various vehicle types, including passenger cars and commercial vehicles.

Furthermore, key components of these systems include electronic control units (ECUs), controller area networks (CAN), local interconnect networks (LIN), microcontrollers, printed circuit boards, input-output devices, bus transceivers, and more. Tier 1 suppliers play a crucial role in supplying these hardware components to automakers for integration into their vehicle model variants. Vehicle connectivity through the Internet of Things (IoT), smartphones, cloud services, Bluetooth, Wi-Fi, and near field communication (NFC) is also driving the growth of the body control module market. These technologies enable personalized in-car experiences, remote module control, and real-time vehicle data access. In summary, the automotive body control market is a dynamic and growing sector that caters to various vehicle types and advanced technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.30 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 55% |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aptiv Plc, Continental AG, DENSO Corp., FEV Group GmbH, HELLA GmbH and Co. KGaA, Hitachi Ltd., Hyundai Motor Co., Infineon Technologies AG, Information Technologies Institute Intellias LLC, Lear Corp., Mitsubishi Electric Corp., Nidec Corp., NXP Semiconductors NV, OMRON Corp., Renesas Electronics Corp., Robert Bosch GmbH, Samvardhana Motherson International Ltd., STMicroelectronics International N.V., and Texas Instruments Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch