Automotive ADAS Aftermarket Market Size 2025-2029

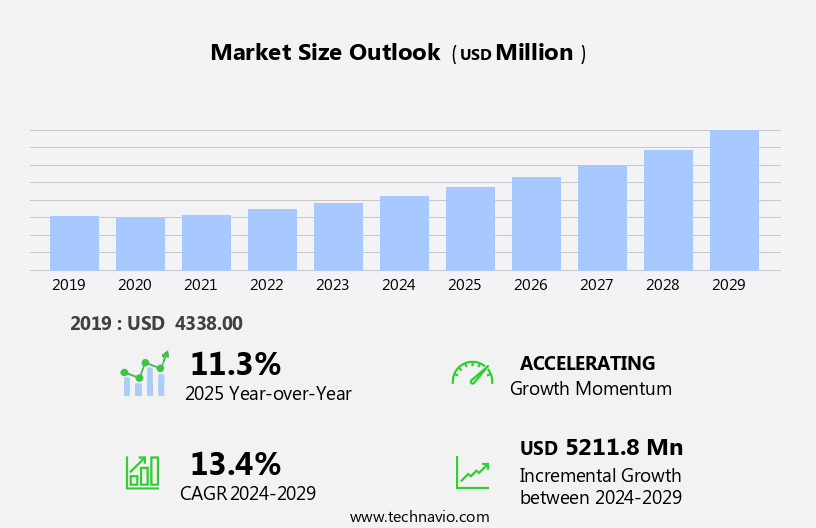

The automotive ADAS aftermarket market size is forecast to increase by USD 5.21 billion at a CAGR of 13.4% between 2024 and 2029.

- The Automotive Advanced Driver-Assistance Systems (ADAS) aftermarket is experiencing significant growth, driven by the declining prices of sensors and the increasing development of aftermarket solutions for commercial vehicles. This trend is further fueled by the adoption of active ADAS technologies by Original Equipment Manufacturers (OEMs), creating opportunities for aftermarket players to cater to the growing demand for advanced safety features. However, market penetration remains a challenge due to the complexity of ADAS systems and the need for specialized installation and calibration services.

- To capitalize on this market, companies must focus on developing user-friendly solutions, building strategic partnerships with OEMs and suppliers, and investing in research and development to stay abreast of emerging technologies. By addressing these challenges and leveraging the growing demand for advanced safety features, players in the automotive ADAS aftermarket can expect growth and profitable opportunities. StartFragment

What will be the Size of the Automotive ADAS Aftermarket Market during the forecast period?

- The Automotive Advanced Driver-Assistance Systems (ADAS) aftermarket is experiencing significant growth due to increasing consumer demand for enhanced safety, convenience, and fuel efficiency in vehicles. This market encompasses a wide range of technologies, including Level 0-5 autonomous vehicles, ADAS mapping and algorithms, processors, vision systems, and connectivity solutions. Key trends include continuous advancements in ADAS algorithms for improved accident prevention, emissions reduction through optimized fuel economy, and the integration of convenience features such as alcohol detection and driver monitoring. The market is driven by the rising awareness of safety and comfort benefits, as well as the cost savings associated with aftermarket solutions compared to original equipment manufacturer (OEM) offerings.

- The ADAS aftermarket landscape is characterized by ongoing innovation, with a focus on validation, simulation, and hardware components to ensure optimal performance and reliability. The market's future direction is towards the development of more advanced, integrated systems that cater to the growing demand for autonomous and connected vehicles.

How is this Automotive ADAS Aftermarket Industry segmented?

The automotive ADAS aftermarket industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Passive park assists

- FCWS and LDWS

- Others

- Vehicle Type

- Passenger vehicles

- Commercial vehicles

- Channel

- OEM-fitted ADAS

- Independent aftermarket

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

By Technology Insights

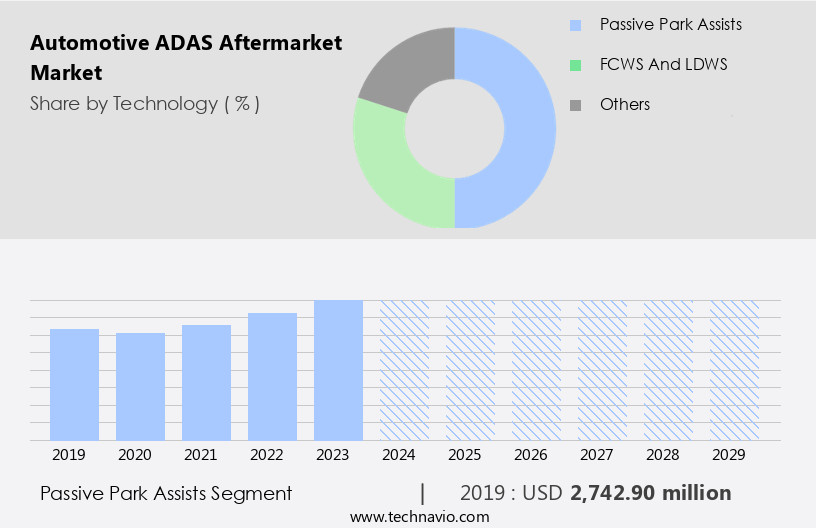

The passive park assists segment is estimated to witness significant growth during the forecast period. The Automotive ADAS (Advanced Driver-Assistance Systems) aftermarket is witnessing significant growth due to increasing ADAS adoption and the availability of advanced technologies. ADAS partnerships and collaborations between OEMs and aftermarket suppliers are driving the market, enabling the provision of value-added services such as ADAS repair, calibration, and upgrading. Traffic sign recognition, lane departure warning, night vision, automatic emergency braking, and blind spot monitoring are some of the popular ADAS features in demand. The market is also witnessing the integration of artificial intelligence, machine learning, and deep learning to enhance user experience and improve system performance. Driver monitoring, adaptive cruise control, and parking assist are other emerging ADAS technologies gaining traction in the aftermarket.

Passive park assists, including rear parking sensors, backup cameras, and rear cross-traffic alerts, are particularly popular due to their simplicity and cost-effectiveness. The demand for these systems is growing, with tight parking spaces in urban areas being a significant factor. ADAS service centers and retailers are investing in advanced tools and training to cater to the growing demand for ADAS repairs and maintenance. ADAS certification and standards are also being established to ensure the quality and safety of aftermarket ADAS components and services. ADAS cybersecurity is another critical area of focus, as the increasing use of connectivity and telematics in ADAS systems presents new security challenges.

The market is also witnessing the emergence of subscription services, cloud platforms, and customization options to cater to the diverse needs of customers. The automotive ADAS aftermarket is experiencing rapid growth due to increasing adoption, advanced technologies, and partnerships between OEMs and aftermarket suppliers. Passive park assists, driver monitoring, and adaptive cruise control are some of the popular ADAS technologies in demand, with backup cameras and parking sensors being particularly popular due to their simplicity and cost-effectiveness. The market is also witnessing the integration of artificial intelligence, machine learning, and deep learning to enhance user experience and improve system performance.

ADAS certification and standards are being established to ensure the quality and safety of aftermarket components and services, while cybersecurity is a critical area of focus due to the increasing use of connectivity and telematics in ADAS systems.

Get a glance at the market report of share of various segments Request Free Sample

The Passive park assists segment was valued at USD 2.74 billion in 2019 and showed a gradual increase during the forecast period. The Automotive ADAS Aftermarket Market is evolving rapidly, emphasizing technologies like ADAS calibration and ADAS integration for enhanced safety and performance. Businesses prioritize ADAS upgrading, ADAS maintenance, and fleet management to meet growing demands. ADAS distributors and ADAS workshops ensure seamless accessibility to advanced systems, adhering to stringent ADAS standards and ADAS regulations. Innovations in ADAS connectivity, ADAS cloud platforms, and ADAS telematics leverage cutting-edge technologies like ADAS artificial intelligence, ADAS machine learning, and ADAS deep learning for smarter solutions. Key trends include ADAS customization and ADAS personalization, alongside secure ADAS data privacy policies. The introduction of flexible ADAS subscription services marks a shift in usage models, making this sector critical to modern automotive advancements.

Regional Analysis

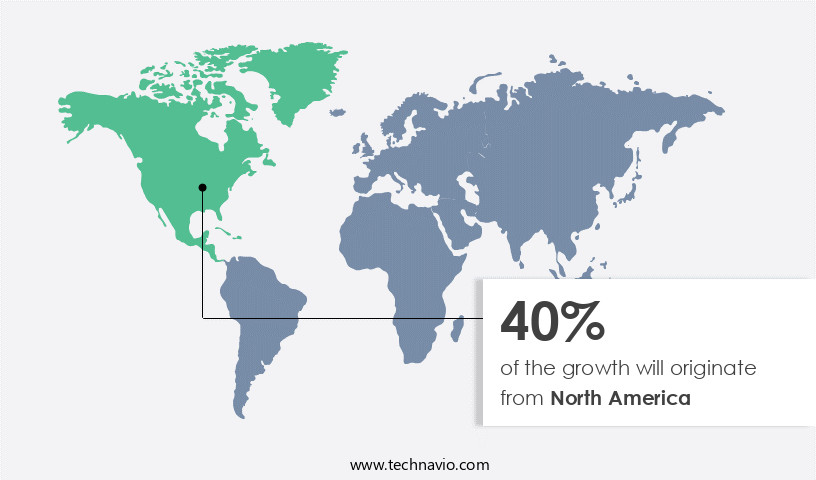

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The US market plays a significant role in the North American automotive ADAS aftermarket, driven by the presence of key industry players and increasing consumer awareness. North America is at the forefront of adopting advanced automotive technologies, making it a prime market for ADAS aftermarket growth. Consumers in the region are becoming increasingly knowledgeable about the benefits of ADAS systems, leading to in demand for these technologies.

ADAS Value-Added Services, such as Driver Monitoring, Parking Assist, and Head-Up Display, are also becoming increasingly popular. ADAS Edge Computing, Machine Learning, and Artificial Intelligence are driving innovation in the ADAS ecosystem, enabling advanced features like Adaptive Cruise Control and Autonomous Driving. The market is expected to continue growing, with investments in ADAS technology and certification programs fueling the adoption of these systems. ADAS Data Analytics and Cybersecurity are also crucial aspects of the ADAS market, ensuring the privacy and security of user data. The ADAS market is evolving rapidly, with new technologies and partnerships shaping the ADAS landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive ADAS Aftermarket Industry?

- Decline in sensor prices is the key driver of the market. The automotive Advanced Driver-Assistance Systems (ADAS) aftermarket is witnessing significant price reductions for key components such as displays and sensors. Economies of scale have played a crucial role in this trend, as the widespread adoption of these technologies in both consumer electronics and automotive industries has led to a decrease in prices. For instance, the cost of displays has dropped substantially over the last decade, enabling automotive OEMs to reduce the overall cost of infotainment systems, thereby increasing their market penetration.

- Similarly, the continuous decline in the pricing of sensors like radars and cameras is attributed to their increasing application in the automotive sector. These cost reductions enable aftermarket companies to develop affordable ADAS technologies, catering to a broader customer base. The Automotive ADAS Aftermarket Market is expanding with innovations in ADAS modules, ADAS controllers, and advanced ADAS processors enhancing system performance. Focus on ADAS localization, ADAS validation, ADAS testing, and efficient ADAS simulation optimizes functionality.

What are the market trends shaping the Automotive ADAS Aftermarket Industry?

- Growing development of aftermarket ADAS for CVs is the upcoming market trend. The global aftermarket Advanced Driver-Assistance Systems (ADAS) market is experiencing growth due to the increasing number of vehicles on the road. However, a significant challenge hindering market expansion is the shortage of skilled automotive technicians. Proper calibration of ADAS technologies in vehicles necessitates the expertise of these technicians, making their availability crucial. Factors contributing to this shortage include the lack of a clear career path, unequal pay packages, and extended working hours.

- Regulatory bodies anticipate a high demand for skilled automotive technicians in developed economies, such as the US, due to the rising demand for repair and maintenance services. This trend is expected to persist throughout the forecast period. Efforts in ADAS training, ADAS education, and increasing ADAS awareness improve consumer adoption and understanding. Emphasis on ADAS safety, ADAS efficiency, ADAS comfort, and ADAS convenience shapes user satisfaction. Strategies targeting ADAS cost savings, ADAS fuel economy, and ADAS emissions reduction support sustainability and affordability. These advancements reflect the market's commitment to integrating cutting-edge technologies while addressing diverse aftermarket demands, solidifying its growth trajectory in the evolving automotive industry.

What challenges does the Automotive ADAS Aftermarket Industry face during its growth?

- Adoption of active ADAS technologies by OEMs is a key challenge affecting the industry growth. The aftermarket for Automotive Advanced Driver-Assistance Systems (ADAS) primarily focuses on passive systems that offer alerts or warnings to drivers due to cost-effectiveness. However, automotive Original Equipment Manufacturers (OEMs) are expanding their offerings to include advanced ADAS technologies such as adaptive cruise control (ACC) and advanced emergency braking systems (AEBS) in mass-segment vehicles.

- This technology gap between OEM and aftermarket ADAS offerings presents a challenge for market growth. Moreover, regulatory authorities are pushing for the mandatory implementation of active ADAS technologies like AEBS. These factors underscore the need for aftermarket companies to adapt and offer advanced ADAS solutions to remain competitive.

Exclusive Customer Landscape

The automotive ADAS aftermarket market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive ADAS aftermarket market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive ADAS aftermarket market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BorgWarner Inc. - The company offers automotive ADAS aftermarket products such as ADAS 1100.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BorgWarner Inc.

- Brandmotion LLC

- Continental AG

- CUB ELECPARTS Inc.

- Garmin Ltd.

- Gentex Corp.

- HELLA GmbH and Co. KGaA

- Information Technologies Institute Intellias LLC

- Intel Corp.

- Knorr Bremse AG

- MINIEYE

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sasken Technologies Ltd.

- Solera Holdings LLC

- TomTom NV

- Valeo SA

- Veoneer Inc.

- VOXX International Corp.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Advanced Driver-Assistance Systems (ADAS) have gained significant traction in the global automotive industry, with an increasing number of Original Equipment Manufacturers (OEMs) integrating these technologies into their vehicles. The ADAS market is characterized by continuous innovation and collaboration between various stakeholders to enhance safety, convenience, and efficiency. ADAS partnerships and collaborations have been instrumental in driving the market's growth. These alliances enable the sharing of resources, expertise, and knowledge, leading to the development of advanced technologies and solutions. For instance, some collaborations focus on the integration of ADAS software with existing vehicle systems, while others aim to create new value-added services.

Traffic sign recognition and lane departure warning systems are among the most common ADAS features. These technologies rely on sensors and machine learning algorithms to identify traffic signs and lane markings, providing drivers with real-time information and alerts. Night vision and driver monitoring systems are other advanced features that enhance safety by improving visibility and detecting driver fatigue. ADAS adoption is on the rise due to the growing demand for safer and more efficient vehicles. The increasing number of regulations mandating the installation of certain ADAS features further accelerates market growth. Automatic emergency braking, for example, is becoming a standard feature in many regions, and its adoption is expected to increase in the coming years.

ADAS retrofit and upgrading services are also gaining popularity, particularly in the aftermarket. Aftermarket suppliers offer various solutions to enable the installation of ADAS systems in older vehicles, providing an affordable alternative to purchasing a new car with these features. Edge computing and cloud platforms are essential components of these services, enabling real-time data processing and analysis. The ADAS ecosystem consists of various stakeholders, including OEMs, suppliers, retailers, distributors, and service centers. Each player contributes to the value chain, from research and development to manufacturing, sales, and maintenance. The market is highly competitive, with numerous players vying for market share and customer loyalty.

Advanced Driver Assistance Systems (ADAS) have revolutionized the automotive industry by enhancing safety, efficiency, and comfort for drivers. The integration of ADAS sensors, such as ultrasonic sensors, enables accurate detection and calibration, playing a crucial role in the performance of ADAS hardware and modules. With the rapid growth of ADAS technologies, aftermarket installation, upgrading, and maintenance have become essential for keeping vehicles equipped with the latest features. ADAS retailers and distributors collaborate with workshops to meet the increasing demand for ADAS services, adhering to standards and regulations that ensure safety and performance. Data privacy, connectivity, and cloud platforms are key factors in enhancing ADAS functionality, while artificial intelligence (AI), machine learning, and deep learning technologies are driving innovation in areas like telematics and autonomous vehicles.

As ADAS penetration increases, user experience and interface designs are becoming more personalized, contributing to cost savings, fuel economy, and emissions reduction. Training, education, and awareness programs are crucial in ensuring the proper use and ADAS systems, which ultimately help in accident prevention, alcohol detection, and improving road safety. ADAS's role in the development of connected and autonomous vehicles, from Level 0 to Level 5, is shaping the future of transportation, fostering collaborations and investments in research and development. The ongoing validation, testing, and simulation of ADAS processes are critical to refining and advancing the roadmap for safer, more efficient driving experiences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.4% |

|

Market growth 2025-2029 |

USD 5.21 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.3 |

|

Key countries |

US, Canada, UK, Germany, France, The Netherlands, Italy, India, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive ADAS Aftermarket Market Research and Growth Report?

- CAGR of the Automotive ADAS Aftermarket industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive ADAS aftermarket market growth and forecasting

We can help! Our analysts can customize this automotive ADAS aftermarket market research report to meet your requirements.