Automotive Center Console Market Size 2024-2028

The automotive center console market size is forecast to increase by USD 9 billion, at a CAGR of 7.02% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for charging ports to support the use of electronic gadgets in vehicles. Younger populations are driving this trend, as they prioritize technologically advanced features in their vehicles. Automotive manufacturers are responding by increasing production capacities to meet these changing demands. Lightweight materials, such as carbon fiber and aluminum, are being used to create sleek and stylish center consoles without compromising vehicle interiors. The integration of display screens into center consoles is also becoming more common, providing customers with easy access to information and entertainment. The aftermarket for center console upgrades is also high volume, offering opportunities for businesses in this space. However, fluctuations in material prices can impact the profitability of manufacturers and aftermarket providers. Overall, the market is an exciting and dynamic space, with continued innovation and advancements on the horizon.

Market Analysis

The market is witnessing significant evolution as automobile manufacturers respond to the shifting preferences of customers. This market encompasses various components located in the center portion of the dashboard, including storage compartments, control units for audio and temperature control features, transmission panels, and charging ports for electronic gadgets. In today's technologically advanced automobiles, the center console plays a crucial role in accommodating the increasing number of high-performance vehicles and luxury vehicles' demands for advanced features. These vehicles often incorporate lightweight materials, smart devices, and electronic systems that require dedicated spaces within the console.

Moreover, the driver seat and front passenger seat areas house essential components such as cup holders, air conditioner panes, and display screens. These features cater to the young population's growing reliance on convenience and connectivity while on the go. Control units for audio and temperature control are integral components of the center console, enabling drivers to manage various functions with ease. These units are increasingly being integrated with advanced technologies, such as voice recognition and touchscreen interfaces, to enhance user experience. Charging ports for smartphones, tablets, and other electronic devices are becoming a standard feature in modern automobiles.

Further, the availability of these ports within the center console ensures that drivers and passengers can stay connected during long journeys. The market is witnessing high volume demand from both OEM (Original Equipment Manufacturers) and aftermarket sectors. Manufacturers are continuously innovating to cater to the evolving needs of customers, offering customizable and modular console designs. In conclusion, the market is undergoing transformative changes to meet the demands of modern consumers. As automobile manufacturers strive to create technologically advanced vehicles that cater to the needs of the young population, the center console will continue to play a vital role in enhancing the overall driving experience.

Market Segmentation

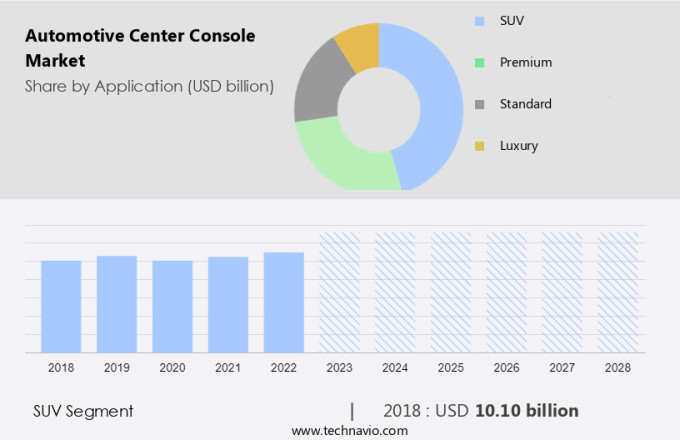

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- SUV

- Premium

- Standard

- Luxury

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

The SUV segment is estimated to witness significant growth during the forecast period. The market for SUVs is experiencing significant growth due to the increasing use of electronic gadgets and the demand for technologically advanced vehicle interiors among young populations. During the forecast period, the global market for automotive center consoles in SUVs is projected to exhibit an upward trend. Although there may be a slight decline in growth during the middle term, the market is expected to rebound due to the continuous improvement in console design quality and the increasing penetration of these features in the SUV segment.

Also, as consumers increasingly rely on charging ports for their electronic devices, the demand for center consoles with integrated charging capabilities is on the rise. Lightweight console designs are also gaining popularity, as they contribute to overall vehicle weight reduction and improved fuel efficiency. The aftermarket for center console upgrades is also growing, offering consumers the opportunity to customize their vehicles to meet their specific needs. In conclusion, the market for SUVs is poised for high volume growth due to changing customer demands and the increasing availability of technologically advanced features. Manufacturers are responding to these trends by expanding their production capacities to meet the increasing demand for these consoles.

Get a glance at the market share of various segments Request Free Sample

The SUV segment was valued at USD 10.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

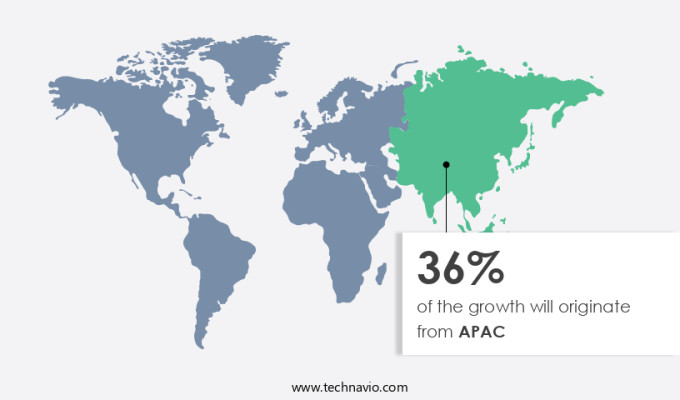

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is a significant segment of the automotive industry, with key contributors being countries such as China, Japan, India, Indonesia, and Thailand. China, with its large domestic market and status as a manufacturing hub, has become a significant player in the production and development of automotive components and technologies. Japan, known for its technological innovations, hosts several OEMs like Honda, Nissan, and Toyota, making it a critical contributor to the market. India, as a developing economy, presents a vast opportunity for automotive interiors equipment, particularly electronics, high-tech accessories, heating and cooling containers, touchscreens, GPS, and other console-related features. The Asia Pacific region, with its abundant resources, is a low-cost market for automotive accessories and aftermarket upgrades. These countries' economic growth and increasing consumer demand fuel the development of advanced automotive center console technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing SUV sales is the key driver of the market. The market is gaining significant traction in the US, particularly in the light, efficient automobiles segment, such as SUVs and luxury vehicles. These types of vehicles prioritize fuel efficiency and performance, making advanced center console designs an attractive feature. Center consoles in SUVs and luxury vehicles often incorporate touch screens, buttons, and controls to integrate various cabin systems. Due to their advanced materials and utility features, the manufacturing costs for these consoles are higher than those in entry-level vehicles.

Moreover, the US market holds a substantial share in the global SUV market, including pickup trucks and mini-vans. SUVs are increasingly popular in the Asia Pacific region as well, with countries like India, Japan, and China experiencing rapid growth in their automotive industries. The escalating demand for SUVs and luxury vehicles has positioned the center console as a desirable aesthetic feature for buyers. By integrating numerous cabin systems and offering enhanced utility, center consoles contribute to the overall appeal of these vehicles.

Market Trends

The development of smart glass technology for center console is the upcoming trend in the market. The automotive industry is making significant strides in enhancing the in-cabin experience for passengers. One of the latest developments in this area is the integration of advanced technology into the center console. This console, located between the driver and front passenger seats, serves as a storage compartment and a control hub for various cabin features. The center console houses control units for temperature control, audio control, and transmission panel. The temperature control feature includes an air conditioner pane, ensuring a comfortable riding experience.

Meanwhile, the audio control enables passengers to manage their entertainment preferences. Additionally, cup holders are integrated into the console for convenience. High-performance and luxury vehicles are increasingly incorporating these advanced features into their center consoles. These vehicles aim to provide a futuristic feel to their interiors, making the ride more enjoyable and convenient for passengers. The center console, with its smart design and functionality, is a crucial component of this evolving automobile technology.

Market Challenge

Fluctuation in material prices is a key challenge affecting market growth. The center console system in modern passenger vehicles has witnessed significant expansion plans due to the integration of advanced entertainment and data display innovations. These components, which include select textile fabrics, plastic injection molds, petroleum-based resins, polymers, composites, and certain metals, contribute to the revenue and profitability of automakers. However, the pricing of these raw materials can impact the base price of original equipment manufacturers (OEMs), subsequently influencing consumer demand. While most OEMs secure close-ended supply contracts with cost protection, shielding them from open-market price fluctuations, raw material suppliers to tier-1 console manufacturers are not similarly constrained. Consequently, the costing of tier-1 suppliers is affected, posing a challenge to maintain profitability or break even.

This trend is expected to continue as automobile interiors increasingly incorporate GPS capabilities and other advanced features. To stay competitive, it is crucial for automakers to redesign their center console systems with an emphasis on passenger comfort and convenience. By integrating the latest technologies, such as voice recognition and wireless charging, automakers can differentiate their offerings and cater to the evolving needs of consumers. Incorporating these features requires a deep understanding of market trends and consumer preferences, as well as a strong supplier network capable of delivering high-quality components at competitive prices. In summary, the market is experiencing growth due to the increasing demand for advanced features and data display innovations in passenger vehicles.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Continental AG - The company offers automotive center consoles with different surface materials such as Acella, Acella Eco green, and Acella Go.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Emerson Electric Co.

- Faurecia SE

- FIT AG

- Fritz Draxlmaier GmbH and Co. KG

- GRAMMER AG

- HASCO Co. Ltd.

- International Automotive Components Group SA

- Leggett and Platt Inc.

- Lund Motion Products Inc.

- Marelli Holdings Co. Ltd.

- Methode Electronics Inc.

- Novares

- Novem Group SA

- Weber GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the automobile industry, focusing on the production of consoles for passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV). These consoles are integrated into the vehicle interiors, primarily located in the driver seat and front passenger seat areas. They serve various functions, including storage compartments, transmission panel access, control units for audio and temperature control features, charging ports for electronic gadgets, and cup holders. High-performance vehicles and luxury cars often feature advanced technology in their center consoles, including high-resolution touchscreens, GPS capabilities, and data display innovations.

In summary, the young population's changing demands and rising income levels have led automotive manufacturers to develop technologically advanced center console systems. Lightweight and high-efficiency vehicles are also a focus, with manufacturers integrating electronic systems and hightech accessories to enhance the driving experience. The automotive centre market is experiencing expansion plans, with prominent automakers redesigning automotive interiors to accommodate modern, complex components for advanced entertainment and heating/cooling containers. The sales and production of automobiles in developing economies are driving the growth of this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.02% |

|

Market Growth 2024-2028 |

USD 9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.28 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Continental AG, Emerson Electric Co., Faurecia SE, FIT AG, Fritz Draxlmaier GmbH and Co. KG, GRAMMER AG, HASCO Co. Ltd., International Automotive Components Group SA, Leggett and Platt Inc., Lund Motion Products Inc., Marelli Holdings Co. Ltd., Methode Electronics Inc., Novares, Novem Group SA, and Weber GmbH and Co. KG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.