Automotive Connected Car Platform Market Size 2025-2029

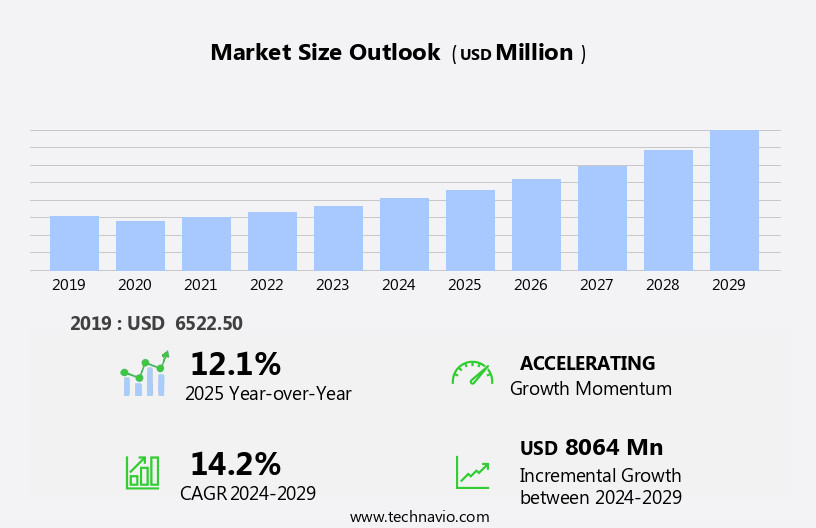

The automotive connected car platform market size is forecast to increase by USD 8.06 billion at a CAGR of 14.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increased focus of Original Equipment Manufacturers (OEMs) on developing autonomous and connected vehicles. This trend is driven by the consumer demand for advanced in-vehicle technologies and the potential for enhanced safety and convenience features. Furthermore, rental companies are adopting connected car platforms to attract customers and differentiate their offerings. Autonomous cars represent a key trend in this market, with V2V communication enabling vehicles to exchange data and improve road safety. However, the market faces challenges, including design complexity and technological hurdles. The integration of various sensors, communication systems, and software components necessitates intricate engineering and testing processes, which can increase development costs and time-to-market. These challenges include ensuring secure data transmission, integrating multiple sensors and systems, and complying with regulatory requirements.

- Additionally, ensuring interoperability and compatibility across different vehicle models and manufacturers poses a significant challenge. Navigating these challenges requires strategic partnerships, robust R&D investments, and a deep understanding of consumer preferences and market trends. Companies that can effectively address these challenges and deliver innovative connected car solutions will capitalize on the market's growth potential.

What will be the Size of the Automotive Connected Car Platform Market during the forecast period?

- The connected car market is experiencing significant advancements, with the integration of various technologies reshaping the automotive industry. Connected car apps enable remote vehicle diagnostics, allowing drivers to monitor and address issues before they become major concerns. Head-up displays provide real-time information, enhancing safety and convenience. Startups are introducing innovative solutions, such as parking assistance, gesture control, and predictive maintenance, to meet evolving consumer demands. Connected car deployment continues to expand, with infrastructure developments facilitating seamless integration of real-time traffic information, emergency assistance, and fuel efficiency. Connected car partnerships are crucial in driving growth, with industry leaders collaborating to offer integrated entertainment systems, vehicle health monitoring, and connected car marketplaces. The connected car platform market is experiencing significant growth due to the increased focus of Original Equipment Manufacturers (OEMs) on the development of autonomous and connected vehicles.

- Voice control and policy adjustments further enhance user experience, ensuring a more personalized and efficient driving experience. Connected car investments are surging, fueled by the potential for significant cost savings through improved vehicle maintenance and enhanced safety features. As the market evolves, driver behavior monitoring and connected car infrastructure will continue to shape the future of the automotive industry.

How is this Automotive Connected Car Platform Industry segmented?

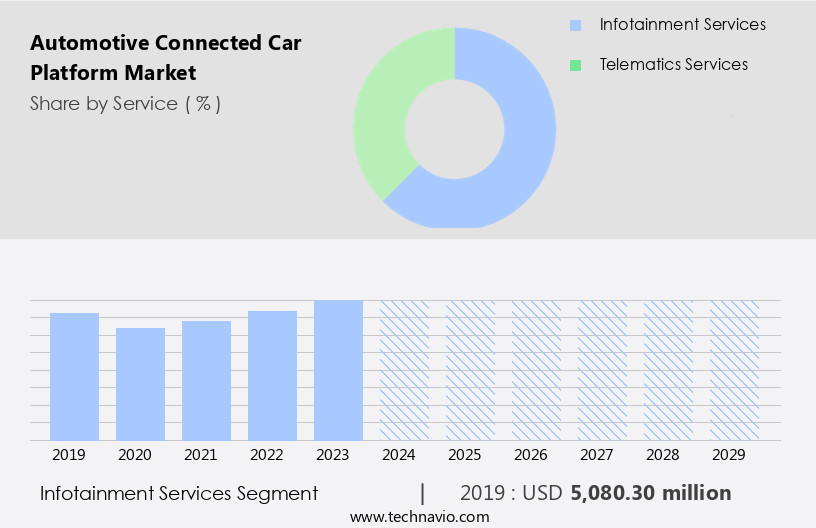

The automotive connected car platform industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Infotainment services

- Telematics services

- Technology

- Integrated solutions

- Embedded solutions

- Tethered solutions

- Communication Technology

- Vehicle to infrastructure

- Vehicle to vehicle

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Service Insights

The infotainment services segment is estimated to witness significant growth during the forecast period. In the dynamic automotive landscape of 2024, connected car technology continued to advance, with infotainment systems integrating news, weather, social networking, and audio/video streaming. OEMs recognized the importance of differentiation to attract customers and invested in unique connected car services. For instance, one OEM introduced a personalized in-car assistant, while another offered real-time traffic and parking information. In May 2025, Kia announced a significant update to its EV6 model, enhancing its competitiveness in the electric vehicle market. The EV6 now supports the North American Charging Standard (NACS), enabling access to Tesla Supercharger networks. Furthermore, the updated model boasts expanded battery capacities, with the 84 kWh variant delivering up to 319 miles of range.

The Infotainment services segment was valued at USD 5.08 billion in 2019 and showed a gradual increase during the forecast period. As the connected car ecosystem expanded, data analytics became a critical component, enabling vehicle diagnostics, predictive maintenance, and vehicle data monetization. Connected car services also extended to fleet management, navigation and mapping, vehicle tracking, and 5G connectivity. Autonomous driving, driver assistance systems, and connected car regulations continued to shape the industry, with over-the-air updates and cloud computing ensuring seamless integration and innovation. Connected car security remained a priority, with cybersecurity measures becoming increasingly sophisticated to protect against potential threats. The future of the connected car market looked promising, with continued investment in research and development, and the potential for significant growth in the adoption of software-defined vehicles and connected car solutions. This technology is also being used for fleet management and maintenance scheduling, reducing production costs and maintenance expenses.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The connected car market in North America is witnessing notable progress in 2024, with a focus on integrating advanced connectivity solutions within vehicles. This integration aims to enhance the driving experience and safety features for consumers across the region. The adoption of connected car platforms in North America is driven by the increasing demand for real-time traffic management, improved in-car entertainment systems, and enhanced vehicle safety. These platforms leverage advanced technologies such as 5G, artificial intelligence, and machine learning to provide seamless connectivity and intelligent data processing capabilities. This enables vehicles to communicate with each other, infrastructure, and cloud-based services, creating a more efficient and safer driving environment. This platform allows users to control the car and driver consoles from their smartphones, providing features like music and video streaming through online apps.

Connected car services encompass driver assistance systems, vehicle diagnostics, remote vehicle control, and vehicle data monetization. The integration of these services is expected to revolutionize the automotive industry, with implications for fleet management, navigation and mapping, vehicle tracking, and infotainment systems. Connected car analytics and cybersecurity are critical components of these platforms, ensuring data privacy and security. The future of the connected car ecosystem will be characterized by autonomous driving, over-the-air updates, and cloud computing. The connected car industry is poised for significant growth, with implications for connected car insurance and regulations. The implementation of connected car standards will be essential to ensure interoperability and compatibility across the ecosystem. The complexity of these systems increases with the addition of more applications, requiring numerous software solutions and sophisticated network technology. The connected car trend is expected to continue, with vehicle connectivity becoming increasingly integral to the driving experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Automotive Connected Car Platform market drivers leading to the rise in the adoption of Industry?

- The primary catalyst driving the market is the heightened emphasis of Original Equipment Manufacturers (OEMs) on the development of autonomous and connected vehicles. The automotive industry is undergoing a significant transformation, with a focus shifting from traditional car ownership to connected car services and technologies. The next generation of consumers, primarily millennials, are embracing new mobility solutions such as carpooling, ride-hailing, and car rentals due to urban traffic congestion and changing lifestyle preferences. In response, Original Equipment Manufacturers (OEMs) are investing in connected car development, including driver assistance systems and data analytics, to cater to this evolving market. Connected car platforms are becoming the backbone of the connected car ecosystem, enabling real-time data exchange between vehicles and the cloud. These platforms offer various services such as navigation, infotainment, and vehicle diagnostics, enhancing the driving experience for consumers.

- Furthermore, data analytics plays a crucial role in providing valuable insights to both OEMs and consumers, enabling predictive maintenance and personalized services. As the connected car market continues to grow, cybersecurity becomes a critical concern. Ensuring the security of connected cars and their data is essential to build trust and confidence among consumers. Therefore, automotive cybersecurity solutions are becoming increasingly important to protect against potential threats and vulnerabilities. The automotive industry's future lies in connected car technologies, offering new opportunities for innovation, growth, and consumer engagement. OEMs must focus on developing robust connected car platforms, data analytics, and cybersecurity solutions to meet the evolving needs of the connected car ecosystem.

What are the Automotive Connected Car Platform market trends shaping the Industry?

- Connected car platforms are increasingly being adopted by rental companies as a market trend. This innovation aims to attract customers by offering advanced services and enhanced user experiences. Connected car technology is gaining traction among both retail consumers and rental companies, leading to increased deployment of connected car platforms. These systems enable users to manage car functions via their smartphones or in-vehicle devices, offering features such as music and video streaming through online applications. While current focus lies on comfort and entertainment, future developments will prioritize loyalty programs for priority bookings. The primary objective is to keep customers engaged with the rental company's app, thereby enhancing customer attraction and retention.

- Connected car infrastructure continues to evolve, with connected car standards playing a crucial role in ensuring seamless integration. The future of connected cars holds immense potential for vehicle data monetization, offering opportunities for rental companies to provide personalized services and improve the overall connected car experience.

How does Automotive Connected Car Platform market faces challenges face during its growth?

- The connected car industry faces significant growth challenges due to the intricate design complexities and technological hurdles inherent in implementing and integrating advanced car technologies. The market is experiencing significant growth due to the increasing adoption of connected car solutions. Remote vehicle control, connected car insurance, and vehicle diagnostics are among the popular applications driving this market. The complexity of connected car systems arises from the advanced technologies, diverse features, and multiple connectivity options. Telematics and infotainment systems have evolved, with the former focusing on vehicle diagnostics and the latter providing entertainment and communication services.

- The challenge for companies lies in designing user interfaces that are affordable, less distracting, simple, and accessible. The connected car industry is also grappling with regulations related to autonomous driving and data security. Despite these challenges, innovation continues to shape the market, offering new opportunities for growth.

Exclusive Customer Landscape

The automotive connected car platform market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive connected car platform market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive connected car platform market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbiquity Inc. - This company specializes in advanced connected car solutions, empowering vehicles with the capability to receive remote over-the-air (OTA) software updates and transmit diagnostic and operational data from onboard systems and components.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbiquity Inc.

- AppDirect Inc.

- AT and T Inc.

- BlackBerry Ltd.

- Capgemini Service SAS

- Cisco Systems Inc.

- Connexion Telematics Ltd.

- GlobalLogic Inc.

- Harman International Industries Inc.

- Insurance and Mobility Solutions

- Information Technologies Institute Intellias LLC

- KaaIoT Technologies LLC

- LG Electronics Inc.

- Microsoft Corp.

- NNG Software Developing and Commercial Llc.

- Otonomo Technologies Ltd.

- Robert Bosch GmbH

- Stellantis NV

- TomTom NV

- Qualcomm Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Connected Car Platform Market

- In February 2024, Volkswagen Group and Microsoft announced a strategic partnership to develop a next-generation connected car platform, integrating Microsoft's Azure cloud technology with Volkswagen's vehicles. This collaboration aims to enhance in-car experiences, improve vehicle connectivity, and enable advanced services like predictive maintenance and over-the-air updates (Volkswagen press release).

- In July 2025, Magna International, a leading automotive supplier, acquired Cybersecurity and Connectivity Solutions (CCS), a subsidiary of Elektrobit, for â¬360 million. This acquisition significantly strengthened Magna's connected car capabilities, allowing it to offer advanced security features and expand its connected services offerings to automakers worldwide (Magna International press release).

- In November 2024, Samsung and Harman International, a subsidiary of Samsung Electronics, unveiled a new connected car platform, Intelligent Cockpit 3.0. This platform combines Samsung's advanced technologies, including its Exynos automotive processors and Knox security platform, with Harman's connected car expertise, creating a more integrated and secure in-car experience (Samsung press release).

- In March 2025, the European Union introduced new regulations for connected cars, requiring all new vehicles to have eCall emergency response systems and be capable of wireless software updates by 2027. These regulations aim to improve vehicle safety and enhance connectivity, pushing automakers to invest in advanced connected car platforms and services (European Commission press release).

Research Analyst Overview

The connected car platform market continues to evolve, driven by advancements in data analytics, software-defined vehicles, and connected car deployment. The connected car ecosystem is expanding, encompassing retail, infrastructure, and various services. Driver assistance systems and connected car analytics are increasingly integrated, offering enhanced safety and convenience. Automotive cybersecurity is a critical concern, as connected car technology advances. Connected car infrastructure and integration are essential components of the connected car future, enabling remote vehicle control, vehicle diagnostics, and fleet management. Navigation and mapping, infotainment systems, and vehicle tracking are key applications of connected car technology. The connected car industry is innovating rapidly, with over-the-air updates, cloud computing, and 5G connectivity shaping the future of connected car services.

Connected car regulations are evolving to address data privacy and security concerns. Vehicle data monetization and connected car insurance are emerging areas of interest. Connected car adoption is on the rise, transforming the automotive landscape. Autonomous driving is a significant trend, with connected car technology playing a crucial role in its development. The connected car market is dynamic, with continuous innovation and new applications emerging.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Connected Car Platform Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market growth 2025-2029 |

USD 8.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.1 |

|

Key countries |

US, Germany, China, Canada, UK, Japan, India, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Connected Car Platform Market Research and Growth Report?

- CAGR of the Automotive Connected Car Platform industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive connected car platform market growth of industry companies

We can help! Our analysts can customize this automotive connected car platform market research report to meet your requirements.