Automotive Control Cables Market Size 2024-2028

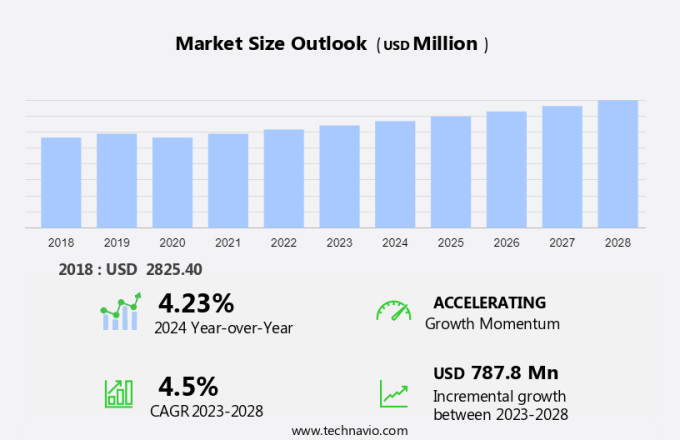

The automotive control cables market size is forecast to increase by USD 787.8 billion at a CAGR of 4.5% between 2023 and 2028. The market is driven by the increasing demand for commercial vehicle models and advancements in transmission systems. Legislation mandating the use of specific control cables in automotive applications is another growth factor. Shielded automotive wires are gaining popularity due to their ability to withstand high temperatures, moisture, and oil contamination. The shift towards electromobility and the increasing adoption of electric vehicles also presents opportunities for the market. However, challenges such as stringent regulations and the need for high-performance materials to meet the demands of air brake systems pose challenges. Key trends include the development of lightweight and flexible control cables to reduce vehicle weight and improve fuel efficiency. To remain competitive, market players are focusing on innovation and technological advancements to meet the evolving needs of the automotive industry.

What will be the Size of the Market During the Forecast Period?

The automotive control cables market is witnessing strong growth, driven by a wide variety of vehicles, including compact cars, military ships, and aircraft. Auto control cables, such as mechanical control cables and push-pull control cables, are integral to systems like anti-lock braking, exhaust after-treatment, and automatic emergency braking systems. These cables are crucial in ensuring vehicle safety, offering high reliability and redundancy in critical components like engine control, landing gear, and flight control systems. Shielded automotive wire, typically made from polyethylene and PVC, provides excellent protection against high temperatures and harsh conditions. The OEM segment is key in driving demand for automotive cables, including car battery cables and cockpit controls. Meanwhile, military and aerospace sectors rely on specialized cables for aircraft seating, cabin equipment, and coastal shipping applications, amid growing global defense spending and geopolitical rifts.

Further, the market plays a crucial role in enabling the smooth functioning of various vehicle components. These cables are essential for transmitting signals and power between different parts of a vehicle, including brakes, clutches, transmissions, engine accelerators, audio systems, and wiring harnesses. In the context of the diverse range of vehicles in existence, the market caters to the needs of passenger automobiles. These cables are manufactured using materials such as wires and stainless steel wires to ensure durability and resistance to wear and tear. The demand for automotive control cables is directly linked to automobile vehicle sales. According to the International Energy Agency, global passenger automobile sales reached approximately 80 million units in 2020. This significant number underscores the immense potential for the market. Safety is a primary concern in the automotive industry, and automotive control cables play a pivotal role in ensuring it. They are integral to critical vehicle systems such as brakes and clutches, which are essential for road safety.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger car

- Commercial vehicle

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

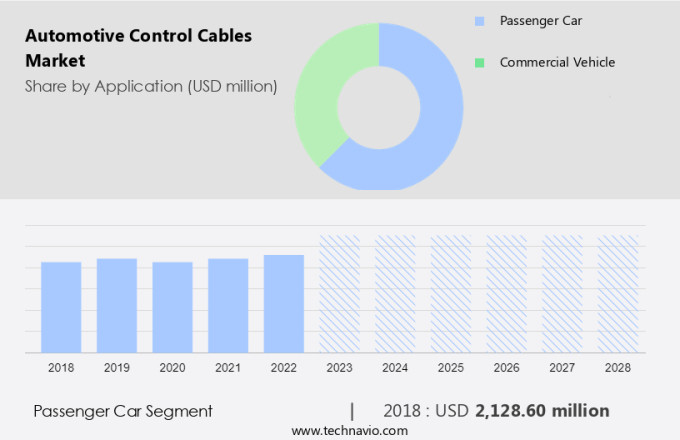

By Application Insights

The passenger car segment is estimated to witness significant growth during the forecast period. The market is projected to expand significantly over the next several years. This growth can be attributed to the increasing demand for passenger vehicles, particularly in the entry-level segment. Additionally, the rising popularity of larger utility vehicles, including sport-utility vehicles (SUVs), crossovers, and multipurpose vehicles (MPVs), is contributing to the market's expansion. Furthermore, the expanding scope of control cables' applications and functions is driving market growth. In terms of volume, the Asia Pacific region leads the global passenger vehicle market, with China, Japan, South Korea, India, and Indonesia being major contributors.

The defense sector is also a significant consumer of automotive control cables, with defense forces worldwide investing heavily in armored vehicles. Commercial aircraft, such as the Airbus A380, also rely on sophisticated wiring harnesses and control cables to ensure regulatory compliance and reliability. Regulatory requirements and the need for redundancy are crucial factors driving the demand for high-quality control cables in both the automotive and aerospace industries.

Get a glance at the market share of various segments Request Free Sample

The passenger car segment accounted for USD 2.13 billion in 2018 and showed a gradual increase during the forecast period.

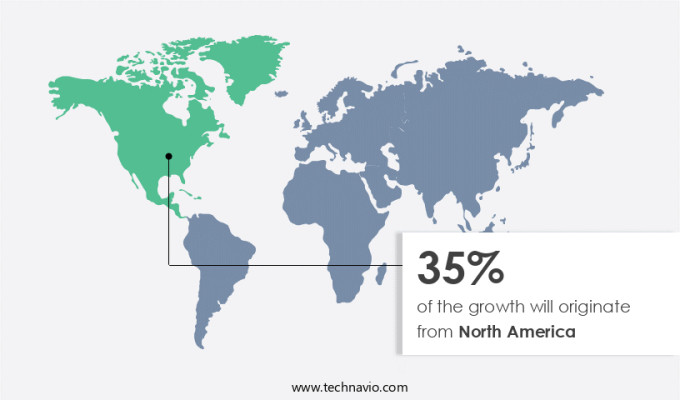

Regional Insights

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth, particularly in developing economies such as India and China, and established markets like Japan and South Korea. The increasing sales of hybrid passenger vehicles from leading automakers like Hyundai Motors, Toyota Motor, and Lexus are driving market expansion in the Asia Pacific (APAC) region.

Additionally, established markets such as Japan, South Korea, and Australia contribute to the market's growth due to their high demand for advanced automotive technologies. As per the latest market reports, the market is expected to experience steady growth, emphasizing its significant role in the automotive industry.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Automotive control cables are cheap owing to the use of cost-effective materials and the manufacturing process is the key driver of the market. Automotive control cables play a crucial role in various vehicle types, including passenger automobiles, by transmitting power and motion between the vehicle's components. These cables are essential for the proper functioning of braking systems, clutch systems, and transmission systems. The affordability of automotive control cables, making them cost-effective for mass production, is a significant factor fueling market growth.

OEMs utilize different materials, such as steel and aluminum, for manufacturing these cables based on their specific applications and vehicle requirements. The use of superior quality materials enhances cable performance and durability. Additionally, the manufacturing process, which involves wire drawing from wire rods, results in a lower cost due to the use of high-tensile spring steels of various grades.

Market Trends

Developments in the field of automotive control cables is the upcoming trend in the market. The market is experiencing innovations in design, material, and manufacturing methods, leading to enhanced cable efficiency and durability. These advancements contribute significantly to the overall performance and reliability of the transmission systems in commercial vehicle models. companies employ sophisticated manufacturing techniques to extend the product lifecycle and ensure optimal cable functionality. Moreover, the use of advanced materials, such as high-strength aluminum, is gaining popularity due to its ability to reduce the likelihood of cracks caused by wear and tear. This material's adoption also enhances the resistance of control cables against harsh environmental conditions, including high temperatures, moisture, and oil contamination.

The electromobility trend is driving the demand for control cables in electric vehicles, particularly in air brake systems. As legislation continues to prioritize safety and efficiency in transportation, the market is expected to grow steadfastly. companies are focusing on research and development to cater to the evolving needs of the industry, ensuring their products meet the highest standards.

Market Challenge

Government guidelines on the use of control cables for automotive applications is a key challenge affecting the market growth. In the automotive industry, government regulations play a crucial role in shaping the market landscape. These regulations aim to enhance vehicle safety, minimize carbon emissions, and boost energy efficiency. However, they pose challenges for control cable manufacturers, who must comply with established quality standards and design specifications. Various countries have set these standards to ensure the effective use of control cables in vehicles. Wires, including stainless steel ones, are essential components in transmissions, clutches, brakes, engine accelerators, and audio systems. Adherence to these regulations is vital to prevent road accidents and promote overall vehicle performance. As a professional assistant, I understand the significance of these regulations and the importance of maintaining high-quality control cables to meet the demands of the automotive industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

DURA Automotive Systems: The company offers automotive control cables which is used for the transfer of pull and push forces.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acey Engineering Pvt. Ltd.

- BBB Industries LLC

- Cable Manufacturing and Assembly Co. Inc.

- Chuo Spring Co. Ltd.

- Grand Rapids Controls Co. LLC

- HI-LEX Corp.

- Kalpa Industries

- KALTROL

- Kongsberg Automotive ASA

- KUSTER Holding GmbH

- Minda Corp. Ltd.

- Panasonic Holdings Corp.

- Premier Auto Cables

- Silco Automotive Solutions LLP

- Suprajit Engineering Ltd.

- Tata Sons Pvt. Ltd.

- Thai Steel Cable Public Co. Ltd.

- Tyler Madison Inc.

- WR Controls Sweden AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the demand for various types of vehicles, including passenger automobiles and commercial models. These cables play a crucial role in transmitting signals and power between different vehicle components such as brakes, clutches, transmissions, engine accelerators, audio systems, and transmissions. The absolute dollar opportunity in the market is driven by the increasing automobile vehicle sales worldwide. The market is segmented into several types of cables, including brake cables, clutch cables, transmission cables, and wires made of stainless steel and other materials. These cables are designed to withstand harsh conditions, including high temperatures, moisture, and oil contamination. Safety is a significant factor driving the demand for automotive control cables. Legislation and regulatory requirements mandate the use of reliable and redundant systems in vehicles, leading to an increased focus on the development of advanced materials and technologies for automotive control cables.

Further, the electrification of vehicles, including electric vehicles and hybrids, is also driving growth in the market. Shielded automotive wires and high-performance coatings are being used to enhance the durability and performance of automotive control cables in electromobility applications. Air brake systems in commercial vehicles and wiring harnesses in aircraft are other significant applications for automotive control cables. The market also caters to the needs of defense forces, maritime activities, and commercial aircraft manufacturers, including Airbus A380. In summary, the market is a dynamic and growing industry, driven by the increasing demand for vehicles, safety regulations, and the electrification of transportation. The market offers significant opportunities for innovation and growth in various applications, including passenger automobiles, commercial vehicles, and aerospace.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 787.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 35% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acey Engineering Pvt. Ltd., BBB Industries LLC, Cable Manufacturing and Assembly Co. Inc., Chuo Spring Co. Ltd., DURA Automotive Systems, Grand Rapids Controls Co. LLC, HI-LEX Corp., Kalpa Industries, KALTROL, Kongsberg Automotive ASA, KUSTER Holding GmbH, Minda Corp. Ltd., Panasonic Holdings Corp., Premier Auto Cables, Silco Automotive Solutions LLP, Suprajit Engineering Ltd., Tata Sons Pvt. Ltd., Thai Steel Cable Public Co. Ltd., Tyler Madison Inc., and WR Controls Sweden AB |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch