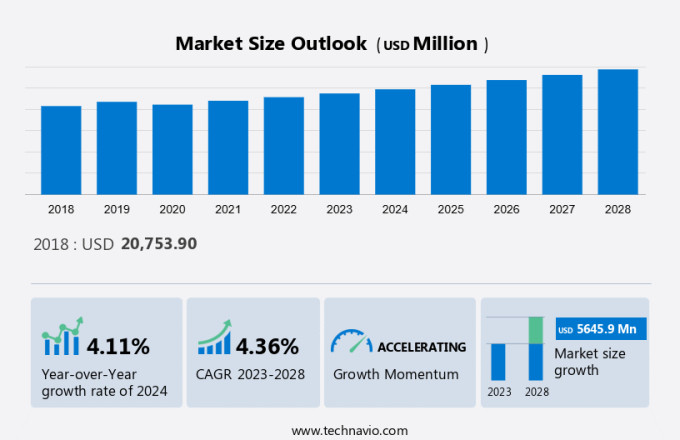

Automotive Differential Gear Market Size 2024-2028

The automotive differential gear market size is forecast to increase by USD 5.65 billion at a CAGR of 4.36% between 2023 and 2028. The market is experiencing significant growth due to several key factors. One trend driving market expansion is the rising popularity of SUVs, which require strong differential gears to effectively distribute power to the wheels and navigate curves with ease. Another factor is the development of epicyclic train technology, which allows for more efficient power transfer between shafts in the rear axle of automotive vehicles. Additionally, advancements in braking systems have led to improved response times, further increasing the demand for high-performance differential gears. However, the market is not without challenges, including the risk of product recalls due to manufacturing defects or design issues. Despite these hurdles, the future looks bright for the market as it continues to play a crucial role in enhancing the performance and safety of automotive vehicles.

The market is a significant component of the global automotive industry. Differential gears play a crucial role in enabling vehicles to navigate curves and corners by distributing power evenly to the wheels on each side of an axle. This ensures optimal traction and stability. Rear wheel drive and all-wheel drive technology play key roles in the performance of multi-utility and off-road vehicles, enhancing their handling on high speed curves and rough terrain. These vehicles rely on advanced braking systems and drive wheels to ensure stability, while the electronic control unit (ECU) and electronic circuits optimize power distribution and vehicle response in various conditions, including passenger vehicles designed for both on-road and off-road use. The market caters to various vehicle segments, including passenger cars and commercial vehicles. Passenger cars incorporate front-wheel drive (FWD) and rear-wheel drive (RWD) systems, while commercial vehicles, such as buses, heavy trucks, and light commercial vehicles, utilize differential gears in their heavy-duty engine systems. Key trends shaping the market include advancements in technology and increasing demand for fuel efficiency.

Furthermore, modern differential gears employ epicyclic trains, which consist of sun gear, planet gears, and annulus gear. The rotation of these gears facilitates the transmission of power from the engine to the wheels while allowing for a significant reduction in the size and weight of the gearbox. Moreover, the integration of advanced features like locking differentials and torque vectoring differentials has become increasingly popular in both passenger cars and commercial vehicles. These systems enhance vehicle performance by optimizing torque distribution between the wheels, improving traction and stability, particularly during challenging driving conditions. The market is driven by several factors.

Moreover, the growing demand for premium SUVs and sedans, which often feature advanced differential systems, is a significant growth driver. Additionally, the increasing popularity of electric vehicles (EVs) and the integration of electric motors, traction motors, electric compressors, and batteries in their powertrains, necessitate the use of efficient and strong differential gears. In terms of vehicle types, the trucks segment is expected to witness substantial growth in the market. The increasing demand for heavy-duty trucks and the need for improved traction and stability in heavy commercial vehicles are key factors driving this growth. In conclusion, the market is a dynamic and evolving sector within the automotive industry.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Channel

- Aftermarket

- OEM

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Channel Insights

The Aftermarket segment is estimated to witness significant growth during the forecast period. The automotive aftermarket caters to the production and sale of vehicle components, chemicals, and accessories following the original equipment manufacturer's (OEM) sale of the car to the consumer. This market encompasses replacement, collision, aesthetic, and performance parts. The aftermarket provides consumers with a diverse selection of parts, catering to various quality levels and price points for almost all vehicles and models.

Furthermore, consumers have the flexibility to either repair their vehicles independently or seek professional assistance. This market segment's growth is driven by factors such as the ability to offer control over vehicle maintenance, size reduction, weight savings, and enhanced performance through lighter and quieter differential gears.

Get a glance at the market share of various segments Request Free Sample

The Aftermarket segment was valued at USD 10.97 billion in 2018 and showed a gradual increase during the forecast period.

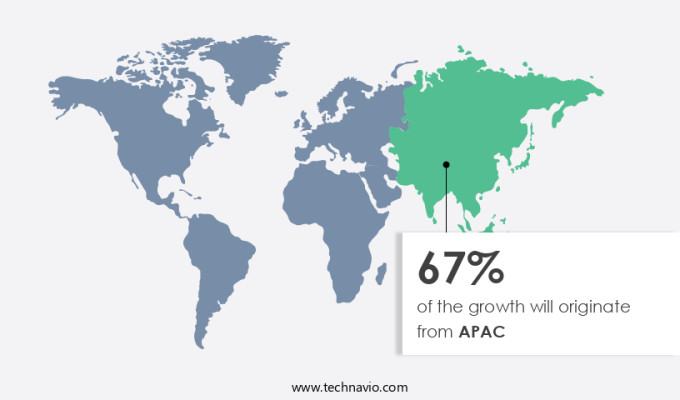

Regional Insights

APAC is estimated to contribute 67% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific is projected to experience steady expansion over the coming years. Favorable socioeconomic conditions, particularly in China and India, are boosting the automotive industry in the region. A substantial consumer base, rising per capita income, and accessible financing options are fueling the demand for premium SUVs, sedans, heavy duty engines, heavy commercial vehicles, light commercial vehicles, heavy trucks, and electric vehicles.

In addition, the burgeoning e-commerce sector, expansive construction industry, and expanding mining industry are major drivers for the demand in commercial vehicles. In 2023, Asia Pacific accounted for the majority of global vehicle sales and production. The region's automotive industry is expected to continue its growth trajectory, driven by the increasing demand for passenger and commercial vehicles.

Our automotive differential gear market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increase in sales of SUVs is the key driver of the market. The market has experienced significant growth in recent years, particularly in the segment of electric vehicles. Factors contributing to this trend include the integration of advanced technologies such as electric motors, electric compressors, and batteries in vehicles. Power electronics play a crucial role in managing the power distribution from these components to the gearbox, enabling efficient engine power transmission. In the United States, the demand for electric vehicles, including passenger cars and trucks, is on the rise.

Furthermore, this growth is driven by various factors, including government incentives, increasing environmental concerns, and advancements in battery technology. Moreover, the integration of electric components in vehicles requires the use of sophisticated power electronics, which in turn increases the complexity of the gearbox system. This complexity necessitates the use of advanced manufacturing techniques and materials to ensure the reliability and durability of the gearbox. In conclusion, the market is poised for significant growth in the coming years, driven by the increasing demand for electric vehicles in the United States and other global markets. The integration of advanced technologies such as electric motors, electric compressors, and batteries, along with the use of power electronics, is transforming the gearbox system, making it more efficient and reliable.

Market Trends

The development of hub motors is the upcoming trend in the market. In the automotive industry, the focus on enhancing the performance and range of Electric Vehicles (EVs) is a significant trend. The rise in EV sales worldwide can be attributed to various factors, including stricter emission regulations, the gradual phase-out of diesel vehicles, and incentives for EV purchases. In response, automakers are investing in innovative technologies to improve EV efficiency. One such solution is the epicyclic train-based electric hub motor. This motor design integrates an electric motor directly into the wheel hub, eliminating the need for a separate powertrain. The hub motor employs Brushless Direct Current (BLDC) technology, which enhances power density and efficiency.

Moreover, hub motors' integration into the rear axle of automotive vehicles allows for improved torque distribution and better handling, especially during curve driving. Additionally, the hub motor's compact design can contribute to a more streamlined EV chassis, potentially improving overall vehicle performance. In summary, the implementation of advanced technologies, such as BLDC hub motors, is crucial for automakers to meet the increasing demand for EVs and maintain a competitive edge in the market.

Market Challenge

Product recall is a key challenge affecting market growth. In the automotive industry, the integration of advanced differential gears, such as Traction Differentials and Torque Vectoring Differentials, has become a key trend in vehicle design, particularly in premium models. These systems improve traction and vehicle stability, especially during high-speed turns.

However, the implementation of these complex systems adds to the cost and complexity of the drivetrain. The use of multiple clutches, synchromesh gear sets, and lightweight materials contribute to the overall cost. While these advancements enhance the driving experience, they also increase the risk of malfunctions, which can result in significant financial implications for both the component manufacturer and the vehicle's original equipment manufacturer (OEM) due to the shared liability business model. In the market, the demand for advanced electronic systems and sensors in vehicles, particularly in front-wheel and rear-wheel drive applications, is on the rise. Bus manufacturers also incorporate these differentials in their designs to ensure optimal performance and safety.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

American Axle and Manufacturing Holdings Inc.: The company offers differential gear, under its driveline product portfolio named Damped gears.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Axle and Manufacturing Holdings Inc.

- AmTech International

- Bharat Gears Ltd.

- Circle Gear and Machine Company Inc.

- Dana Inc.

- Eaton Corp. Plc

- FA.TA. Ricambi S.p.A.

- Gear Motions Inc.

- GKN Sinter Metals Engineering GmbH

- Hitachi Ltd.

- Linamar Corp.

- Neapco Holdings LLC

- NSK Ltd.

- Perfect Gears Pvt. Ltd.

- Polaris Inc.

- Shandong Heavy Industry Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the demands of various vehicle segments, including premium SUVs, sedans, heavy duty engines for heavy commercial vehicles and heavy trucks, light commercial vehicles, electric vehicles, and buses. The differential gear system is a crucial component in automotive vehicles, enabling power transmission to the drive wheels while accommodating the difference in wheel speed during turns. Traction motors, electric motors, electric compressors, batteries, power electronics, and gearboxes are integral components of the differential gear system in electric vehicles. The market is witnessing significant growth due to the increasing demand for efficient, lighter, quieter, and high-performance vehicles. The differential gear system's size reduction and weight optimization contribute to improved vehicle handling and response time.

Furthermore, the integration of electronic control units, traction control, and torque vectoring differentials enhances vehicle control and reduces slippage during high-speed curves and braking. In multi utility vehicles, the braking system and drive wheel work together to ensure optimal performance, with the electronic circuit managing power distribution and braking force, allowing for smooth operation across various terrains and driving conditions. The market encompasses front-wheel-drive and rear-wheel-drive systems for passenger cars and multi-utility vehicles, off-road vehicles, and autonomous vehicles. The demand for electrification in commercial vehicles is also driving the growth of the market. The epicyclic train, rotation of shafts, and rear axle design are essential factors influencing the market's development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 5.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 67% |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Axle and Manufacturing Holdings Inc., AmTech International, Bharat Gears Ltd., Circle Gear and Machine Company Inc., Dana Inc., Eaton Corp. Plc, FA.TA. Ricambi S.p.A., Gear Motions Inc., GKN Sinter Metals Engineering GmbH, Hitachi Ltd., Linamar Corp., Neapco Holdings LLC, NSK Ltd., Perfect Gears Pvt. Ltd., Polaris Inc., and Shandong Heavy Industry Group Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch