Automotive Double Wishbone Suspension System Market Size 2024-2028

The automotive double wishbone suspension system market size is forecast to increase by USD 192.2 million at a CAGR of 3.27% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. The increasing demand for SUVs and pick-up trucks, which typically utilize double wishbone suspension systems, is driving market growth. Additionally, the development of multi-material chassis construction is enhancing the performance and efficiency of these vehicles, further fueling market demand. Automotive engineering continues to evolve, with suspension technologies such as active suspension systems, predictive analytics, and control arm geometry, contributing to the development of advanced suspension systems. However, the market is also facing challenges such as fluctuating costs of raw materials, which can impact the affordability and profitability of suspension system manufacturers. To stay competitive, companies must focus on innovation and cost optimization strategies to address these challenges and meet the evolving needs of consumers. Overall, the double wishbone suspension system market is expected to continue its growth trajectory, driven by these trends and challenges.

What will be the Size of the Automotive Double Wishbone Suspension System Market During the Forecast Period?

- The market encompasses the production and supply of arm structures, wheel assemblies, suspension springs, and associated components for various vehicle types, including passenger cars, high-performance vehicles, luxury cars, sports cars, ATVs, and heavy commercial vehicles. This market is driven by the demand for enhanced vehicle performance, stability, and durability. Double wishbone suspension systems offer superior handling characteristics, ride comfort, and safety, making them a preferred choice for automakers. The market's growth is fueled by the increasing popularity of high-performance vehicles and the continuous advancements in suspension technologies. These innovations cater to the evolving needs of consumers seeking improved vehicle safety, emissions reduction, and lightweighting strategies.

- Additionally, fleet management companies and commercial vehicle manufacturers require strong suspension systems to ensure optimal vehicle performance and fuel efficiency. Overall, the market is expected to grow steadily, driven by the ongoing demand for advanced suspension systems that cater to diverse vehicle applications and customer preferences.

How is this Automotive Double Wishbone Suspension System Industry segmented and which is the largest segment?

The automotive double wishbone suspension system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- SUVs

- MPVs and pickup trucks

- High performance vehicles

- ATVs

- Geography

- North America

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Application Insights

- The SUVs segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2023, with SUVs leading the segment. The increasing preference for SUVs In the global automotive industry, driven by their safety, reliability, and affordability, has fueled innovation in suspension technologies. The market offers various types of SUVs catering to diverse price points, contributing to its dominance. Europe and several APAC markets, in addition to North America, exhibit high demand for SUVs. In 2023, over two million SUVs were sold in India alone. The double wishbone suspension system, a popular independent suspension design, enhances vehicle performance, stability, and durability. It is widely used in high-performance cars, luxury vehicles, ATVs, heavy commercial vehicles, and racing events.

Get a glance at the market report of share of various segments Request Free Sample

The SUVs segment was valued at USD 832.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

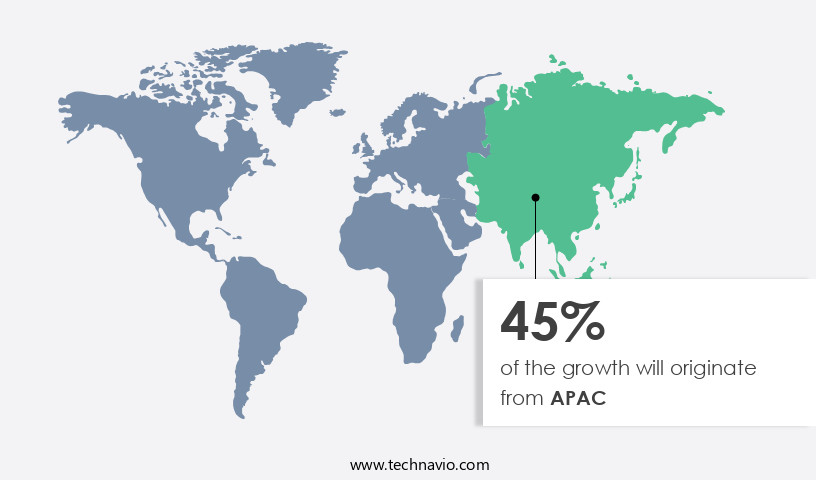

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds a significant share In the market, driven by the increasing demand for utility vehicles In the region. In 2023, the US was the leading contributor to the market in North America, with Canada and Mexico also making notable contributions. The preference for personal vehicles over public transport In the US, particularly SUVs, fuels the demand for automotive double wishbone suspension systems. These systems enhance vehicle performance, stability, and durability, making them ideal for high-performance cars, ATVs, heavy commercial vehicles, and even SUVs and pickup trucks. The market is further driven by safety and comfort considerations, as independent suspension systems provide superior ride comfort and handling characteristics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Double Wishbone Suspension System Industry?

Growing demand for SUVs and pick-up trucks is the key driver of the market.

- The market has experienced significant growth due to the increasing popularity of high-performance vehicles, including sports cars, luxury cars, and SUVs. These vehicles require advanced suspension systems to ensure optimal vehicle performance, ride comfort, and handling characteristics. The arm structure of double wishbone suspension systems, consisting of dual arms connected to the wheel and chassis via suspension springs and a knuckle, offers superior stability and durability. Moreover, the demand for double wishbone suspension systems is not limited to high-performance cars but also extends to ATVs, heavy commercial vehicles, and MPVs. The growing urbanization, improving living standards, and increasing purchasing capacity of consumers have led to an increase in demand for vehicles, driving the need for reliable and efficient suspension systems.

- Safety is another crucial factor driving the market growth. Double wishbone suspension systems provide excellent vehicle control and stability, enhancing safety during racing events, off-road competitions, and everyday driving. However, regulatory hurdles and standards compliance, including emissions, lightweighting strategies, fuel efficiency, and carbon emissions, pose challenges to the market. The composition of materials used in suspension systems and their damping characteristics are essential factors in meeting these regulations while maintaining performance and durability.

What are the market trends shaping the Automotive Double Wishbone Suspension System Industry?

Development of multi-material chassis construction is the upcoming market trend.

- The automotive suspension market is experiencing innovation as automakers explore weight reduction strategies to meet regulatory requirements and customer preferences. Advanced materials, such as aluminum, carbon fiber, and magnesium, are increasingly used in chassis manufacturing due to their lightweight properties and durability. One recent development is the multi-material chassis, which combines various materials to create a stronger and lighter structure. Audi pioneered this approach with the A8, an aluminum-based spaceframe chassis that also incorporates magnesium, carbon fiber reinforced polymer (CFRP), and conventional steel. This design enhances performance, stability, and safety in high-performance cars, SUVs, pickup trucks, ATVs, and other vehicles.

- The suspension system plays a crucial role in vehicle performance, ride comfort, handling characteristics, and safety. Suspension technologies, including independent and non-independent suspensions, have evolved to accommodate the needs of different vehicle types.

What challenges does the Automotive Double Wishbone Suspension System Industry face during its growth?

Fluctuating costs of raw materials is a key challenge affecting the industry growth.

- The market is significantly influenced by the cost of raw materials, primarily alloys of steel and aluminum. These materials account for a substantial portion of the manufacturing costs. Fluctuations in raw material prices or increased costs can negatively impact the profitability of market participants. Double wishbone suspension systems are crucial for enhancing vehicle performance and ensuring stability and comfort in various types of vehicles, including high-performance cars, luxury cars, SUVs, pickup trucks, ATVs, and heavy commercial vehicles. Independent suspension systems, such as double wishbone, are popular due to their ability to provide better handling characteristics, ride comfort, and safety.

- Market dynamics, such as urbanization, rising living standards, purchasing capacity, and road infrastructure development, contribute to the growth of the market. Additionally, regulatory hurdles and standards compliance, including vehicle safety and emissions, are driving the adoption of advanced suspension technologies like active suspension systems and predictive analytics. The market for double wishbone suspension systems is diverse, catering to various vehicle segments, from racing events and off-road competitions to fleet management and everyday commuting. Automakers continue to invest in research and development, focusing on lightweighting strategies, fuel efficiency, and carbon emissions reduction. Control arm geometry, material composition, and damping characteristics are essential factors influencing the performance and efficiency of double wishbone suspension systems.

Exclusive Customer Landscape

The automotive double wishbone suspension system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive double wishbone suspension system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive double wishbone suspension system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Star Manufacturing LLC

- ANAND Group

- Benteler International AG

- BorgWarner Inc.

- CCYS Hi Tech International Ltd

- Cheng Ching Yong Sheng

- DRiV Automotive Inc.

- GESTAMP AUTOMOCION SA

- Hendrickson Holdings LLC

- HL Mando Co. Ltd.

- Marelli Holdings Co. Ltd.

- Mobex Global

- Musashi Seimitsu Industry Co. Ltd.

- Schaeffler AG

- Sogefi Spa

- TAHIKO Co. Ltd.

- Tenneco Inc.

- thyssenkrupp AG

- YOROZU Corp.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive suspension system market encompasses a wide range of technologies designed to provide vehicles with optimal stability, durability, and ride comfort. One such suspension system that has gained significant traction In the industry is the double wishbone suspension system. This suspension design utilizes an arm structure, consisting of two parallel arms connected to the chassis and the wheel, to create an independent suspension setup. The wheel is connected to the lower arm via suspension springs, which absorb shocks and maintain contact between the tire and the road surface. The upper arm, in turn, is connected to the chassis and the lower arm via a pivot point, allowing the wheel to move up and down independently of the vehicle's body.

In addition, this design provides several benefits, including improved performance enhancement, stability, and handling characteristics. Double wishbone suspension systems are commonly used in various vehicle applications, including high-performance cars, SUVs, pickup trucks, ATVs, and heavy commercial vehicles. In high-performance cars, this suspension system contributes to enhanced vehicle performance by allowing for precise handling and control. In SUVs and pickup trucks, it provides the necessary stability and durability to handle heavy loads and off-road conditions. The demand for double wishbone suspension systems is driven by several factors, including the increasing focus on safety and comfort in vehicles. With the rise in living standards and purchasing capacity in various regions, consumers are increasingly demanding vehicles that offer a smooth and comfortable ride.

Furthermore, the growing popularity of racing events and off-road competitions has led to an increased focus on suspension technologies that can provide superior handling and performance. Urbanization and the development of road infrastructure have also played a significant role In the growth of the double wishbone suspension system market. As cities continue to expand and roads become more congested, the need for vehicles that can navigate urban environments with ease and provide a comfortable ride has become a priority for automakers. Moreover, the increasing focus on vehicle safety and emissions regulations has led to the development of advanced suspension technologies.

For instance, active suspension systems and predictive analytics are being integrated into suspension designs to improve vehicle safety and performance while reducing emissions and enhancing fuel efficiency. Despite these opportunities, the double wishbone suspension system market faces several challenges, including regulatory hurdles and standards compliance. Automakers must ensure that their suspension systems meet various safety and emissions regulations, which can be costly and time-consuming. Additionally, the increasing adoption of electric vehicles and alternative powertrains, such as battery packs, is leading to the development of new suspension technologies to accommodate these powertrains. In addition, the market is expected to continue growing, with automakers and suspension technology providers investing in research and development to create advanced suspension systems that meet the evolving needs of consumers and regulatory bodies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 192.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Double Wishbone Suspension System Market Research and Growth Report?

- CAGR of the Automotive Double Wishbone Suspension System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive double wishbone suspension system market growth of industry companies

We can help! Our analysts can customize this automotive double wishbone suspension system market research report to meet your requirements.