Automotive Electronic Brake Force Distribution System Market Size 2024-2028

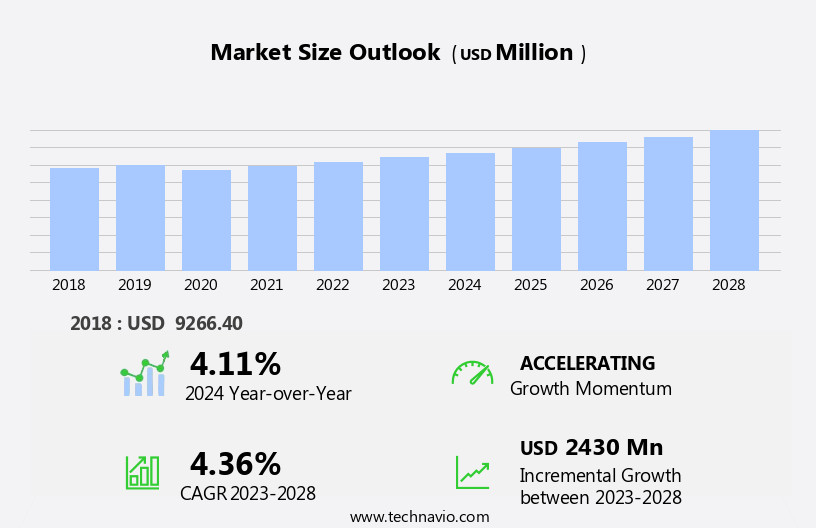

The automotive electronic brake force distribution (EBD) system market size is forecast to increase by USD 2.43 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary factors driving market expansion is the increasing electrification of vehicles. As more automakers shift towards electric and hybrid powertrains, the demand for advanced safety systems, including EBD, is on the rise. Another trend influencing market growth is the growing focus on improving the reliability of EBD systems. With safety becoming a top priority for consumers, automakers are investing heavily in enhancing the performance and dependability of EBD systems, incorporating IoT and machine learning technologies to optimize real-time data analysis and system efficiency. However, the high cost of development and maintenance of these systems remains a challenge for market participants. Despite this, the long-term prospects for the market remain positive, with continued advancements in technology and increasing consumer demand for safer vehicles.

What will be the Size of the Automotive Electronic Brake Force Distribution (EBD) System Market During the Forecast Period?

- The market is a significant segment of the global electronic stability control (ESC) and vehicle safety systems industry. EBD systems enhance vehicle safety by optimally distributing braking force to each wheel during hard braking, improving stability and reducing stopping distance. This market has experienced steady growth due to increasing demand for advanced safety features in passenger cars. However, the market's expansion has been influenced by the recent downturn in vehicle production caused by the global economic climate. EBD systems integrate various components such as speed sensors, brake force modulators, and electronic control units. The integration of artificial intelligence (AI) the increasing popularity of autonomous vehicles and the electrification of vehicles, including hybrid vehicles, are expected to drive future market growth. The potential for clean vehicle credits and government incentives may further boost demand for advanced safety systems like EBD. Despite these positive trends, market expansion could be hindered by the high cost of these systems and the ongoing shift towards smaller vehicle types.

How is this Automotive Electronic Brake Force Distribution (EBD) System Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial cars

- Motorcycles

- Distribution Channel

- OEM

- Aftermarket

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is a significant segment In the automotive industry, accounting for the largest share of vehicle production worldwide. With a focus on enhancing safety and performance, electronic brake systems, such as Automotive Electronic Brake Force Distribution (EBD), are increasingly being adopted. EBD systems utilize speed sensors, brake force modulators, and electronic control units to optimize brake force distribution between wheels, improving vehicle stability and safety. This technology is not limited to passenger cars; it is also applied in light and heavy commercial vehicles. The integration of EBD systems is influenced by stringent vehicle safety standards, the electrification of vehicles, and the growing demand for autonomous vehicles.

Get a glance at the Automotive Electronic Brake Force Distribution (EBD) System Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 6.53 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

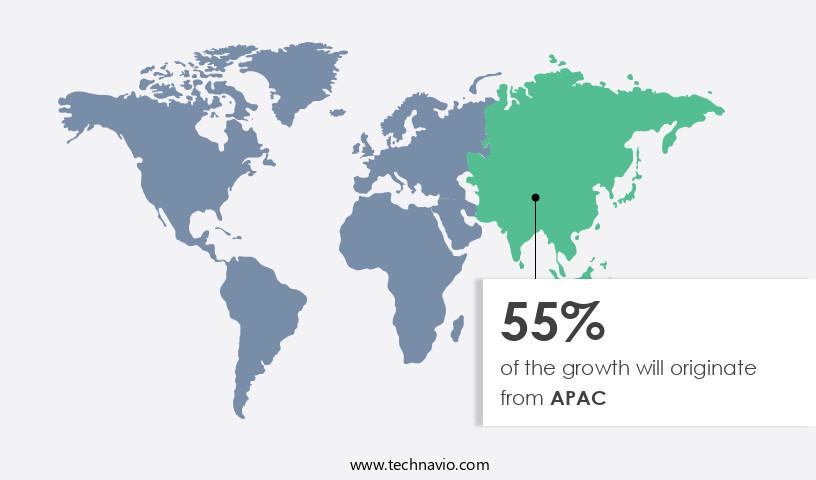

- APAC is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing prioritization of vehicle safety in developing regions, particularly China. Previously, these markets primarily focused on affordability and low maintenance costs. However, with rising consumer awareness and demand for safety features, the adoption of automotive EBD systems is poised for expansion. Additionally, the increasing use of commercial vehicles in countries like China, India, and South Korea is driving market growth. Automotive EBD systems, which include speed sensors, brake force modulators, and electronic control units, are integral to ensuring optimal brake force distribution and enhancing overall vehicle performance and safety. The integration of advanced technologies such as Artificial Intelligence (AI) and electronic systems in vehicles, as well as the increasing demand for autonomous vehicles, electrification, and hybrid vehicles, further boosts the market's growth. The Clean Vehicle Credit and autonomous vehicle demand are also contributing factors. Existing vehicle systems, such as disc brake and drum brake, are being replaced with more advanced electronic systems to meet evolving vehicle safety standards and features.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Electronic Brake Force Distribution (EBD) System Industry?

Increasing electrification in vehicles is the key driver of the market.

- In the realm of passenger car manufacturing, electronic brake systems, including Electronic Brake Force Distribution (EBD), have emerged as essential components that significantly contribute to vehicle safety and performance. With a decrease in vehicle sales due to various economic factors, the focus on enhancing existing vehicle systems has intensified. EBD systems, which distribute brake force optimally among wheels based on vehicle dynamics and speed, have gained prominence. These systems incorporate speed sensors, brake force modulators, and electronic control units to ensure efficient braking and improved handling. Passenger cars and light commercial vehicles are the primary beneficiaries of these advanced safety features.

- The integration of EBD systems is not limited to new vehicle production; third-party EBD solutions are also available for retrofitting in older vehicles. Autonomous vehicles, electrification of vehicles, and hybrid vehicles are the future of the automotive industry. These innovations necessitate the adoption of advanced safety systems, further driving the demand for EBD systems. The integration of Artificial Intelligence (AI) and other advanced technologies in vehicles is expected to revolutionize the automotive industry, leading to increased safety and performance.

What are the market trends shaping the Automotive Electronic Brake Force Distribution (EBD) System Industry?

Growing focus on improving reliability of EBD system is the upcoming market trend.

- The market In the passenger car segment has experienced significant growth over the last two decades, driven by the integration of advanced electronic systems in vehicles. EBD systems, which include speed sensors, brake force modulators, and electronic control units, enhance vehicle safety and performance by optimally distributing brake force between the wheels during hard braking. Despite the low vehicle sales due to the global economic situation, the investment in improving the reliability and durability of EBD systems has continued. This is due to the increasing importance of vehicle safety features, especially in passenger cars, as well as the development of new technologies such as Artificial Intelligence (AI), autonomous vehicles, electrification of vehicles, and electric vehicles.

- Existing vehicle systems, such as disc brake and drum brake, continue to be used in conjunction with EBD systems in various vehicle types, including light commercial vehicles and heavy commercial vehicles. As vehicle safety standards evolve, the demand for third-party EBD systems is also expected to increase. The integration of EBD systems with other vehicle safety systems and emerging technologies presents both opportunities and challenges for automotive system developers and automakers. The focus on improving the reliability and durability of these systems is crucial to ensuring the safety and performance of vehicles, while also meeting the evolving demands of consumers and regulatory bodies.

What challenges does the Automotive Electronic Brake Force Distribution (EBD) System Industry face during its growth?

The high cost of development and maintenance of EBD systems is a key challenge affecting the industry growth.

- The market is experiencing significant advancements, transitioning from traditional mechanical systems to electronic ones. This shift is driven by the integration of electronic components and subsystems, such as speed sensors, brake force modulators, and electronic control units, into electronic braking systems. Although these enhancements boost vehicle safety and performance through precise brake force distribution, they increase the development, maintenance, and repair costs. This system contributes to improved vehicle safety standards and features, aligning with the evolving demands of the market.

- However, the implementation of third-party EBD systems and the electrification of vehicles, such as hybrid and autonomous vehicles, may influence the market dynamics. The integration of artificial intelligence (AI) and autonomous vehicle technology may further impact the market landscape. Despite the challenges, the increasing demand for cleaner vehicles and the implementation of vehicle safety systems may provide growth opportunities for market participants.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the amarket report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akebono Brake Industry Co. Ltd.

- Continental AG

- Hitachi Ltd.

- HL Mando Co. Ltd.

- Knorr Bremse AG

- Robert Bosch GmbH

- Toyota Motor Corp.

- Volkswagen AG

- WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORP.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive electronic brake force distribution (EBFDB) system market encompasses a vital segment of the broader automotive electronic systems industry. EBFDB systems are integral components of advanced vehicle safety systems, enhancing both performance and safety in various vehicle types. EBFDB systems facilitate optimal brake force distribution between wheels during vehicle deceleration. These systems utilize sensors, brake force modulators, and electronic control units (ECUs) to analyze vehicle dynamics and distribute brake force accordingly. The primary objective of EBFDB systems is to improve vehicle stability and handling, particularly during emergency braking situations. Existing vehicle systems, such as disc brakes and drum brakes, have traditionally relied on mechanical means to distribute brake force.

However, the integration of EBFDB systems allows for more precise and dynamic distribution, leading to enhanced safety and improved vehicle performance. The integration of EBFDB systems is not limited to passenger cars. These systems are increasingly being adopted in light commercial vehicles and heavy commercial vehicles to address the unique challenges posed by their larger sizes and weight distributions. The evolution of vehicle safety standards has played a significant role in driving the adoption of EBFDB systems. As safety features become increasingly sophisticated, the demand for advanced electronic systems, including EBFDB, continues to grow. The automotive industry is undergoing significant transformations, with trends such as electrification, autonomous vehicles, and artificial intelligence (AI) influencing the market dynamics of EBFDB systems.

Furthermore, the integration of EBFDB systems in electric and hybrid vehicles, for instance, allows for more efficient energy utilization during braking. The potential for AI and autonomous vehicles to revolutionize the automotive industry also presents new opportunities for EBFDB systems. These advanced systems can analyze vehicle data in real-time, enabling more precise and effective brake force distribution, ultimately improving vehicle safety and performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market Growth 2024-2028 |

USD 2.43 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Electronic Brake Force Distribution (EBD) System Market Research and Growth Report?

- CAGR of the Automotive Electronic Brake Force Distribution (EBD) System industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive electronic brake force distribution (ebd) system market growth of industry companies

We can help! Our analysts can customize this automotive electronic brake force distribution (ebd) system market research report to meet your requirements.