Automotive Fasteners Market Size 2025-2029

The automotive fasteners market size is forecast to increase by USD 9.93 billion at a CAGR of 8.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the cost advantages of using plastic fasteners and the increasing popularity of lightweight fastener solutions. Plastic fasteners offer weight reduction and improved corrosion resistance, making them an attractive alternative to traditional metal fasteners. This trend is particularly prominent in the automotive industry, where reducing vehicle weight is a key focus for enhancing fuel efficiency and reducing emissions. However, the market is not without challenges. Quality control remains a critical issue, with recalls due to improper manufacturing procedures continuing to pose a risk. Ensuring the highest standards of manufacturing and quality assurance is essential for market participants to mitigate these risks and maintain consumer trust. However, the market also faces challenges, such as the increasing trend towards electric vehicle (EV) manufacturing, which requires specific fastener solutions.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should prioritize innovation, operational efficiency, and a strong commitment to quality. By staying abreast of industry trends and consumer demands, they can position themselves for long-term success in the evolving market. Advancements in technology have led to the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) in the manufacturing process of automotive fasteners.

What will be the Size of the Automotive Fasteners Market during the forecast period?

- The market is experiencing significant growth, driven by various factors. Customer relationship management and social media marketing are essential strategies for automotive companies to engage with customers and build brand loyalty. In terms of product development, powder coating enhances impact resistance and improves appearance. Data privacy and creep resistance are critical considerations for manufacturers to ensure consumer trust. Life cycle analysis and quality assurance are crucial aspects of the supply chain, ensuring sustainability and reliability. Corrosion resistance, proof load, and elastic modulus are key performance indicators for fasteners in harsh environments. Digital marketing and lean manufacturing enable efficient production and cost savings. Bolts, characterized by their heads and threaded pins or rods, are commonly used for constructing wheels and other vehicle components.

- Circular design and content marketing are essential for brand differentiation and customer engagement. Just-in-time inventory and break load optimization ensure that fasteners are available when needed, minimizing production delays. The market is also influenced by trends such as the Internet of Things and the increasing importance of assembly line efficiency.

How is this Automotive Fasteners Industry segmented?

The automotive fasteners industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- OEM

- Aftermarket

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Material

- Stainless steel

- Plastic

- Aluminum

- Type

- Threaded

- Non-threaded

- Application

- Engine

- Chassis

- Interior trim

- Front/rear axle

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- South America

- Middle East and Africa

- APAC

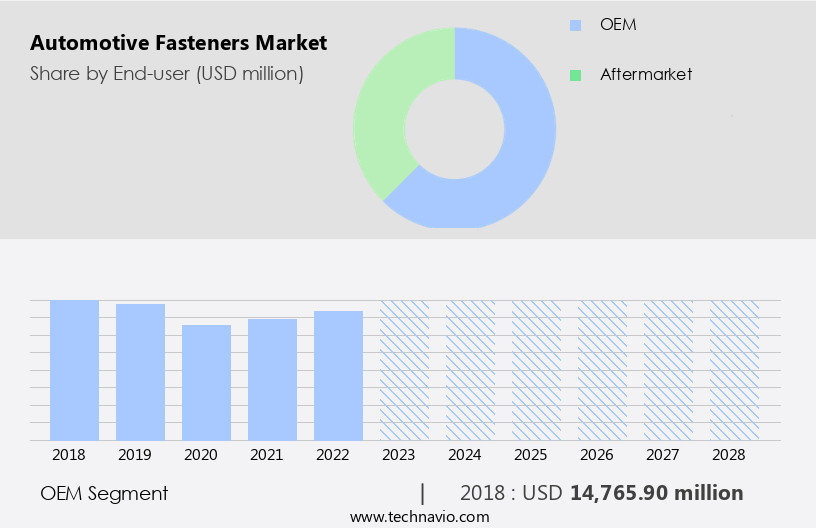

By End-user Insights

The OEM segment is estimated to witness significant growth during the forecast period. In the automotive sector, original equipment manufacturers (OEMs) dominate the global fasteners market due to their extensive usage in vehicle production. OEMs utilize various types of fasteners, including nuts, bolts, and washers, for diverse applications. Nuts featuring interior female threading secure the attachment of bolts and screws to surfaces. Bolts, characterized by heads and threaded with pins and rods, are commonly used for constructing wheels. Material innovation and environmental standards significantly impact the market. Advanced alloys, high-performance materials, and lightweight fasteners are gaining popularity due to their ability to reduce energy consumption and enhance vehicle performance.

Additionally, economic factors, such as raw material costs and labor expenses, influence market dynamics. Heavy-duty vehicles, commercial vehicles, and electric vehicles require specialized fasteners, such as high-strength fasteners and torque-controlled fasteners, for their unique applications. Design optimization, assembly line automation, and smart manufacturing are essential trends in the automotive fasteners industry. Emerging technologies, like additive manufacturing, 3D printing, and surface finishing, are revolutionizing fastener production and application. Government regulations, safety standards, and quality control are crucial considerations in the market. The circular economy and supply chain resilience are essential aspects of the market. Vibration damping materials, functional coatings, and non-threaded fasteners are some of the innovative solutions addressing these concerns.

Get a glance at the market report of share of various segments Request Free Sample

The OEM segment was valued at USD 14.36 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

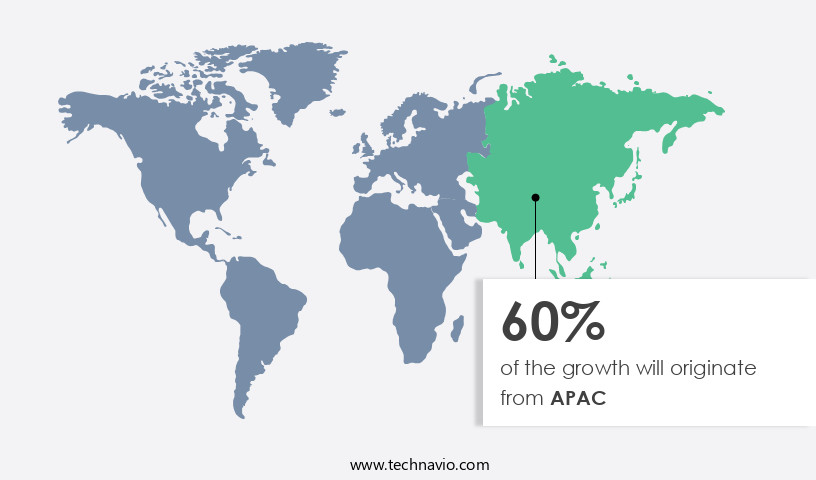

APAC is estimated to contribute 61% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. This region is projected to be the fastest-growing market for automotive fasteners during the forecast period, surpassing the growth rates of Europe and North America. The automotive industry in APAC has seen remarkable expansion, with China, Japan, and India being the major contributors to this growth. The increasing production of automobiles in these countries, driven by global manufacturers such as General Motors, Ford, Volkswagen, and Daimler, is fueling the demand for automotive fasteners. Material innovation and environmental standards are key trends influencing the market. Advanced alloys, high-performance materials, and cost optimization are essential considerations for manufacturers to meet the evolving requirements of the automotive industry.

Electric vehicles and commercial vehicles are gaining popularity, requiring specialized fasteners for battery components and structural reinforcement. Testing and certification are essential to ensure compliance with government regulations and industry standards. The market is a dynamic and evolving landscape, with ongoing advancements in materials, manufacturing processes, and design optimization. The market is expected to continue its growth trajectory, driven by the increasing demand for automotive vehicles and the need for innovative, high-performance fasteners.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Fasteners Industry?

- Cost advantages of using plastic automotive fasteners is the key driver of the market. Plastics are increasingly being adopted in the automotive industry as an alternative to metals for various applications. For instance, plastic clips have replaced metal brackets in automotive fluid routing assemblies as mounting supports for heating, ventilation, and air conditioning (HVAC) and brake lines. The use of plastics offers several cost advantages over metals. Firstly, the cost of plastic is generally lower than that of metals. Secondly, in certain areas of vehicle assembly, a rubber insert or grommet is required between two metal parts to prevent galvanic corrosion. Plastic parts do not necessitate the use of such grommets, thereby eliminating the need for the additional material and the labor costs associated with their installation. In summary, the adoption of plastics in the automotive industry is driven by their cost advantages over metals, including lower material and labor costs.

- This trend is expected to continue as the automotive industry seeks to reduce production costs while maintaining product quality and performance. Augmented reality and virtual reality technologies are transforming design and assembly processes. Predictive analytics and cloud computing enable data-driven decision making and real-time inventory management. Sustainable manufacturing and renewable energy are essential for reducing carbon footprints and meeting regulatory requirements. Tensile strength, shear strength, and yield strength are fundamental properties of fasteners, while thread rolling and precision machining ensure precise fit and function. Machine learning and automation technologies streamline production processes and improve efficiency. Sensor technology and wireless communication enable real-time monitoring and predictive maintenance, enhancing assembly line efficiency and reducing downtime. Fatigue resistance and thermal conductivity are essential for high-performance applications.

What are the market trends shaping the Automotive Fasteners Industry?

- Growing popularity of lightweight fasteners solutions is the upcoming market trend. The automotive industry's shift towards lightweighting vehicles necessitates innovations from fastener manufacturers. Lightweight fasteners are essential to maintain vehicle strength and performance while reducing weight. In the automotive sector, lightweight materials are predominantly utilized in body, chassis, interior applications, and powertrain components. Fastener manufacturers employ technologies like clinching, flow drilling screws for metals, and thread-forming screws for plastics to join these components. These techniques enable the joining of dissimilar or thin materials with the same standard strength, thus reducing weight without compromising performance. The use of lightweight fasteners contributes to the overall weight reduction of vehicles, enhancing fuel efficiency and reducing carbon emissions. Energy costs and trade policies also impact the market dynamics.

- Heavy-duty vehicles, drivetrain components, and suspension systems require high-strength and lightweight fasteners for optimal performance. Torque-controlled fasteners and vibration damping materials ensure safety and durability. Material science plays a crucial role in the development of advanced fasteners, including corrosion-resistant and functional coatings. The circular economy and supply chain resilience are emerging trends in the market. Artificial intelligence, big data analytics, and smart manufacturing are transforming the production process, while 3D printing and assembly line automation streamline the supply chain. Labor costs, safety standards, and quality control are critical factors for manufacturers to maintain competitiveness.

What challenges does the Automotive Fasteners Industry face during its growth?

- Fasteners-related recall due to improper manufacturing procedures is a key challenge affecting the industry growth. The automotive industry faces substantial financial consequences when products, such as fasteners, necessitate recalls. The expense of a recall is distributed among the value chain, contingent on the recall's cause. In the realm of automotive fasteners, two primary reasons for failure leading to vehicle recalls are Inappropriate material and surface treatment, resulting in subpar products. Weak design and assembly These issues can be mitigated or eradicated through the implementation of stringent manufacturing and quality control processes during and post-fabrication of fasteners. Preeminent quality concerns arise from inadequate heat treatment, incorrect raw material selection (wires), complications with thread rolling/cutting, and hydrogen embrittlement, among other factors. By adhering to rigorous manufacturing standards, the automotive industry can minimize the occurrence of such recalls and preserve consumer trust.

- In addition, they come in various material types, including steel, aluminum, and plastic, each with unique characteristics suitable for different vehicle types. Environmental standards and energy costs are driving the demand for cost optimization in the market. Big data analytics and smart manufacturing are being employed to optimize design and improve performance. Heat treatment and surface finishing are also essential processes in ensuring the quality and durability of automotive fasteners. Trade policies and government regulations continue to impact the market, with supply chain management and resilience becoming increasingly important. Torque-controlled fasteners and vibration damping materials are being used to enhance safety standards and improve the overall driving experience. The assembly line automation of interior components is another trend that is gaining traction in the automotive industry.

Exclusive Customer Landscape

The automotive fasteners market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive fasteners market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive fasteners market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.AGRATI Spa - The company specializes in providing innovative fastening and component solutions, including nuts and internally threaded fasteners, to various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.AGRATI Spa

- Acument Global Technologies Inc.

- Bulten AB

- EJOT HOLDING GmbH and Co. KG

- Illinois Tool Works Inc.

- KAMAX Holding GmbH and Co KG

- Koninklijke Nedschroef Holding BV

- Nifco Inc.

- Norm Holding

- Penn Engineering

- Phillips Screw Co.

- Precision Castparts Corp.

- Raygroup SASU

- Rocknel Fastener Inc.

- SBE VARVIT Spa

- Simmonds Marshall Ltd.

- Stanley Black and Decker Inc.

- Sterling Tools Ltd.

- Sundram Fasteners Ltd.

- Trifast plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a critical component of the global automotive industry, with threaded fasteners being the most commonly used type in passenger vehicles and heavy-duty vehicles. Self-tapping screws, in particular, have gained popularity due to their ability to form their own threads during installation, increasing efficiency in the manufacturing process. Material innovation continues to play a significant role in the development of automotive fasteners. Advanced alloys and high-performance materials are being explored to enhance the strength and durability of drivetrain components and braking systems. Additionally, the shift towards electric vehicles and lightweight commercial vehicles has led to the exploration of lightweight fasteners and alternative materials such as carbon fiber and metal forming.

Advanced manufacturing techniques such as additive manufacturing and 3D printing are being explored to reduce labor costs and improve production efficiency. Raw material costs and economic factors continue to influence the pricing dynamics of the market. The circular economy is also gaining momentum, with a focus on the reuse and recycling of materials to reduce waste and minimize the environmental impact. Functional coatings and specialty fasteners are being used to enhance the performance of various automotive components. Testing and certification are essential processes to ensure the safety and reliability of automotive fasteners. Material science continues to be a key area of research and development in the market.

The market is a dynamic and evolving industry, with ongoing research and innovation in areas such as high-strength fasteners, vibration-resistant fasteners, and corrosion-resistant fasteners. The integration of artificial intelligence and smart manufacturing is also transforming the way automotive fasteners are designed, manufactured, and tested. The market is a critical component of the global automotive industry, with ongoing research and innovation driving the development of advanced materials, manufacturing techniques, and design optimization. Environmental standards, cost optimization, and safety are key factors influencing the market, with a focus on improving performance, reducing waste, and enhancing the overall driving experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

250 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 9.93 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Key countries |

China, US, Japan, Canada, India, Germany, UK, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Fasteners Market Research and Growth Report?

- CAGR of the Automotive Fasteners industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive fasteners market growth of industry companies

We can help! Our analysts can customize this automotive fasteners market research report to meet your requirements.