Automotive Glass Market Size 2025-2029

The automotive glass market size is valued to increase USD 4.22 billion, at a CAGR of 3.3% from 2024 to 2029. Increased demand for premium vehicles and sunroofs will drive the automotive glass market.

Major Market Trends & Insights

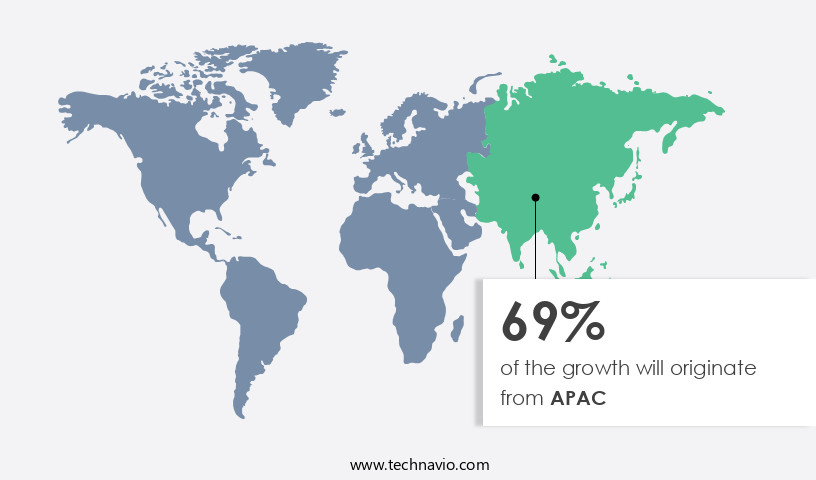

- APAC dominated the market and accounted for a 61% growth during the forecast period.

- By Application - Windscreen segment was valued at USD 10.85 billion in 2023

- By Type - Laminated glass segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 28.49 million

- Market Future Opportunities: USD 4218.40 million

- CAGR from 2024 to 2029 : 3.3%

Market Summary

- The market encompasses the production, sales, and installation of glass components in various vehicle types. This market is driven by the increasing demand for premium vehicles and the rising popularity of innovative automotive glass, such as advanced safety glass and sunroofs. However, the high cost of manufacturing automotive glass poses a significant challenge. According to a recent study, The market is expected to account for over 20% of the total automotive aftermarket. This figure underscores the market's significance and its continuous evolution, shaped by technological advancements and regulatory requirements. For instance, the adoption of lightweight and energy-efficient glass is gaining traction due to stringent emissions regulations.

- In Europe, for example, the European Union's regulations on CO2 emissions from passenger cars are driving the demand for fuel-efficient glass. As the market continues to unfold, players are focusing on developing cost-effective manufacturing processes and exploring new applications to expand their market reach.

What will be the Size of the Automotive Glass Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Glass Market Segmented ?

The automotive glass industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Windscreen

- Backlite

- Sidelite

- Sunroof

- Type

- Laminated glass

- Tempered glass

- Others

- Vehicle Type

- Passenger cars

- Light commercial vehicle

- Medium and heavy commercial vehicle

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The windscreen segment is estimated to witness significant growth during the forecast period.

Between 2025 and 2029, the market will experience significant advancements, driven by evolving consumer expectations and technological integration. The windscreen segment will be at the forefront of these changes, with a focus on accommodating sensors and cameras for advanced driver assistance systems without sacrificing optical clarity. Enhanced safety standards will lead to increased adoption of laminated glass, which boasts improved structural integrity and impact resistance. Sustainability will also be a key consideration, with a shift towards recyclable materials and energy-efficient manufacturing processes. Regarding glass composition analysis, the industry will continue to prioritize glass durability assessment, employing methods such as impact resistance testing, scratch resistance coatings, and UV protection coatings.

Glass polishing methods, glass surface treatment, and glass cutting techniques will also undergo refinements to enhance production efficiency and product quality. Smart glass technology, including electrochromic and thermochromic glass, will gain traction due to their energy-saving properties. The annealing process, heat-strengthened glass, and glass fragmentation patterns will continue to be crucial aspects of glass manufacturing, while glass recycling processes will become increasingly important for reducing environmental impact. Overall, the automotive glazing systems market will remain a dynamic and innovative sector, driven by consumer demands, technological advancements, and regulatory requirements.

The Windscreen segment was valued at USD 10.85 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Glass Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, which includes countries like China, India, and the Association of Southeast Asian Nations (ASEAN), the market holds significant potential. The presence of a substantial number of entry- and mid-segment vehicles and high sales and production volumes make APAC a key contributor to the global automotive industry. Economic growth and industrial development across the region have led to increased disposable income, thereby fueling the demand for both passenger cars and commercial vehicles.

Among the APAC countries, China and India account for a substantial market share due to their large automotive production bases. This trend is expected to continue as the region's economic development progresses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by advancements in glass technology and evolving consumer preferences. Laminated glass, with its superior impact resistance, dominates the market due to its ability to ensure passenger safety in case of accidents. In contrast, tempered glass undergoes rigorous heat soak tests to ensure its durability and strength, making it a popular choice for windshields. Chemical strengthening of glass is another significant trend, enhancing the optical properties of float glass and improving its UV transmission in automotive applications. Moreover, sound absorption coefficient glass is gaining traction as automakers focus on reducing interior noise levels.

Evaluation of glass surface defects and analysis of glass fragmentation are crucial aspects of glass durability assessment. Adhesive bonding strength of PVB is a critical factor in ensuring the structural integrity of laminated glass. Advanced manufacturing techniques, such as electrochromic glass technology applications and self-cleaning glass coating performance, are driving innovation in the market. Improving the scratch resistance of glass through production process optimization and setting new automotive glass quality standards are essential to cater to the increasing demand for high-quality glass. The new generation of automotive glass is focusing on advanced features like anti-fog glass coating durability and electrochromic glass technology for enhanced driver convenience and safety.

Compared to traditional manufacturing methods, the adoption of these advanced technologies and techniques accounts for a substantial share in the market. A significant minority of players, less than 15%, dominate the high-end the market, with their focus on research and development and commitment to delivering superior glass solutions.

What are the key market drivers leading to the rise in the adoption of Automotive Glass Industry?

- The market is primarily driven by heightened consumer demand for luxury vehicles and sunroofs.

- Luxury and premium vehicles continue to gain popularity due to their focus on passenger safety and comfort. Advanced safety and comfort systems, such as adaptive cruise control, lane departure warnings, and automatic emergency braking, have become increasingly common in these vehicles. This trend is driven by the growing preference for enhanced safety and comfort among consumers. The demand for luxury vehicles is on the rise, reflecting this trend.

- Furthermore, the desire for additional comfort and aesthetics has led to an increasing demand for accessories like sunroofs and moonroofs. The adoption of these features has seen significant growth in the current decade, with sunroofs and moonroofs becoming increasingly sought-after additions to luxury and premium vehicles.

What are the market trends shaping the Automotive Glass Industry?

- The rising preference for innovative automotive glass represents a notable market trend in the automotive industry. Increasingly, automotive glass that offers advanced features is gaining popularity.

- Solar reflective glass is gaining traction in the automotive industry due to its numerous benefits. Compared to conventional glass, solar reflective glass can absorb infrared rays, thereby reducing the amount of heat in vehicles. This results in enhanced passenger comfort, as the glass minimizes the impact of ultraviolet radiation on interior trims. Furthermore, solar reflective glass contributes to vehicle aesthetics, catering to consumer preferences. One of the leading manufacturers in this sector is Pilkington, a subsidiary of Nippon Sheet Glass.

- Their optimized solar-absorbing glass products, such as Optikool and EZ-KOOL, provide substantial improvements. These glass variants reduce solar energy entering the vehicle cabin by approximately 20% compared to standard tinted glass. By maintaining a cooler cabin temperature, they ensure a more enjoyable driving experience for passengers. Solar reflective glass's adoption continues to grow, with manufacturers recognizing its potential to enhance both functionality and aesthetics within the automotive industry.

What challenges does the Automotive Glass Industry face during its growth?

- The escalating manufacturing costs for automotive glass is a significant barrier impeding the industry's growth trajectory.

- Autonomous vehicles and electric cars' growing adoption are driving the evolution of automotive glass manufacturing. This sector faces significant challenges, including escalating labor costs, stringent quality and safety regulations, and environmental concerns. The industry relies on specialized equipment for processes like glass melting, forming, cutting, shaping, tempering, laminating, and coating. These investments, coupled with energy-intensive processes, contribute to substantial manufacturing costs. For instance, glass melting furnaces consume considerable energy, primarily in the form of natural gas or electricity. Furthermore, the shift towards advanced glass technologies, such as heat-resistant, lightweight, and electrically conductive glass, adds complexity to the manufacturing process.

- Despite these challenges, automotive glass manufacturers continue to innovate, exploring energy-efficient production methods and integrating advanced materials to meet evolving customer demands.

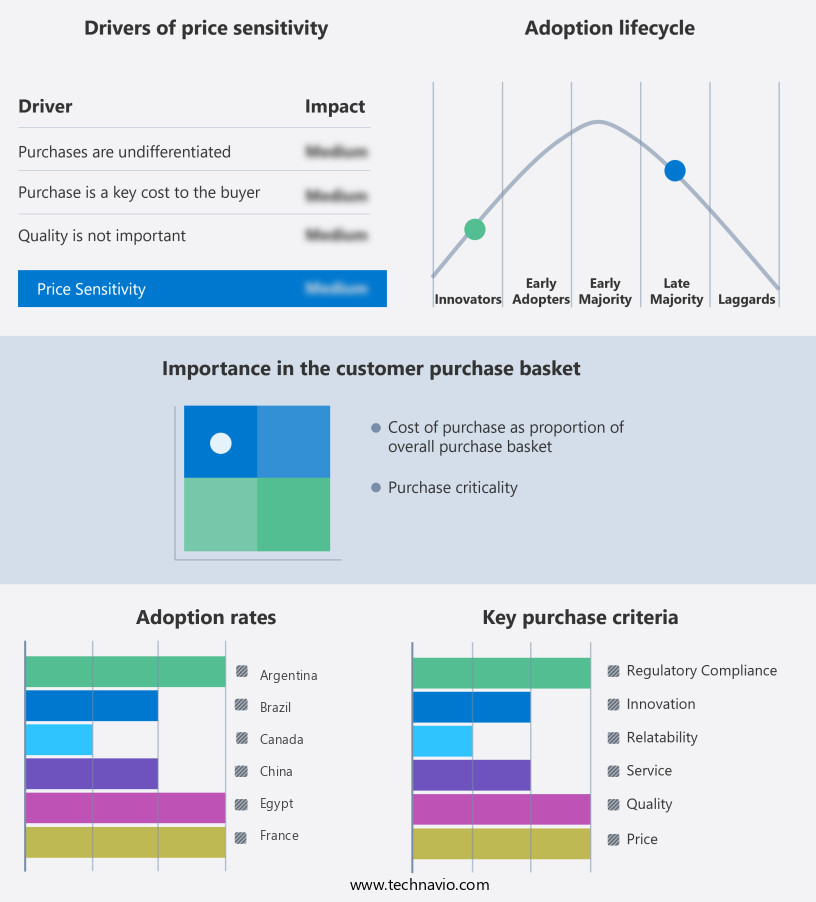

Exclusive Technavio Analysis on Customer Landscape

The automotive glass market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive glass market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Glass Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive glass market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGC Inc. - This company specializes in the production and supply of advanced automotive glass solutions. Their offerings include light control glass, low e glass, integrated glass antennas, and glass for LiDAR systems. These innovative glass products enhance vehicle performance and safety, providing significant benefits to the automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- AGP Group

- Benson Auto Glass LLC

- Central Glass Co. Ltd.

- Compagnie de Saint Gobain SA

- Corning Inc.

- Fuso Glass India Pvt. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- Gauzy Ltd.

- Gentex Corp.

- Independent Glass Co. Ltd.

- Koch Industries Inc.

- Kochhar Glass India Pvt. Ltd.

- Magna International Inc.

- Nippon Sheet Glass Co. Ltd.

- Olimpia Auto Glass Inc.

- PG Group Pty. Ltd.

- Vitro SAB De CV

- Webasto SE

- Xinyi Glass Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Glass Market

- In January 2024, Saint-Gobain, a leading global manufacturer of sustainable building materials and innovative solutions, announced the launch of SAGE Glas® Xtra, an advanced laminated glass product for automotive applications. This new offering combines enhanced safety, acoustic comfort, and solar control properties (Saint-Gobain press release).

- In March 2024, Aptiv and Magna International, two global technology leaders in the automotive industry, entered into a strategic partnership to develop and commercialize advanced driver assistance systems (ADAS) and autonomous driving technologies. The collaboration aims to create a comprehensive, end-to-end autonomous driving solution (Aptiv press release).

- In May 2024, Fuyao Glass, a major automotive glass manufacturer, announced a significant investment of USD1.2 billion in its production capacity expansion in China. The investment will increase the company's annual glass production capacity to 24 million units, solidifying its position as a leading player in the Chinese the market (Fuyao Glass press release).

- In April 2025, the European Union (EU) passed a new regulation mandating the use of advanced safety glass in all new passenger cars by 2027. The regulation aims to improve road safety by reducing the risk of injuries and fatalities from glass-related accidents (European Commission press release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Glass Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 4218.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

China, US, Japan, India, Germany, South Korea, UK, France, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving sector, encompassing various techniques and technologies to enhance the functionality and durability of glass components in vehicles. From glass polishing methods and composition analysis to assessing durability and sound insulation, the industry continually innovates to meet the demands of modern automotive applications. Glass durability is a critical concern, with impact resistance testing, scratch resistance coatings, and tempered glass ensuring safety and longevity. Sound insulation glass, a significant advancement, reduces noise levels, providing a more comfortable driving experience. Defects in glass are meticulously analyzed using various methods, including optical clarity testing and glass surface treatment, to maintain the highest standards.

- Smart glass technology, such as electrochromic and thermochromic glass, offers additional benefits, including adjustable tinting and temperature control. Adhesive bonding processes ensure secure attachment of glass to vehicle frames, while glass cutting techniques ensure precise dimensions. UV protection coatings and self-cleaning glass further enhance the functionality of automotive glazing systems. Automotive glass manufacturing processes, including float glass production and glass recycling, are continually refined to improve efficiency and sustainability. Innovations in glass bending technology and laminated glass production have expanded the possibilities for glass design and functionality. The market for automotive glass is characterized by continuous advancements and evolving trends.

- Glass composition analysis, glass durability assessment, and smart glass technology are just a few examples of the ongoing research and development shaping the future of this dynamic industry.

What are the Key Data Covered in this Automotive Glass Market Research and Growth Report?

-

What is the expected growth of the Automotive Glass Market between 2025 and 2029?

-

USD 4.22 billion, at a CAGR of 3.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Windscreen, Backlite, Sidelite, and Sunroof), Type (Laminated glass, Tempered glass, and Others), Vehicle Type (Passenger cars, Light commercial vehicle, and Medium and heavy commercial vehicle), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased demand for premium vehicles and sunroofs, High cost of manufacturing automotive glass

-

-

Who are the major players in the Automotive Glass Market?

-

AGC Inc., AGP Group, Benson Auto Glass LLC, Central Glass Co. Ltd., Compagnie de Saint Gobain SA, Corning Inc., Fuso Glass India Pvt. Ltd., Fuyao Glass Industry Group Co. Ltd., Gauzy Ltd., Gentex Corp., Independent Glass Co. Ltd., Koch Industries Inc., Kochhar Glass India Pvt. Ltd., Magna International Inc., Nippon Sheet Glass Co. Ltd., Olimpia Auto Glass Inc., PG Group Pty. Ltd., Vitro SAB De CV, Webasto SE, and Xinyi Glass Holdings Ltd.

-

Market Research Insights

- The market encompasses a diverse range of glass applications in the automotive industry, including windshields, side windows, rear windows, and sunroofs. Two key performance aspects of automotive glass are its glass acoustic performance and light transmission rates. According to industry data, The market size was valued at USD35 billion in 2020, with a growth rate of 4% annually. Advanced glass forming techniques, such as tempered, laminated, and coated glass, contribute to enhanced shatter resistance, glass weight reduction, and improved glass cutting precision. Furthermore, glass corrosion resistance, glass surface modification, and adhesive strength testing are crucial factors ensuring glass dimensional stability and coating adhesion.

- In contrast, glass recycling rate remains a significant challenge, with only 70% of collected glass being effectively recycled. The relentless pursuit for glass quality control, glass defect detection, and glass thermal properties drives innovation in the automotive glass industry, ensuring the production of durable, efficient, and safe glass solutions for modern vehicles.

We can help! Our analysts can customize this automotive glass market research report to meet your requirements.