Automotive Grease Market Size 2024-2028

The automotive grease market size is forecast to increase by USD 421.1 million at a CAGR of 3.4% between 2023 and 2028.

- The market is witnessing significant growth due to the expansion of the automotive industry, particularly in sectors such as three-wheelers, passenger cars, lightweight commercial vehicles, and heavy-weight commercial vehicles. Additionally, there is an increasing focus on the use of eco-friendly and biodegradable greases to reduce environmental impact. However, fluctuations in raw material prices pose a challenge to market growth. In the US, this trend is observed across various automotive sectors, with an emphasis on the production of electric vehicles (EVs) and the development of advanced automotive components. The lubricants market is expected to continue its growth trajectory, driven by these factors, despite any challenges that may arise.

What will be the Size of the Automotive Grease Market During the Forecast Period?

- The market is experiencing significant growth due to several factors. One of the primary drivers is the increasing production of private vehicles, which necessitates the use of high-performance lubricants to ensure the smooth operation of automotive components. Economic stability and consumer affordability are also crucial factors influencing the market's growth. As consumers seek to maintain their vehicles in optimal condition, they are willing to invest in premium lubricants, including synthetic lubricants and environmentally friendly alternatives. Synthetic lubricants, such as Savsol Ester 5 from Savita Oil Technologies, have gained popularity due to their superior performance and extended service life. These lubricants offer better protection against wear and corrosion, making them an ideal choice for various automotive applications. Mineral oils continue to dominate the market due to their affordability and widespread availability. However, the shift towards more eco-friendly solutions is driving the demand for bio-based lubricants and fully synthetic oil. The rapid industrialization and increasing adoption of electric vehicles (EVs) are also contributing to the growth of the market.

- Furthermore, the production of EV batteries requires specialized lubricants to ensure efficient cooling and prolonged battery life. The automobile manufacturing industry, including major players such as Volkswagen, Mercedes-Benz, and Porsche, is a significant consumer of automotive grease. These companies rely on high-quality lubricants to ensure the optimal performance of their vehicles and maintain their competitive edge. The trend towards sustainable and eco-friendly solutions is also driving the demand for environmentally friendly lubricants. Savsol Ester 5, for instance, is a bio-based lubricant that offers excellent performance and reduces the carbon footprint of automotive applications. Thus, the market is poised for growth due to the increasing production of private vehicles, the shift towards more eco-friendly solutions, and the demand for high-performance lubricants from the automobile manufacturing industry. The market is expected to continue growing as the industry adapts to the changing landscape, driven by factors such as economic stability, consumer affordability, and the increasing adoption of electric vehicles.

How is this Automotive Grease Industry segmented and which is the largest segment?

The automotive grease industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Aftermarket

- OEM

- Source

- Mineral oil

- Synthetic oil

- Bio-based oil

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

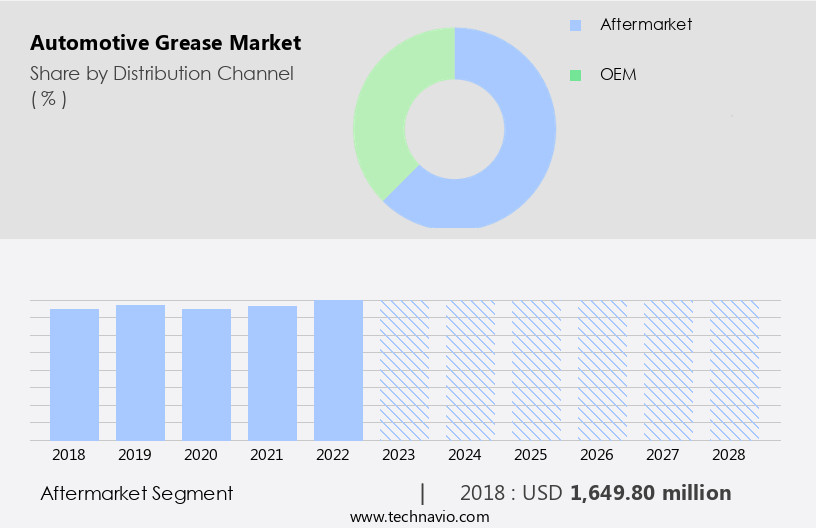

By Distribution Channel Insights

- The aftermarket segment is estimated to witness significant growth during the forecast period.

The market encompasses the sales of this essential product through various distribution channels, including retail stores, online platforms, service stations, and workshops, following the initial sale of a vehicle. The global growth in vehicle ownership is leading to an increased emphasis on maintenance and repair services. Consumers worldwide understand the significance of regular vehicle maintenance to prolong its lifespan, thereby driving the demand for automotive greases used in various applications.

Furthermore, the advent of e-commerce has revolutionized the way consumers purchase automotive products. Online platforms offer convenience and a broader selection of greases, enabling easier access and comparison for consumers, resulting in increased sales of automotive grease In the aftermarket distribution channel. Major automobile manufacturers, such as Volkswagen, Mercedes-Benz, and Porsche, utilize automotive greases extensively In their production processes. In addition, the growth in electric vehicle registrations is expected to fuel the demand for specialized greases to cater to their unique requirements.

Get a glance at the Automotive Grease Industry report of share of various segments Request Free Sample

The aftermarket segment was valued at USD 1.65 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in the United States and North America is experiencing notable growth. Factors such as economic stability and consumer affordability are contributing to an increase in private vehicle ownership. This trend drives the demand for automotive greases in both manufacturing and maintenance applications. Additionally, there is a rising preference for environmentally friendly lubricants, including synthetic lubricating oils, due to growing environmental concerns. Synthetic lubricants, such as synthetic automotive greases, are gaining popularity due to their superior performance and longer lifespan compared to mineral oils. Furthermore, the adoption of electric vehicles (EVs) is on the rise In the region, driven by government incentives and regulations.

For instance, initiatives like the Electric Vehicle Incentive Program in California and the Federal Tax Credit for Electric Vehicles are encouraging consumers to switch to EVs. These factors are expected to influence the growth of the market In the United States and North America. In summary, the market In the United States and North America is growing due to increasing private vehicle ownership, consumer preference for environmentally friendly lubricants, and the adoption of electric vehicles. Market research firms offer valuable insights into the latest trends and growth drivers In the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Grease Industry?

The expansion of the automotive industry is the key driver of the market.

- The Automotive Grease Market is witnessing significant growth due to the increasing demand for private vehicles, driven by economic stability and consumer affordability. Synthetic lubricants, including synthetic lubricating oils, are gaining popularity over mineral oils due to their superior performance and longer lifespan. Savsol Lubricants, a leading player in the market, offers Savsol Ester 5, an eco-friendly lubricant from Savita Oil Technologies. With the rise of electric vehicles (EVs), there is a growing need for environmentally friendly lubricants, such as Ester 5 lubricants, for EV batteries and automotive components. Rapid industrialization and the increasing production of automobiles by manufacturers like Volkswagen, Mercedes-Benz, and Porsche, are fueling the demand for various types of lubricants, including engine oil, brake oil, gear oil, and grease.

- Moreover, the market for lubricants is not limited to passenger cars and lightweight commercial vehicles but also extends to two-wheelers, three-wheelers, and heavy-weight commercial vehicles. The increasing number of electric vehicle registrations and the push towards sustainable manufacturing and automobile production are expected to boost the demand for bio-based lubricants. The Indian government's "Aatma Nirbhar Bharat" initiative and the focus on battery-operated vehicles further focuses on the importance of this market. The market for lubricants is expected to continue its growth trajectory in the coming years, driven by these factors. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Automotive Grease Industry?

An increasing focus on biodegradable greases is the upcoming market trend.

- The Automotive Grease Market is witnessing significant growth due to the increasing demand for private vehicles and the economic stability that comes with it. Consumers are prioritizing affordability, leading to a rise in the usage of both mineral oils and synthetic lubricating oils, such as Savsol Lubricants' Savsol Ester 5, in various applications. Savita Oil Technologies' Ester 5 lubricants are gaining popularity due to their environmentally friendly properties, making them suitable for electric vehicle (EV) batteries and other automotive components. Rapid industrialization and the increasing production of automobiles by leading manufacturers like Volkswagen, Mercedes-Benz, and Porsche, are driving the demand for various types of lubricants, including engine oils, brake oils, gear oils, and grease.

- Further, the shift towards sustainable lubricants, such as fully synthetic oil, semi-synthetic oil, and bio-based oil, is also gaining momentum due to the increasing focus on reducing carbon emissions and promoting Aatma Nirbhar Bharat. The rise in electric vehicle registrations and the production of battery-operated vehicles further accentuates this trend. The Lubricants Market is expected to continue its growth trajectory as the automotive industry evolves towards more sustainable and efficient solutions. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does the Automotive Grease Industry face during its growth?

Fluctuations in raw material prices of automotive grease is a key challenge affecting the industry growth.

- The Automotive Grease Market is witnessing significant growth due to the increasing demand for private vehicles, driven by economic stability and consumer affordability. Synthetic lubricants, such as Savsol Ester 5 from Savita Oil Technologies, are gaining popularity over mineral oils due to their superior performance and longer service life. Savsol Ester 5, an ester 5 lubricant, is widely used in engine oils, brake oils, gear oils, and greases for various automotive applications. The shift towards electric vehicles (EVs) and battery-operated vehicles is also influencing the market trend. While mineral oil continues to dominate the engine oil segment, fully synthetic and semi-synthetic oils are preferred for EV batteries.

- However, the automotive components industry, including automobile manufacturing giants like Volkswagen, Mercedes-Benz, and Porsche, is adopting sustainable lubricants to reduce their carbon footprint and meet the demands of rapid industrialization and Aatma Nirbhar Bharat. The Lubricants Market is expected to grow further with the increasing production of electric vehicles and the rising demand for bio-based lubricants. Two-wheelers, three-wheelers, passenger cars, lightweight commercial vehicles, and heavy-weight commercial vehicles are major consumers of lubricants. The market for grease is expected to grow significantly due to its wide application in automotive components. The use of environmentally friendly lubricants is becoming a necessity to reduce the carbon footprint of the automotive industry. The demand for bio-based lubricants is increasing as they offer excellent performance and are renewable and sustainable. Hence, the above factors will impede the growth of the market during the forecast period.

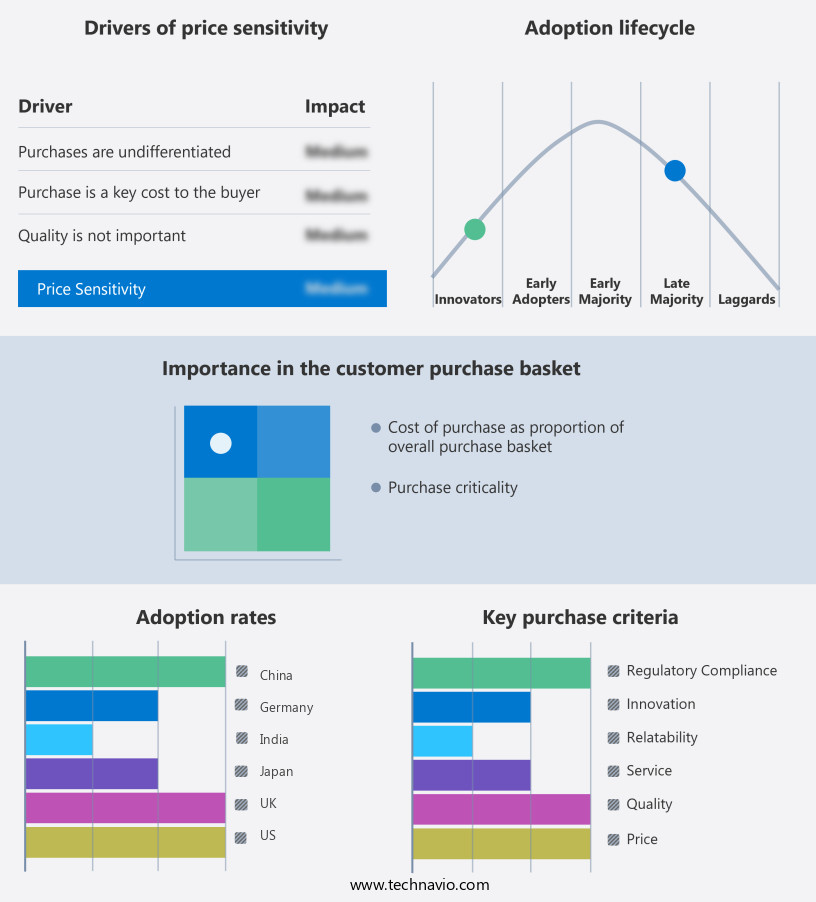

Exclusive Customer Landscape

The automotive grease market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive grease market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive grease market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- Auto Pickup Petro Chem Pvt Ltd.

- Axel Christiernsson International AB

- Balmer Lawrie and Co. Ltd.

- BP Plc

- Chevron Corp.

- China Petrochemical Corp.

- Dow Inc.

- Eni SpA

- Exxon Mobil Corp.

- FUCHS PETROLUB SE

- Indian Oil Corp. Ltd.

- Phillips 66

- PJSC LUKOIL

- San Miguel Corp

- Schaeffler AG

- Shell plc

- Siddharth Grease and Lubes Pvt. Ltd

- TotalEnergies SE

- Valvoline Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for private vehicles, especially in regions with economic stability and consumer affordability. The market is segmented into synthetic lubricants and mineral oils. Synthetic lubricants, including Savsol Ester 5 from Savita Oil Technologies and ester 5 lubricants, are gaining popularity due to their superior performance and longer lifespan. Moreover, the shift towards environmentally friendly lubricants is driving the market's growth. Synthetic lubricating oils, such as fully synthetic oil and semi-synthetic oil, are increasingly being used in automotive components, including engines, brakes, and gears. The rise of electric vehicles (EVs) and battery-operated vehicles is also impacting the market.

Thus, while mineral oil continues to be the primary choice for conventional vehicles, the demand for bio-based oil is increasing In the EV production sector. Rapid industrialization and the 'Aatma Nirbhar Bharat' initiative in India are expected to boost the automotive production sector, leading to increased demand for lubricants. Motor equipment manufacturers are also focusing on development activities to produce sustainable lubricants that reduce carbon emissions. Two-wheelers, three-wheelers, passenger cars, lightweight commercial vehicles, and heavy-weight commercial vehicles all require different types of greases and lubricants to ensure optimal performance. The market is expected to continue growing as the automotive industry evolves and adapts to new technologies and consumer demands.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2024-2028 |

USD 421.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

US, China, India, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Grease Market Research and Growth Report?

- CAGR of the Automotive Grease industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive grease market growth of industry companies

We can help! Our analysts can customize this automotive grease market research report to meet your requirements.