Automotive Panoramic Sunroof Market Size 2024-2028

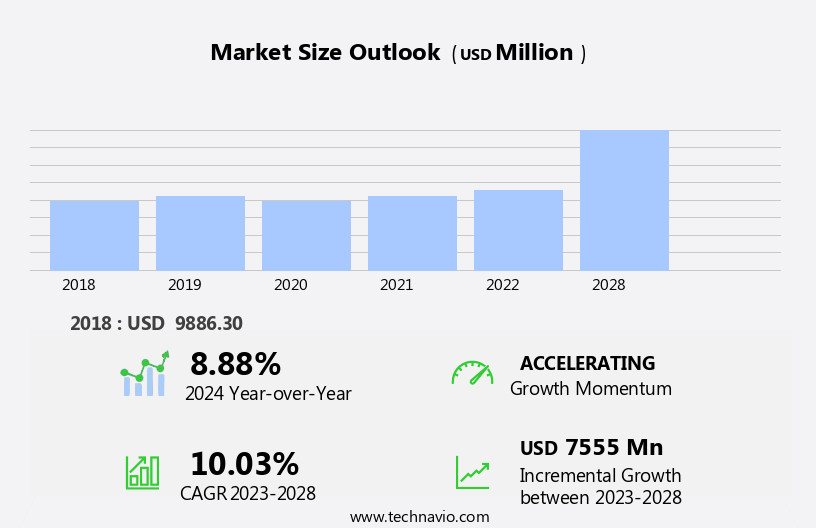

The automotive panoramic sunroof market size is forecast to increase by USD 7.56 billion at a CAGR of 10.03% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by advancements in glass technology. These innovations enable larger sunroofs with improved functionality and aesthetics, making them increasingly popular among consumers. Another key trend is the increased adoption of panoramic sunroofs in the sports utility vehicle segment. However, this market faces challenges, including the high integration and maintenance costs associated with these sophisticated systems.

- Manufacturers must carefully balance the desire for larger, more feature-rich sunroofs with the need to keep costs competitive. Effective supply chain management and continuous innovation in manufacturing processes will be crucial for companies seeking to capitalize on market opportunities and navigate these challenges successfully.

What will be the Size of the Automotive Panoramic Sunroof Market during the forecast period?

- The market continues to evolve, driven by advancements in glass technology and consumer demand for enhanced vehicle aesthetics and passenger comfort. OEM sunroofs, including tempered glass, electric sunroofs, and advanced systems, are integral components of modern vehicle design, found in passenger vehicles, premium cars, and commercial vehicles alike. Sunroof ventilation and insulation technologies have gained significant attention, ensuring passenger comfort in various weather conditions. Manufacturers focus on improving sunroof safety regulations, durability, and integration with vehicle features such as roof rails and vehicle styling. Sliding and manual sunroofs remain popular options, while tinted glass and UV protection add to the appeal.

- Sunroof frames, closing mechanisms, and seals undergo continuous innovation to ensure optimal performance and longevity. Aftermarket sunroofs cater to the growing demand for customization and affordability, with a focus on quality standards and compatibility with various vehicle models. Composite materials, smart glass, and acoustic glass are some of the emerging trends in sunroof manufacturing, offering lightweight, energy-efficient, and noise-reducing solutions. Sunroof maintenance and repair services are essential to ensure the longevity and functionality of these systems. The market's ongoing dynamism is further fueled by the integration of sunroofs into luxury vehicles and sports cars, where they serve as key differentiators. As the market unfolds, sunroof technology continues to redefine passenger experiences, setting new benchmarks for vehicle design and innovation.

How is this Automotive Panoramic Sunroof Industry segmented?

The automotive panoramic sunroof industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- SUV

- Sedan and hatchbacks

- Others

- Type

- Fixed Sunroof

- Operable Sunroof

- Vehicle Types

- Passenger Vehicles

- Luxury Vehicles

- Material Type

- Glass

- Polycarbonate

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

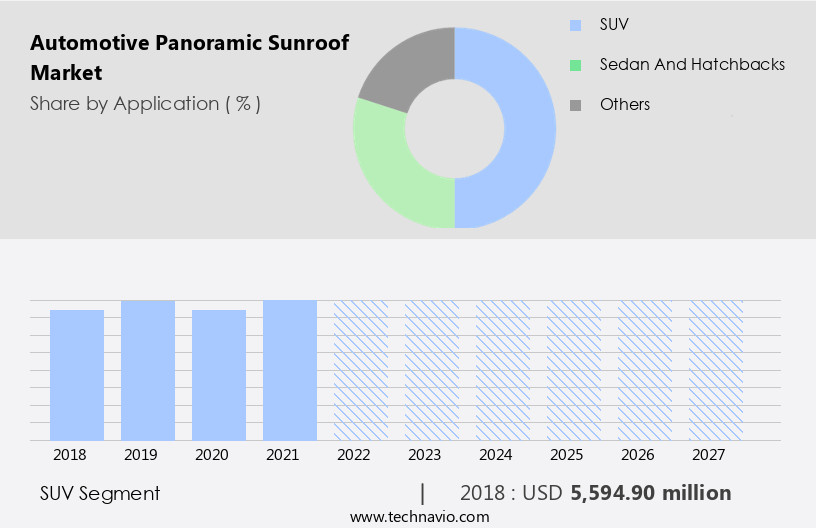

The suv segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the SUV segment. Panoramic sunroofs, featuring expansive glass panels, are no longer confined to luxury vehicles. Mid-size SUVs now offer this feature, catering to the rising demand for convenience and safety. SUVs, the highest adopters of panoramic sunroofs, are increasingly popular worldwide. In 2023, SUVs surpassed all other passenger cars in global sales. Sunroof technology advances with glass innovations such as electrochromic glass, which adjusts tint for enhanced passenger comfort. Sunroof control units, switches, motors, and closing mechanisms ensure seamless operation. Advanced sunroof systems integrate sunroof ventilation, insulation, and safety regulations for optimal performance.

Sunroof manufacturers focus on durability, using lightweight materials like composite materials and laminated glass for stronger sunroof frames and seals. Sunroof installation and maintenance are crucial aspects of the market, with OEM sunroofs ensuring optimal integration and aftermarket sunroofs offering cost-effective alternatives. The market trends include the use of smart glass and acoustic glass for enhanced vehicle features, passenger comfort, and UV protection. Sunroof safety remains a priority, with regulations mandating safety measures such as sunroof closing mechanisms and sunroof safety regulations. In the commercial vehicle sector, sunroofs are gaining popularity for their aesthetic appeal and functionality.

Sunroofs in commercial vehicles can improve cargo space utilization and provide natural light, contributing to the market's expansion. The market is a dynamic and evolving industry, driven by technological advancements, consumer preferences, and the growing popularity of SUVs.

The SUV segment was valued at USD 5.59 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

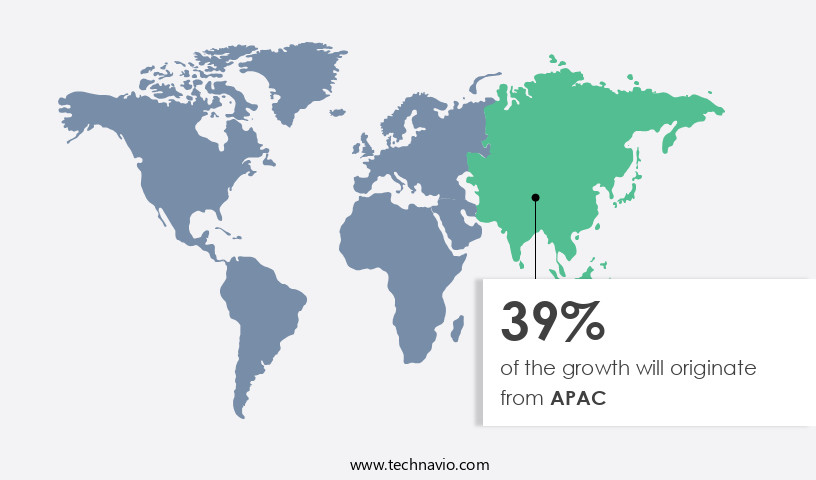

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. Tempered glass and sunroof control units are essential components of electric and advanced sunroof systems, which are increasingly popular in both original equipment manufacturer (OEM) and aftermarket applications. Sunroof ventilation and glass technology enhance passenger comfort, while sunroof safety regulations ensure secure sunroof closing mechanisms and opening mechanisms. APAC is expected to be the fastest-growing region, with China, India, South Korea, and Japan driving market growth. Major automotive manufacturers, including Hyundai-Kia, Suzuki, Mitsubishi, Tata Motors Limited, Lexus, and Toyota, are based in this region, contributing to its large market share.

The increasing trend of vehicle customization and a younger population seeking aftermarket sunroof installations are key factors fueling demand. Sunroof innovations, such as electrochromic glass, sunroof motor, and smart glass, are improving passenger comfort and vehicle aesthetics. Sunroof safety regulations ensure the integration of sunroof systems with vehicle features, such as roof rails and sunroof frames, for optimal safety and durability. Sunroof insulation and uv protection are also crucial for passenger comfort and vehicle maintenance. Commercial vehicles and luxury vehicles are also adopting panoramic sunroofs to enhance their design and passenger experience. Lightweight materials and sunroof installation techniques are continuously evolving to improve sunroof durability and reduce installation costs.

The market for sunroof repair and maintenance is also growing as sunroofs become increasingly common in vehicles. In conclusion, The market is witnessing significant growth, driven by increasing demand for passenger comfort, vehicle customization, and safety regulations. The APAC region, with its major automotive manufacturers and growing demand for aftermarket sunroof installations, is expected to remain a key player in the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Panoramic Sunroof Industry?

- The advancements in glass technology serve as the primary catalyst for market growth, given its significance in driving innovations within this industry.

- Sunroofs have evolved significantly, with glassmakers incorporating advanced technologies to create UV-protective glasses such as tempered, laminated, and green glass. For instance, Mercedes-Benz offers a panoramic Vario-roof with magic sky control in the SLK model, which provides a comfortable interior climate by offering translucent or darker glass options for an open-air experience during cold weather and sun protection. Additionally, Webasto's unique solar sunroof and Volkswagen Eos' convertible panoramic sunroof enable better control of natural light. Sunroof innovations focus on enhancing durability, safety, and insulation.

- Sunroof safety regulations mandate robust opening mechanisms to ensure passenger safety. Sunroof integration with other vehicle systems is also a key trend, such as climate control and entertainment systems. Composite materials are increasingly used for sunroof installation to improve durability and reduce weight. Overall, sunroofs continue to be a desirable feature in vehicles, particularly in sports cars, offering both functional and aesthetic benefits.

What are the market trends shaping the Automotive Panoramic Sunroof Industry?

- The trend in the automotive market is shifting towards an increased adoption of sunroofs in sports utility vehicles. This feature is becoming increasingly popular among consumers, enhancing the overall driving experience.

- The automotive industry continues to prioritize passenger comfort and luxury, with panoramic sunroofs gaining significant popularity in various vehicle classes. These expansive glass structures offer enhanced aesthetics and a sense of openness, making them an increasingly desirable feature for consumers. Manufacturers, such as Ford, Chevrolet, Toyota, and Kia, have responded to this trend by integrating panoramic sunroofs into their offerings, extending beyond the realm of luxury vehicles. In recent developments, Mahindra introduced the XUV 3XO with a panoramic sunroof in India, following suit with Kia's Seltos, which also features this amenity in both diesel and petrol variants.

- Sunroof seals ensure proper functionality and weather resistance, while lightweight materials and smart glass contribute to improved fuel efficiency and acoustic performance. As the demand for advanced vehicle features continues to grow, the integration of panoramic sunroofs is expected to remain a key focus for automakers.

What challenges does the Automotive Panoramic Sunroof Industry face during its growth?

- The high integration and maintenance costs represent a significant challenge to the growth of the industry. This challenge arises from the complex interconnections between various components and the ongoing expenses required to keep them functioning optimally.

- Sunroofs, featuring tempered glass and advanced sunroof systems, have become increasingly popular in the automotive industry. However, these components, which include sunroof control units, sunroof switches, electric sunroofs, sunroof ventilation, and sunroof motors, can experience issues such as leaks or malfunctions due to defective parts or wear and tear. The cost of installation and repair can be significant, making aftermarket sunroofs an attractive alternative for some consumers. These sunroof components are often combined onto a single plate, contributing to their overall weight. Rain sensors, power-operated sliding glass panels, and other accessories are less expensive alternatives to steel or carbon fiber.

- However, these components require frequent maintenance, which may hinder the growth of the market. Additionally, glass technology advancements, such as electrochromic glass, offer improved functionality and energy efficiency, further driving demand for these features in premium vehicles. Despite these opportunities, the market may face challenges due to the cost and maintenance requirements associated with sunroof systems.

Exclusive Customer Landscape

The automotive panoramic sunroof market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive panoramic sunroof market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive panoramic sunroof market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGC Inc. - The company provides advanced automotive sunroofs, featuring low-e glass for energy efficiency, tempered glass for durability, on-glass antennas for seamless design, and integrated module assemblies within our extensive automotive glass range. These sunroofs ensure optimal performance and enhance vehicle interiors, providing drivers and passengers with an unobstructed view while maintaining superior glass quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- AISIN CORP.

- BOS GmbH and Co. KG

- CIE Automotive SA

- Continental AG

- Fuyao Glass America

- Inteva Products LLC

- Volkswagen AG

- Webasto SE

- Yachiyo Industry Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Panoramic Sunroof Market

- In February 2024, Mercedes-Benz unveiled its latest innovation, the Mercedes-Benz S-Class with an expansive panoramic sunroof, spanning over 32 square feet, making it the largest in the automotive industry (Mercedes-Benz press release, 2024). This development underscores the growing trend of providing customers with more open and spacious interiors in luxury vehicles.

- In March 2025, Ford and Tesla announced a strategic partnership to collaborate on advanced technologies, including panoramic sunroofs, to enhance their vehicle offerings and improve customer experience (Ford press release, 2025). This collaboration signifies a significant shift towards industry consolidation and collaboration to stay competitive in the evolving automotive market.

- In May 2024, Magna International, a leading automotive supplier, announced a USD500 million investment in its sunroof manufacturing facility in Mexico, expanding its production capacity and strengthening its position as a key player in The market (Magna International press release, 2024). This investment represents a significant commitment to meeting the increasing demand for panoramic sunroofs in the automotive industry.

- In September 2025, the European Union introduced new regulations mandating the installation of panoramic sunroofs in all new vehicles with a size above 2.5 tons, aiming to reduce carbon emissions and improve air quality within the vehicles (European Commission press release, 2025). This regulatory development represents a significant shift towards more stringent environmental regulations in the automotive industry.

Research Analyst Overview

The automotive sunroof market encompasses various components, including sunroof blinds, noise reduction systems, electric motors, customization options, and warranty coverage. Sunroof installation processes and repair costs are also significant factors in this market. Sunroof actuators, wiring harnesses, and sensor technologies are essential elements of sunroof functionality, addressing concerns such as water leakage and user experience. Sunroof trends lean towards innovation, with advancements in defroster systems, tilt functions, and opening sizes catering to diverse target audiences. Sunroof replacement and aftermarket installation are growing segments, driven by consumer demand for customization and cost-effectiveness. Sunroof safety features, durability testing, and crash testing are crucial aspects of market growth, ensuring consumer confidence and satisfaction.

Sunroof sensor technologies and controller systems enable seamless operation and enhanced user experiences. The sunroof market is competitive, with ongoing developments in seal design, sunroof warranty coverage, and sunroof market segmentation. Sunroof innovation continues to evolve, addressing consumer preferences and industry demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Panoramic Sunroof Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 7555 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, Canada, Brazil, UAE, Australia, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Panoramic Sunroof Market Research and Growth Report?

- CAGR of the Automotive Panoramic Sunroof industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive panoramic sunroof market growth of industry companies

We can help! Our analysts can customize this automotive panoramic sunroof market research report to meet your requirements.