Automotive Power Sliding Door System Market Size 2025-2029

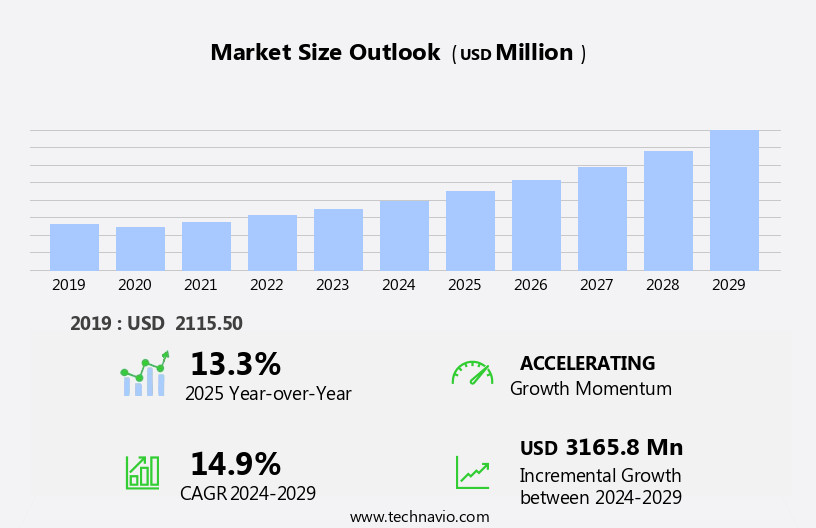

The automotive power sliding door system market size is forecast to increase by USD 3.17 billion at a CAGR of 14.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of luxury vans and the rise in new ride-sharing platforms. The demand for power sliding doors in vans is on the rise due to their convenience and ease of use, particularly in the context of ride-sharing services where quick entry and exit are essential. Furthermore, the growing trend towards luxury vehicles, including vans, is fueling market expansion. However, this market growth is not without challenges. Governments around the world are imposing higher taxes on luxury vehicles, which may increase the cost of production and, in turn, the price of vehicles equipped with power sliding door systems.

- The market is expanding as the demand for efficient last mile delivery solutions increases, with power sliding doors offering enhanced convenience and accessibility for delivery vehicles. Companies seeking to capitalize on this market opportunity must navigate these challenges effectively by focusing on cost reduction strategies and exploring emerging markets where demand for luxury vehicles and ride-sharing services is high. Overall, the market presents significant growth potential for companies that can innovate and adapt to changing market dynamics.

What will be the Size of the Automotive Power Sliding Door System Market during the forecast period?

- The market encompasses the production and supply of motors, sensors, control units, tracks, and actuators for horizontal sliding doors in various vehicle types, including minivans and large SUVs. These systems offer enhanced convenience and improved accessibility, with key trends leaning towards energy efficiency and safety features such as anti-pinch technology and obstacle detection systems. Material advancements, including the use of aluminum and composite polymers, contribute to lighter weight and increased durability. The market's growth is driven by the increasing popularity of electric cars (EVs) and the integration of sliding doors in ride sharing and ride hailing services as part of evolving mobility concepts.

- Electric motors power these systems, enabling smooth and quiet operation. Overall, the automotive sliding door system market is experiencing strong growth, with a focus on innovation and integration into diverse vehicle applications. Anti pinch technology is increasingly being integrated into automotive sliding doors and hinged doors, enhancing safety and hands-free operation, with motors and actuators playing a key role. The Camden Loop is also improving last mile delivery for commercial van, which are transitioning from internal combustion engines to more sustainable solutions to cater to the growing middle class population.

How is the Automotive Power Sliding Door System Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger vehicle

- Cargo vans

- Product Type

- Single sliding door

- Dual sliding door

- Type

- Power-operated

- Manual

- Channel

- OEM

- Aftermarket

- Geography

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Europe

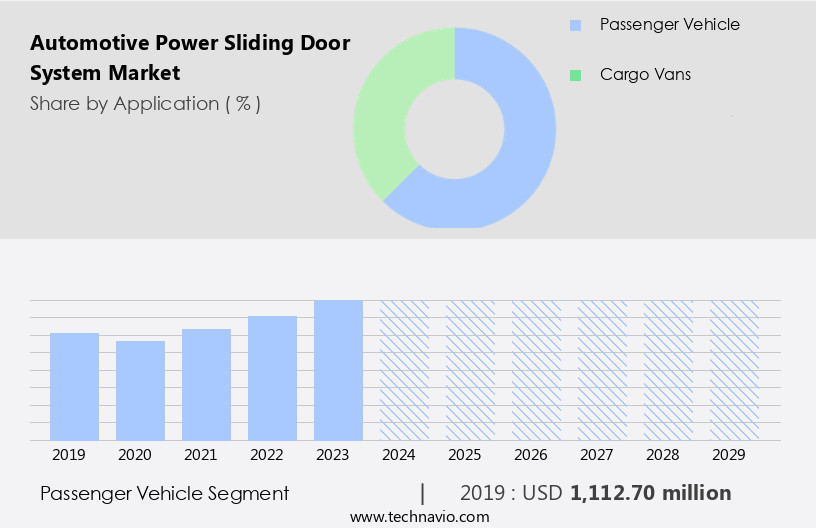

By Application Insights

The passenger vehicle segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, particularly in the passenger vehicle segment. This segment encompasses passenger vans and multi-purpose vehicles (MPVs), where power sliding door systems are increasingly popular due to the convenience and advanced features offered by automotive original equipment manufacturers (OEMs). The increasing demand for comfort and convenience from emerging economies is driving the growth of this segment. APAC is expected to dominate the market due to the expanding middle-class population and the high demand for automobiles in the region. Key features of power sliding doors include energy efficiency, safety technologies such as anti-pinch and obstacle detection systems, and hands-free operation.

Materials used in the production of these systems include aluminum and composite polymers. The market is also witnessing increasing adoption in electric cars (EVs), ride sharing and ride hailing services, electric vans, and electric buses. Power sliding doors offer benefits such as soundproofing, insulation, and ease of access, making them a desirable feature for both luxury and commercial vehicles.

Get a glance at the market report of share of various segments Request Free Sample

The Passenger vehicle segment was valued at USD 1.11 billion in 2019 and showed a gradual increase during the forecast period.

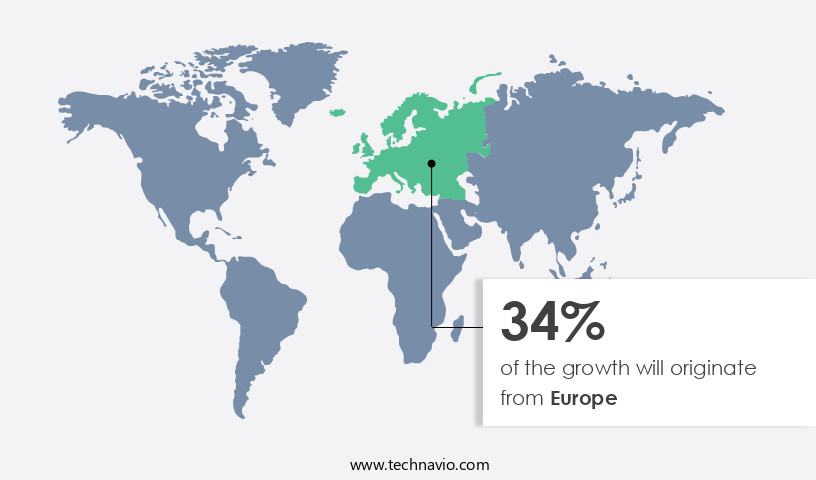

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European market is significantly driven by the high adoption of luxury and commercial vehicles in major countries like Germany, France, Italy, Spain, and the UK. These nations are home to leading global automotive manufacturers and premium brands, fueling the demand for advanced power sliding door systems. Europe's automotive industry is witnessing continuous technological innovations and improvements, with power sliding doors becoming increasingly popular due to their energy efficiency, convenience, and safety features, such as anti-pinch technology and obstacle detection systems. Furthermore, the rise of ride sharing, ride hailing services, and mobility concepts, such as microtransit, electric cars (EVs), electric vans, and electric buses, is expected to further boost the market growth.

Power sliding doors offer hands-free operation, latches and locks, soundproofing, insulation, and are available in various materials, including aluminum and composite polymers. The increasing standard of living and safety concerns are also significant factors contributing to the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Power Sliding Door System Industry?

- Increase in adoption of luxury vans is the key driver of the market. The market experiences significant growth, particularly In the power sliding door system segment. This trend is predominantly fueled by the increasing demand for luxury cars and vans. In the luxury cars segment, the demand for power sliding doors is driven by the convenience and elegance they offer to consumers. Similarly, In the luxury vans segment, the market growth is attributed to the increasing purchases by fleet operators. These companies cater to various industries such as limousine transportation, media networks, VIP transportation, and business and telecommunication services.

- The competition among fleet operators is intensifying, leading manufacturers to introduce new luxury van models and update existing ones with advanced power sliding door variants to capture emerging opportunities. In 2024, major purchases of luxury vans were reported globally by these fleet operators.

What are the market trends shaping the Automotive Power Sliding Door System Industry?

- The rise in new ride-sharing platforms spurring van sales is the upcoming market trend. The demand for large vans in the automotive industry is experiencing growth, despite not being a common vehicle choice for family garages. This trend is primarily driven by the rise of on-demand ride-sharing services, which make city transportation more efficient, flexible, and eco-friendly.

- The proliferation of ride-sharing platforms is significantly fueling van sales due to increasing vehicle ownership costs and the emergence of autonomous ride-sharing services. This market growth underscores the evolving transportation landscape and the shift towards shared and sustainable mobility solutions.

What challenges does the Automotive Power Sliding Door System Industry face during its growth?

- Growing tax on luxury vehicles is a key challenge affecting the industry's growth. The market's expansion hinges on the growth of the global luxury vehicle sector. Factors influencing the expansion of this sector, such as increasing disposable income and a preference for convenience and comfort, will consequently drive market demand.

- However, the market is highly competitive, and companies must differentiate themselves. Product innovation, quality, and pricing are the primary differentiators. Given the luxury segment's saturation with advanced technologies, pricing becomes a crucial factor in gaining a competitive edge. Despite the increasing cost due to taxes on luxury vehicles, the market is expected to grow steadily.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AISIN CORP.: The company offers a power sliding door system, such as linkage-type power door systems, which enable easy opening and closing while preserving the vehicle's design and do away with the need to install rails on the vehicle body.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AISIN Corp.

- BFT

- Bode

- Brose Fahrzeugteile SE and Co. KG

- Continental AG

- GESTAMP AUTOMOCION SA

- Kiekert AG

- Magna International Inc.

- Mitsuba Corp.

- Mitsui Kinzoku ACT Corp.

- STRATTEC SECURITY Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of advanced technologies and components that enable seamless door opening and closing in various vehicle types. These systems, which include motors, sensors, control units, tracks, and actuators, are increasingly popular in minivans and SUVs due to their energy efficiency and convenience. The integration of these systems in automotive applications is driven by several factors. Firstly, the growing demand for convenience and hands-free operation in vehicles is fueling the adoption of power sliding doors. This is particularly true in ride-sharing and ride-hailing services, where quick and easy access to the vehicle is essential.

Moreover, the shift towards electric vehicles (EVs) and other mobility concepts, such as microtransit and last-mile delivery services, is also driving the growth of the power sliding door system market. These vehicles often feature sliding side doors, which offer improved accessibility and maneuverability in tight spaces. The use of lightweight materials, such as aluminum and composite polymers, in the production of power sliding door systems is another significant trend. These materials help to reduce the overall weight of the vehicle, improving energy efficiency and contributing to a better standard of living for consumers. Safety concerns are also a key consideration in the design and development of power sliding door systems.

Furthermore, anti-pinch technology and obstacle detection systems are essential features that help to prevent accidents and ensure the safety of passengers and pedestrians. Furthermore, the integration of power sliding doors in luxury and commercial vans is becoming increasingly common. These vehicles often require large doors that offer easy access to the cargo area, and power sliding doors provide a convenient and efficient solution. The use of electric motors and soundproofing, and insulation materials in power sliding door systems is also gaining popularity. These features help to improve the overall driving experience by reducing noise levels and enhancing the comfort of the vehicle.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.9% |

|

Market growth 2025-2029 |

USD 3.17 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

13.3 |

|

Key countries |

US, UK, Canada, Germany, China, France, The Netherlands, India, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.