Automotive Rear-View Mirror Market Size 2024-2028

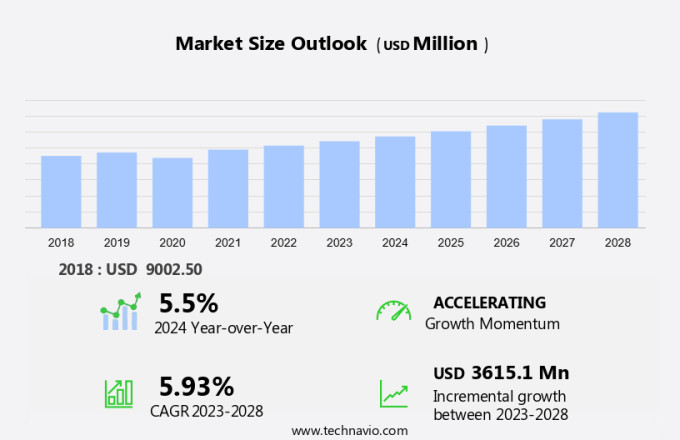

The automotive rear-view mirror market size is forecast to increase by USD 3.62 billion at a CAGR of 5.93% between 2023 and 2028. The market is witnessing significant growth due to the increasing demand for advanced features in passenger cars and commercial vehicles. The heating function segment is a key feature type gaining popularity, especially in colder regions. Blind spot detection and power control are other essential features driving market growth. Automatic folding mirrors and LCD monitor screens are becoming increasingly common in the exterior mirror segment. The market can be segmented by product type into door mounted and body mounted mirrors, with the door mounted segment dominating due to its ease of installation and cost-effectiveness. The passenger cars segment is the largest consumer, but the commercial vehicle segment is expected to witness faster growth due to the integration of advanced technologies like camera systems. The market is also witnessing the trend of mounting locations shifting from traditional rear-view mirrors to side-view mirrors with integrated cameras. Overall, the market is poised for growth, with technological advancements and evolving consumer preferences shaping market trends.

The market is an essential component of the automobile production industry. With the increasing trend towards advanced vehicle design, rear-view mirrors have evolved from traditional mirrors to smart mirrors, full-screen monitors, and multi-sensor systems. The automobile production sector has faced numerous challenges due to supply chain disruptions. Production sites have been impacted by various factors, including government lockdown measures, which have led to decreased production volumes. These disruptions have affected the supply chain network, leading to delays in the delivery of auto components, including rear-view mirrors. Despite these challenges, the market continues to grow.

Similarly, smart mirrors, full-screen monitors, and multi-sensor systems have gained popularity due to their ability to enhance safety and improve the driving experience. Auto component suppliers have responded by increasing their production capacity and implementing agile supply chain strategies to mitigate the impact of disruptions. The forecast period for the market is expected to see continued growth, driven by the increasing demand for advanced safety features in vehicles. The integration of sensors and digital displays in rear-view mirrors is a significant trend, providing drivers with real-time information and improving situational awareness. The automotive production sector's resilience in the face of supply chain disruptions is a testament to its adaptability.

Also, auto manufacturers and component suppliers have implemented contingency plans, including diversifying their supplier base and increasing inventory levels, to mitigate the risks associated with disruptions. In conclusion, the market is an integral part of the automobile production industry. Despite the challenges posed by supply chain disruptions, the market is expected to continue growing due to the increasing demand for advanced safety features. Auto component suppliers are responding by increasing production capacity and implementing agile supply chain strategies to mitigate the impact of disruptions. The future of the market is bright, with smart mirrors, full-screen monitors, and multi-sensor systems leading the way in enhancing safety and improving the driving experience.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Product Placement

- Exterior

- Interior

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Vehicle Type Insights

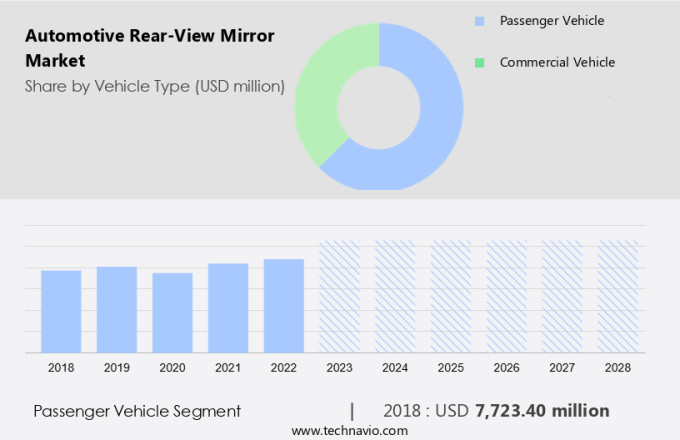

The passenger vehicle segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing demand for advanced features in passenger vehicles. Auto component suppliers are responding to this trend by expanding production sites and enhancing their supply chain networks. However, government lockdown measures have impacted production volumes, leading to supply chain disruptions in the medium term.

Get a glance at the market share of various segments Request Free Sample

The passenger Vehicle segment was valued at USD 7.72 billion in 2018 and showed a gradual increase during the forecast period. Despite these challenges, the market is expected to grow as consumers continue to prioritize comfort, safety, and convenience in their vehicles. Advanced Driver Assistance Systems (ADAS) features, such as auto-dimming and side-view dimming mirrors, are becoming increasingly popular. These features not only enhance the driving experience but also improve safety by reducing back over accidents. Government regulations continue to drive the adoption of such technologies, making them standard features in many vehicles. The market is poised for steady growth in the coming years.

Regional Insights

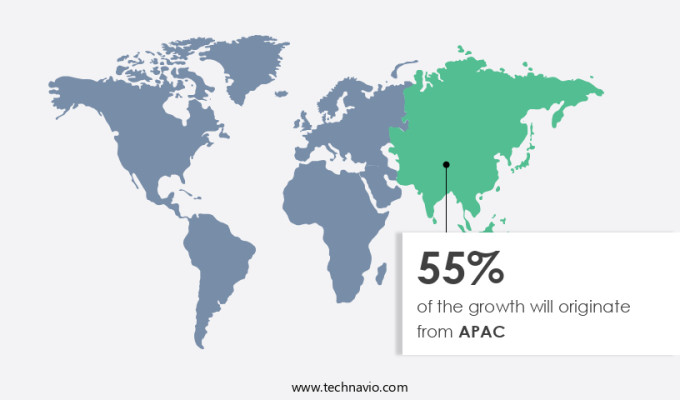

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia-Pacific Region (APAC) is experiencing significant growth due to several factors. With the increasing focus on electric mobility and the establishment of battery facilities in Michigan by General Motors in Lansing, there may be potential hindrances to traditional rear-view mirror integration. However, this region is poised for high growth due to its advantages, including the availability of low-cost raw materials and cheap labor. APAC is the leading region in The market, driven by the high volume adoption of passenger cars. China, India, South Korea, and Japan are the major contributors to this growth.

Moreover, the passenger cars segment in APAC is projected to expand at a faster rate compared to other regions during the forecast period, leading to increased demand for advanced mirror technologies such as camera systems. Consumer preferences are shifting towards aesthetics and advanced features, leading to the adoption of advanced mirrors like auto-dimming, power fold side-view mirrors, and mirrors with indicators. These features not only enhance the driving experience but also contribute to revenue growth in the region during the forecast period. In summary, the Asia-Pacific Region is the fastest-growing market for automotive rear-view mirrors, driven by the high volume adoption of passenger cars, consumer preference for advanced features, and the availability of cost advantages. The region is expected to maintain its dominant position in the market during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing popularity of premium sport utility vehicles (SUVs) is the key driver of the market. In the automotive industry, rear-view mirrors continue to be essential components in vehicle design, particularly in the popular SUV segment. The increased height of SUVs can obstruct the driver's view of short obstacles while reversing, leading to the adoption of additional rear-view mirrors mounted on the rear windshield. However, developed regions are transitioning towards camera systems as they offer a more comfortable and wider viewing angle for the driver. By the end of the forecast period, camera systems are anticipated to witness the highest adoption rates.

Currently, both rear-view mirrors and electronic mirrors remain prevalent in the automotive market. The growing popularity of small SUVs and crossovers in the SUV market, driven by their affordability and lower cost of ownership, further boosts the demand for rear-view mirrors. The automotive sector, including new energy vehicles, is subject to supply chain disruptions, and governments and administrations worldwide are focusing on transportation policies to mitigate their impact on automobile production.

Market Trends

The integration of different technologies in automotive mirror is the upcoming trend in the market. Driving at night on poorly lit roads can be uncomfortable and dangerous for drivers due to the bright glare from vehicles behind. This glare can act as a distraction, causing a blinding effect that may lead to accidents. To address this issue, automakers are integrating advanced technologies into rear-view mirrors, such as dimming functionality. These mirrors automatically adjust to reduce the glare, enhancing both safety and comfort for drivers. Furthermore, the integration of camera and LED technologies with dimming mirrors is expected to become a standard feature in the automotive market.

Additionally, radar systems are being integrated with dimming mirrors to aid in blind spot detection, a feature that is anticipated to be offered by most Original Equipment Manufacturers (OEMs) in the coming years. The automotive industry is investing heavily in Research and Development (R&D) projects to improve Interior mirror segment features, including the use of SoC (system-on-a-chip) technology, HD screens, and console control. These technological advancements are aimed at providing users with a more comfortable and safer driving experience.

Market Challenge

The auto-dimming mirrors are still seen as expensive option in emerging regions is a key challenge affecting the market growth. The market encompasses various feature types, including the heating function segment. The market offers mirrors with power control, automatic folding, blind spot detection, and camera options. These features are predominantly found in passenger cars and commercial vehicles. The mounting location of mirrors is categorized into door mounted and body mounted segments. Regarding product types, there are exterior mirrors with LCD monitor screens.

However, although auto-dimming mirrors, which are part of the exterior mirror segment, have been available since the 1980s, their adoption has been gradual, particularly in price-sensitive emerging markets. Conventional mirrors are priced below USD 99 while auto-dimming mirrors with additional features like blind spot detection and power control cost above USD 250. As a result, customers in regions like India consider auto-dimming mirrors as luxury equipment and opt for conventional mirrors instead. Automotive OEMs in these markets are implementing economies of scale to introduce auto-dimming mirrors in the top variants of compact vehicles, thereby enabling differentiation.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Burco Inc. - The company offers automotive rear view mirrors such as Breakaway Wedge and Camlock mount.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Continental AG

- FLABEG Automotive Glass Group GmbH

- Gentex Corp.

- Holitech Technology Co. Ltd.

- Konview Electronics Corp. Ltd.

- Lumax Industries Ltd

- Magna International Inc.

- MEKRA Lang GmbH and Co. KG

- Murakami Corp.

- OmniVision Technologies Inc.

- Panasonic Holdings Corp.

- Sakae Riken Kogyo Co. Ltd.

- Shenzhen Germid Co. Ltd

- SL Corp.

- SMR Deutschland GmbH

- Tata Sons Pvt. Ltd.

- Tokai Rika Co. Ltd.

- Valeo SA

- VOXX International Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the auto component suppliers industry, with production sites spread across various regions. The market has experienced disruptions due to government lockdown measures imposed to curb the spread of the global pandemic. Production volumes have been affected, leading to a decline in vehicle sales, particularly in the passenger car segment. Government regulations aim to enhance safety and comfort for passengers, with a focus on preventing accidents such as back over accidents involving children, elders, and other victims. Blind-spot accidents are also a concern, leading to the prime utilization of ADAS features in rear-view mirror systems.

Also, the market is witnessing technological development, with innovative products such as complex camera systems and full-screen monitor rearview mirrors gaining popularity. The use of cameras and sensors in rear-view mirror systems is becoming increasingly common in new vehicles, with OEMs integrating these features into their designs. The high growth rate of the market is attributed to the increasing demand for fuel-efficient vehicles and the integration of advanced camera technologies. The Asia-Pacific region is a prominent market due to its low-cost raw materials and cheap labor. The automotive market's R&D projects focus on improving inside rear-view mirrors with features such as auto dimming, power control, and automatic folding.

In summary, the market segmentation includes LCD monitor screens, exterior mirror segment, and interior mirror segment. The heating function segment and feature type segment include blind spot detection and multi-sensor systems. The market's growth is hindered by supply chain disruptions, with automotive production being significantly impacted. However, governments and administrations worldwide are providing incentives to promote the sales of new energy vehicles, which is expected to boost the market's growth in the medium term. The luxury vehicles segment and conventional mirrors continue to dominate the market, with technological dominance driving improved IRVM features for user safety and comfort.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.93% |

|

Market growth 2024-2028 |

USD 3.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 55% |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Burco Inc., Continental AG, FLABEG Automotive Glass Group GmbH, Gentex Corp., Holitech Technology Co. Ltd., Konview Electronics Corp. Ltd., Lumax Industries Ltd, Magna International Inc., MEKRA Lang GmbH and Co. KG, Murakami Corp., OmniVision Technologies Inc., Panasonic Holdings Corp., Sakae Riken Kogyo Co. Ltd., Shenzhen Germid Co. Ltd, SL Corp., SMR Deutschland GmbH, Tata Sons Pvt. Ltd., Tokai Rika Co. Ltd., Valeo SA, and VOXX International Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch