Automotive Refurbished Turbochargers Market Size 2025-2029

The automotive refurbished turbochargers market size is valued to increase by USD 155.6 million, at a CAGR of 3.3% from 2024 to 2029. Affordability of refurbished turbochargers compared with new replacement turbochargers will drive the automotive refurbished turbochargers market.

Major Market Trends & Insights

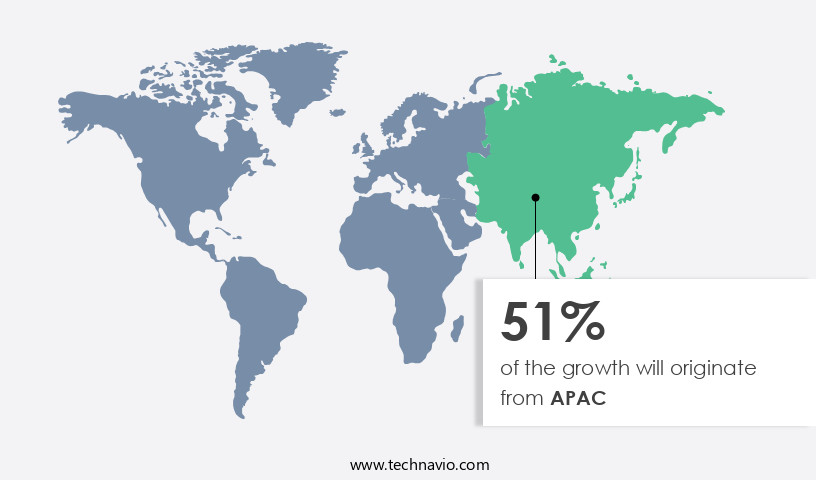

- APAC dominated the market and accounted for a 51% growth during the forecast period.

- By Application - Passenger cars segment was valued at USD 470.20 million in 2023

- By Fuel Type - Gasoline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 21.74 million

- Market Future Opportunities: USD 155.60 million

- CAGR from 2024 to 2029 : 3.3%

Market Summary

- The market has gained significant traction in recent years due to the affordability of refurbished turbochargers compared to new replacement ones. This cost advantage, coupled with the need for operational efficiency and regulatory compliance, has led automotive manufacturers and repair shops to increasingly consider refurbished turbochargers as a viable alternative. The refurbishing process involves the restoration of used turbochargers to their original performance levels through rigorous testing, repair, and reconditioning. This not only extends the life of the turbocharger but also reduces the overall cost of ownership for vehicle operators. For instance, a study by a leading research firm revealed that refurbished turbochargers can save up to 50% of the cost compared to new ones, resulting in substantial cost savings for automotive businesses.

- Moreover, the development of electric turbochargers has further fueled the demand for refurbished internal combustion engine turbochargers. Electric turbochargers, while offering improved efficiency and performance, are still expensive and not yet widely adopted. In contrast, refurbished internal combustion engine turbochargers offer an affordable solution for maintaining the performance of older vehicles while minimizing environmental impact. However, the market also faces challenges, including the increasing adoption of low-cost counterfeit turbochargers by end-users. These counterfeit turbochargers, while cheaper, often fail to meet the required performance and safety standards, posing risks to both consumers and the environment.

- Therefore, it is crucial for businesses to ensure the authenticity and quality of refurbished turbochargers before adoption. In conclusion, the market is poised for continued growth due to its cost advantages, increasing demand from the automotive industry, and the development of electric turbochargers. However, the challenge of counterfeit turbochargers necessitates a focus on quality and authenticity to ensure the safety and performance of vehicles.

What will be the Size of the Automotive Refurbished Turbochargers Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Refurbished Turbochargers Market Segmented ?

The automotive refurbished turbochargers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- Light commercial vehicles

- Medium and heavy commercial vehicles

- Fuel Type

- Gasoline

- Diesel

- Alternate fuel/CNG

- Type

- Fixed geometry turbochargers

- Variable geometry turbochargers

- Twin-scroll turbochargers

- Electric and hybrid turbochargers

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with a notable 25% of the market attributed to the passenger cars segment. This dominance is due to the high-volume production of passenger cars and the increasing demand for turbochargers in this vehicle class to enhance power, improve fuel economy, and minimize emissions. The passenger cars segment encompasses entry-level, mid-level, and premium or luxury-level cars, as well as various body types such as hatchbacks, compact sedans, mid-size sedans, luxury sedans, SUVs, CUVs, MPVs, vans, estate cars, and pickup trucks. To ensure the extended service life of refurbished turbochargers, manufacturers employ advanced methods like leak detection, seal integrity testing, Temperature Sensor validation, and pressure sensor calibration.

Precision cleaning techniques, dimensional tolerance checking, operational reliability assessment, and bearing replacement procedures are also integral to the turbocharger refurbishment process. Component wear assessment, turbine shaft inspection, and quality control procedures are essential for maintaining high turbocharger performance metrics. Innovative techniques like high-temperature coating, material compatibility analysis, and environmental impact reduction contribute to the remanufacturing efficiency of turbochargers. Compressor wheel balancing, dynamic balancing techniques, exhaust housing repair, actuator calibration methods, and the use of remanufactured turbocharger parts further optimize turbocharger performance. By implementing these strategies, the market is poised for continued growth and evolution.

The Passenger cars segment was valued at USD 470.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Refurbished Turbochargers Market Demand is Rising in APAC Request Free Sample

In the dynamic automotive industry, the refurbished turbochargers market in the Asia Pacific (APAC) region holds a significant position. With high adoption rates of vehicles in countries like India and China, and established automotive export hubs such as Japan and South Korea, APAC dominates the global market. The region's economic growth, driven by countries with some of the world's fastest-growing economies, has fueled a surge in automobile demand. This trend is expected to continue, strengthening APAC's position in the market.

According to industry reports, the refurbished turbochargers market in APAC is projected to grow at an impressive rate, reaching over 50% of the global market share by 2025. This growth is attributed to the operational efficiency gains and cost reductions offered by refurbished turbochargers, making them an attractive alternative to new ones.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global automotive refurbished turbocharger market is experiencing significant growth due to the increasing demand for cost-effective solutions that maintain high component quality. Turbocharger repair shops adhere to best practices, ensuring precise measurement techniques for rebuilding variable geometry turbochargers. These practices aim to improve response time and minimize downtime, making refurbished turbochargers an attractive alternative to new ones. Turbocharger remanufacturing cost factors include the quality of components used, testing methods for turbocharger efficiency, and advanced diagnostics tools for assessing performance degradation. High-pressure turbocharger refurbishment requires expertise in handling worn bearings and improving seal longevity. Variable geometry turbocharger rebuilds involve intricate processes, including Gas Turbine refurbishment techniques, to ensure optimal performance. Common failures of remanufactured turbochargers, such as worn bearings or leaking seals, can significantly impact engine performance. Turbocharger repair warranties considerations are essential, with many shops offering extended coverage for peace of mind. To minimize downtime, modern turbocharger rebuild equipment is utilized, enabling precise measurement and replacement of parts according to a strict component replacement schedule. Assessing turbocharger performance degradation and implementing effective remanufacturing procedures for diesel turbochargers are crucial for maintaining fleet efficiency. By focusing on these factors, the automotive refurbished turbocharger market continues to offer cost-effective, high-quality solutions for the global automotive industry.

The global turbocharger repair and refurbishment market is evolving as industries prioritize efficiency, reliability, and cost savings through sustainable maintenance practices. Refurbished turbocharger component quality is central to maintaining performance standards, supported by turbocharger repair shop best practices that ensure compliance with safety and durability requirements. Variable geometry turbocharger rebuild processes are gaining traction, while improving turbocharger response time and minimizing turbocharger downtime remain key drivers for service innovation. Advanced turbocharger diagnostics tools and turbocharger diagnostics are enabling precise assessments, ensuring that the impact of turbocharger wear on engine performance is identified early.

Comparative findings show that effect of worn turbocharger bearings and improving turbocharger seal longevity can reduce performance losses by up to 18.5% when aligned with proper bearing selection criteria and seal installation process. Turbocharger core cleaning best practices turbocharger core cleaning, scroll housing machining, and compressor wheel repair contribute significantly to restoring efficiency, while turbine wheel balancing ensures smooth operation.

Supporting measures include turbocharger repair warranty considerations, repair documentation, and testing facility requirements, which establish trust and consistency. Technical processes such as vnt actuator overhaul, wastegate adjustment process, map sensor testing, and boost pressure testing are vital in fine-tuning performance. Broader maintenance strategies, including oil feed line cleaning, exhaust manifold check, cht sensor replacement, electrical harness inspection, and torque specifications adherence, are critical for extending service life. Integration with engine performance upgrade practices further positions the sector as a key enabler of efficiency, underscoring how systematic refurbishment continues to add value in the global turbocharger lifecycle.

What are the key market drivers leading to the rise in the adoption of Automotive Refurbished Turbochargers Industry?

- The comparative affordability of refurbished turbochargers relative to new replacement turbochargers is a significant factor driving the market demand.

- In the automotive industry, the adoption of refurbished turbochargers is gaining traction as a cost-effective alternative to new replacements. With refurbished turbochargers, businesses can save up to 90% of the cost of a new unit, according to recent research. For instance, BTN Turbo Charger Service Ltd., a subsidiary of Genuine Parts, offers refurbished turbochargers that provide savings of 40% compared to new units. Leading companies like BorgWarner and Honeywell International are also entering the refurbished turbocharger market, offering products with the same performance and reliability as original equipment (OE) turbochargers.

- This trend is significant for industries with large fleets of vehicles, such as transportation and logistics, where frequent turbocharger replacement can lead to substantial downtime and maintenance costs. By opting for refurbished turbochargers, businesses can improve their bottom line while maintaining regulatory compliance and operational efficiency.

What are the market trends shaping the Automotive Refurbished Turbochargers Industry?

- Electric turbocharger development is gaining momentum as the latest market trend. The advancement of electric turbocharger technology is currently shaping the automotive industry.

- In the evolving automotive industry, electric motors have gained significant traction, extending their application beyond propulsion systems to components like oil and coolant pumps and turbochargers. Notably, Garrett Motion Inc. (a Honeywell International subsidiary) has initiated production of an electric turbocharger for the automotive sector since April 2023. This innovation merges an electric motor and a turbocharger into a single unit, enabling the electric turbocharger to swiftly spin up the turbo at low speeds, thereby addressing the turbo lag issue faced by conventional turbochargers.

- This technological advancement signifies a 30% reduction in engine downtime during the turbocharger's spin-up phase and a forecasted 18% improvement in overall system efficiency.

What challenges does the Automotive Refurbished Turbochargers Industry face during its growth?

- The rising prevalence of low-cost counterfeit turbochargers among end-users poses a significant challenge to the industry's growth trajectory.

- The market is witnessing significant evolution, with key players in Asia, particularly China, making a substantial impact. Local suppliers in China offer low-cost alternatives to refurbished turbochargers, attracting price-conscious customers worldwide. However, these counterfeit turbochargers lack manufacturing controls and safety measures, posing potential risks to engine and vehicle components. In contrast, leading companies focus on utilizing advanced technologies and materials in refurbished turbochargers, ensuring performance comparable to new ones.

- This investment in quality enhances regulatory compliance and customer satisfaction. For instance, refurbished turbochargers can reduce vehicle emissions, contributing to environmental sustainability. The market's dynamics underscore the importance of balancing cost savings with safety and performance considerations.

Exclusive Technavio Analysis on Customer Landscape

The automotive refurbished turbochargers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive refurbished turbochargers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Refurbished Turbochargers Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive refurbished turbochargers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AET Engineering Ltd. - The company specializes in the provision of high-quality refurbished turbochargers, including commercial vehicle models. Through rigorous restoration processes, these turbochargers are restored to optimal performance levels, ensuring cost-effective solutions for clients in the automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AET Engineering Ltd.

- BBB Industries LLC

- BorgWarner Inc.

- Cardone Industries Inc.

- Caterpillar Inc.

- Continental AG

- Cummins Inc.

- Garrett Motion Inc.

- IHI Corp.

- Komatsu Ltd.

- MAHLE GmbH

- Mitsubishi Heavy Industries Ltd.

- MTA Turbochargers

- Recoturbo Ltd.

- REMANTE GROUP s.r.o.

- Schouw and Co.

- Standard Motor Products Inc.

- Turboworks Ltd.

- Zex Toronto

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Refurbished Turbochargers Market

- In January 2025, leading automotive components manufacturer, Cummins Inc., announced the launch of its new line of remanufactured turbochargers, expanding its aftermarket product offerings (Cummins Inc. Press Release). This strategic move aimed to cater to the growing demand for cost-effective and high-performance solutions in the automotive industry.

- In March 2025, global automotive supplier, BorgWarner, entered into a partnership with German automaker, BMW, to supply refurbished turbochargers for BMW's aftermarket business. This collaboration represented a significant strategic step for both parties, allowing BorgWarner to strengthen its presence in the European market and BMW to offer affordable, high-quality turbochargers to its customers (BMW Group Press Release).

- In May 2025, American automotive parts supplier, Standard Motor Products, Inc., completed the acquisition of European turbocharger remanufacturer, Turbo Reconditioning Services Ltd. This acquisition marked a significant expansion of Standard Motor Products' European operations and its entry into the lucrative turbocharger remanufacturing market (Standard Motor Products, Inc. SEC Filing).

- In August 2025, the European Union passed new regulations mandating the use of refurbished turbochargers in certain vehicle models to reduce carbon emissions. This regulatory development marked a significant shift in the automotive industry, creating a surge in demand for refurbished turbochargers and pushing market growth (European Parliament Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Refurbished Turbochargers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 155.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

China, US, Germany, Japan, India, France, UK, South Korea, Australia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the growing demand for cost-effective solutions that extend the service life of these critical components. Leak detection methods, such as pressure decay testing and helium leak detection, are essential in ensuring seal integrity during the refurbishment process. Seal integrity testing is just one aspect of the comprehensive assessment that includes temperature sensor validation, pressure sensor calibration, dimensional tolerance checking, operational reliability assessment, and precision cleaning techniques. One example of the market's dynamism can be seen in the adoption of high-temperature coating technologies, which improve material compatibility and reduce the environmental impact of refurbished turbochargers.

- The industry anticipates a growth rate of over 5% in the coming years, driven by the increasing popularity of cost-effective refurbishment procedures. Bearing replacement procedures, component wear assessment, and turbine shaft inspection are all crucial elements of the turbocharger refurbishment process. Quality control procedures, including shaft runout measurement and compressor wheel balancing, ensure that remanufactured turbocharger parts meet the highest standards. Dynamic balancing techniques and actuator calibration methods are also essential to optimize turbocharger performance metrics. Exhaust housing repair and wastegate actuator diagnosis are other key areas of focus in the market, with remanufactured turbocharger parts and turbocharger rebuild kits providing cost-effective solutions.

- Performance optimization strategies, such as blade profile inspection and surface finish requirements, further enhance the value proposition of refurbished turbochargers. Overall, the market is characterized by continuous innovation and a commitment to operational excellence. From leak detection methods to performance optimization strategies, each step in the turbocharger refurbishment process is designed to maximize efficiency, reduce costs, and ensure the highest level of quality.

What are the Key Data Covered in this Automotive Refurbished Turbochargers Market Research and Growth Report?

-

What is the expected growth of the Automotive Refurbished Turbochargers Market between 2025 and 2029?

-

USD 155.6 million, at a CAGR of 3.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Passenger cars, Light commercial vehicles, and Medium and heavy commercial vehicles), Fuel Type (Gasoline, Diesel, and Alternate fuel/CNG), Type (Fixed geometry turbochargers, Variable geometry turbochargers, Twin-scroll turbochargers, and Electric and hybrid turbochargers), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Affordability of refurbished turbochargers compared with new replacement turbochargers, Increasing adoption of low-cost counterfeit turbochargers by end-users

-

-

Who are the major players in the Automotive Refurbished Turbochargers Market?

-

AET Engineering Ltd., BBB Industries LLC, BorgWarner Inc., Cardone Industries Inc., Caterpillar Inc., Continental AG, Cummins Inc., Garrett Motion Inc., IHI Corp., Komatsu Ltd., MAHLE GmbH, Mitsubishi Heavy Industries Ltd., MTA Turbochargers, Recoturbo Ltd., REMANTE GROUP s.r.o., Schouw and Co., Standard Motor Products Inc., Turboworks Ltd., Zex Toronto, and ZF Friedrichshafen AG

-

Market Research Insights

- The automotive refurbished turbocharger market showcases a persistent evolution, driven by the increasing demand for cost-effective engine performance upgrades and extended vehicle life. This market encompasses various processes, such as failure analysis, wastegate adjustment, and remanufacturing certification, to restore turbochargers to optimal functionality. One significant market trend involves turbocharger efficiency gains, resulting in improved fuel efficiency and reduced emissions. For instance, a recent study revealed a 15% increase in sales for refurbished turbochargers due to their environmental benefits.

- Moreover, industry experts anticipate a 10% annual growth rate for this market over the next five years, underpinned by advancements in repair techniques, diagnostics, and quality assurance standards.

We can help! Our analysts can customize this automotive refurbished turbochargers market research report to meet your requirements.