Automotive Seat Massage System Market Size 2025-2029

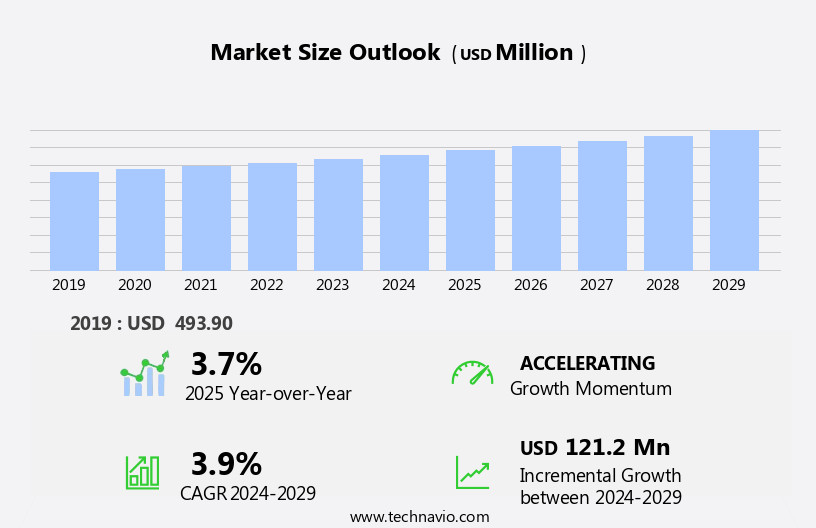

The automotive seat massage system market size is forecast to increase by USD 121.2 million, at a CAGR of 3.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing electrification in vehicles and the development of holistic human-machine interface (HMI) seats. Electrification is leading to an enhanced focus on comfort and convenience features, making seat massage systems an attractive addition to electric vehicles. Furthermore, the integration of advanced technologies into seats is creating a more personalized driving experience, appealing to consumers. However, the market faces challenges as cost pressure intensifies for Original Equipment Manufacturers (OEMs). The integration of complex technologies into seat systems increases production costs, which may deter some OEMs from offering seat massage systems as standard features.

- To navigate this challenge, OEMs must focus on optimizing production processes and exploring cost-effective solutions, such as partnerships with suppliers or tier-two manufacturers. By doing so, they can capitalize on the growing demand for seat massage systems while maintaining competitiveness in the market.

What will be the Size of the Automotive Seat Massage System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and innovation, driven by advancements in mechanical engineering, design optimization, and therapeutic applications. This dynamic market caters to various sectors, including luxury cars and electric vehicles, offering enhanced comfort features for both drivers and passengers. Power supply systems, integration with electrical vehicles, and smartphone connectivity are key components of these systems. Shoulder and lumbar support, noise reduction, and vibration control are essential for driver comfort, while circulation improvement and muscle relaxation contribute to passenger comfort. Smart seat technology, pressure sensors, and data analytics enable customization options based on user preferences and regulatory compliance.

Thermal management, cooling systems, and heating elements offer additional comfort features, while safety standards ensure the technology's integration with seat belts and testing procedures. The market's ongoing unfolding is marked by the development of sophisticated control units, user interfaces, and massage system technologies. Vibration motors and wiring harnesses facilitate seamless integration with vehicle electrical systems. The focus on human factors and material science continues to improve the overall user experience, offering health benefits and reducing stress for drivers. The integration of driver assistance systems, autonomous vehicles, and quality control measures further enhances the market's evolution, ensuring the delivery of high-performing and reliable automotive seat massage systems.

How is this Automotive Seat Massage System Industry segmented?

The automotive seat massage system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Front seat massage systems

- Back seat massage systems

- Product Type

- Rolling

- Kneading

- Shiatsu

- Vibration

- Variant

- Manual

- Remote

- App controlled

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

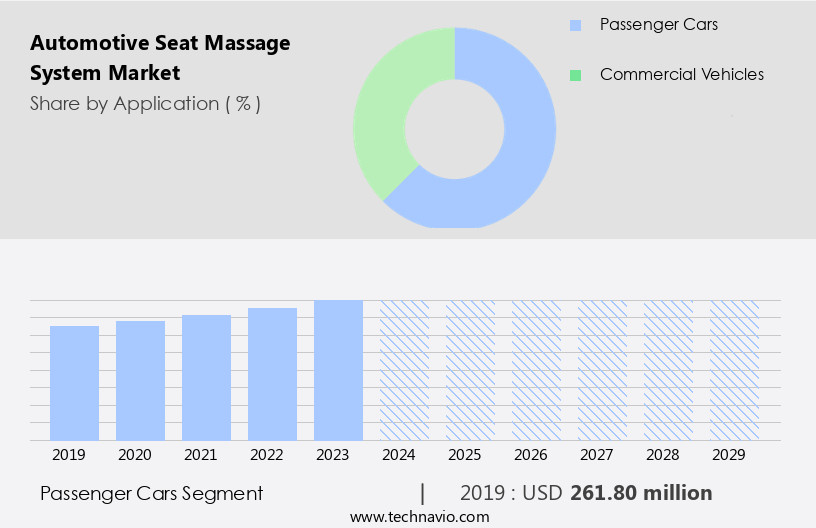

The passenger cars segment is estimated to witness significant growth during the forecast period.

The market represents a significant advancement in passenger vehicle comfort and fatigue mitigation. These innovative seats, predominantly found in luxury cars, offer unique riding experiences and are increasingly becoming standard features. The integration of advanced technologies, such as computer chips and digital controls, allows for customizable massage techniques including kneading, vibration, sawing, and rolling. The mechatronics design is based on the distribution of human bone and muscle acupoints for optimal stimulation. User interface and control units enable on-demand massage sessions, enhancing overall comfort and well-being.

Additionally, these systems offer regulatory compliance, thermal management, cooling systems, and pressure mapping for enhanced safety and comfort. The integration of smartphone connectivity, driver assistance systems, and autonomous vehicles further elevates the user experience. The market's evolution reflects a focus on human factors, material science, and safety standards, ensuring a harmonious blend of comfort and technology.

The Passenger cars segment was valued at USD 261.80 million in 2019 and showed a gradual increase during the forecast period.

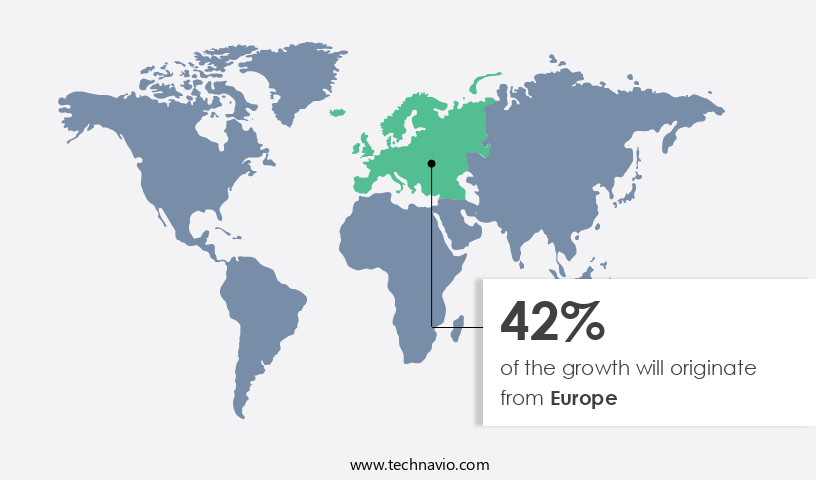

Regional Analysis

Europe is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European automotive seat massage market is experiencing growth driven by the integration of advanced comfort features in luxury cars. Mechanical engineering and design optimization play a crucial role in the development of these systems, which offer fatigue mitigation and therapeutic applications. Power supply, whether from the vehicle's electrical systems or external sources, enables the operation of massage systems, including those in electric vehicles. Lumbar and shoulder support, noise reduction, and circulation improvement are key benefits, making these seats desirable for both drivers and passengers. Human factors and pressure sensors ensure optimal comfort and customization options cater to diverse customer preferences.

Regulatory compliance and safety standards are essential considerations, with testing procedures ensuring the effectiveness and reliability of these systems. The European market is significant, with major contributions from countries like France, Italy, Germany, and the UK, due to their high penetration of premium vehicles. Despite economic uncertainty, the luxury car segment continues to dominate the market. The aging population and the need for stress reduction have increased the demand for massage seats in cars. Integration with driver assistance systems, autonomous vehicles, and smartphone applications further enhances the user experience. Cooling systems, thermal management, and heating elements contribute to overall comfort and well-being.

The market's evolution includes the use of data analytics, software algorithms, and vehicle integration to optimize performance and customize user experiences. Material science and safety standards ensure the durability and reliability of these systems.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a burgeoning sector in the automotive industry, offering drivers a new level of comfort and relaxation. These advanced systems utilize innovative technologies such as percussion massage, heat therapy, and vibration to soothe muscles and improve blood flow. Seat massage systems are increasingly popular in luxury and high-end vehicles, with features like customizable programs, wireless connectivity, and voice activation. Comfort and convenience are at the forefront, with adjustable intensity levels, multiple massage zones, and quiet operation. The market caters to diverse consumer preferences, integrating ergonomic designs, eco-friendly materials, and user-friendly interfaces. The market is expected to grow significantly due to rising disposable income, increasing consumer awareness, and advancements in technology. Additionally, the integration of autonomous driving technology may lead to longer commute times, further boosting demand for automotive seat massage systems.

What are the key market drivers leading to the rise in the adoption of Automotive Seat Massage System Industry?

- The significant growth in the electrification of vehicles serves as the primary market catalyst.

- The automotive industry is witnessing significant advancements, with a growing focus on enhancing comfort features for consumers. One such innovation is the automotive seat massage system. This technology offers back pain relief and customization options, catering to the diverse preferences of customers. Regulatory compliance is a crucial factor driving the integration of massage systems in automotive seats. Pressure mapping technology and wiring harnesses enable the system to provide a personalized massage experience. The integration of massage systems is not limited to luxury vehicles; they are increasingly being adopted in commercial vehicles as well. The trend is fueled by the growing demand for driver assistance systems and the advent of autonomous vehicles.

- As the automotive industry continues to evolve, the emphasis on comfort and quality control remains paramount. Technological advancements, such as electric power windows, electric steering, actuators, heated seats, and massage seats, are becoming standard features in modern vehicles. The increasing adoption of these features is expected to boost the installation of electronic content in cars and commercial vehicles.

What are the market trends shaping the Automotive Seat Massage System Industry?

- Holistic human-machine interface (HMI) seat development is gaining significant traction in the market. This trend reflects the increasing importance of creating seamless and intuitive interactions between humans and machines.

- Autonomous vehicles are revolutionizing the automotive industry, and seat suppliers are responding to the challenge of creating more engaging and effective human-machine interfaces. Traditional seat adjustment features and intelligent seat configurations have been enhanced with software algorithms for memory functions and smartphone integration. However, these developments fall short in autonomous vehicles, which require active communication seats to ensure driver engagement and stress reduction. Companies like Continental and Faurecia are leading the way with advanced seat technologies. Continental's concept seat stores and retrieves seat positions through memory functions, while also prioritizing safety standards and electrical system integration.

- Faurecia's smart seat technology incorporates vibration control and muscle relaxation through software algorithms, creating an immersive and harmonious user experience. These innovations in material science and electrical systems aim to provide drivers with a more comfortable and relaxing ride, even in the autonomous vehicles of the future.

What challenges does the Automotive Seat Massage System Industry face during its growth?

- The escalating cost pressures encountered by Original Equipment Manufacturers (OEMs) represents a significant challenge to the industry's growth trajectory.

- The market experiences significant pressure on original equipment manufacturers (OEMs) due to escalating costs caused by dynamic regulations and evolving customer preferences. OEMs face cost pressures from stringent emission norms, substantial investments in research and development, market competition, and customer demands for advanced features. These factors necessitate the incorporation of design optimization and mechanical engineering in seat massage systems for fatigue mitigation, therapeutic applications, and improved shoulder and lumbar support. Power supply systems, including those for electric vehicles, must also be considered for seamless integration with seat massage systems. Noise reduction is another essential consideration for premium vehicles, necessitating the use of sophisticated technologies.

- Seat belts are a critical safety component that must be integrated seamlessly with seat massage systems. Component manufacturers and tier-1 suppliers face immense pressure to deliver benefits to OEMs while managing the risk of component failure and recall. OEMs cannot pass the increased costs onto consumers due to market competition. Consequently, they must limit production costs to meet demand and provide high-quality products, assuming liability for any product failures or recalls that could impact their bottom line.

Exclusive Customer Landscape

The automotive seat massage system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive seat massage system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive seat massage system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adient Plc - The company specializes in advanced automotive seat technology, featuring the AI18 intelligent front seat system.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adient Plc

- Alba Automotive Services BV

- Alfmeier Prazision SE

- Automotive Concepts

- Continental AG

- DONMAR Enterprises Inc.

- Erickson Auto Trim Inc.

- InSeat Solutions LLC

- Lear Corp.

- Leggett and Platt Inc.

- Magna International Inc.

- Rostra Precision Controls Inc.

- TACHI-S Co. Ltd.

- The Miami Corp.

- Toyota Boshoku Corp.

- Treadwell Auto Trim

- TS TECH Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Seat Massage System Market

- In January 2024, Panasonic Corporation, a leading technology company, announced the launch of its new automotive seat massage system, "Nanoe X Seat Massage," at the Consumer Electronics Show (CES) in Las Vegas. The system uses nanoe X technology to ionize and filter the air, providing a more comfortable and healthy in-car experience (Panasonic Press Release, 2024).

- In March 2024, Faurecia, a global automotive technology company, and Embention, a Spanish drone technology provider, entered into a strategic partnership to develop an autonomous drone-based solution for inspecting and maintaining automotive seat massage systems. This collaboration aims to improve the efficiency and accuracy of seat massage system inspections and maintenance (Faurecia Press Release, 2024).

- In April 2025, Johnson Controls, a leading global automotive supplier, completed the acquisition of Reclaim, a California-based startup specializing in recycled materials for automotive applications, including seat massage systems. This acquisition will help Johnson Controls expand its sustainability initiatives and offer more eco-friendly automotive components (Johnson Controls Press Release, 2025).

- In May 2025, the European Union announced new regulations mandating the installation of seat massage systems in all new passenger cars, starting from 2027. The regulations aim to improve driver comfort and reduce the risk of musculoskeletal disorders related to prolonged driving (European Commission Press Release, 2025).

Research Analyst Overview

- The market exhibits dynamic trends as brands prioritize customer satisfaction and health-conscious features. Reputation management plays a crucial role in differentiating offerings, with recycled materials and eco-friendly production methods gaining favor. Adaptive massage systems, powered by AI-driven personalization, are increasingly popular, enhancing user experience. Intellectual property protection and product lifecycle management are essential for maintaining a competitive edge. Quality assurance, cost optimization, and service manuals are vital for effective installation procedures and repair services. Health monitoring and biometric sensors offer unique selling points, while haptic feedback and climate control integration cater to diverse customer needs. Inflatable lumbar support and lightweight materials contribute to modular design and manufacturing efficiency.

- Training programs and technical support ensure seamless integration of these systems into vehicles. Data privacy and user feedback are crucial for continuous improvement and performance evaluation. Component sourcing, testing and validation, and supply chain management are essential aspects of the market's competitive landscape. Aftermarket parts and replacement components cater to the evolving needs of consumers, providing cost-effective solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Seat Massage System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2025-2029 |

USD 121.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, Germany, China, France, Canada, UK, Italy, Japan, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Seat Massage System Market Research and Growth Report?

- CAGR of the Automotive Seat Massage System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive seat massage system market growth of industry companies

We can help! Our analysts can customize this automotive seat massage system market research report to meet your requirements.