Automotive Stereo Camera Market Size 2024-2028

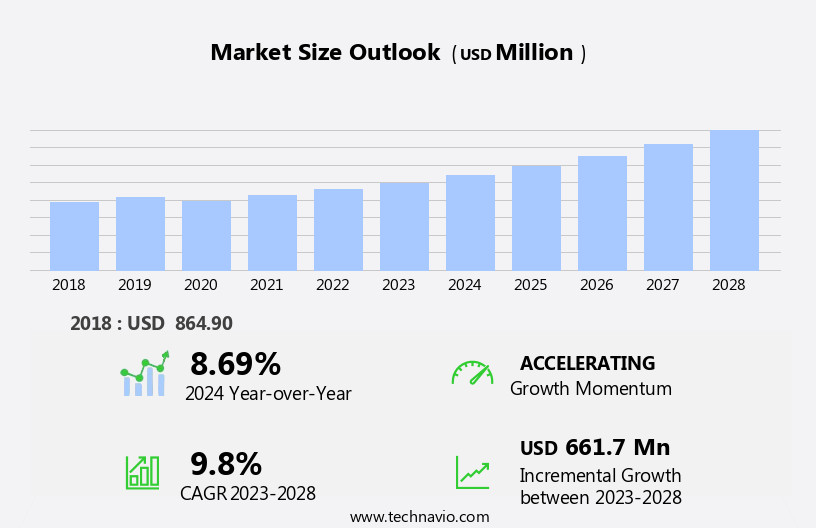

The automotive stereo camera market size is forecast to increase by USD 661.7 million at a CAGR of 9.8% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for advanced safety solutions in vehicles. This trend is driven by the development of smaller, more cost-effective stereo video cameras. However, the high costs associated with these cameras remain a challenge for market growth. The growing preference for enhanced safety features, particularly In the North American region, is expected to continue fueling market demand. Additionally, the integration of stereo cameras into advanced driver assistance systems (ADAS) and autonomous vehicles is further boosting market growth. Despite these opportunities, the high initial investment and complex installation processes are major obstacles that need to be addressed to expand the market's reach. Overall, the market is poised for steady growth, driven by technological advancements and the increasing focus on vehicle safety.

What will be the Size of the Automotive Stereo Camera Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing adoption of Advanced Driver-Assistance Systems (ADAS) and active safety systems in both passenger cars and commercial vehicles. These technologies rely heavily on camera-based sensors to detect and respond to potential hazards on the road. Autoliv and other automotive industry leaders are investing heavily in camera technologies to meet the rising demand for advanced safety features. Automotive production is shifting towards autonomous vehicles, further fueling the market's expansion. Advancements in stereo camera technology, including improved resolution and field of view, are enhancing the performance and reliability of these systems. The market is poised for continued growth as the global automotive industry embraces the benefits of enhanced safety and autonomy.

How is this Automotive Stereo Camera Industry segmented and which is the largest segment?

The automotive stereo camera industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial cars

- Type

- Static

- Dynamic

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing adoption of advanced driver-assistance systems (ADAS) in passenger cars. This market is primarily driven by the automotive industry's shift towards enhancing safety features and improving the driving experience. The integration of stereo cameras in various ADAS, such as lane departure warning, pedestrian detection, and emergency brake assist systems, is a key trend in this market. Geographically, APAC is expected to lead the automotive production and sales, making it a significant market for automotive stereo cameras. However, the current penetration of these cameras in passenger cars is low, with only a few models incorporating this technology.

Get a glance at the Automotive Stereo Camera Industry report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 786.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

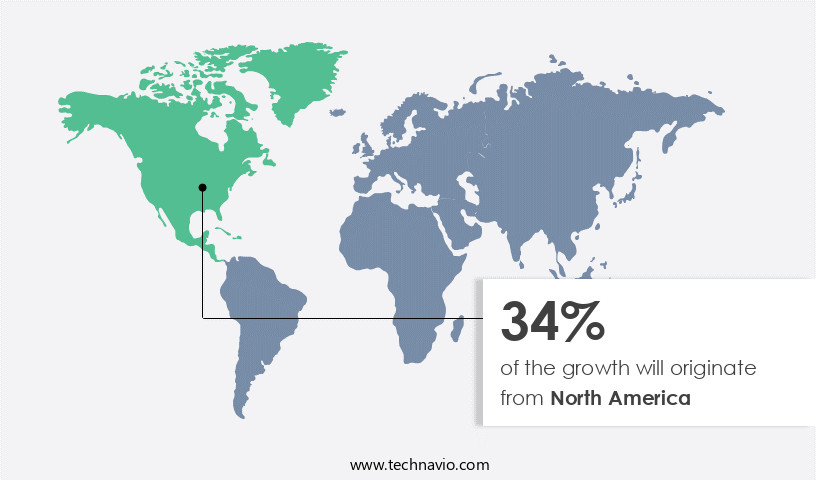

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America experienced significant growth in 2023, with the US being the major contributor. The increasing demand for advanced safety features, particularly in luxury vehicles, is driving the adoption of automotive stereo cameras. Active safety systems, such as automatic emergency braking systems (AEBS) through Advanced Driver-Assistance Systems (ADAS), are increasingly popular, and the US automotive industry has been an early adopter. While initially limited to high-end vehicles, the adoption rate of these systems has expanded. Stereo cameras are essential components of these systems, enabling features like lane departure warning, pedestrian detection, and night vision. The implementation of mandates for advanced safety systems is further boosting the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Stereo Camera Industry?

Growing demand for automotive safety solutions is the key driver of the market.

- The market is experiencing significant growth due to the increasing prioritization of vehicle safety. Advanced Driver-Assistance Systems (ADAS), which include features like Automatic Emergency Braking (AEB), Lane Departure Warning (LDW), and Pedestrian Detection, are becoming increasingly common. These systems rely heavily on stereo cameras for image processing and analysis. As consumer preference for safety features continues to rise, the demand for these systems is expanding beyond luxury vehicles to include commercial and mass-market automobiles. Autoliv, Continental, and other leading automotive suppliers are investing heavily In the development of new stereo camera technologies, such as Dynamic Stereo Cameras and higher resolution systems, to enhance the performance of these safety features.

- However, the high initial investment required for implementation and infrastructure limitations pose challenges for market growth. Additionally, emerging trends In the automotive industry, such as e-mobility and autonomous vehicles, are expected to further fuel the demand for advanced safety systems and stereo cameras. Favorable government policies and expert panel reviews highlight the importance of these technologies in reducing accidents and improving the driving experience. Despite these opportunities, the market faces competition from competing technologies and intermediaries. Malfunctioning camera components and installation costs are also concerns for consumers. However, the potential growth in this market is significant, with industry magazines and research papers projecting strong growth potential In the coming years.

What are the market trends shaping the Automotive Stereo Camera Industry?

Development of smallest stereo video camera is the upcoming market trend.

- The market is witnessing significant growth due to the increasing adoption of Advanced Driver-Assistance Systems (ADAS) In the automotive industry. Active safety systems, such as Automatic Emergency Braking Systems (AEBS) and cruise control systems, are integrating stereo cameras to enhance their capabilities. These cameras help detect vehicles and pedestrians ahead, improving safety and driving experience. However, the high initial investment required for stereo cameras remains a challenge, limiting their implementation in commercial vehicles and automotive production. Leading automotive suppliers, including Autoliv and Continental, are investing in advancements in stereo camera technologies, such as higher resolution and dynamic image processing algorithms.

- These improvements aim to reduce installation costs and intermittency and reliability issues. Night vision systems and pedestrian detection are emerging trends In the market, driven by consumer preference for enhanced safety features. Government mandates and favorable policies are also fueling the growth potential of the market. For instance, the increasing focus on e-mobility and environmental awareness is leading to the integration of stereo cameras in electric and hybrid vehicles. Expert panel reviews and industry-related research papers suggest that the market will continue to grow, despite infrastructure limitations and competition among companies. Despite these opportunities, challenges remain. Malfunctioning camera components and lack of awareness among consumers and automobile manufacturers are potential hurdles.

What challenges does the Automotive Stereo Camera Industry face during its growth?

High costs associated with stereo cameras is a key challenge affecting the industry growth.

- The market is experiencing growth due to the increasing adoption of advanced driver assistance systems (ADAS) and active safety technologies In the automotive industry. Automotive stereo cameras are essential components of these systems, providing high-resolution images of the vehicle's surroundings to enable features such as lane departure warning, pedestrian detection, and emergency brake assist. However, the high initial investment required for implementing stereo camera systems remains a significant challenge. Autoliv and Continental are major players In the market, offering solutions to automobile manufacturers. Advancements in image processing algorithms and higher resolution cameras are driving competition among companies.

- Commercial vehicles and luxury vehicles are also seeing increased demand for these systems due to their safety benefits. Emerging trends In the automotive industry, such as e-mobility and autonomous vehicles, are further increasing the growth potential of the market. Favorable government policies and expert panel reviews in industry magazines and industry-related research papers are also contributing to the market's expansion. However, infrastructure limitations and intermittency and reliability issues are challenges that need to be addressed. Cost reduction measures, such as implementation of mass production techniques and lowering installation costs, are being explored to make these systems more accessible to consumers.

Exclusive Customer Landscape

The automotive stereo camera market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive stereo camera market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive stereo camera market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Autoliv Inc.

- Continental AG

- DENSO Corp.

- Fluke Corp.

- Gentex Corp.

- HELLA GmbH and Co. KGaA

- Hitachi Ltd.

- Hyundai Motor Group

- Intel Corp.

- LG Electronics Inc.

- Magna International Inc.

- Mobileye Technologies Ltd.

- NVIDIA Corp.

- Panasonic Holdings Corp.

- Ricoh Co. Ltd.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Teledyne Technologies Inc.

- Veoneer Inc.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing adoption of advanced driver-assistance systems (ADAS) in both passenger and commercial vehicles. These systems rely on stereo cameras to provide depth perception and enable features such as lane departure warning, emergency brake assist, and pedestrian detection. The automotive industry's shift towards autonomous vehicles is a major factor driving the demand for automotive stereo cameras. These cameras enable image processing algorithms to analyze the environment in real-time, allowing the vehicle to make informed decisions and navigate safely. Advancements in camera technologies, such as higher resolution and dynamic stereo cameras, are also contributing to the market's growth.

In addition, these improvements offer better image quality and increased accuracy, making them essential for the safe operation of autonomous vehicles. However, the high initial investment required for implementing these systems is a significant challenge for automotive manufacturers and commercial vehicle fleets. Cost reduction through economies of scale and technological advancements is essential to make these systems more accessible to a broader market. Competing technologies, such as lidar and radar sensors, also present competition In the market. Each technology has its strengths and weaknesses, and the choice between them depends on the specific application and requirements. Consumer preference for safety features and favorable government policies are also contributing to the growth potential of the market.

Moreover, as consumers become more aware of the benefits of advanced safety systems, demand for these features is increasing. Additionally, governments worldwide are mandating the implementation of these systems in new vehicles to improve road safety. The market is also experiencing emerging trends, such as e-mobility and environmental awareness. These trends are driving the demand for cameras that can detect and respond to obstacles and pedestrians in real-time, making electric vehicles safer for both the driver and the environment. Despite the market's growth potential, there are challenges that need to be addressed. Infrastructure limitations, intermittency and reliability, and malfunctioning camera components are some of the issues that need to be addressed to ensure the safe and effective implementation of automotive stereo cameras.

Furthermore, the role of intermediaries In the market is also significant. They play a crucial role In the distribution and installation of these systems, making them essential partners for automotive manufacturers and suppliers. The market's growth is driven by advancements in camera technologies, consumer preferences, and favorable government policies. However, challenges such as high initial investment, competing technologies, and infrastructure limitations need to be addressed to ensure the safe and effective implementation of these systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.8% |

|

Market growth 2024-2028 |

USD 661.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.69 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Stereo Camera Market Research and Growth Report?

- CAGR of the Automotive Stereo Camera industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive stereo camera market growth of industry companies

We can help! Our analysts can customize this automotive stereo camera market research report to meet your requirements.