Automotive Ultracapacitor Market Size 2024-2028

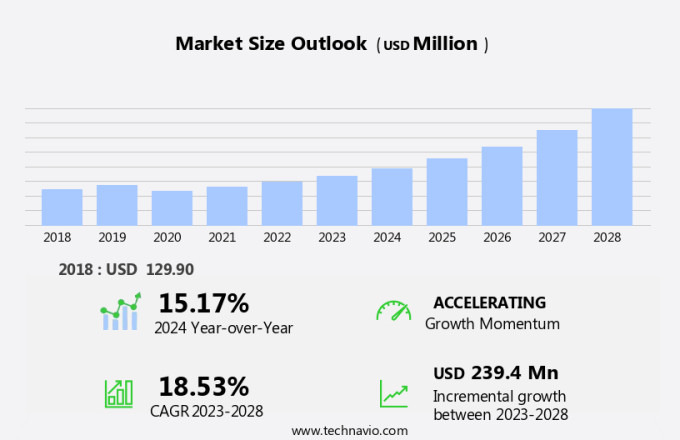

The automotive ultracapacitor market size is forecast to increase by USD 239.4 million, at a CAGR of 18.53% between 2023 and 2028.

- The market is witnessing significant growth due to the expanding electric vehicle (EV) industry. Ultracapacitors, also known as supercapacitors, are gaining popularity In the automotive sector due to their ability to charge and discharge rapidly, making them ideal for energy recovery and regenerative braking systems in EVs. Furthermore, there is an increasing focus on advanced ultracapacitors with higher energy density and power density, which can enhance vehicle performance and extend battery life. However, the high-cost burden associated with ultracapacitors remains a challenge for market growth. Despite this, the market is expected to experience steady growth In the coming years as technological advancements and economies of scale lead to cost reductions and improved performance.

What will be the Size of the Automotive Ultracapacitor Market During the Forecast Period?

- The market encompasses the production and application of energy storage devices, specifically ultracapacitors, In the automotive sector. Ultracapacitors, also known as supercapacitors, utilize electrostatic charge separation to store electrical energy. These devices offer several advantages in automotive applications, including regenerative braking and peak power assistance for Internal Combustion Engine (ICE) vehicles and electrified vehicles. Automotive ultracapacitors are gaining traction due to the increasing electrification of vehicles and the integration of autonomous driving technologies. EDLC radial supercapacitors, a type of ultracapacitor, provide lightweight, high-performance energy storage solutions for automotive electronics, enhancing vehicle performance and sustainability.

- Ultracapacitors complement batteries in electric and hybrid vehicles by providing quick energy release and absorbing excess energy during regenerative braking. The market's growth is driven by the demand for fuel efficiency, reduced greenhouse gas emissions, and the expanding electric vehicles market. Ultracapacitors contribute to the overall energy management system in vehicles, improving vehicle performance and extending the range of electric and hybrid vehicles.

How is this Automotive Ultracapacitor Industry segmented and which is the largest segment?

The automotive ultracapacitor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Double-layered capacitors

- Pseudo capacitors

- Hybrid capacitors

- Application

- Brake regeneration

- Start-stop operation

- Active suspension

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

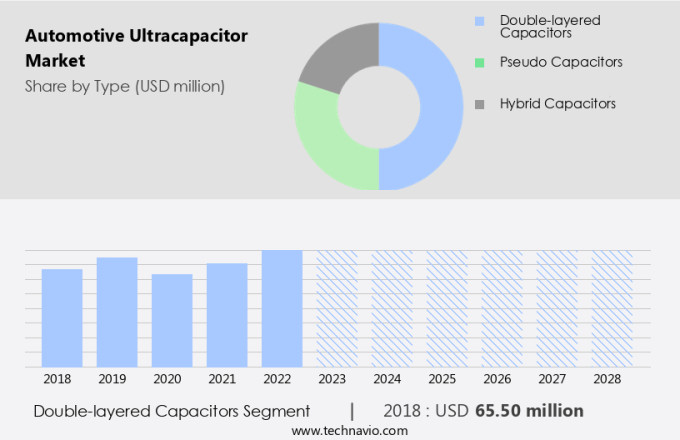

- The double-layered capacitors segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2023, with the double-layered capacitors or electric double-layered capacitors (EDLCs) segment leading in market size. EDLCs offer the energy storage capabilities of batteries and the power discharge characteristics of capacitors, making them ideal for electric and hybrid vehicles. The increasing demand for compact, energy-efficient storage solutions In the transportation sector, driven by the growing popularity of electric vehicles (EVs), contributed to the market expansion. According to the International Energy Agency (IEA), global sales of electric cars reached a record high in 2023, accounting for 18% of electric car sales, up from 4% in 2020.

Ultracapacitors play a crucial role in various automotive applications, including regenerative braking, peak power assistance, electric parking brake, power steering, turbocharger, and suspension systems. The electrification of vehicles, autonomous driving technologies, and emission regulations are key factors driving the market growth. Ultracapacitors provide high power density, fast charging capabilities, and long cycle life, making them an attractive energy storage solution for both electric and hybrid vehicles. The market is expected to continue expanding as the electrification of passenger cars, commercial vehicles, SUVs, hatchbacks, sedans, multi-purpose vehicles, light commercial vehicles, and large commercial vehicles gains momentum.

Get a glance at the Automotive Ultracapacitor Industry report of share of various segments Request Free Sample

The double-layered capacitors segment was valued at USD 65.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

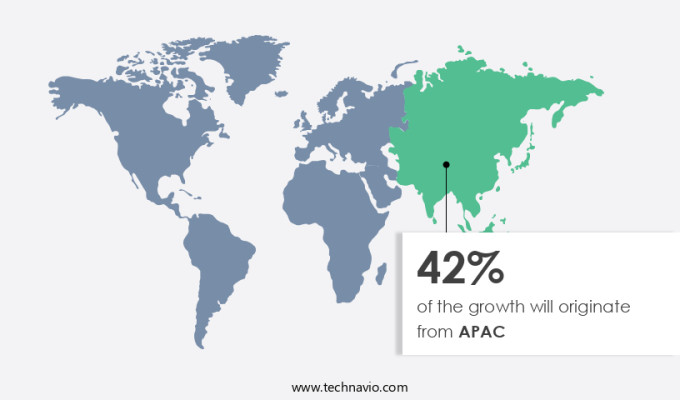

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing electrification of vehicles, particularly in Asia Pacific regions such as China and India. Government initiatives and supportive policies are driving the adoption of electric vehicles (EVs) and hybrid vehicles (HEVs) In these countries, with China being the leading market for EV inventory. The Chinese government's mandate for new energy vehicles (NEVs) and the extension of subsidies and tax breaks until 2022 have boosted the market. Ultracapacitors, also known as EDLC radial supercapacitors, are essential components in various automotive applications, including regenerative braking systems, electric parking brakes, power steering, turbochargers, and suspension systems.

Ultracapacitors offer high power density, fast charging capabilities, and long cycle life, making them ideal for automotive electronics and sustainability-focused initiatives. The ultracapacitor market is expected to grow as the automobile industry transitions towards electrification, fuel efficiency, and emission regulations. Ultracapacitors are also used in EV fast charging and mild hybrid systems, providing peak power assistance and energy storage solutions for electric passenger cars and commercial vehicles. The market growth is further fueled by the increasing demand for fuel-efficient vehicles and the rising gasoline prices, as well as the shift towards renewable energy applications and autonomous driving technologies.

Market Dynamics

Our automotive ultracapacitor market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Automotive Ultracapacitor Industry?

The growing EV automotive industry is the key driver of the market.

- The market is witnessing substantial growth due to the increasing adoption of energy storage devices in various automotive applications. Ultracapacitors, also known as EDLC radial supercapacitors, offer advantages such as high power density, fast charging capabilities, and long cycle life. These features make them an ideal energy storage solution for automotive applications, including regenerative braking systems, peak power assistance, and mild hybrid systems. Automotive ultracapacitors are used in both electric vehicles (EVs) and internal combustion engine (ICE) vehicles. In EVs, they provide additional power during acceleration and assist in fast charging. In ICE vehicles, they help in improving vehicle performance by storing energy during regenerative braking and providing power to auxiliary systems, such as electric parking brakes, power steering, turbochargers, and suspension systems.

- The electrification of vehicles, including electric passenger cars, commercial vehicles, SUVs, hatchbacks, sedans, multi-purpose vehicles, light commercial vehicles, and large commercial vehicles, is driving the demand for automotive ultracapacitors. This trend is being fueled by factors such as emission regulations, electrification initiatives, and the increasing popularity of green technologies. Moreover, ultracapacitors are also used in autonomous driving technologies and renewable energy applications, further expanding their market potential. The market is expected to grow significantly during the forecast period, driven by the increasing demand for high performance supercapacitors in automotive electronics and the need for sustainability and fuel efficiency In the automobile market.

What are the market trends shaping the Automotive Ultracapacitor Industry?

Increasing focus on advanced ultracapacitors is the upcoming market trend.

- Ultracapacitors, a type of energy storage device based on Electrostatic charge separation, are gaining traction In the automotive industry due to their advantages in providing peak power assistance during the electrification of vehicles. Automotive applications of ultracapacitors include regenerative braking systems, mild hybrid systems, and electric parking brakes, among others. These systems help improve vehicle performance and reduce greenhouse gas emissions, aligning with sustainability and fuel efficiency initiatives. Advanced ultracapacitors, such as EDLC radial supercapacitors and high performance supercapacitors, offer benefits like lightweight, high mechanical strength, and elastic properties. The automotive industry, including OEMs, is investing In these ultracapacitors for use in electric and hybrid vehicles, passenger cars, commercial vehicles, and various automotive electronics.

- Ultracapacitors can also be used in renewable energy applications and thermal energy storage systems. Carbon nanotubes and graphene-based ultracapacitors are the focus of current research and development efforts due to their potential to store large amounts of energy and release it quickly. This can lead to significant improvements in vehicle performance, including power steering, suspension systems, and even turbochargers. Additionally, ultracapacitors can help reduce the dependence on fossil fuels and gasoline prices, contributing to the electrification of the automobile market. Emission regulations and electrification initiatives are driving the adoption of ultracapacitors in the automotive industry.

What challenges does the Automotive Ultracapacitor Industry face during its growth?

The high-cost burden is a key challenge affecting the industry growth.

- The market faces a significant challenge due to the high initial cost of ultracapacitors compared to batteries, which is a major barrier to their large-scale adoption In the automotive industry. Ultracapacitors, an energy storage device based on Electrostatic charge separation, are used in various automotive applications, including regenerative braking, peak power assistance, and mild hybrid systems. They offer advantages such as high power density, fast charging capabilities, and long cycle life. However, the cost of incorporating ultracapacitors in electric and hybrid vehicles ranges from USD 2,000 to USD 10,000 per kWh, which is almost ten times more expensive than batteries. This high cost is a major deterrent for Original Equipment Manufacturers (OEMs) and consumers.

- Moreover, the market for ultracapacitors is still in its nascent stages, with very few suppliers, and they have not been extensively tested in various applications. Despite these challenges, significant investments in research and development are expected to bring down the cost of ultracapacitors In the near future. The ultracapacitor market is poised to grow as the electrification of vehicles, including electric passenger cars, commercial vehicles, SUVs, hatchbacks, sedans, multi-purpose vehicles, light commercial vehicles, and large commercial vehicles, gains momentum due to factors such as emission regulations, electrification initiatives, and the need for fuel efficiency and sustainability. Ultracapacitors are also used in various automotive electronics, such as Electric Parking Brakes, Power steering, Turbochargers, Suspension systems, and Autonomous driving technologies.

- The market is expected to grow as the demand for high-performance energy storage solutions for electric and hybrid vehicles increases. The market for ultrcapacitors is also expected to expand in renewable energy applications, such as EV fast charging, as they offer advantages such as high power density, fast charging capabilities, and long cycle life. The market for ultracapacitors is expected to grow as the demand for lightweight, high-performance supercapacitors, such as EDLC radial supercapacitors, increases. The market for ultracapacitors is expected to grow as the demand for electric energy storage solutions for electric and hybrid vehicles increases.

Exclusive Customer Landscape

The automotive ultracapacitor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive ultracapacitor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive ultracapacitor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CAP XX Ltd.

- Cornell Dubilier Electronics Inc.

- Eaton Corp. Plc

- GODI India Pvt. Ltd.

- Kyocera Corp.

- LICAP Technologies Inc.

- LS MTRON Ltd.

- Nippon Chemi Con Corp.

- Panasonic Holdings Corp.

- Shanghai Aowei Technology Development Co. Ltd.

- Skeleton Technologies GmbH

- SPEL TECHNOLOGIES PVT. LTD.

- Systematic Power Manufacturing LLC

- TAIYO YUDEN Co. Ltd.

- TDK Corp.

- UCAP Power Inc.

- VINATech Co. Ltd.

- Yageo Corp.

- Yunasko Ltd.

- Zoxcell Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive industry is witnessing a significant shift towards electrification, with various types of electric vehicles (EVs) and hybrid vehicles gaining popularity due to their sustainability and fuel efficiency benefits. One of the essential components enabling the enhanced performance of these vehicles is energy storage devices. Among these, ultracapacitors have emerged as a viable alternative to traditional batteries due to their unique properties. Ultracapacitors, also known as supercapacitors, are energy storage devices that utilize electrostatic charge separation to store energy. They offer several advantages over batteries, including faster charging times, longer cycle life, and higher power density. These properties make ultracapacitors an ideal solution for automotive applications, particularly in hybrid and electric vehicles.

In the context of automotive applications, ultrcapacitors play a crucial role in various systems. For instance, they provide peak power assistance during acceleration, support regenerative braking systems, and power auxiliary loads such as electric parking brakes, power steering, and turbochargers. Additionally, ultracapacitors can be employed in active suspension systems to improve vehicle performance and enhance ride comfort. The electrification of vehicles, driven by emission regulations and electrification initiatives, is expected to fuel the demand for ultracapacitors in the automotive industry. While internal combustion engine (ICE) vehicles continue to dominate the market, the shift towards EVs and hybrid vehicles is gaining momentum.

Further, the growing popularity of EVs, particularly electric passenger cars, is expected to create significant opportunities for ultracapacitor manufacturers. Moreover, the integration of ultracapacitors in EVs offers several benefits. For instance, they can help improve the overall energy efficiency of EVs by recovering energy during braking and providing power during acceleration. Additionally, ultracapacitors can help reduce the size and weight of EV batteries, thereby improving the vehicle's range and overall performance. The market is expected to witness significant growth In the coming years due to the increasing demand for lightweight, high-performance energy storage solutions. The market is also expected to benefit from the growing adoption of autonomous driving technologies, which require high-power energy storage devices to support the various sensors and systems.

|

Automotive Ultracapacitor Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.53% |

|

Market growth 2024-2028 |

USD 239.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.17 |

|

Key countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Ultracapacitor Market Research and Growth Report?

- CAGR of the Automotive Ultracapacitor industry during the forecast period

- Detailed information on factors that will drive the Automotive Ultracapacitor Market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive ultracapacitor market growth of industry companies

We can help! Our analysts can customize this automotive ultracapacitor market research report to meet your requirements.