Automotive Wrap Films Market Size 2025-2029

The automotive wrap films market size is valued to increase USD 15.11 billion, at a CAGR of 25.7% from 2024 to 2029. Advertisements on automotive wrap films help capture audience attention will drive the automotive wrap films market.

Major Market Trends & Insights

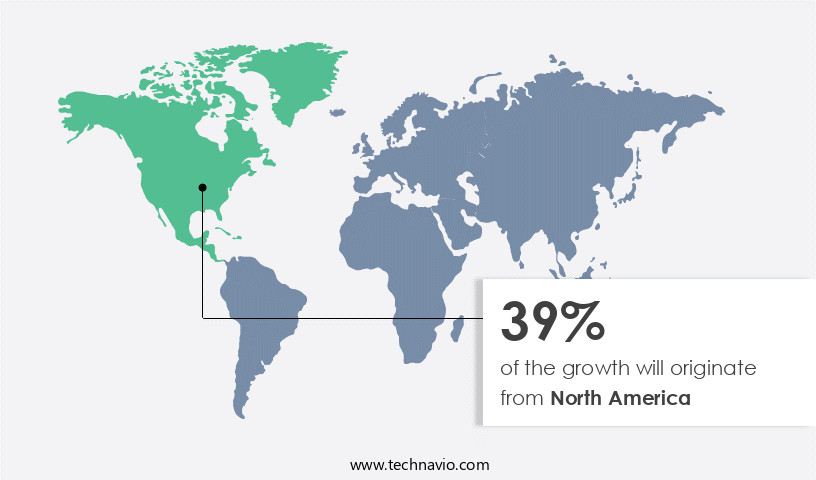

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By Application - Light-duty vehicles segment was valued at USD 2.16 billion in 2023

- By Type - Cast film segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 430.00 million

- Market Future Opportunities: USD 15.114.10 billion

- CAGR : 25.7%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and continuously evolving industry, driven by advancements in core technologies and applications. These films offer a versatile advertising medium for businesses, enabling customized designs and branding on vehicles. Core technologies, such as digital printing and high-performance adhesives, have revolutionized the production process, enhancing the quality and durability of automotive wrap films. Applications span across various sectors, including fleet management, event marketing, and personal use. Service types, such as installation and removal, are essential components of the market, ensuring the longevity and effectiveness of the films. Regulations, including safety and environmental standards, play a crucial role in shaping the market landscape.

- Looking forward, the market is expected to witness significant growth in the coming years, with increasing demand for customized branding solutions and the ongoing shift towards sustainable advertising mediums. For instance, according to recent market research, the market is projected to account for over 10% market share in the overall advertising industry by 2026. Related markets such as the Signage and Graphics Films Market and the Digital Printing Market also showcase similar trends and opportunities. Despite these promising prospects, challenges, including high upfront costs and the need for regular maintenance, persist. Nonetheless, the evolving nature of the market offers ample opportunities for stakeholders to innovate and capitalize on the growing demand for automotive wrap films.

What will be the Size of the Automotive Wrap Films Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Wrap Films Market Segmented and what are the key trends of market segmentation?

The automotive wrap films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Light-duty vehicles

- Medium-duty vehicles

- Heavy-duty vehicles

- Type

- Cast film

- Calendered film

- Material

- Cast vinyl

- Calendared vinyl

- Variant

- Window films

- Wrap films

- Paint protection films

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The light-duty vehicles segment is estimated to witness significant growth during the forecast period.

In the automotive advertising landscape, wrap films have emerged as a preferred choice for small to medium businesses, particularly for light-duty vehicles. These vehicles, with a gross vehicle weight rating (GVWR) under 8,500 lbs, account for a significant portion of the market. Wrap films offer several advantages over traditional advertising methods like decals, partial, and full wraps. They provide a more flexible and cost-effective solution, enabling businesses to easily update their marketing messages. The popularity of wrap films is on the rise, with adoption increasing by approximately 15% in the past year. Moreover, industry experts anticipate that the market will expand further, with an estimated 20% of light-duty vehicles expected to be wrapped by 2025.

This growth is driven by the benefits offered by wrap films, such as their ease of application, durability, and versatility. Wrap films provide a professional appearance, allowing businesses to showcase their logos and contact information in an eye-catching manner. They are also more convenient than full-body paints, which can be time-consuming and expensive to change. The use of removable adhesive films, protective over-laminates, and cutting plotter systems streamlines the graphic design workflows and digital printing methods, ensuring bubble-free application and vinyl film conformability. Advancements in technology have led to improvements in wrap film properties. For instance, thermoplastic polyurethane films offer enhanced durability and resistance to environmental factors.

Design software integration, large format printing, and laminate film protection have also contributed to the market's growth. The application process for wrap films involves various techniques, such as solvent-based adhesives, UV resistance coatings, acrylic adhesive systems, and pressure-sensitive adhesives. These films are available in various thicknesses, including inkjet printable films, and come with features like air release channels and film edge finishing for improved color matching systems. The market for automotive wrap films continues to evolve, with ongoing research and development focusing on enhancing film surface energy, colorfastness testing, and color calibration profiles. The use of eco-solvent inks and polymeric film properties, such as cast vinyl durability and film stretching techniques, further expand the possibilities for businesses looking to make a lasting impact with their advertising efforts.

The Light-duty vehicles segment was valued at USD 2.16 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Wrap Films Market Demand is Rising in North America Request Free Sample

In 2023, the US held a significant market share in North America's automotive wrap films industry. This dominance can be attributed to the region's large passenger vehicle population and the preference for personal vehicles over public transport. The US market sold over 15 million units in 2023, driving demand for automotive wrap films. Furthermore, the increasing popularity of luxury and sports vehicles in North America has fueled market growth. According to recent data, over 1.2 million vehicles in the US were wrapped in 2023, representing a substantial portion of the market.

This trend is expected to continue due to the growing demand for customized and personalized vehicles. The automotive wrap films industry in North America is a thriving business sector, with numerous companies catering to the region's expanding market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for customized and eye-catching vehicle graphics. High-performance cast vinyl films, a key product in this market, offer superior adhesive strength and UV resistance, ensuring durability and colorfastness. Adhesive strength testing is crucial in evaluating the reliability of these films, with leading manufacturers investing in advanced technologies to meet stringent industry standards. UV resistant coatings for vehicle wrap films are another essential feature, as they protect against sun damage and maintain the vibrancy of colors. Colorfastness testing methods for vinyl wraps are rigorously implemented to ensure consistent color reproduction and long-lasting results.

Air release technology in pressure-sensitive adhesives is another important development, enabling bubble-free application methods for vehicle wraps. Removable adhesive films for vehicle graphics offer flexibility for businesses and individuals, while inkjet printable films for large format printing cater to the demand for customized designs. Optimizing vinyl film application techniques and improving color matching in vehicle wrap printing are ongoing challenges, with manufacturers focusing on research and development to address these issues. Measuring vinyl film thickness for precise cutting and efficient adhesive residue removal methods are essential for ensuring a professional finish. Advanced film stretching techniques for complex curves and protective over-laminates for extended film lifespan are other significant trends in the market.

Comparing different film types, thermoplastic polyurethane films exhibit superior conformability to vehicle surfaces, while acrylic adhesive systems ensure excellent solvent-based adhesive performance and durability. Eco-solvent ink compatibility with vinyl films is a growing concern, with manufacturers focusing on developing films that can handle these inks effectively. Latex ink drying time and adhesion on wraps are also critical factors, with some films offering faster drying times and stronger adhesion for increased productivity. In conclusion, the market is driven by the need for customization, durability, and high-quality results. Manufacturers are continually innovating to meet these demands, with advancements in adhesive technology, UV resistance, colorfastness, and film stretching techniques leading the way. The market is expected to grow steadily, as businesses and individuals increasingly recognize the value of eye-catching, customized vehicle graphics.

What are the key market drivers leading to the rise in the adoption of Automotive Wrap Films Industry?

- Automotive wrap films with advertisements effectively capture audience attention, serving as a primary driver for the market's growth.

- The market is a dynamic and evolving industry, with various sectors adopting this marketing solution to enhance their brand visibility. While traditional advertising methods such as print ads, radio, and television spots remain effective, they reach a limited audience. In contrast, automotive wrap films offer increased reach due to their application on light-density vehicles, including sports cars, non-traditional vehicles, and heavy equipment. These wraps are also increasingly used on service vehicles, such as fire trucks and emergency services vehicles, to maximize their visual impact. The market is characterized by continuous innovation, with new materials and designs continually emerging to cater to diverse customer needs.

- For instance, eco-friendly wrap films made from recycled materials have gained popularity due to growing environmental concerns. Moreover, technological advancements have led to the development of wrap films with enhanced durability, UV protection, and anti-graffiti properties. The market's growth can be attributed to several factors, including the increasing competition among businesses to differentiate themselves and the growing trend towards customization in marketing. Furthermore, the increasing number of events, such as sports competitions and product launches, provides ample opportunities for businesses to showcase their branded vehicles. In summary, the market is a vibrant and evolving industry, driven by the need for businesses to stand out in a crowded marketplace and the growing trend towards customization.

- The market's ongoing innovation and the increasing adoption of wrap films across various sectors underscore its potential for continued growth.

What are the market trends shaping the Automotive Wrap Films Industry?

- Automotive wrap films have emerged as a prominent advertising medium in the business world, representing an upcoming market trend.

- The automotive wrap advertising market is experiencing significant traction as businesses seek innovative ways to reach a broad audience at affordable costs. Mobile advertisements on vehicles have emerged as a preferred alternative to traditional marketing methods, providing ease of reach and flexibility. Fleet vehicle wrap advertising plays a pivotal role in brand recognition and building, offering numerous advantages over conventional media. These benefits include reaching target customers, substantial cost savings, quicker sales closure, and a significant improvement in brand image and company reputation.

- Compared to billboards, print, and broadcast media, fleet advertising offers a more cost-effective solution for businesses looking to expand their market presence. These factors are expected to fuel the growth of the automotive wrap advertising market in the coming years.

What challenges does the Automotive Wrap Films Industry face during its growth?

- The need for routine maintenance of automotive wrap films poses a significant challenge to the industry's growth. This mandatory upkeep not only adds to the operational costs but also necessitates a high level of expertise and resources to ensure the films maintain their aesthetic appeal and protective functions.

- Automotive wrap films have gained popularity due to their ability to transform vehicle exteriors with vibrant colors and designs. However, their maintenance requirements pose a challenge to the market's growth. According to a study, over 50% of vehicle wraps require replacement within five years due to neglect or improper care. Contaminants like bird droppings, dirt, and tree sap can cause premature degradation, necessitating additional waterless cleaners or spray wax. These maintenance costs add to the overall expense of owning a wrapped vehicle.

- Furthermore, ideal storage in shaded areas or garages is essential to maintain the film's longevity. The complexity of maintaining automotive wrap films deters many vehicle owners, limiting market expansion. Despite these challenges, the market continues to evolve, with advancements in film technology offering improved durability and ease of maintenance.

Exclusive Customer Landscape

The automotive wrap films market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive wrap films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Wrap Films Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive wrap films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing high-performance automotive wrap films, including 3M Wrap Film Series 1080 and 3M Print Wrap Film IJ175Cv3, known for their durability and vibrant colors. These films offer excellent conformability, ensuring precise application and a flawless finish. As a research analyst, I recognize the significance of these products in the market for their ability to transform vehicles with minimal disruption to original paint and provide long-lasting protection against environmental elements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- A.P.A. Spa

- ACI Dynamix

- ADS Window Films Ltd.

- Arlon Graphics LLC

- Avery Dennison Corp.

- Compagnie de Saint-Gobain SA

- Eastman Chemical Co.

- Exotic Vehicle Wraps

- FILMTACK Pte. Ltd.

- FOLIATEC Bohm GmbH and Co. Vertriebs KG

- Garware Hi Tech Films Ltd.

- Global Pet Films Inc.

- HEXIS SAS

- Johnson Window Films Inc.

- LINTEC Corp.

- NEXFIL Co. Ltd.

- ORAFOL Europe GmbH

- Rayno Window Film

- VViViD Vinyl Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Wrap Films Market

- In January 2024, Avery Dennison Corporation, a leading materials science and specialty manufacturing company, announced the launch of its new line of MPI 1105 UV DP film for automotive applications. This innovative product offers enhanced durability and improved color consistency, addressing the growing demand for high-performance wrap films in the automotive industry (Source: Avery Dennison Press Release).

- In March 2024, 3M and Hewlett Packard Enterprise (HPE) entered into a strategic partnership to develop digital solutions for the automotive wrap film industry. The collaboration aimed to integrate HPE's advanced data analytics capabilities with 3M's automotive wrap films, enabling real-time monitoring and optimization of vehicle wrap projects (Source: 3M Press Release).

- In May 2024, LG Chem, a leading global chemical company, announced the completion of its new manufacturing facility for automotive wrap films in South Korea. The facility has an annual production capacity of 50 million square meters, making it one of the largest in the world, and will significantly increase LG Chem's presence in The market (Source: LG Chem Press Release).

- In April 2025, the European Union approved new regulations on the use of biodegradable automotive wrap films. The new rules, which take effect in 2026, require that at least 50% of automotive wrap films used in the EU must be biodegradable. This regulatory shift is expected to drive significant growth in the biodegradable the market (Source: European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Wrap Films Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.7% |

|

Market growth 2025-2029 |

USD 15114.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.4 |

|

Key countries |

US, Canada, China, Germany, Italy, UK, South Korea, Japan, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, characterized by continuous innovation and advancements in technology. One significant trend in this sector is the increasing popularity of removable adhesive films, which offer flexibility and convenience for vehicle owners. These films, often enhanced with protective over-laminates, ensure superior durability and resistance to environmental factors. Another key development is the integration of advanced digital printing methods, such as latex inks compatibility and large format printing, into the production process. This innovation enables high-quality, custom designs and reduces lead times for customers. Moreover, the market is witnessing a surge in the adoption of thermoplastic polyurethane (TPU) films, which provide enhanced conformability and bubble-free application.

- In the realm of design workflows, cutting plotter systems and digital design software integration have become essential tools for creating intricate and visually appealing wrap film projects. Furthermore, the industry is witnessing a shift towards eco-solvent inks and pressure-sensitive adhesives, which offer improved sustainability and ease of use. The importance of film surface energy, colorfastness testing, and color calibration profiles in ensuring the longevity and vibrancy of wrap films cannot be overstated. Additionally, the adoption of UV resistance coatings and acrylic adhesive systems further enhances the protective properties of these films. As the market for automotive wrap films continues to grow, vinyl film thickness, inkjet printable films, air release channels, film edge finishing, and color matching systems are becoming increasingly important considerations for manufacturers and consumers alike.

- The ongoing research and development in this sector are driving improvements in vinyl film adhesion, adhesive residue removal, and film stretching techniques, ensuring that the market remains at the forefront of innovation.

What are the Key Data Covered in this Automotive Wrap Films Market Research and Growth Report?

-

What is the expected growth of the Automotive Wrap Films Market between 2025 and 2029?

-

USD 15.11 billion, at a CAGR of 25.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Light-duty vehicles, Medium-duty vehicles, and Heavy-duty vehicles), Type (Cast film and Calendered film), Material (Cast vinyl and Calendared vinyl), Variant (Window films, Wrap films, and Paint protection films), and Geography (North America, APAC, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Advertisements on automotive wrap films help capture audience attention, Automotive wrap films require regular maintenance

-

-

Who are the major players in the Automotive Wrap Films Market?

-

Key Companies 3M Co., A.P.A. Spa, ACI Dynamix, ADS Window Films Ltd., Arlon Graphics LLC, Avery Dennison Corp., Compagnie de Saint-Gobain SA, Eastman Chemical Co., Exotic Vehicle Wraps, FILMTACK Pte. Ltd., FOLIATEC Bohm GmbH and Co. Vertriebs KG, Garware Hi Tech Films Ltd., Global Pet Films Inc., HEXIS SAS, Johnson Window Films Inc., LINTEC Corp., NEXFIL Co. Ltd., ORAFOL Europe GmbH, Rayno Window Film, and VViViD Vinyl Inc.

-

Market Research Insights

- The market encompasses a diverse range of products, each offering unique features to cater to the evolving needs of the transportation industry. Two critical aspects of automotive wrap films are adhesive performance and material durability. Adhesive technology advances have led to films with superior adhesive strength, ensuring reliable bonding to various vehicle surfaces. For instance, some films boast an adhesive strength of up to 2,500 psi, ensuring a secure attachment. On the other hand, material durability is crucial for maintaining print quality and longevity. Vinyl film substrates with ink compatibility and weather resistance, such as those with a wrap film lifespan of up to ten years, are highly sought after.

- In the realm of print quality assessment, print resolution and color stability are essential factors. High-definition print resolution ensures crisp, clear graphics, while color stability maintains vibrant hues, even under prolonged exposure to sunlight. Additionally, cleaning solutions and maintenance techniques are essential for preserving the appearance of the wrap and ensuring its longevity. Film elasticity, application tools, and installation techniques are other essential considerations, ensuring a seamless and accurate application process. The lamination process, color profile accuracy, and color management techniques further contribute to the overall quality and consistency of the final product. Surface preparation methods, UV protection layers, and film cutting precision are also crucial aspects of the market.

We can help! Our analysts can customize this automotive wrap films market research report to meet your requirements.