Baby Powder Market Size 2024-2028

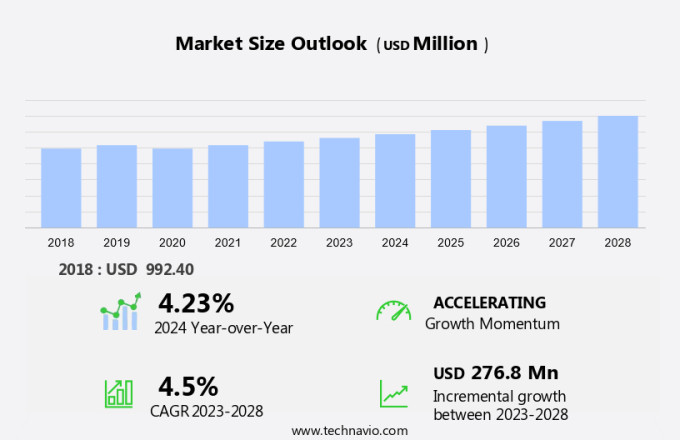

The baby powder market size is forecast to increase by USD 276.8 million at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by increasing parental awareness towards the importance of safe and gentle baby care products. Parents are prioritizing natural deodorants and talc-free alternatives due to concerns over the potential harmful chemicals in traditional baby powders. These natural alternatives offer not only deodorizing properties but also soothing and moisturizing benefits for infants' delicate skin.

The market is witnessing innovative packaging trends to enhance consumer convenience and ensure a clean and hygienic application process. Additionally, the demand for nontoxic ingredients is on the rise, as parents prioritize their babies' health and wellbeing. These trends are expected to continue shaping the market in the US.

Market Analysis

The market is witnessing significant shifts as consumers prioritize safety and natural ingredients for their little ones. Talc-based baby powders, long a staple in diaper bags, face growing concerns regarding potential health risks, including carcinogenic properties. In response, talc-free alternatives, such as cornstarch-based powders, are gaining traction. Natural ingredients, including essential oils, are increasingly preferred, with organic baby powders and plant-based formulations becoming more popular. Premiumization is a key trend, as parents are willing to pay a premium for eco-friendly packaging, sustainable sourcing, and organic formulations.

Moreover, online purchases dominate the market, with online platforms offering a wide range of options. Social media influence plays a significant role in consumer decision-making, with parents seeking recommendations from trusted sources. Safety concerns, particularly those related to talc-based products and talcum powder, continue to shape market trends. Hypoallergenic and eco-friendly options cater to the growing demand for products that minimize the risk of diaper rash and offer peace of mind for parents.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- Europe

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

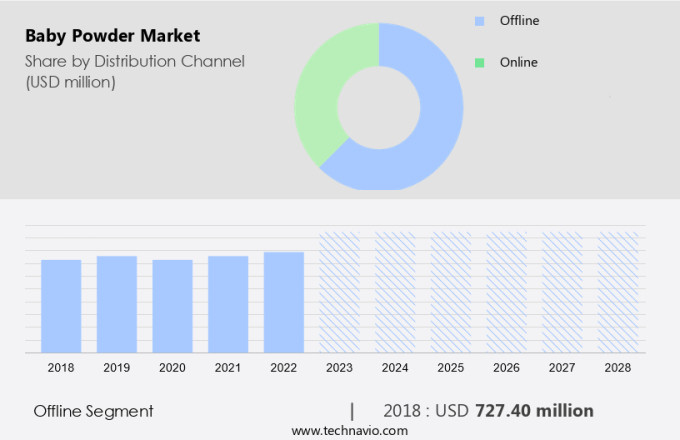

The offline segment is estimated to witness significant growth during the forecast period. In the market, offline distribution channels held the largest market share in 2023. Specialty stores, hypermarkets, supermarkets, convenience stores, and drug stores are the primary offline channels contributing significantly to the industry's growth. Consumers prefer these channels for their hands-on experience and extensive product offerings. Specialty stores, in particular, are popular for their diverse range of baby care products, including baby powders, baby shampoos, and more. These stores stock a wide array of brands, catering to various consumer preferences. Some consumers opt for organic baby powders infused with natural ingredients like lavender, almond, or olive oils. Others may choose plant-based baby powders made from organic ingredients for their eco-consciousness and premium quality.

Similarly, social media influence and online platforms have also impacted the market, but offline channels continue to dominate due to their tangible benefits. As consumers prioritize the well-being of their children, they value the ability to touch, feel, and compare products before making a purchase. This personal interaction is a crucial factor in the decision-making process, making offline channels an essential component of the market.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 727.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) has witnessed significant expansion due to factors such as rising disposable income, growing customer consciousness, and a decrease in child mortality rates. Key players in this region include Johnson and Johnson and Himalaya. India and China are major contributors to the market's growth, with stable birth rates presenting substantial opportunities. The region's expanding middle class and the rise of organized retailing for consumer essentials like baby powders are further driving market growth. Moreover, there is a rising trend towards organic and plant-based baby powders, with consumers preferring products made from lavender, almond, and olive oils.

Moreover, organic ingredients are increasingly popular, as parents seek premium baby care products for their children. Online platforms and social media influence have also played a crucial role in shaping consumer preferences and driving sales. Overall, the market in APAC is poised for continued growth in the coming years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing parents' awareness about baby care products is the key driver of the market. The demand for baby powder continues to grow as parents seek to protect their newborns' delicate skin from infections and rashes. Talc-based baby powders have long been a popular choice due to their ability to absorb moisture and reduce friction. However, concerns over the potential health risks associated with talc have led to an increase in the use of talc-free alternatives, such as cornstarch-based powders. These natural alternatives offer peace of mind for parents, as they contain essential oils and other gentle ingredients. With the birth rate decreasing in many developed countries, the market is experiencing a shift towards online sales.

Moreover, parents are increasingly making purchases online for the convenience and accessibility it offers. Parents are becoming more aware of the importance of using natural ingredients in baby care products, and this trend is expected to continue. As a result, companies are investing in research and development to create talc-free and cornstarch-based baby powders with natural fragrances and essential oils. These products offer parents the peace of mind they need, knowing that they are using safe and effective products for their babies.

Market Trends

The availability of baby care kits is the upcoming trend in the market. Parents prioritize using a range of baby care products, such as lotions, creams, oils, powders, and cleansing supplies, to cater to their infants' unique skin requirements. Baby powders, specifically, have been a popular choice due to their ability to absorb moisture and prevent diaper rashes.

However, with increasing health concerns and the birth rate decrease, there is a growing demand for talc-free alternatives like cornstarch-based powders. companies in the global market cater to this trend by offering comprehensive baby care kits, which include talc-free baby powders, baby oils, and lotions, to meet the diverse needs of parents. For example, Johnson & Johnson's Baby Care Collection provides a kit containing organic cotton bib, baby comb, baby soap, baby powder, and baby oil.

Market Challenge

The availability of substitutes is a key challenge affecting the market growth. Baby powder, traditionally made from talc, has been a staple in the baby care market for decades. However, concerns regarding the potential health risks associated with talc-based baby powders have led to a shift in consumer preferences towards talc-free alternatives. Cornstarch-based baby powders and those infused with natural ingredients, such as essential oils, have gained popularity.

As a result, the demand for baby powders has decreased, and baby creams and lotions have emerged as viable alternatives. These semi-liquid baby care products do not scatter particles and pose no risk of inhalation, making them a safer choice for babies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amishi Consumer Technologies Pvt. Ltd. - The Chicco brand provides baby powder options, including talcum powder, in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Artsana Spa

- Bridges Consumer Healthcare LLC

- Burts Bees

- California Baby

- Church and Dwight Co. Inc.

- CITTA

- earthBaby

- FREZYDERM SA

- GAIA Skin Naturals

- Himalaya Global Holdings Ltd.

- Honasa Consumer Pvt. Ltd.

- Johnson and Johnson Services Inc.

- Lotus Herbals Pvt. Ltd.

- Mother Sparsh

- Mountain Valley Springs India Pvt. Ltd.

- Natures Baby Organics

- Prestige Consumer Healthcare Inc.

- Sebapharma GmbH and Co. KG

- Simply Pure Products

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Baby powder, a staple in infant care and personal hygiene, comes in two main varieties: talcbased and talcfree, with cornstarch-based powders being a popular alternative. The market has seen a shift towards natural and organic formulations, driven by increasing health consciousness and safety concerns. Essential oils, such as lavender and almond, are added to some baby powders for their soothing properties. Birth rate decrease and changing consumer preferences have led to an increase in online purchases, with e-commerce platforms and social media influencers driving brand visibility. Talc safety concerns, including carcinogenic risks, have led to a rise in demand for talcfree baby powders.

Moreover, premiumization is a key trend in the consumer products industry, with parents seeking safe and gentle, eco-friendly packaging and sustainable sourcing in their baby powder choices. Innovative product formulations, such as those using olive oils for moisturization, and packaging designs that control odor and reduce friction, are also gaining popularity. The ecommerce industry's growth has led to an increase in online platforms for baby powder sales, making it easier for parents to access a wide range of products. Skin allergies, diaper rash, and other skin issues are common concerns for parents, and baby powders that offer moisturization, skin soothing, and deodorizing properties are in high demand. Nontoxic ingredients and harmless packaging are also important considerations for health-conscious parents.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 276.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 38% |

|

Key countries |

US, China, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amishi Consumer Technologies Pvt. Ltd., Artsana Spa, Bridges Consumer Healthcare LLC, Burts Bees, California Baby, Church and Dwight Co. Inc., CITTA, earthBaby, FREZYDERM SA, GAIA Skin Naturals, Himalaya Global Holdings Ltd., Honasa Consumer Pvt. Ltd., Johnson and Johnson Services Inc., Lotus Herbals Pvt. Ltd., Mother Sparsh, Mountain Valley Springs India Pvt. Ltd., Natures Baby Organics, Prestige Consumer Healthcare Inc., Sebapharma GmbH and Co. KG, and Simply Pure Products |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch