Backhoe Loaders Market Size 2024-2028

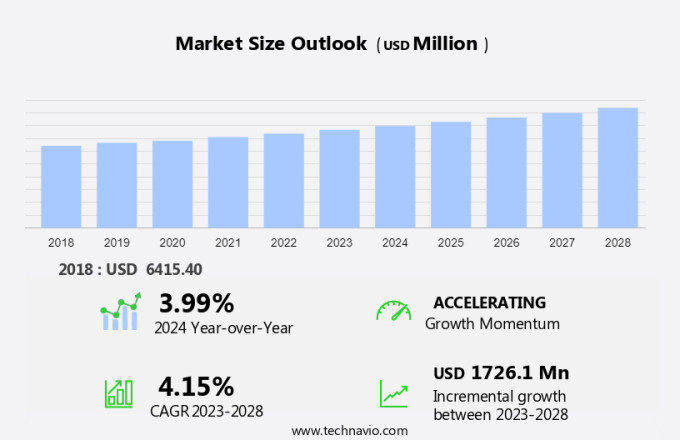

The backhoe loaders market size is forecast to increase by USD 1.73 billion at a CAGR of 4.15% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing investment in natural gas pipeline projects and infrastructure development. This trend is expected to continue as governments and private entities prioritize infrastructure expansion. Another key trend is the increasing use of telematics in backhoe loaders, enabling remote monitoring and diagnostics, improving efficiency and productivity. However, the market faces challenges, including the volatility in raw material prices, which can impact the cost of production and profitability for manufacturers. Additionally, the market is witnessing intense competition, necessitating continuous innovation and differentiation to stay competitive. Overall, the market is poised for growth, driven by construction, infrastructure development and technological advancements, while navigating the challenges of raw material price volatility and intense competition.

What will be the Size of the Market During the Forecast Period?

- Backhoe loaders, also known as diggers or JCBs, are heavy digging equipment that combine the functions of a shovel and a backhoe in one machine. These versatile machines are essential in various industries, including construction, urban engineering, and mining. The backhoe component of the machine is used for material excavation, digging, and demolitions, while the shovel is used for transporting building materials. Backhoe loaders are equipped with turbocharged engines, rugged tires, and a simple cabin. The boom, bucket, and stick are the primary components that enable the machine's digging and lifting capabilities. These machines are widely used in building equipment for construction sites, public infrastructure development, and private infrastructure development.

Backhoe loaders are also used in landscaping projects for digging and transporting soil. In the mining sector, they are used for digging and loading materials for transportation. The durability of the tires and the machine's structure make it suitable for rough terrain and heavy-duty applications. Overall, backhoe loaders are an essential piece of equipment in various industries, enabling efficient and productive work in material excavation, transporting building materials, and digging.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Side shift

- Center-pivot

- Application

- Construction

- Utility

- Agriculture

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Product Insights

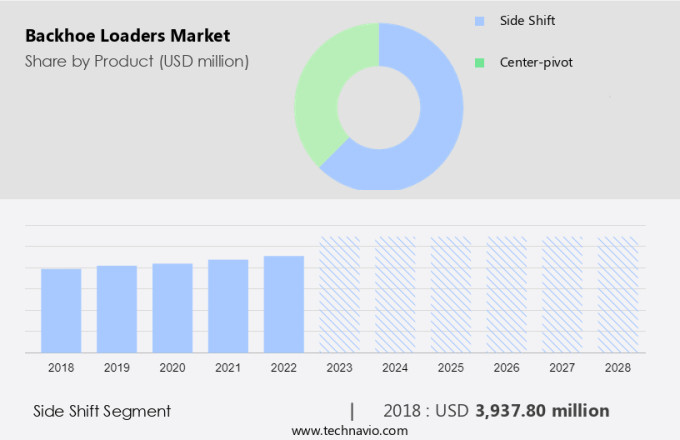

- The side shift segment is estimated to witness significant growth during the forecast period.

Backhoe loaders, also known as diggers or heavy digging equipment, are versatile building equipment characterized by a backhoe, a shovel, and a bucket attached to an arm that can be extended and retracted. This hydraulic excavator is essential for urban engineering projects, where its turbocharged engine, rugged tires, and basic cabin enable efficient material excavation and transporting building materials. In smart cities, backhoe loaders are employed for infrastructure repair and construction, while in the agricultural sector, they are used for land preparation and material handling. Autonomous operating technology, telematics, and GPS systems are increasingly being integrated into these machines to enhance productivity and adhere to emission standards.

Further, the center mount, sideshift, and various attachments cater to diverse applications, including construction, mining, utility, agriculture, forestry, demolitions, paving pads, and landscaping. Price wars among leading manufacturers continue to intensify, making it crucial for buyers to consider factors like durability, simple cabin design, boom length, and tire type before making a purchase.

Get a glance at the market report of share of various segments Request Free Sample

The side shift segment was valued at USD 3.94 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Backhoe loaders are versatile heavy equipment machines used for transporting and loading various building materials, making them indispensable in the construction industry. The global construction sector, including public infrastructure development and private infrastructure development, significantly relies on backhoe loaders for projects such as urban highways, power projects, and utility sector works. The mining sector and agriculture sector also benefit from these machines in material handling and site preparation. Moreover, backhoe loaders play a crucial role in disaster response sectors and telecommunications sector for emergency excavation and digging tasks. In the mining segment, backhoe loaders are used for road construction activities and material handling in open-pit mines.

Further, compact wheel loaders and mini excavators are smaller versions of backhoe loaders, catering to small construction projects and tight workspaces. Equipment rental services have made backhoe loaders accessible to a broader audience, making them an economical choice for various applications. Operator-friendly features and advanced technology enhance productivity and efficiency, ensuring a high return on investment. Incentives and government initiatives further boost the market growth of backhoe loaders.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Backhoe Loaders Market?

Growing investment in natural gas pipeline projects is the key driver of the market.

- The Backhoe, a versatile digging machine, is a popular heavy digging equipment used extensively in various industries, including construction, mining, utility, agriculture, forestry, and infrastructure repair. It is commonly referred to as a digger or a shovel loader, characterized by its back-mounted hydraulic excavator arm. The backhoe's boom, stick, and bucket facilitate material excavation, transporting building materials, and digging. In urban engineering, backhoes are essential for paving pads, demolitions, and highway projects. Advancements in backhoe loader technology include turbocharged engines, rugged tires, and basic cabins. Smart cities' development necessitates the adoption of autonomous operating technology, telematics, and GPS systems.

- Backhoes in the agricultural sector are increasingly using durable tires and a simple cabin. Emission standards are driving the development of more eco-friendly backhoes. The center mount and sideshift designs offer enhanced versatility. The price wars among manufacturers ensure competitive pricing, making backhoes an affordable building equipment option. The market is expected to grow significantly due to the increasing demand for infrastructure development, urbanization, and agricultural modernization.

What are the market trends shaping the Backhoe Loaders Market?

Increasing use of telematics in backhoe loaders is the upcoming trend in the market.

- Backhoe loaders, also known as diggers or heavy digging equipment, have become indispensable tools in various industries such as construction, mining, utility, agriculture, forestry, and infrastructure repair. These versatile machines, equipped with a backhoe, shovel, boom, bucket, stick, and paving pads, are used for digging, material excavation, transporting building materials, demolitions, and paving projects. With the increasing focus on smart cities and urban engineering, backhoe loaders are being increasingly utilized in the construction sector for highway projects and landscaping. Modern backhoe loaders come with advanced features such as turbocharged engines, rugged tires, basic cabins, hydraulic excavators, and autonomous operating technology.

- Telematics, including GPS systems, are increasingly being adopted as standard or optional features to enable fleet management and preventive maintenance scheduling. The agricultural sector is also a significant market for backhoe loaders, particularly for material excavation and transportation. The growing demand for backhoe loaders in the construction industry, particularly in Asia, the Middle East, and Africa, has led to an increase in fleet sizes. This trend has made telematics essential for fleet owners to monitor the location and run time of their equipment, optimize fuel consumption, and ensure compliance with emission standards. The competition in the market is intense, with price wars among manufacturers, making it crucial for companies to offer durable tires, simple cabins, and advanced features to differentiate themselves.

What challenges does Backhoe Loaders Market face during the growth?

Volatility in raw material prices is a key challenge affecting the market growth.

- Backhoe loaders, also known as diggers or heavy digging equipment, are essential building and material handling machines used extensively in various industries, including construction, mining, utility, agriculture, forestry, and infrastructure repair. These versatile machines, featuring a backhoe, shovel, boom, bucket, stick, and paving pad, are powered by turbocharged engines and equipped with rugged tires and a basic cabin. In urban engineering, backhoes play a crucial role in smart cities' development, material excavation, and transporting building materials. The agricultural sector also benefits significantly from backhoe loaders, particularly in material handling and land preparation tasks. However, the production cost of backhoe loaders is influenced by the price fluctuations of major raw materials, such as steel, hardened steel, and aluminum.

- These materials are integral to the manufacturing process, and their cost increases can directly impact the market price. For instance, the steel price wave in Europe and the US, reaching over USD 1,600 per ton in March 2022, was a result of the Russia-Ukraine conflict. To gain cost advantages, suppliers may increase the prices of raw materials. In the construction sector, backhoes are employed in demolitions, digging, and paving projects. Autonomous operating technology, telematics, GPS systems, and emission standards are increasingly being integrated into backhoe loaders to enhance their functionality and efficiency. The durable tires and simple cabin designs cater to the demanding requirements of various industries, ensuring optimal performance and operator comfort.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Action Construction Equipment Ltd.

- Bull Machines Pvt Ltd.

- C M Engineering Works

- Caterpillar Inc.

- China National Machinery Industry Corp. Ltd.

- CNH Industrial N.V.

- Cukurova Makina

- Deere and Co.

- Doosan Corp.

- Groupe Mecalac SAS

- Guangxi Liugong Machinery Co. Ltd.

- Hitachi Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- Mahindra and Mahindra Ltd.

- Manitou BF SA

- PREET Group

- Shandong Lingong Construction Machinery Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Backhoe loaders, also known as diggers or heavy digging equipment, are versatile building equipment that combine the functions of a shovel and a backhoe in one machine. These rugged machines are essential for various industries, including construction, mining, utility, agriculture, forestry, and infrastructure repair. A backhoe loader is typically equipped with a turbocharged engine, hydraulic excavators, and durable tires, making it ideal for heavy-duty tasks. In the urban engineering sector, backhoe loaders play a crucial role in smart cities' development. With the integration of autonomous operating technology, telematics, and GPS systems, these machines offer enhanced productivity and efficiency. In the agricultural sector, backhoe loaders are used for material excavation, transporting building materials, and land preparation.

Additionally, price wars among key market players, such as Caterpillar, Komatsu, and Volvo Construction Equipment, have led to the development of advanced features, including center mount, sideshift, and boom, bucket, and stick configurations. Backhoe loaders are also used for demolitions, paving pads, and digging in highway projects. Emission standards continue to evolve, driving the demand for backhoe loaders with low-emission engines. Overall, the backhoe loader market is expected to grow significantly due to its wide range of applications and the increasing demand for efficient and durable building equipment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.15% |

|

Market growth 2024-2028 |

USD 1.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.99 |

|

Key countries |

India, US, China, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch