Backup-As-A-Service Market Size 2025-2029

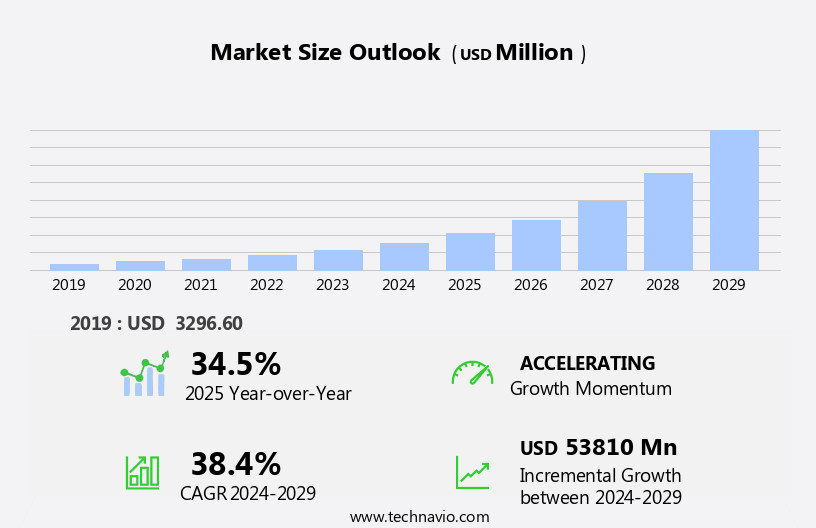

The backup-as-a-service market size is forecast to increase by USD 53.81 billion, at a CAGR of 38.4% between 2024 and 2029.

- The Backup-as-a-Service (BaaS) market is experiencing significant growth due to the increasing shift from capital expenditures to operational expenditures. Companies are recognizing the cost-effective advantages of outsourcing their data backup needs to third-party service providers. Additionally, the exponential growth in data volumes necessitates robust backup solutions to mitigate potential data loss risks. However, the implementation of BaaS comes with challenges. Failure during implementation can lead to significant downtime and loss of critical data, potentially damaging a company's reputation and bottom line.

- Therefore, service providers must prioritize seamless implementation processes and offer reliable, secure backup solutions to meet the evolving needs of their clients. Companies seeking to capitalize on the opportunities presented by the BaaS market must focus on delivering high-quality services, ensuring data security, and addressing implementation challenges effectively. Navigating these dynamics requires a strategic approach and a deep understanding of the market landscape.

What will be the Size of the Backup-As-A-Service Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The backup-as-a-service (BaaS) market continues to evolve, with dynamic market trends shaping its applications across various sectors. Hybrid cloud backup solutions enable businesses to protect their data by seamlessly integrating incremental backups, data protection, and storage capacity in a single, flexible package. Data replication ensures business continuity, while incident response capabilities address unexpected data loss. Virtual tape libraries and data deduplication optimize storage efficiency, reducing costs and enhancing data protection. Infrastructure-as-a-service (IaaS) offerings further extend BaaS capabilities, allowing for scalable, on-demand backup and disaster recovery solutions. The market's ongoing unfolding reveals a growing emphasis on data security, with API integrations, vulnerability assessments, and security audits becoming increasingly important.

Data lifecycle management, including retention policies and data archiving, ensures regulatory compliance and effective data governance. Cloud storage, object storage, and software-as-a-service (SaaS) applications integrate seamlessly with BaaS solutions, offering businesses a comprehensive data protection strategy. Platform-as-a-service (PaaS) and high availability solutions further enhance business continuity, ensuring uninterrupted access to critical applications and data. Cost optimization remains a key consideration, with automated backup, capacity planning, and differential backups playing essential roles in reducing costs and improving efficiency. The continuous evolution of BaaS market dynamics underscores its importance in today's data-driven business landscape.

How is this Backup-As-A-Service Industry segmented?

The backup-as-a-service industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Large enterprises

- SMEs

- Application

- Online backup

- Cloud backup

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

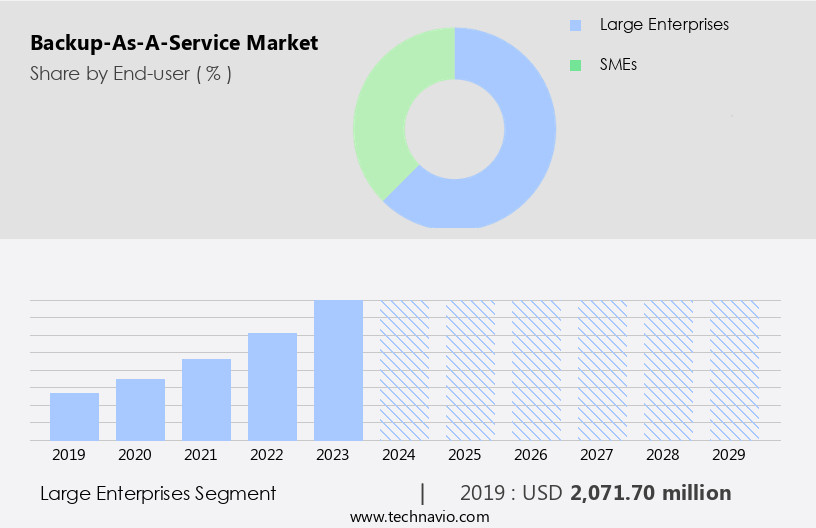

By End-user Insights

The large enterprises segment is estimated to witness significant growth during the forecast period.

Backup-as-a-service (BaaS) has emerged as a preferred solution for large enterprises, addressing the intricacies of managing vast amounts of data with scalable and comprehensive backup systems. BaaS providers offer enterprises the flexibility to accommodate their expanding data needs without the burden of acquiring and managing additional hardware. The increasing complexity of data protection, coupled with the benefits of outsourcing backup operations, fuels the demand for BaaS. Enterprises prioritize data resilience, cost-effectiveness, compliance, and operational efficiency, which BaaS solutions deliver effectively. BaaS encompasses various features such as backup verification, penetration testing, vulnerability assessments, data archiving, backup scheduling, disaster recovery, and data lifecycle management.

These solutions enable enterprises to optimize costs through techniques like data deduplication and incremental backups. BaaS offerings extend to hybrid cloud backup, ensuring data protection across multiple environments. Restore capabilities and incident response are critical components of BaaS, ensuring minimal downtime during data recovery. BaaS solutions integrate with APIs, software-as-a-service (SaaS), and infrastructure-as-a-service (IaaS) platforms for seamless application integration. Data security is a top priority, and BaaS providers implement security audits and encryption to safeguard sensitive data. On-premise backup and data migration are also supported by BaaS solutions, offering enterprises flexibility in their backup strategies.

Automated backup and retention policies ensure data protection adheres to industry regulations. Cloud-native backup and platform-as-a-service (PaaS) are the latest trends in BaaS, offering high availability and business continuity. Capacity planning and data governance are essential aspects of BaaS, ensuring enterprises maintain control over their data while leveraging the benefits of outsourced backup solutions.

The Large enterprises segment was valued at USD 2.07 billion in 2019 and showed a gradual increase during the forecast period.

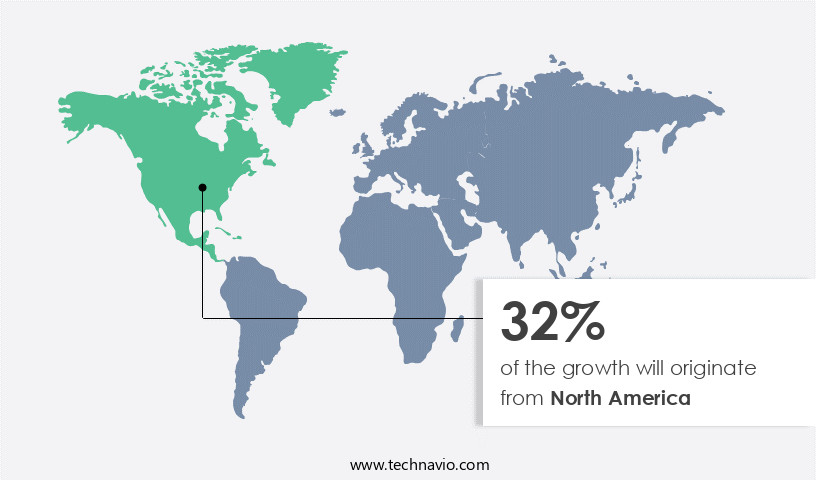

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the region's leadership in data generation and consumption, driven by the digital transformation fueled by interconnected technologies such as cloud solutions, mobility, Big Data, and social media. Advanced technologies like artificial intelligence (AI), machine learning (ML), virtualization, and cloud computing are creating numerous use cases for BaaS solutions. These technologies enable businesses to implement robust data protection strategies, including backup verification, scheduling, and disaster recovery. Additionally, BaaS offerings provide data archiving, data lifecycle management, and cost optimization through features such as differential and incremental backups, data deduplication, and capacity planning.

Furthermore, API integrations, security audits, and incident response capabilities ensure data security. Hybrid cloud backup solutions, on-premise backup, data migration, and automated backup are also essential components of the market. Platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS) offerings, along with high availability and business continuity solutions, cater to various industries' evolving data protection needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the ever-evolving digital landscape, the backup-as-a-service (BaaS) market continues to gain traction as businesses seek reliable and cost-effective data protection solutions. This cloud-based service offers businesses on-demand access to secure data backups, ensuring business continuity and disaster recovery. BaaS solutions leverage advanced technologies like incremental backups, deduplication, and compression to minimize storage requirements and optimize bandwidth usage. Additionally, they provide features such as automated backups, real-time monitoring, and remote data access, making them an indispensable tool for businesses of all sizes. The BaaS market caters to various industries, including healthcare, finance, education, and retail, offering customized solutions to meet their unique data protection needs. With the increasing adoption of digital transformation and the growing complexity of data, the BaaS market is poised for significant growth in the coming years.

What are the key market drivers leading to the rise in the adoption of Backup-As-A-Service Industry?

- The growing demand for operational expenditure (OPEX) models over capital expenditure (CAPEX) is a significant market trend, driven by the increasing need for flexibility, cost savings, and scalability in business operations.

- The Backup-as-a-Service (BaaS) market is experiencing significant growth due to the shift from capital expenditures (CAPEX) to operational expenditures (OPEX) in various industries. BaaS solutions offer clients a pay-per-use pricing model, providing flexibility and cost optimization. Deployment models for BaaS include Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS), allowing businesses to customize their infrastructure according to their needs. Industrial clients can choose from a range of BaaS services based on their budgets and requirements. One of the primary advantages of BaaS is the absence of upfront costs, a significant contrast to traditional on-premises IT infrastructure.

- BaaS solutions also provide added benefits such as backup verification, scheduling, data archiving, disaster recovery, api integrations, vulnerability assessments, and data lifecycle management. Differential backups ensure efficient use of storage space and cost savings. Overall, the flexibility, affordability, and comprehensive features of BaaS make it an attractive option for businesses seeking reliable data protection solutions.

What are the market trends shaping the Backup-As-A-Service Industry?

- Exponential growth in data volumes is an emerging market trend. This signifies a significant increase in the amount of data being generated and collected daily.

- In today's digital economy, the exponential growth of data from various sources presents enterprises with valuable assets for competitive advantage. However, many legacy data centers lack the capacity to manage and protect the vast amounts of data generated by modern applications and mobile devices. The inability to securely back up data in a distributed computing environment can be detrimental to businesses as they expand. To address this challenge, enterprises are turning to Backup-as-a-Service (BaaS) solutions. These offerings enable businesses to store and manage data in a secure, hybrid cloud environment, ensuring data protection and availability. BaaS solutions offer restore capabilities, incremental backups, data replication, and data deduplication.

- Additionally, they provide infrastructure-as-a-service (IaaS) and virtual tape libraries for efficient storage capacity management. Furthermore, BaaS solutions enable incident response and disaster recovery, ensuring business continuity during unexpected events. With advanced features like data deduplication and incremental backups, BaaS solutions offer cost savings and improved efficiency compared to traditional backup methods.

What challenges does the Backup-As-A-Service Industry face during its growth?

- The potential for failure during implementation poses a significant challenge to the industry's growth trajectory. It is crucial to address this issue with meticulous planning, robust implementation strategies, and continuous monitoring to mitigate risks and ensure successful project execution.

- The global Backup-as-a-Service (BaaS) market growth is influenced by several factors. On one hand, the increasing preference for cloud storage and Software-as-a-Service (SaaS) solutions is driving the demand for BaaS. On the other hand, concerns regarding data security and the complexity of implementation processes are acting as growth inhibitors. Security audits are a crucial aspect of implementing BaaS. Service providers must ensure that their solutions meet the clients' security requirements, including data encryption, access control, and compliance with industry standards. Full backups are essential for disaster recovery, and BaaS offers the advantage of automated backups, reducing the risk of human error.

- Object storage is another key feature of BaaS, enabling clients to store large amounts of data cost-effectively. Application integration is also important, as BaaS should be able to integrate seamlessly with various applications and systems. Data migration is a common challenge, and service providers must offer efficient and reliable solutions to help clients transition from on-premise backup to BaaS. Despite these advantages, the implementation process of BaaS can be complex. Service providers must manage various processes, including project management, vulnerability management, compliance, content management, event monitoring, access management, and managing huge servers and databases. The planning phase also requires careful consideration of the devices needed, their locations in the clients' architecture, and their proper configuration.

- In conclusion, while the benefits of BaaS are compelling, the implementation process can be complex, and service providers must address clients' concerns regarding data security and compliance to drive market growth.

Exclusive Customer Landscape

The backup-as-a-service market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the backup-as-a-service market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, backup-as-a-service market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acronis International GmbH - This company delivers backup-as-a-service solutions, including Acronis Cyber Protect Cloud and Acronis Cloud Storage, ensuring data security and recovery for businesses. Our offerings leverage advanced technologies to enhance data protection and minimize downtime. By prioritizing originality and search engine optimization, we help clients maintain business continuity and mitigate risks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acronis International GmbH

- Alphabet Inc.

- Amazon.com Inc.

- Arcserve USA LLC

- Broadcom Inc.

- Cisco Systems Inc.

- Commvault Systems Inc.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Insight Enterprises Inc.

- International Business Machines Corp.

- Microsoft Corp.

- NetApp Inc.

- NxtGen Datacenter and Cloud Technologies Pvt. Ltd.

- Quantum Corp.

- Rubrik Inc.

- Veeam Software Group GmbH

- Vembu Technologies Pvt. Ltd.

- Viatel Ireland Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Backup-As-A-Service Market

- In January 2024, IBM announced the launch of its new Backup-as-a-Service (BaaS) offering, IBM Cloud Object Storage, which provides automated backup and disaster recovery services for businesses (IBM Press Release, 2024). In March 2024, Microsoft entered into a strategic partnership with Acronis to integrate Acronis Cyber Protect cloud services into Microsoft 365, expanding Microsoft's BaaS offerings (Microsoft News Center, 2024).

- In May 2024, Veritas Technologies raised USD750 million in a funding round to accelerate its expansion in the BaaS market and invest in research and development (Veritas Technologies Press Release, 2024). In February 2025, Google Cloud Platform received approval from the European Commission to operate its BaaS services in the European Union, marking a significant geographic expansion for the company (Google Cloud Blog, 2025).

Research Analyst Overview

- The market is experiencing significant growth as businesses prioritize data protection and disaster recovery. Solid-state drives (SSDs) are increasingly being adopted for backup infrastructure due to their faster data transfer rates and improved reliability. Cloud-to-cloud backup solutions enable seamless backup and recovery of data across multiple cloud environments. Application-aware backup ensures consistent data protection for databases and virtual machines. Storage tiers, including disk storage, tape storage, and cloud storage, are utilized based on data access frequency and cost considerations. Network backup and endpoint backup safeguard against data loss from external threats. Risk assessment and business impact analysis are crucial components of backup strategies, ensuring data integrity and minimizing downtime.

- Backup management software facilitates centralized control and automation of backup processes. Multi-cloud backup and offsite backup provide redundancy and disaster recovery capabilities. Contingency planning and recovery testing are essential to ensure business continuity. Backup appliances, agentless backup, and image-level backup offer additional flexibility and efficiency. Data center backup, system recovery, and data center resilience are key concerns for organizations with large-scale IT infrastructure. Data compression and data consistency are essential features for optimizing backup infrastructure and maintaining data accuracy. Remote backup and physical server backup cater to the needs of organizations with distributed workforces and on-premises IT assets.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Backup-As-A-Service Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 38.4% |

|

Market growth 2025-2029 |

USD 53810 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

34.5 |

|

Key countries |

US, China, India, UK, Germany, Canada, South Korea, France, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Backup-As-A-Service Market Research and Growth Report?

- CAGR of the Backup-As-A-Service industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the backup-as-a-service market growth of industry companies

We can help! Our analysts can customize this backup-as-a-service market research report to meet your requirements.