Battery Market In Telecommunication Industry Size 2025-2029

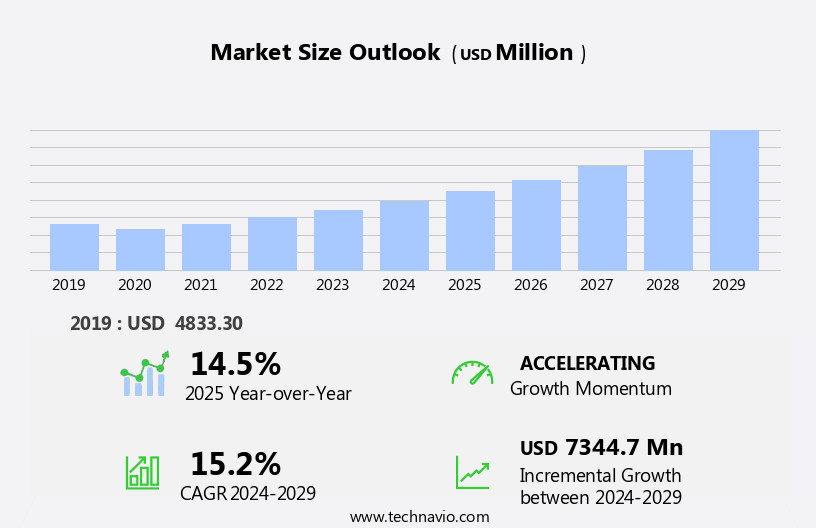

The battery market size in telecommunication industry is forecast to increase by USD 7.34 billion at a CAGR of 15.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing power consumption in the telecommunications industry. This trend is being fueled by the proliferation of 5G networks and the Internet of Things (IoT), which require more power to support their operations. Additionally, the decline in lithium-ion battery prices and diesel prices is making these energy sources more cost-effective for telecom companies, further boosting market growth. However, challenges such as the need for reliable and long-lasting batteries, as well as the environmental concerns surrounding battery disposal, remain key obstacles to market expansion.

- Companies in the telecommunications sector seeking to capitalize on this market opportunity must focus on developing innovative battery solutions that address these challenges while meeting the increasing power demands of their networks. Strategic partnerships, research and development investments, and a commitment to sustainability will be essential for success in this dynamic and evolving market.

What will be the Size of the Battery Market In Telecommunication Industry during the forecast period?

- The market encompasses various battery types, including lithium-ion, lead-acid, flow, nickel-metal hydride, sodium-sulfur, zinc-manganese dioxide, and SLI batteries. These batteries cater to diverse applications, such as consumer electronics, portable devices, industrial equipment, power tools, automotive needs, and grid storage. The market's growth is driven by the increasing demand for sustainable transportation, renewable energy infrastructure, and carbon emissions reduction.

- Electric vehicles, a significant segment, necessitate large-scale battery production capacity to meet growing consumer demand. Battery innovations continue to emerge, with advancements in energy storage solutions and sustainable energy sources shaping the market's future direction. Overall, the telecommunication industry battery market is poised for significant expansion, fueled by the global shift towards sustainable and efficient energy solutions.

How is this Battery Market In Telecommunication Industry segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Capacity

- Low

- Medium

- High

- Product

- Lead-acid battery

- Li-ion battery

- Others

- Application

- Base stations

- Backup power systems

- Data centers

- Small cells

- Mobile devices

- End-user

- Mobile network operators (MNOs)

- Internet service providers (ISPs)

- Data center operators

- Government/enterprises

- Technology

- Traditional

- Advanced

- Renewable integration

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South America

- APAC

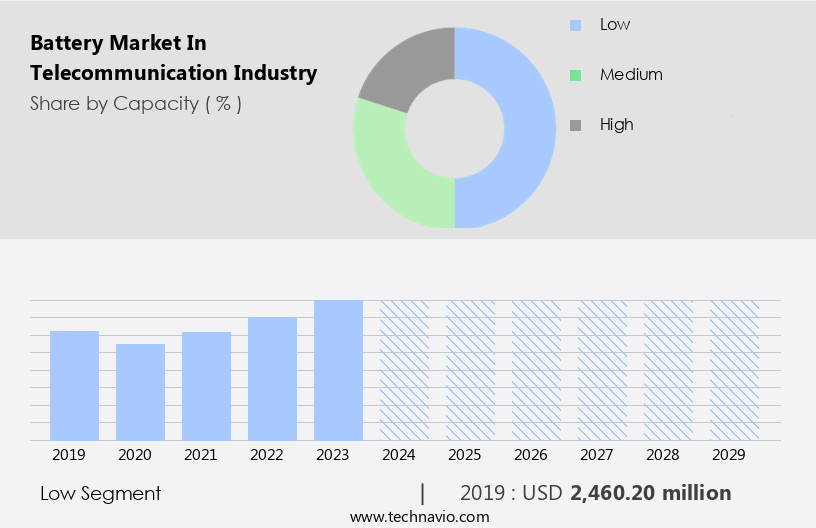

By Capacity Insights

The low segment is estimated to witness significant growth during the forecast period. The low capacity battery segment, which includes rechargeable batteries with a lower charge capacity, primarily serves the market for portable electronic devices such as smartphones, laptops, and power banks. The increasing global demand for these devices, fueled by the expanding population and rural infrastructure projects, will drive the growth of this segment in the telecommunication industry market between 2025 and 2029. Furthermore, the accelerated development of telecommunication infrastructure and the expanding renewable energy sector will increase the demand for energy storage solutions, benefiting the low capacity battery segment. Lithium-ion batteries, a popular choice for portable electronics due to their high energy density and fast charging speed, dominate this segment.

Other battery types, including lead-acid, flow, nickel-metal hybrid, sodium-sulfur, zinc-manganese dioxide, and SLI batteries, also find applications in specific niches within the telecommunication industry. The global battery market in the telecommunication industry is expected to grow significantly due to the increasing demand for energy storage solutions in renewable energy projects, backup power solutions, and the automotive sector. The market is further driven by the need for sustainable transportation, grid storage, and consumer electronics, as well as the shift towards sustainable materials and ethical sourcing practices in battery production. Lithium-ion battery recycling and the development of solid-state and lithium-sulfur batteries are key areas of focus for future research and innovation.

Get a glance at the market report of share of various segments Request Free Sample

The low segment was valued at USD 2.46 billion in 2019 and showed a gradual increase during the forecast period.

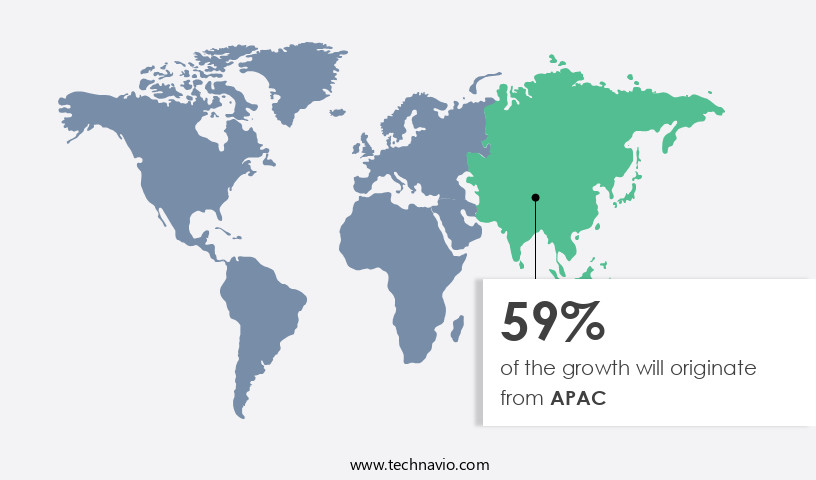

Regional Analysis

APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the market forecast period.

For more insights on the market size of various regions, Request Free Sample

The telecommunication industry battery market in APAC is projected to experience substantial growth from 2025 to 2029, fueled by the expansion of 5G infrastructure and the rising demand for sustainable energy solutions. China, in particular, is anticipated to lead this growth, with a projected 5G user penetration rate surpassing 85% by 2027, according to the Global Times. The country aims to install 38 5G base stations per 10,000 residents by then, with 5G connections expected to account for 75% of mobile internet traffic. Furthermore, the number of IoT devices connected via 5G is projected to exceed 100 million. This growth is influenced by the increasing adoption of electric vehicles (EVs) and the integration of renewable energy infrastructure, including grid storage and sustainable transportation.

In addition, battery production capacity is expanding to meet the demands of these sectors, with lithium-ion batteries being the most commonly used due to their energy density and charging speed. Other battery types, such as lead-acid, flow, nickel-metal hybrid, sodium-sulfur, zinc-manganese dioxide, SLI, automotive, portable, industrial, power tools, electric vehicles, and primary and secondary batteries, are also in demand for various applications. The market is further driven by the need for backup power solutions, lithium-ion battery recycling, and the use of sustainable materials in battery production. The integration of smart homes, IoT devices, wireless networking, portable electronics, household electronic devices, and battery recycling also contributes to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Battery In Telecommunication Industry Industry?

- Increase in power consumption is the key driver of the market. The global battery market in the telecommunication industry is experiencing significant growth due to the increasing energy demand driven by population growth and urbanization. This rise in power consumption has resulted in frequent power outages and heavy loads during peak hours in various countries. One of the primary reasons for these outages is the considerable loss of electricity during transmission and distribution from power plants.

- In response to this rising demand, Amara Raja Batteries announced plans to expand its manufacturing capacity in India to meet the increasing need for telecom batteries. This expansion underscores the importance of reliable battery solutions to mitigate power outages and ensure uninterrupted telecommunications services.

What are the market trends shaping the Battery In Telecommunication Industry Industry?

- Declining Li-ion battery prices is the upcoming market trend. The market has witnessed a significant shift towards the adoption of lithium-ion (Li-ion) batteries due to their advantages over traditional lead-acid batteries. One of the primary factors driving this trend is the continuous price reduction of Li-ion batteries. Over the past decade, Li-ion battery prices have dropped by approximately 80%, making them increasingly cost-competitive.

- Manufacturers, such as Panasonic and LG, are investing in technological advancements to further decrease costs and enhance battery performance. By January 2025, these companies aim to achieve year-over-year cost reductions. Li-ion batteries offer several advantages over lead-acid batteries, including higher energy density, longer lifespan, and faster charging capabilities. These benefits have made Li-ion batteries the preferred choice for telecommunication applications, contributing to their increasing market penetration.

What challenges does the Battery In Telecommunication Industry Industry face during its growth?

- The decline in diesel prices is a key challenge affecting the industry's growth. The market has experienced notable growth due to the cost-saving benefits of using battery systems in telecom towers. However, the market's expansion has been affected by the continuous decrease in diesel prices since 2012. This price decline has diminished the value proposition for switching to new power systems, resulting in extended payback periods.

- For instance, Exide Industries introduced a new line of lead-acid batteries in January 2025, designed to offer a cost-effective backup power solution for telecom towers. Despite this innovation, the ongoing decline in diesel prices remains a significant challenge for the market's growth. This trend underscores the importance of monitoring energy market dynamics to optimize the adoption of battery systems in the telecommunications industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, battery market in telecommunication industry forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accumulatorenwerke HOPPECKE Carl Zoellner and Sohn GmbH - The company offers Battery for telecommunications such as grid power VRM ,net power and grid power VM.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amara Raja Batteries Ltd.

- C and D Technologies Inc.

- East Penn Manufacturing Co. Inc.

- EnerSys

- Exide Industries Ltd.

- GS Yuasa International Ltd.

- HBL Power Systems Ltd.

- Kabra Extrusiontechnik Ltd.

- Leoch International Technology Ltd.

- LG Corp.

- Panasonic Holdings Corp.

- Star Battery Ltd.

- Victron Energy BV

- Zhejiang Narada Power Source Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has grown significantly in recent years, driven by the increasing demand for sustainable transportation, renewable energy infrastructure, and the proliferation of consumer electronics. This trend is expected to continue as the world transitions towards more sustainable energy sources and decreases its carbon emissions. Batteries play a crucial role in various applications within the telecommunication sector. In the realm of transportation, the adoption of electric vehicles (EVs) is on the rise, leading to an increased demand for high-performance batteries. These batteries must offer a long lifespan, high energy density, and fast charging speeds to meet the needs of consumers and businesses.

In the context of renewable energy, batteries serve as essential energy storage solutions for intermittent sources such as solar and wind power. They help maintain a consistent power supply and ensure the stability of the grid. The most commonly used batteries for this purpose are lithium-ion batteries, flow batteries, nickel-metal hydride batteries, sodium-sulfur batteries, zinc-manganese dioxide batteries, and lead-acid batteries. The telecommunication industry's battery market is diverse, with applications ranging from automotive and industrial sectors to portable electronics and smart homes. Automotive batteries require high energy density and long lifespan, while industrial batteries must be strong and able to withstand heavy usage.

Portable batteries, on the other hand, prioritize compact size and lightweight design. The demand for batteries is not limited to the telecommunication industry alone. The growing popularity of renewable energy projects and backup power solutions has led to a rise in battery production capacity. This trend is expected to continue as the world moves towards more sustainable energy sources and decreases its reliance on fossil fuels. Battery chemistries continue to evolve, with solid-state batteries and lithium-sulfur batteries gaining significant attention due to their high energy density and potential for longer battery life. However, the production and recycling of these batteries pose unique challenges that must be addressed to ensure their widespread adoption.

In addition, transportation demand for energy-efficient batteries is driving innovations, including flow batteries, nickel-metal hybrid batteries, sodium-sulfur batteries, and zinc-manganese dioxide batteries. These technologies are vital for telecom power systems, supporting network infrastructure and managing data usage and signal strength. Battery applications, such as power tool batteries and electric vehicle batteries, are seeing increased adoption. Furthermore, supply chain sustainability and recycling methods are becoming critical in reducing costs. The rise in battery demand is also influencing lithium prices, impacting primary batteries like alkaline batteries. With a focus on economic activity and battery technology, cost reduction efforts are key to sustaining growth in the telecom sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

266 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market Growth 2025-2029 |

USD 7.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.5 |

|

Key countries |

US, China, India, Japan, Germany, UK, Canada, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Battery Market In Telecommunication Industry Research and Growth Report?

- CAGR of the Battery In Telecommunication Industry industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the battery market in telecommunication industry growth of industry companies

We can help! Our analysts can customize this battery market in telecommunication industry research report to meet your requirements.