Beverage Flavoring System Market Size 2024-2028

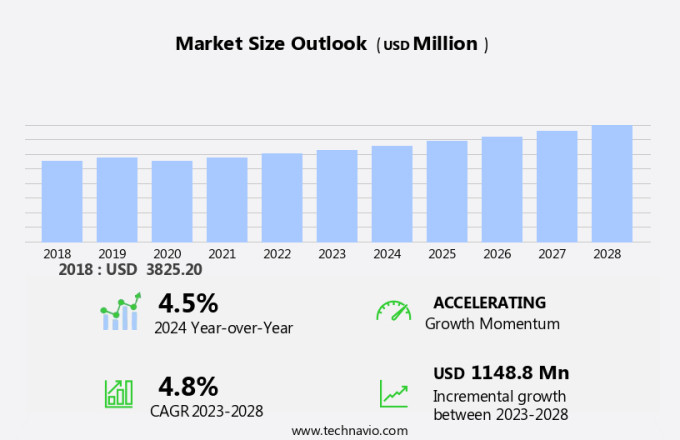

The beverage flavoring system market size is forecast to increase by USD 1.15 billion, at a CAGR of 4.8% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing consumption of various types of beverages such as alcoholic beverages, dairy beverages, packaged juices, sports drinks, soft drinks, and energy drinks. Consumers are increasingly preferring beverages with natural and botanical flavors, leading to a rise in demand for flavor enhancers like natural flavors, artificial flavors, and nature-identical flavors. Additionally, growing consumer awareness about food additives is driving manufacturers to use clean-label ingredients in their beverage flavoring systems. This report provides an in-depth analysis of the market trends and growth factors, including the increasing popularity of chocolate flavors and the growing demand for flavor enhancement in ready-to-eat food and beverages.

What will the size of the market be during the forecast period?

- The beverage flavoring systems market is a significant segment within the food and beverage industry, focusing on enhancing the taste and sensory experience of various beverage categories. These systems utilize a range of ingredients and technologies to modify and improve the flavors of beverages, catering to evolving consumer preferences. Beverage flavoring systems encompass a wide array of applications, including fruit beverages, packaged juices, sports drinks, energy drinks, functional beverages, alcoholic beverages, and non-alcoholic beverages. The primary goal is to create a desirable taste profile while maintaining the nutritional values and desirable qualities of the base beverage. Taste modulation and masking are essential aspects of beverage flavoring systems. Taste modulators help adjust the overall taste of a beverage by enhancing or suppressing specific flavors, while taste-masking agents are used to mask unpleasant tastes, such as bitterness or sourness.

- Natural flavoring ingredients, such as pectin, are increasingly popular in the market due to consumer demand for natural and clean-label products. Exotic flavors continue to gain popularity in the beverage market, driving the demand for innovative flavoring systems. These systems enable the creation of unique and complex flavor profiles, enhancing the overall consumer experience. Beverage flavoring systems play a crucial role in the food and beverage industry, providing solutions for taste enhancement, aroma, and sensory experience. As consumer preferences continue to evolve, the market for these systems is expected to grow, offering opportunities for innovation and product development.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Non-alcoholic

- Alcoholic

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

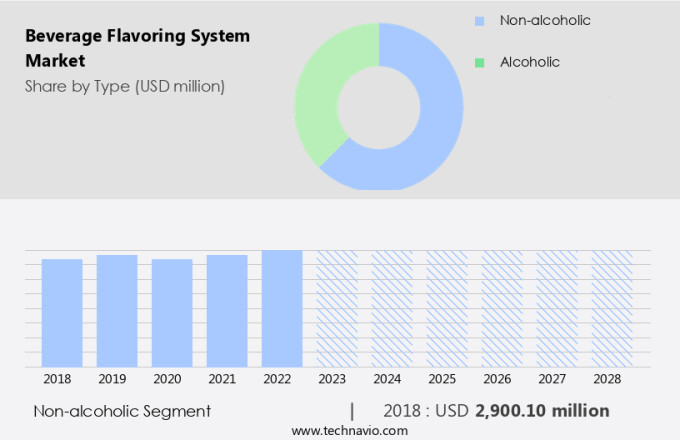

- The non-alcoholic segment is estimated to witness significant growth during the forecast period.

The market encompasses the sales of various types of beverages, including hot and cold options such as coffee, fruit juices, flavored water, sports beverages, and alcoholic drinks. This segment holds the largest market share. The preference for non-alcoholic beverage flavoring systems is on the rise due to the increasing number of health-conscious consumers seeking alcohol-free alternatives. Another significant factor fueling market growth is the increasing demand for specialty and premium hot beverages, particularly coffee. However, the sales of carbonated soft drinks have been decreasing in developed regions of North America and Europe. This trend can be attributed to the growing health and wellness consciousness and the negative perception of carbonated soft drinks as unhealthy options.

Additionally, beverage flavoring systems consist of various components such as aromas, sensory experiences, sweeteners, acids, colors, and masking agents. These elements contribute to the overall taste and appeal of the beverage. Fruit juices and flavored water are popular choices among health-conscious consumers, while sports beverages cater to the active population. Alcoholic drinks also utilize flavoring systems to enhance their taste and appeal. The flavor profiles of these beverages are carefully crafted to cater to diverse consumer preferences and trends. The shelf life of beverages is another crucial factor that flavoring systems help to extend, ensuring consumer satisfaction and repeat purchases.

Get a glance at the market report of share of various segments Request Free Sample

The non-alcoholic segment was valued at USD 2.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

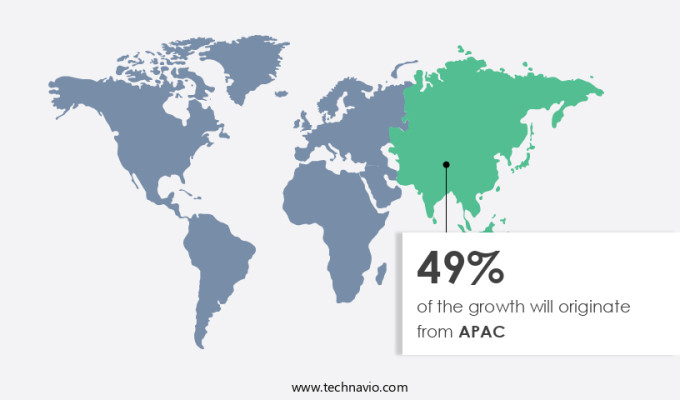

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region is experiencing consistent growth. In 2023, China held the largest market share, with an abundance of cafes, restaurants, and bars providing a variety of beverages. Major consumers in APAC include Japan, Australia, and South Korea. The rise in beverage consumption can be attributed to the growth in disposable income levels and the increasing trend of socializing at dining establishments. For instance, during the first half of 2021, China's per capita disposable income swelled by over 12% compared to the same period in 2020. Additionally, spending on food, tobacco, and alcohol increased by over 14% during the first half of 2021 compared to the previous year.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Beverage Flavoring System Market?

Increasing consumption of beverages is the key driver of the market.

- The market for beverage flavoring systems in the United States is experiencing significant growth as consumers increasingly seek healthier options in their beverages. Low-salt, low-sugar, and low-fat beverages are gaining popularity, as are fortified beverages with enhanced nutritional values. Taste modulators and taste-masking agents are essential components of these beverages, ensuring a pleasing taste while maintaining the health benefits. Natural flavoring ingredients, such as pectin, are increasingly being used to replace artificial flavors. Moreover, the demand for natural products is on the rise, leading to the development of beverages with natural preservatives.

- The trend toward healthier beverage options is driven by growing health consciousness among consumers. Juice drinks, in particular, are favored over carbonated beverages due to their natural ingredients and absence of added sugars, artificial flavors, and preservatives. The market in the US is expected to continue this growth trajectory, providing opportunities for industry players to innovate and cater to the evolving consumer preferences.

What are the market trends shaping the Beverage Flavoring System Market?

A rising preference for botanical flavors is the upcoming trend in the market.

- Consumers' preferences in the beverage market are shifting from traditional citrus flavors towards more exotic botanical and herbal profiles. Hibiscus, lavender, elderflower, turmeric, anise, and rosemary are among the popular botanical and herbal flavors gaining traction, particularly in the premium sector. These flavors offer a unique experience for consumers, who are less concerned about calorie restrictions or sugar content. The trend is not limited to non-alcoholic beverages; it is also influencing the alcoholic beverage industry.

- Companies in the beverage flavoring market can expect new growth opportunities from these emerging flavors during the forecast period. This includes packaged juices, sports drinks, energy drinks, and ready-to-eat food. Nature-identical and artificial flavors, as well as natural ones, will continue to play a significant role in enhancing the taste and functionality of these beverages.

What challenges does Beverage Flavoring System Market face during the growth?

Growing consumer awareness about food additives is a key challenge affecting the market growth.

- The beverage industry, encompassing fruit beverages, soft drinks, non-alcoholic carbonated drinks, juices, and functional drinks, is witnessing a shift towards the use of innovative tastes and flavoring systems. This trend is driven by growing consumer concerns over the health implications of traditional additives, such as preservatives, artificial flavoring agents, and coloring agents. For example, sodium sulfite, a preservative commonly found in packaged and canned foods, has been linked to respiratory problems and nervous system complications. Monosodium glutamate (MSG), an artificial flavoring agent, has been associated with symptoms including asthma, numbness, and depression.

- Coal-tar dyes used in some coloring agents pose additional health risks. Specific additives, such as aspartame and MSG, can trigger adverse reactions in sensitive individuals, including migraines and chest tightness, respectively. To address these concerns, beverage manufacturers are turning to homogeneous flavoring systems that utilize flavoring agents and carriers to create consistent, high-quality taste profiles without the need for excessive additives. This approach not only benefits consumer health but also enhances brand reputation and competitive edge in the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Dohler GmbH

- Firmenich SA

- Flavorchem Corp.

- Foodie Flavours Ltd.

- Givaudan SA

- International Flavors and Fragrances Inc.

- Kerry Group Plc

- Keva Flavours Pvt Ltd

- H Roberts Group Pte Ltd

- Koninklijke DSM NV

- McCormick and Co. Inc.

- Robertet SA

- Sensient Technologies Corp.

- Symrise Group

- Synergy Flavors Inc.

- T.Hasegawa USA Inc.

- Takasago International Corp.

- Tate and Lyle PLC

- V. Mane Fils

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the growing demand for innovative and health-conscious beverage options. This market encompasses a wide range of beverages, including non-alcoholic, carbonated soft drinks, juices, functional drinks, and alcoholic beverages. Taste modulators and masking agents play a crucial role in enhancing the taste of low-salt, low-sugar, and low-fat beverages, ensuring consumer satisfaction. Fortified beverages with nutritional values are gaining popularity, driving the market's growth. Natural flavoring ingredients, such as pectin, fruit extracts, and botanicals, are increasingly used to create natural and exotic flavors. Preservatives, emulsifiers, stabilizers, and other additives are employed to maintain the homogeneous nature of beverages and extend their shelf life.

Further, beverage manufacturers focus on clean-label ingredients and flavor customization to cater to the health-focused consumer base. Functional beverages, such as sports drinks, energy drinks, and ready-to-drink (RTD) beverages, are gaining traction due to their health benefits. The market also includes dairy beverages, chocolate flavors, and novel flavors that cater to diverse consumer preferences. Beverage flavoring systems are designed to enhance the sensory experience, with aroma playing a significant role in taste perception. Food safety and health and wellness are key considerations in the development of these systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market Growth 2024-2028 |

USD 1.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.5 |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.