Sports Drink Market Size 2025-2029

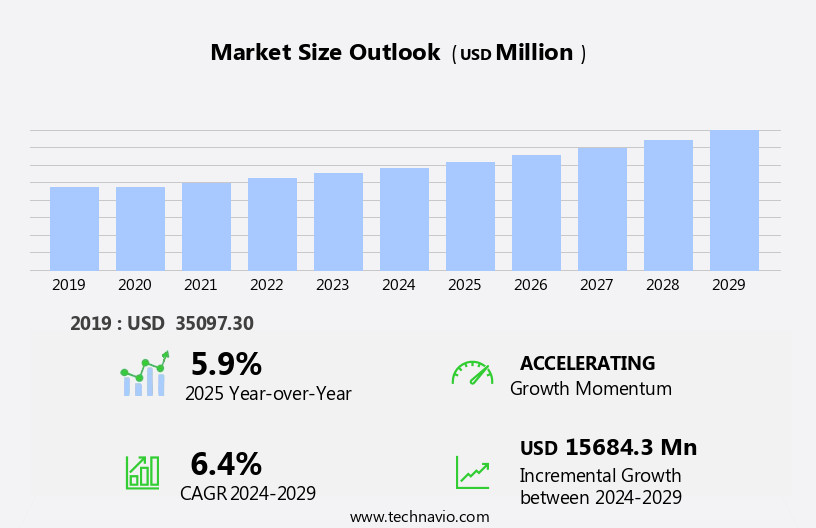

The sports drink market size is forecast to increase by USD 15.68 billion at a CAGR of 6.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing consumer focus on health and wellness. With the global population becoming more health-conscious, there is a rising demand for hydration products that offer added nutritional benefits. Changing consumer demographics, particularly the millennial and Gen Z generations, are fueling this trend, as they prioritize fitness and an active lifestyle. However, the market is not without challenges. The threat from other health and wellness products, such as functional beverages and nutritional supplements, is intensifying.

- These competitors offer similar health benefits but may be perceived as more natural or convenient alternatives. To capitalize on market opportunities and navigate challenges effectively, companies in the market must focus on product innovation, targeted marketing, and strategic partnerships. By addressing consumer preferences and staying ahead of competitors, market players can differentiate themselves and maintain a strong market position.

What will be the Size of the Sports Drink Market during the forecast period?

- The market in the United States continues to experience strong growth, driven by consumer preferences for convenient, nutrient-dense beverages that support mental focus, muscle recovery, and hydration during physical activity. Fruit juices and natural flavors remain popular choices, while sugar alternatives and environmental sustainability are key trends shaping the market. Brands are also leveraging social media marketing, influencer partnerships, and data-driven marketing strategies to connect with their target audience. Sports drinks provide essential electrolytes, vitamins, and energy to fuel strength training and endurance capacity, making them a staple in the fitness industry. Brands are investing in product innovation, including absorption rate technology, artificial intelligence, and personalized nutrition, to optimize performance and cater to evolving consumer needs.

- Social responsibility and brand reputation are increasingly important considerations, with companies focusing on recyclable packaging, loyalty programs, and strategic partnerships with sports medicine professionals and fitness organizations. As consumer expectations for transparency and value proposition continue to rise, sports drink brands must prioritize customer satisfaction, post-workout recovery, and cognitive function to maintain market share.

How is this Sports Drink Industry segmented?

The sports drink industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Packaging

- PET bottles

- Cans

- Product Type

- Isotonic drinks

- Hypotonic drinks

- Hypertonic drinks

- End-user

- Fitness enthusiasts and general consumers

- Athletes and sports professionals

- Lifestyle users

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

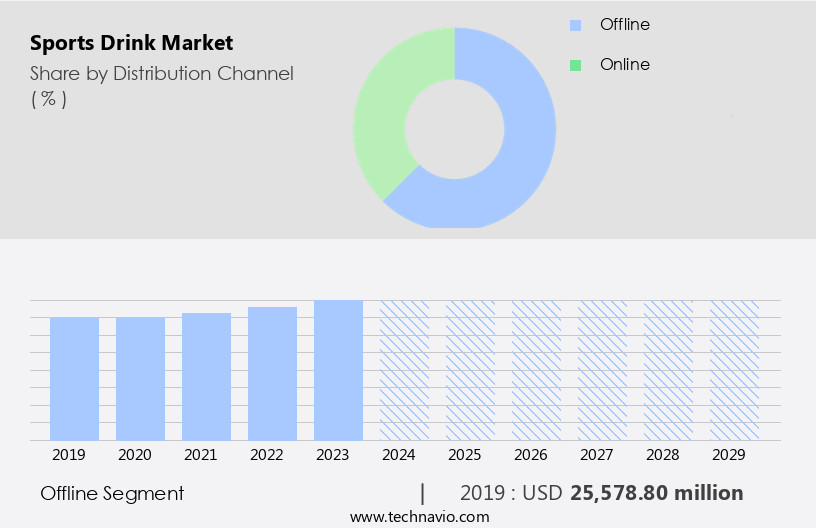

The offline segment is estimated to witness significant growth during the forecast period. The market primarily relies on offline distribution channels, including retail formats such as specialty stores, hypermarkets, supermarkets, convenience stores, and warehouse clubs. These channels account for a significant portion of the market's revenue, with hypermarkets, supermarkets, and department stores being major contributors due to their extensive product offerings and promotional deals. The penetration of organized retail stores has significantly boosted sales of sports drinks, with many retailers dedicating separate sections to these beverages. Consumer insights reveal that health-conscious individuals, including fitness enthusiasts, endurance athletes, and recreational athletes, are the primary buyers of sports drinks. They seek scientific validation through clinical studies, natural ingredients, and low sugar content in their beverage choices.

Innovation pipelines focus on sugar-free options, organic certification, vegan alternatives, and functional food ingredients to cater to diverse consumer demographics and dietary restrictions. Product development prioritizes taste preferences, shelf life, and personalized nutrition. Marketing strategies highlight performance enhancement, isotonic beverages, and carbohydrate electrolyte solutions for electrolyte replacement. Price sensitivity and brand loyalty also influence sales, with smart packaging and product innovation playing essential roles in brand awareness and differentiation. Additionally, distribution channels prioritize dehydration prevention, calorie content, and ingredient blends to cater to various lifestyle trends and consumer health concerns. Data analytics and consumer demographics continue to shape the value perception of sports drinks in the market.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 25.58 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

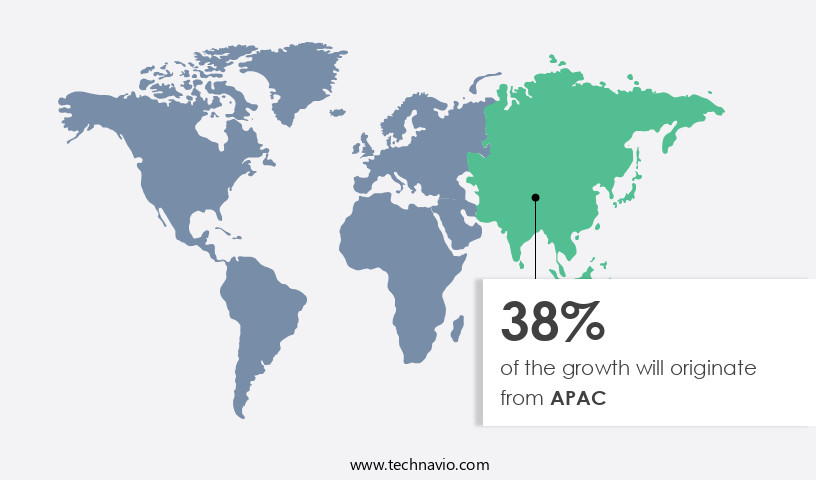

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to increasing consumer awareness towards proactive personal healthcare and the rising number of individuals adopting an active lifestyle. Clinical studies validating the benefits of sports drinks for athletic performance and muscle recovery have fueled demand for these beverages. Consumers, particularly fitness enthusiasts and endurance athletes, seek out options that cater to their dietary restrictions, such as sugar-free, organic certification, vegan, and low-sodium alternatives. The innovation pipeline includes natural ingredient-based formulations, functional beverages, and smart packaging solutions. Health-conscious consumers prioritize taste preferences, calorie content, and ingredient blends. Sodium content and carbohydrate electrolyte solutions are essential for electrolyte replacement during intense workouts.

Brand awareness and marketing strategies targeting millennial and Gen Z consumers, as well as professional athletes, contribute to the market's growth. Supply chain management and ingredient sourcing are crucial aspects of the industry, ensuring shelf life, personalized nutrition, and performance enhancement. Data analytics and consumer insights help companies tailor their offerings to meet the evolving needs and lifestyle trends of their customer base. Online and retail sales channels continue to dominate the market, with price sensitivity and brand loyalty playing key roles in consumer decision-making.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Sports Drink Industry?

- Consumer focus on health and wellness is the key driver of the market. The health and wellness trend has gained prominence among consumers, driven by rising healthcare costs and an aging population. With increasing life expectancy comes a higher incidence of chronic diseases. In response, consumers seek convenient and affordable ways to maintain their health. Sports drinks, which contain carbohydrates, electrolytes, vitamins, and nutrients, offer a nutritious option for those looking to enhance their well-being. Manufacturers and retailers can capitalize on this consumer trend by offering sports drinks as a healthier alternative to energy drinks, which are often rich in stimulants like caffeine, guarana, and herbal supplements.

- While energy drinks can help improve productivity and provide essential nutrients, they may not be the best choice for those seeking a healthier lifestyle. Sports drinks, on the other hand, offer a more balanced approach to health and energy.

What are the market trends shaping the Sports Drink Industry?

- Changing consumer demographics is the upcoming market trend. The market is experiencing significant growth due to demographic changes and increasing health consciousness. With urbanization leading to higher disposable incomes, consumers are adopting new lifestyle habits, including regular exercise and a more active lifestyle. This shift in consumer behavior, coupled with the growing awareness of the benefits of sports drinks for hydration and nutrient replenishment during workouts, is driving market growth. Additionally, the increasing working population and hectic schedules have resulted in a decrease in home-cooked meals and an increase in the consumption of ready-to-eat and processed foods.

- The adverse effects of these food choices on health have led consumers to seek healthier alternatives, making sports drinks an attractive option. Overall, these factors are expected to contribute to the growth of the market during the forecast period.

What challenges does the Sports Drink Industry face during its growth?

- Threat from other health and wellness products is a key challenge affecting the industry's growth. The market faces significant challenges due to the availability of effective alternatives, such as protein shakes or smoothies, supplementary tablets, and energy drinks or powders. These options offer more natural and direct nutrition, and in some cases, align better with health and wellness trends. Additionally, consumers are increasingly prioritizing reducing their sugar intake, leading to a preference for beverages and supplements with minimal or no artificial sweeteners.

- Sports drinks, which are typically carbonated and contain sugar, may not meet these evolving consumer preferences. To remain competitive, market participants must adapt by offering more natural, low-sugar, and plant-based alternatives. This shift could potentially open new opportunities for growth in the market.

Exclusive Customer Landscape

The sports drink market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sports drink market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sports drink market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company offers sports drinks such as Pedialyte Sport.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Acli Mate

- Active Nutrition International GmbH

- Ajinomoto Co. Inc.

- All Sport

- Biosteel Sports Inc.

- Britvic plc

- Cipla Inc.

- Danone SA

- Decathlon SA

- Gujarat Cooperative Milk Marketing Federation Ltd.

- MyDrink Beverages

- Nestle SA

- Otsuka Pharmaceutical Co Ltd.

- PepsiCo Inc.

- Steric Trading Pty Ltd.

- Suntory Beverage and Food Ltd.

- The Coca Cola Co.

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by consumer preferences for beverages that support an active lifestyle and enhance athletic performance. Fitness enthusiasts, endurance athletes, and recreational athletes alike seek out beverages that provide essential nutrients for optimal hydration and energy. Science plays a crucial role in the development of sports drinks, with a focus on clinical studies and scientific validation to support product claims. Innovation in the pipeline includes sugar-free options, natural ingredients, organic certification, and vegan alternatives, catering to various dietary restrictions and taste preferences. Packaging formats have also evolved to meet consumer demands, with an emphasis on smart packaging, longer shelf life, and personalized nutrition.

Sodium content, carbohydrate electrolyte solutions, and isotonic beverages remain key components of sports drinks, providing essential electrolytes for dehydration prevention and muscle recovery. Consumer insights reveal that health concerns, value perception, and brand loyalty are significant factors in the market. Millennial and Gen Z consumers, in particular, prioritize natural ingredients, functional food, and transparency in sourcing and manufacturing processes. Marketing strategies for sports drinks focus on performance enhancement, energy boost, and wellness trends. Functional beverages and energy drinks have gained popularity, offering consumers additional benefits beyond basic hydration. Brand awareness and distribution channels are essential for success in the market.

Online sales and retail sales channels cater to the diverse needs of consumers, with a focus on convenience and accessibility. Data analytics and consumer demographics play a crucial role in comprehending market trends and consumer preferences. Price sensitivity and brand loyalty are also key factors, with consumers seeking out cost-effective options and loyal brands that align with their values and lifestyle. In the realm of sports nutrition, sports drinks offer a convenient and effective solution for consumers seeking to optimize their performance and support their active lifestyle. The market continues to innovate, with a focus on natural ingredients, functional benefits, and sustainable practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 15.68 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, Canada, India, Japan, UK, Germany, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sports Drink Market Research and Growth Report?

- CAGR of the Sports Drink industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sports drink market growth and forecasting

We can help! Our analysts can customize this sports drink market research report to meet your requirements.