Biobanking Market Size 2024-2028

The biobanking market size is valued to increase USD 1.67 billion, at a CAGR of 9.04% from 2023 to 2028. Growing demand for personalized medicine will drive the biobanking market.

Major Market Trends & Insights

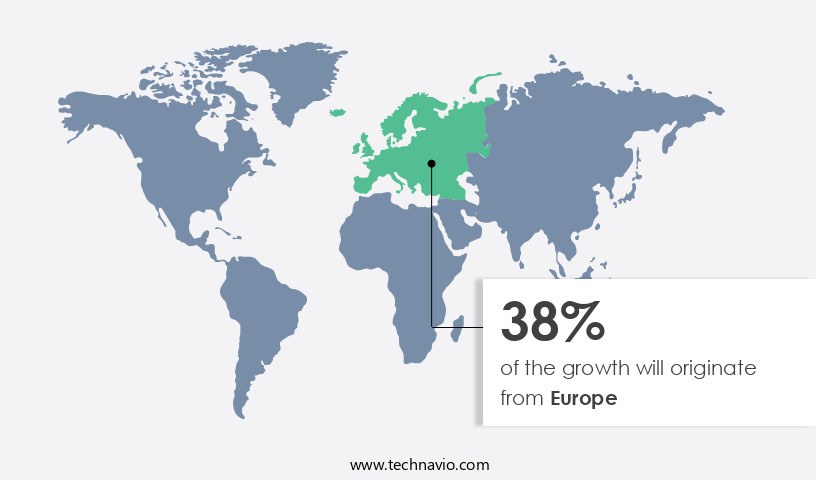

- Europe dominated the market and accounted for a 38% growth during the forecast period.

- By Type - Physical segment was valued at USD 1.66 billion in 2022

- By Product - Equipment segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 123.36 million

- Market Future Opportunities: USD 1669.10 million

- CAGR from 2023 to 2028 : 9.04%

Market Summary

- The market encompasses the production, storage, and distribution of biological samples for research and diagnostic purposes. This dynamic market is driven by the growing demand for personalized medicine, with core technologies such as nucleic acid isolation and cryopreservation playing crucial roles. The emergence of stem cell storage in biobanks represents a significant opportunity, as these cells hold immense potential for disease research and regenerative therapies. However, the market also faces challenges, including ethical issues surrounding informed consent and data privacy.

- According to a recent report, the market is expected to account for over 20% of the global diagnostics market by 2025, underscoring its growing importance in the healthcare industry. Despite these opportunities and challenges, the market continues to evolve, with ongoing research and innovation shaping its future trajectory.

What will be the Size of the Biobanking Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Biobanking Market Segmented ?

The biobanking industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Physical

- Virtual

- Product

- Equipment

- Consumables

- End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Hospitals

- Contract Research Organizations (CROs)

- Application

- Regenerative Medicine

- Life Science Research

- Clinical Research

- Drug Discovery & Development

- Personalized Medicine

- Sample Type

- Blood Products

- Human Tissues

- Cell Lines

- Nucleic Acids

- Biological Fluids

- Human Waste Products

- Biobank Type

- Population-Based Biobanks

- Disease-Based Biobanks

- Virtual Biobanks

- Tissue Biobanks

- Genetic Biobanks

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The physical segment is estimated to witness significant growth during the forecast period.

Biobanks, essential repositories for storing and managing biological samples, have gained significant traction due to the increasing focus on personalized medicine. These institutions house various types of samples, including human tissues, cells, blood, DNA, and biomolecules, for research and medical applications. The classification of biobanks is based on the physical nature of the samples, resulting in tissue biobanks, cell biobanks, and blood biobanks. Automation solutions play a crucial role in enhancing the efficiency of biobanking processes. Long-term storage is a critical aspect, with ultra-low temperature freezers and liquid nitrogen storage ensuring sample integrity. Microbial contamination prevention and cross-contamination prevention are essential for maintaining sample quality.

Informed consent processes, sample tracking systems, and regulatory compliance are integral components of biobanking operations. Sample distribution, quality control metrics, tissue processing workflows, and LIMs integration are other essential elements. Data security measures, RNA isolation protocols, viability assays, cryopreservation techniques, sample annotation standards, and sample integrity are crucial for maintaining the integrity and usability of the stored samples. Ethics review boards oversee ethical considerations, while inventory management systems, quality assurance, sample retrieval, and data privacy regulations ensure compliance and transparency. Cell culture media, DNA extraction methods, and biospecimen management are essential for sample preparation and processing.

Biorepository informatics, sample storage systems, database integration, vapor phase storage, and inventory management systems facilitate efficient data management and access. The market for biobanking solutions is expanding, with a reported 15% of hospitals and research institutions adopting biobanking services. Furthermore, industry experts anticipate a 17% increase in the adoption of biobanking services by pharmaceutical and biotech companies. These trends underscore the growing importance of biobanking in advancing medical research and personalized medicine.

The Physical segment was valued at USD 1.66 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Biobanking Market Demand is Rising in Europe Request Free Sample

The European the market is characterized by a significant presence of established biobanks, with over 60% of the global total located in the region. This trend is largely due to the well-developed biobanking systems in Nordic countries such as Sweden, Norway, Denmark, Finland, Iceland, and France, among others. These nations have been at the forefront of population-based biobanking and possess a high degree of expertise. Advanced biobanks and effective public health services are the primary drivers of these robust biobanking systems.

Currently, more than 10 million biological samples are stored in European biobanks, with an annual growth rate of approximately 5%. This growth can be attributed to the increasing demand for research and personalized medicine, as well as the expansion of existing biobanks.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical sector in the life sciences industry, driven by the increasing demand for automated sample processing workflows and high-throughput screening techniques to accelerate research and development in various fields. Biobanks employ cryopreservation optimization strategies to maintain biospecimen quality, ensuring their integrity during long-term storage. Stringent biospecimen quality control procedures and sample tracking and traceability systems are essential to ensure data integrity and regulatory compliance for biorepositories. Secure data management and access control are vital components of modern biobanking, as advanced data analysis for biobanking becomes increasingly sophisticated. Regulatory compliance for biorepositories is a significant concern, with ethical considerations in biobanking playing an essential role in shaping industry best practices.

Integration of Laboratory Information Management Systems (LIMS) and biorepository systems is a key trend, enabling cross-platform data integration and effective sample management strategies. Preventative maintenance of storage equipment and validation of sample preparation methods are crucial for maintaining biospecimen quality assurance programs. Advanced statistical analysis of biobanking data and implementation of data security measures are essential to ensure data privacy and security. The industrial application segment accounts for a significantly larger share of the market compared to the academic segment, with more than 70% of new product developments focusing on industrial applications. Efficient sample retrieval protocols and best practices for sample annotation are essential for maximizing the value of biospecimens.

Cross-platform data integration and effective sample management strategies enable researchers to access and analyze data more efficiently, driving innovation and discovery in various fields. In conclusion, the market is a dynamic and evolving sector, with a strong focus on automation, data security, and regulatory compliance.

What are the key market drivers leading to the rise in the adoption of Biobanking Industry?

- The expanding need for personalized medicine serves as the primary catalyst for market growth.

- The unmet medical need for effective therapies has fueled the demand for personalized medicine, leading to a significant increase in the utilization of biobanks. Personalized medicine, which involves treatments tailored to individual characteristics, needs, and preferences, necessitates the availability of individual samples with annotated clinical and pathological data. Research organizations are actively seeking ways to develop personalized treatments using biological samples, making biobanks an essential component of this evolving landscape. The growing demand for personalized medicine is driving the global expansion of biobanks, offering potential opportunities for companies in this sector.

- This trend is not limited to healthcare; biobanks also find applications in various industries, including agriculture and research. The potential for personalized treatments using biological samples is vast, making the biobank market a dynamic and evolving one.

What are the market trends shaping the Biobanking Industry?

- The emergence of stem cell storage in biobanks represents a significant market trend. This innovative development is poised to shape the future of regenerative medicine.

- The demand for stem cell storage in biobanks is experiencing significant expansion, significantly influencing market progression during the forecast period. The utilization of biobanking solutions in stem cell research is enhancing access to innovative therapeutic options for a broader population. Stem cells are reported to address numerous unmet medical requirements in sectors like cardiology and oncology. Consequently, there is a surge in the establishment of specialized biobanking facilities dedicated to stem cell research.

- For example, the Global Stem Cells Group inaugurated operations at its new clinics in Arica and Iquique, Chile. This trend underscores the dynamic nature of the market and its applications across various industries.

What challenges does the Biobanking Industry face during its growth?

- The industry's expansion is significantly hindered by the escalating ethical concerns that pose a major challenge.

- Biobanking, the preservation of biological samples for research and diagnostic purposes, continues to evolve, raising ethical concerns and debates. Protecting individuals' identities is paramount, with informed consent being a crucial first step. However, potential misuse of biobank data by private companies adds to the ethical dilemma. The ongoing debate surrounding the use of biological samples, such as tissues and stem cells, is a contentious issue in many countries.

- Disagreements persist regarding the storage and application of human embryonic stem cells in research, sparking ongoing discussions among scientists and policymakers. These ethical concerns underscore the importance of establishing clear guidelines and regulations to ensure the proper handling and use of biological samples in a professional and ethical manner.

Exclusive Technavio Analysis on Customer Landscape

The biobanking market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biobanking market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Biobanking Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, biobanking market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AMS Biotechnology Europe Ltd. - This company specializes in providing a range of high-quality biobanking solutions, including Pig Liver Total RNA, Zebrafish Genomic DNA, and Human tonsil normal FFPE tissue blocks. Their offerings cater to various research needs, ensuring scientific advancements with reliable and authentic biological materials.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMS Biotechnology Europe Ltd.

- ASKION GmbH

- Azenta Inc.

- Bay Biosciences LLC

- BioIVT LLC

- Boca Biolistics LLC

- CTIBiotech

- Cureline Inc.

- Danaher Corp.

- Firalis SA

- GENETICIST Inc.

- Greiner Bio One International GmbH

- Hamilton Co.

- OraSure Technologies Inc.

- PHC Holdings Corp.

- Promega Corp.

- ProteoGenex Inc.

- Shanghai Genext Medical Technology Co. Ltd.

- Thermo Fisher Scientific Inc.

- US Biolab Corp. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Biobanking Market

- In January 2024, Thermo Fisher Scientific, a leading life sciences solutions provider, announced the launch of its new Carrier Screening Service, expanding its portfolio in the market. This service enables laboratories to offer comprehensive carrier screening tests, helping identify genetic risks before pregnancy (Thermo Fisher Scientific Press Release, 2024).

- In March 2024, Illumina and F. Hoffmann-La Roche Ltd. Entered into a strategic collaboration to develop and commercialize a new solution for long-read, whole-genome sequencing. This partnership combines Illumina's sequencing technology with Roche's clinical and diagnostic expertise, aiming to advance precision medicine and biobanking applications (Illumina Press Release, 2024).

- In May 2024, Qiagen announced the acquisition of Bio-IT Technology, a leading bioinformatics software provider. This acquisition strengthens Qiagen's position in the market by enhancing its software offerings for managing and analyzing large genomic data sets (Qiagen Press Release, 2024).

- In April 2025, the European Union approved the Horizon Europe research and innovation program, allocating €95.5 billion (approximately USD107 billion) for the period 2021-2027. A significant portion of this funding will be dedicated to personalized medicine and biobanking initiatives, boosting the European the market's growth prospects (European Commission Press Release, 2021).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Biobanking Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.04% |

|

Market growth 2024-2028 |

USD 1669.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.36 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, automation solutions have become a crucial component for efficient long-term storage and management of various biospecimens. These solutions mitigate the risks of microbial contamination and cross-contamination, ensuring sample integrity. Ultra-low temperature freezers, a significant investment in biobanking infrastructure, maintain samples at optimal temperatures for extended periods. Cross-contamination prevention is achieved through stringent sample tracking systems and regulatory compliance measures. Quality control metrics, such as tissue processing workflows and LIMs integration, ensure standardization and accuracy. Data security measures are essential in biobanking, with biorepository informatics and database integration playing a vital role in maintaining data privacy regulations.

- Vapor phase storage and inventory management systems further enhance the efficiency of sample retrieval and distribution. Sample annotation standards and ethics review boards ensure the ethical handling and use of biospecimens. Technological advancements include RNA isolation protocols, cryopreservation techniques, and DNA extraction methods. Viability assays and quality assurance processes are integral to maintaining sample integrity, while data integrity and cell culture media are crucial for maintaining sample health during storage. Regulatory compliance is a continuous process, with ongoing updates and adjustments to ensure the highest standards are met. The market activities reflect a focus on innovation, with advancements in sample storage systems, data privacy regulations, and tissue processing workflows.

- The integration of LIMs, data security measures, and biorepository informatics has streamlined operations and improved overall efficiency. In the competitive landscape, biobanks strive for excellence in sample integrity, regulatory compliance, and data security, setting the stage for a robust and evolving market.

What are the Key Data Covered in this Biobanking Market Research and Growth Report?

-

What is the expected growth of the Biobanking Market between 2024 and 2028?

-

USD 1.67 billion, at a CAGR of 9.04%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Physical and Virtual), Product (Equipment and Consumables), Geography (Europe, North America, Asia, and Rest of World (ROW)), End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Hospitals, and Contract Research Organizations (CROs)), Application (Regenerative Medicine, Life Science Research, Clinical Research, Drug Discovery & Development, and Personalized Medicine), Sample Type (Blood Products, Human Tissues, Cell Lines, Nucleic Acids, Biological Fluids, and Human Waste Products), and Biobank Type (Population-Based Biobanks, Disease-Based Biobanks, Virtual Biobanks, Tissue Biobanks, and Genetic Biobanks)

-

-

Which regions are analyzed in the report?

-

Europe, North America, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Growing demand for personalized medicine, Increasing ethical issues

-

-

Who are the major players in the Biobanking Market?

-

AMS Biotechnology Europe Ltd., ASKION GmbH, Azenta Inc., Bay Biosciences LLC, BioIVT LLC, Boca Biolistics LLC, CTIBiotech, Cureline Inc., Danaher Corp., Firalis SA, GENETICIST Inc., Greiner Bio One International GmbH, Hamilton Co., OraSure Technologies Inc., PHC Holdings Corp., Promega Corp., ProteoGenex Inc., Shanghai Genext Medical Technology Co. Ltd., Thermo Fisher Scientific Inc., and US Biolab Corp. Inc.

-

Market Research Insights

- The market encompasses the collection, processing, storage, and distribution of biospecimens for research and diagnostic purposes. This sector continues to evolve, integrating advanced technologies such as metabolomic and proteomic analysis, genomic sequencing, and data mining. Quality control and sample preparation are crucial components, ensuring audit trails and maintaining biospecimen preservation. Machine learning and predictive modeling facilitate data analysis, while validation studies ensure data accuracy. Performance metrics and user authentication provide access control and security. Sample labeling methods and data standardization enable effective metadata management and disease research.

- Biobanking plays a pivotal role in drug discovery, personalized medicine, regenerative medicine, and clinical trials, with an estimated 1.5 billion biospecimens in use worldwide. The market's value is projected to reach USD20 billion by 2025, growing at a significant rate due to the increasing demand for biomarker discovery and precision medicine applications.

We can help! Our analysts can customize this biobanking market research report to meet your requirements.