Biochips Market Size 2024-2028

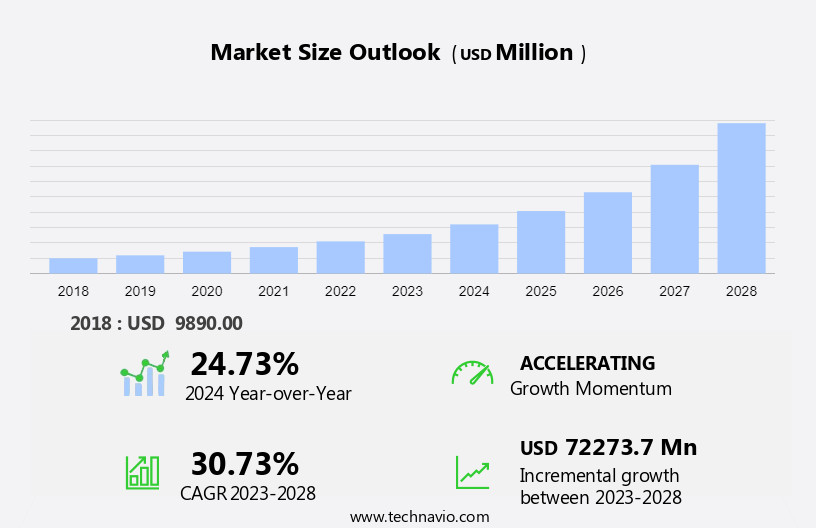

The biochips market size is forecast to increase by USD 72.27 billion at a CAGR of 30.73% between 2023 and 2028.

- The market is witnessing significant growth due to the expanding applications of microarray biochips in drug discovery. This technology allows for the simultaneous analysis of thousands of biological molecules, accelerating the drug development process.

- The increasing use of chemical microarray technology in point-of-care (POC) diagnostics is another key trend, as it allows for rapid and accurate testing outside of traditional laboratory settings. In drug discovery informatics, these devices have significantly reduced timelines by facilitating high-throughput screening of compounds. However, the high costs associated with biochip research and development remain a challenge for market growth. Despite these hurdles, the potential benefits of biochips in fields such as diagnostics, drug discovery, and research make it an attractive market for investors and industry players.

- Key market player Agilent offers Agilent 2100 Bioanalyzer system, Bioanalyzer RNA kits and reagents, and Bioanalyzer software.The company offers Agilent 2100 Bioanalyzer system, Bioanalyzer RNA kits and reagents, and Bioanalyzer software.

What will be the Size of the Biochips Market During the Forecast Period?

- The market encompasses a range of microfluidic-based devices used in genomics and proteomics research, drug discovery, and diagnostics. Key applications include cancer research, drug development for personalized medicines, and infectious disease detection. The market's growth is driven by advancements in next-generation sequencing (NGS) technology and the increasing demand for functional analyses in molecular biology.

- Biomedical advancements in genomics and proteomics have led to significant investments from both academic institutions and biopharma companies. Biochips enable high-throughput analysis of CVDS, single-cell analysis, and epidemiological devices, making them essential tools for biomedical research and diagnostics. The market is expected to continue growing due to the increasing focus on precision medicine and the need for faster, more accurate diagnostic tools.

How is this Biochips Industry segmented and which is the largest segment?

The biochips industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Biotechnology and pharmaceutical companies

- Hospitals and diagnostics centers

- Academic and research institutes

- Technology

- Microarrays

- Microfluidics

- Type

- DNA Chips

- Protein Chips

- Lab-on-chip

- Tissue Arrays

- Cell Arrays

- Geography

- North America

- US

- Europe

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By End-user Insights

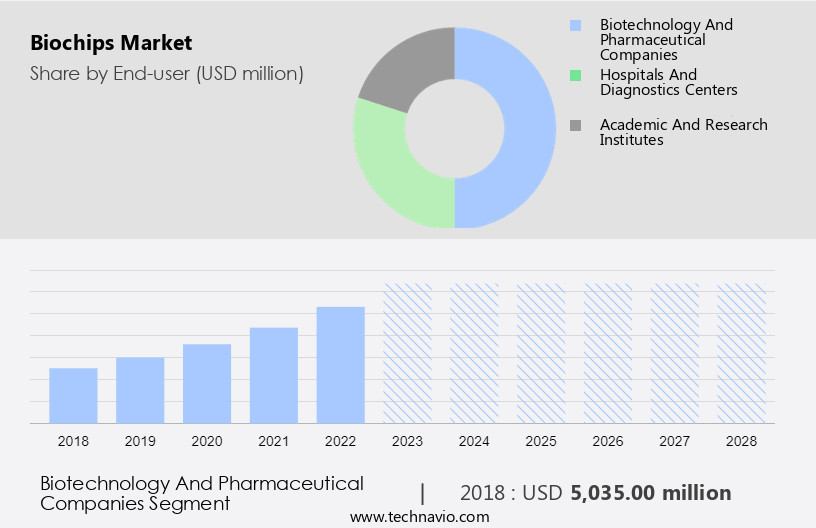

- The biotechnology and pharmaceutical companies segment is estimated to witness significant growth during the forecast period.

Biochips have witnessed substantial growth in demand over the last decade, particularly in the biotechnology and pharmaceutical industries. These microchip devices are utilized for various applications, including genomic, proteomic, and diagnostic analyses. Notable applications include genotyping, DNA methylation analysis, and gene expression analysis, which employ microarray-based BeadChip technology. Pharmaceutical companies also leverage biochips for drug development, such as assessing medication toxicity, pharmacokinetics, and efficacy using platforms. This real-time cell examination tool employs microelectronic sensors to monitor cell behavior and drug response.

Get a glance at the Biochips Industry report of share of various segments Request Free Sample

The biotechnology and pharmaceutical companies segment was valued at USD 5.04 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

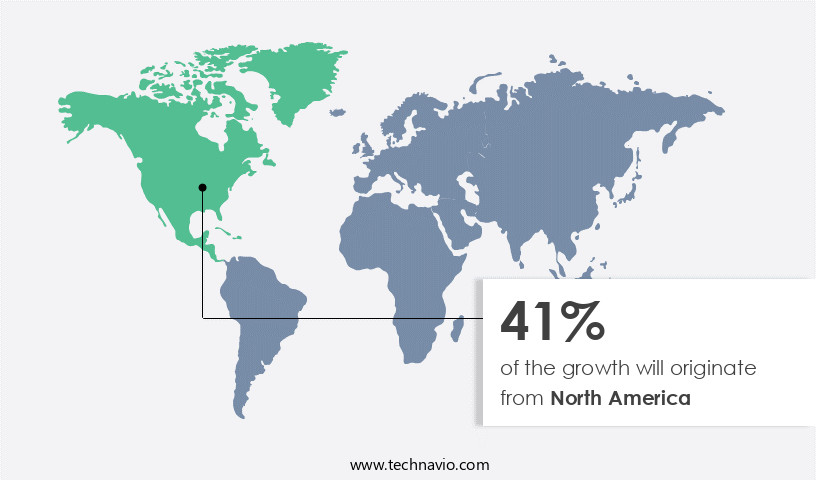

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds the largest share of the market due to advanced infrastructure for medical research and innovation in healthcare technology. With a focus on genomics and proteomics, the region has been at the forefront of using biochips for gene expression profiling, functional analyses, and drug discovery. Microarray technology, a key biochip technology, is extensively utilized for DNA sequencing and gene identification. The region's rapid advancements in robotics and drug formulations further boost the demand for biochips. These factors contribute significantly to the growth of the North American market.

Market Dynamics

Our biochips market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Biochips Industry?

Growing applications of microarray biochips in drug discovery is the key driver of the market.

- The market encompasses various applications in genomic and proteomic research, drug discovery, and disease detection. With advancements in molecular biology, microfluidics-based devices, and next-generation sequencing (NGS), the market has gained significant traction. Biochips, including DNA chips, protein chips, and microarrays, play a pivotal role in gene expression profiling, functional analyses, and epidemiological devices. In the healthcare sector, they are used for disease detection, drug development, and personalized medicines, particularly for cancer and infectious diseases. Academic institutions and biopharma companies invest heavily in this field to develop antigen tests, PCR testing, and nanoparticle delivery technology for rare diseases and drug-resistant cancer cells.

- The market for biochips is expanding due to the increasing number of trials in drug discovery for diseases like COVID-19, leading to the development of point-of-care diagnostics and lab-on-a-chip (LOC) systems. The fabrication technology markets for biochips, such as graphene and nanotechnology, are also experiencing growth. Despite the high manufacturing cost, the market is expected to continue its upward trend due to its potential in various industries, including agriculture and cytogenetic laboratories. Patent applications and research collaborations further fuel the market's growth.

What are the market trends shaping the Biochips Industry?

Increasing use of chemical microarray technology is the upcoming market trend.

- Microarray technology plays a pivotal role in the fields of genomics and proteomics, enabling simultaneous analysis of multiple bioentities. DNA microarrays, protein microarrays, and chemical microarrays are essential for research in various domains, including drug discovery, cancer research, and infectious diseases. The demand for microarray technology is on the rise due to the need for high-throughput, cost-effective screening of large numbers of chemicals against numerous biological targets. Chemical microarrays, specifically, present a challenge due to their ability to identify and evaluate small molecules as potential therapeutic reagents. In the context of drug development, microarrays facilitate gene expression profiling, disease detection, and functional analyses, contributing significantly to molecular biology research.

- Moreover, microarrays are increasingly being utilized in point-of-care diagnostics, epidemiological devices, and agriculture. Next-generation sequencing (NGS) technologies and lab-on-a-chip (LOC) systems have revolutionized the market, enabling single-cell analysis and nanoparticle delivery technology. These advancements are particularly crucial in the fight against drug-resistant cancer cells and rare diseases. Academic institutions and biopharma companies are actively investing in microfluidic-based devices and molecular microchips to drive biomedical advancement. Microarrays are also used in cytogenetic laboratories for DNA chip fabrication and RNA manufacturing platforms. The manufacturing cost of biochips is a significant factor influencing market growth, with ongoing efforts to reduce costs through advanced fabrication technology markets.

What challenges does the Biochips Industry face during its growth?

High costs associated with biochip R and D is a key challenge affecting the industry growth.

- The market encompasses various applications in genomics, proteomics, drug discovery, and disease detection. Key financial challenges include the high cost of research and development (R&D) and manufacturing for biochips, which are essential for biomedical advancements in areas such as personalized medicines, cancer research, and infectious diseases. These expenses include investments in specialized facilities and tools, as well as costly raw materials, like reagents and oligonucleotides. This high-cost barrier can limit market accessibility, particularly in resource-constrained environments. Small and medium-sized businesses face challenges in competing due to these financial hurdles, potentially slowing down innovation and the pace of technological progress.

- Applications of biochips span gene expression profiling, molecular microchips, lab-on-a-chip (LOC) systems, next-generation sequencing (NGS), and point-of-care diagnostics. In addition, biochips are utilized in various industries, including agriculture, cytogenetic laboratories, and biopharma companies, for functional analyses, antigen tests, PCR testing, and nanoparticle delivery technology. The market for biochips is driven by the need for advanced molecular biology tools for research and diagnostics, as well as the growing focus on rare diseases and single-cell analysis. Emerging economies are also expected to contribute significantly to the market growth. Applications in cardiovascular diseases (CVDs) and epidemiological devices are also on the rise. Microfluidics-based devices, DNA chips, protein chips, and microarrays are some of the popular types of biochips.

Exclusive Customer Landscape

The biochips market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biochips market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biochips market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Analis sa

- Arrayit Corp.

- BICO Group AB

- Bio Rad Laboratories Inc.

- Boao Bio Group Co. Ltd.

- Dynamic Biosensors GmbH

- Eden Tech

- Greiner Bio One International GmbH

- IDEX Corp.

- Illumina Inc.

- INNOPSYS

- Micronit BV

- Nutcracker Therapeutics Inc.

- Perkin Elmer Inc.

- QIAGEN NV

- Randox Laboratories Ltd.

- Sphere Fluidics Ltd.

- Takara Holdings Inc.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing a significant rise as a result of the increasing demand for rapid, accurate, and cost-effective diagnostic solutions and the advancement of molecular biology techniques. Biochips, also known as molecular microchips or lab-on-a-chips (LOC), are microfabricated devices that integrate various biological processes onto a single chip. These devices enable the simultaneous analysis of multiple biomolecules, such as DNA, RNA, proteins, and cells, offering numerous applications in various industries. Biochips have revolutionized the field of genomics and proteomics, enabling researchers to analyze gene expression profiling, functional analyses, and disease detection with unprecedented speed and accuracy.

Moreover, in the realm of drug discovery, biochips have emerged as essential tools for high-throughput screening, allowing researchers to identify potential drug candidates and optimize their therapeutic properties. The integration of biochips in the field of personalized medicines has led to significant advancements in the treatment of various diseases, including cancer. By analyzing the unique genetic makeup of individual patients, healthcare professionals can tailor treatment plans to address drug-resistant cancer cells, thereby improving patient outcomes. Moreover, biochips have shown great potential in the detection and diagnosis of infectious diseases, such as COVID-19, HIV, and malaria. Antigen tests and PCR testing, which utilize biochips, have proven to be effective in the early detection and diagnosis of these diseases, contributing significantly to public health efforts.

Furthermore, the emergence of next-generation sequencing (NGS) technology has further expanded the applications of biochips. NGS platforms, which are often integrated with biochips, enable the analysis of entire genomes and transcriptomes, offering valuable insights into the genetic basis of various diseases, including rare diseases. Biochips have also found applications in agriculture, where they are used for the detection of genetic markers in crops, enabling farmers to optimize their yield and improve crop health. Furthermore, academic institutions and biopharma companies are investing heavily in the development of biochips for various applications, including the manufacturing of tissue beads for drug testing and the creation of nanoparticle delivery technology for targeted drug delivery.

|

Biochips Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 30.73% |

|

Market Growth 2024-2028 |

USD 72.27 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

24.73 |

|

Key countries |

US, China, Russia, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biochips Market Research and Growth Report?

- CAGR of the Biochips industry during the forecast period

- Detailed information on factors that will drive the Biochips market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biochips market growth of industry companies

We can help! Our analysts can customize this biochips market research report to meet your requirements.