Biohacking Market Size 2025-2029

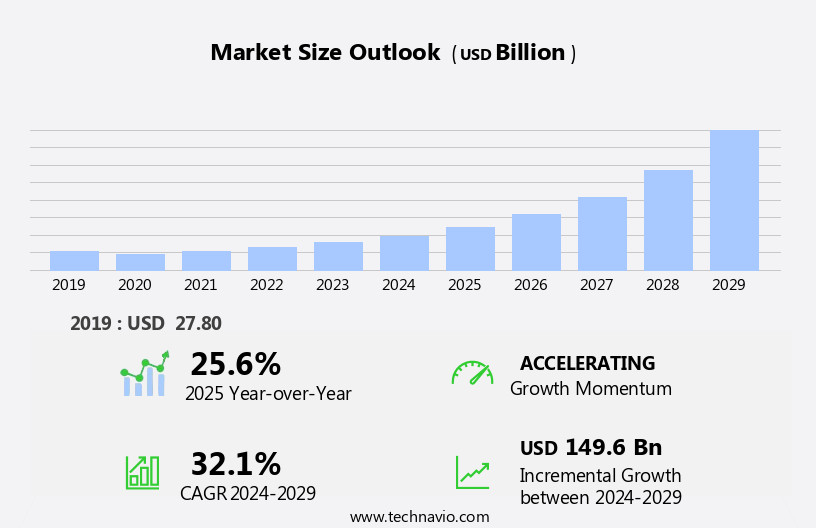

The biohacking market size is forecast to increase by USD 149.6 billion at a CAGR of 32.1% between 2024 and 2029.

- The market in North America is experiencing significant growth due to increasing awareness about the importance of health and wellness. Consumers are increasingly adopting wearable technology such as smart glasses, rings, watches, and fitness equipment to monitor their health and fitness levels in real-time. Tobacco use is declining as more people turn to nootropics and personalized nutrition apps for cognitive enhancement and optimal health. Synthetic biology and medical devices like smart pills, sensors, and virtual assistants are revolutionizing healthcare, offering accurate and timely health information. However, data integrity and privacy concerns remain a challenge for the market. Wearables, consumer electronics, and even apparel are being integrated with sensors and microphones to monitor various health metrics and provide real-time feedback. GPS technology is being used to track physical activity and location, while robotics and virtual assistants offer assistance in daily tasks. In the food industry, fast food chains are offering healthier options, and stethoscopes and other medical devices are being redesigned to be more user-friendly and accessible. Public safety is also a concern, with the potential for misuse of biohacking technology. Overall, the market is expected to continue growing as consumers seek innovative ways to improve their health and well-being.

What will be the Size of the Biohacking Market During the Forecast Period?

- The market encompasses a diverse range of innovations, from wearable devices and smart technology to advanced implants and nootropic medications. This burgeoning industry is driven by a growing consumer interest in self-experimentation and optimization of biology. Biohackers explore various technologies, such as brain sensors, microchips, RFID implants, and magnetic fingerprints, to enhance cognitive function, monitor health, and even diagnose chronic diseases. Medical apps, IOT innovations, robotics, and virtual assistants are revolutionizing healthcare delivery, enabling more efficient and personalized care. Hospitals and clinics are integrating these technologies to streamline operations and improve patient outcomes. The market's size is substantial, with significant growth potential as technology continues to intersect with biology.

- Imagination is the only limit for biohackers, as they tinker in storage rooms, garages, and laboratories. From smart drugs and microphones to stethoscopes and cameras, the market is a dynamic, ever-evolving landscape that pushes the boundaries of what is possible In the realm of health and wellness.

How is this Biohacking Industry segmented and which is the largest segment?

The biohacking industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Wearables

- Smart drugs

- Application

- Forensic science

- Synthetic biology

- Genetic engineering

- Others

- End-user

- Pharmaceutical and biotechnology companies

- Forensic laboratories

- Others

- Geography

- North America

- Canada

- US

- Asia

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- Rest of World (ROW)

- North America

By Product Insights

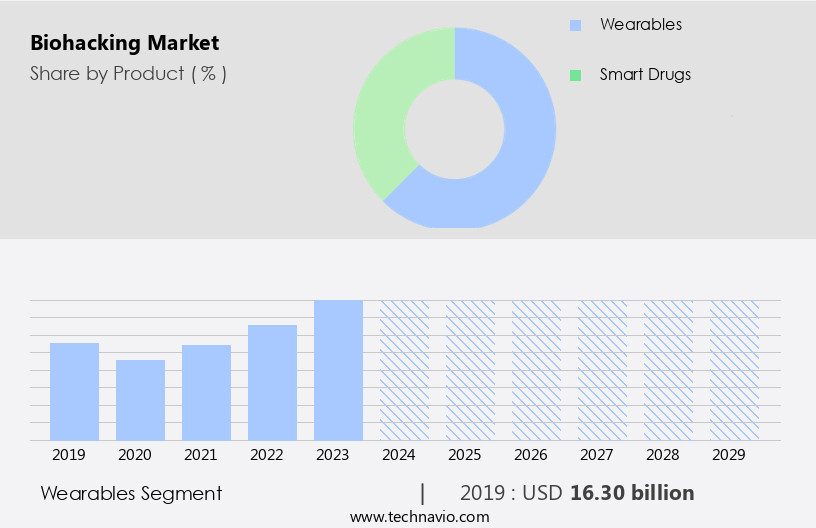

- The wearables segment is estimated to witness significant growth during the forecast period.

The wearable segment is a significant aspect of the biohacking movement, focusing on enhancing human health and well-being through technology and data. Wearable devices, including smartwatches, fitness trackers, and smart rings, are gaining popularity due to their real-time monitoring capabilities of various physiological aspects. These gadgets offer features such as calling, messaging, and fitness tracking, which integrate with smartphones for activities like heart rate monitoring, GPS tracking, and sleep monitoring. The demand for wearables is escalating, with advancements in technology improving their functionality yearly. These devices provide valuable insights into health metrics, enabling users to make informed decisions regarding their well-being.

Get a glance at the market report of share of various segments. Request Free Sample

The wearables segment was valued at USD 16.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

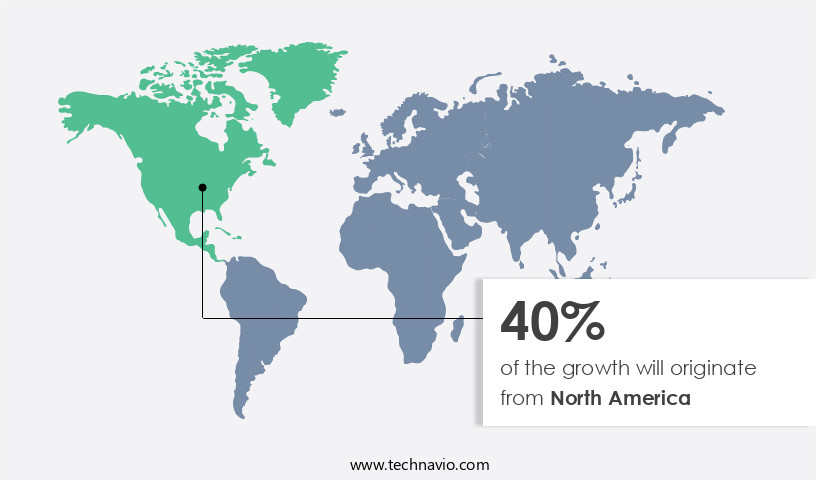

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is currently leading the global landscape, driven by the US and Canada, due to the large health-conscious population and affordability of connected fitness technology. The rise in chronic diseases, such as diabetes and cardiovascular diseases, has fueled the adoption of various health monitoring devices and annual health club memberships. The integration of smart technology in healthcare, including smart health devices, smart medications, and medical apps, is revolutionizing disease management and diagnostics. Additionally, advancements in biotechnology, such as genetic engineering experiments, molecular biology, and neuro-nutrition, are transforming the medical industry. The use of wearables, body sensors, and heart rate tracking devices enable patients to monitor their health in real-time, improving overall wellness and disease management.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Biohacking Industry?

Increasing awareness about benefits of healthy lifestyle is the key driver of the market.

- The market is experiencing significant growth due to the increasing awareness of the importance of health and wellness. With hectic work schedules and the rise of chronic diseases, such as obesity and diabetes, individuals are seeking innovative solutions to improve their cognitive performance, sleep quality, and overall health. Biohacking encompasses various practices, including the use of smart drugs, brain sensors, microchips, RFID implants, and wearable devices. These technologies enable real-time monitoring of vital signs, such as heart rate, body movement, and blood sugar levels. Moreover, the integration of technology in healthcare is revolutionizing disease management and diagnostics.

- Smart medications, such as smart pills, are being developed to enhance drug adherence and monitor drug intake. Clinical trials and pharmaceutical firms are investing in drug monitoring and adherence sensors to improve patient outcomes. The market for biohacking is also driven by the advancements in scientific research, particularly In the fields of molecular biology, genetic engineering, and synthetic biology. Neuro-nutrition and genetic modification kits are gaining popularity as individuals seek to optimize their brain function and explore the genetic underpinnings of various conditions. Furthermore, the integration of technology in healthcare is expanding beyond hospitals and clinics. Medical apps, smart health devices, and virtual assistants are enabling remote care and patient monitoring, providing doctors with valuable insights into their patients' health status.

What are the market trends shaping the Biohacking Industry?

Rising consumer interest in yoga, aerobics, and mixed martial arts is the upcoming market trend.

- Biohacking, the practice of using technology to optimize one's biological processes, is gaining traction In the consumer market. Smart drugs, brain sensors, microchips, RFID implants, and magnetic fingerprints are some of the tools employed by biohackers to enhance cognitive performance, monitor health, and manage chronic diseases. Wearables, such as health trackers and smart devices, are increasingly popular In the wellness space, providing real-time data on heart rate, body movement, and calorie burning. The medical industry is also embracing smart technology, with hospitals and clinics utilizing medical apps, Apple Watch data, and smart health devices for disease management and diagnostics.

- Smart medications, such as those using adherence sensors and software, are revolutionizing the pharmaceutical industry by ensuring drug monitoring and improving patient compliance. Neuro-nutrition, genetic engineering experiments, and molecular biology are some of the areas of scientific research being explored In the biohacking community. Forensic science and synthetic biology are also intersecting with biohacking, with applications in drug testing and diagnostic studies. Body sensors, heart rate tracking, stress levels, and blood sugar level measures are essential tools for biohackers seeking to optimize their health. Cybersecurity and patient safety information are critical concerns in this field, with medical insurers and regulatory bodies closely monitoring developments.

What challenges does the Biohacking Industry face during its growth?

Data integrity and privacy issues in biohacking is a key challenge affecting the industry growth.

- Wearable technology, including smart devices and biohacking tools such as brain sensors, microchips, RFID implants, and body sensors, is revolutionizing the healthcare industry. These devices collect and store vast amounts of data, including health information and user behavior, in databases. Advanced features like cognitive enhancers, genetic modification kits, and neuro-nutrition apps are increasingly integrated into these devices. However, with the rise of biohacking comes privacy concerns. Hackers can access sensitive patient data through wireless interceptors, posing a significant threat to patient safety. Smart pills technology, clinical trials, and pharmaceutical firms are also leveraging smart medications and drug monitoring systems with adherence sensors and software.

- In the wellness space, consumers are using wearables for health monitoring, disease management, and diagnostics. Medical apps, such as those for atrial fibrillation, are integrated with smartphones and smartwatches to provide real-time heart rate tracking, stress levels, and sleep quality analysis. The medical insurers and hospitals & clinics are also adopting IoT innovations, such as robotics and virtual assistants, for remote care and patient data management.

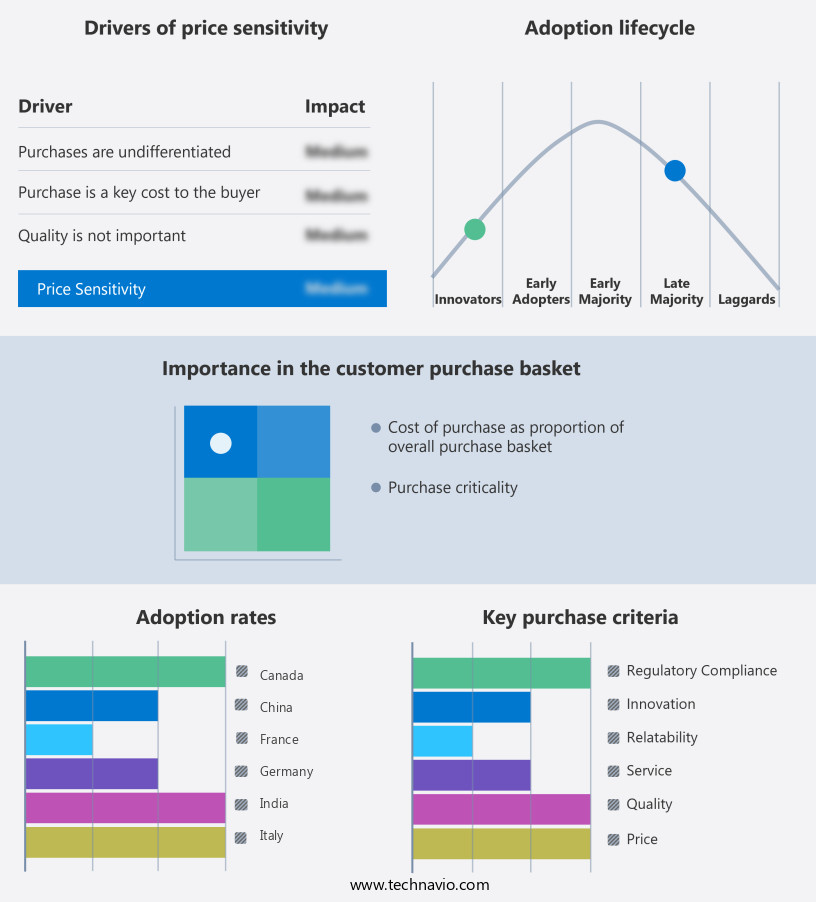

Exclusive Customer Landscape

The biohacking market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biohacking market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biohacking market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Apalon LLC - The company offers biohacking solutions such as MoodKit and Moodnotes through its subsidiary Thriveport LLC.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Beeblesoft Ltd.

- Biohacker Center Store

- Biohackers Health and Fitness

- Biostrap USA LLC

- Fitbit LLC

- Halo Neuro Inc.

- Health Via Modern Nutrition Inc.

- InteraXon Inc.

- NEUROHACKER COLLECTIVE LLC

- Nuanic Oy

- Oura Health Oy

- Soylent Nutrition Inc.

- Synthego Corp.

- The ODIN

- Thync Global Inc.

- True Wellness LLC

- Vigofere Oy

- Viome Life Sciences Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing revolutionary developments as technology continues to intertwine with biology. This sector encompasses various domains, including cognitive enhancers, body sensors, and smart devices, all aimed at optimizing personal health and wellbeing. At the core of this market are individuals who are self-experimenters, constantly seeking to enhance their cognitive performance, memory, and overall health. They employ various methods, such as nootropic medications, neuro-nutrition, and genetic engineering experiments, to augment their mental and physical abilities. The biohacking landscape is marked by an influx of smart technology, with wearables and medical apps becoming increasingly popular. These devices offer real-time health monitoring, disease management, and diagnostics, enabling individuals to take a proactive approach to their wellbeing.

In addition, smart health devices, such as smart glasses, smartwatches, and smartphones, provide measures like heart rate tracking, stress levels, body movement, and calorie burning, allowing users to make informed decisions about their lifestyle and health. The integration of technology in healthcare is not limited to consumers. Hospitals and clinics are also adopting smart devices and medical apps to streamline operations, improve patient care, and enhance diagnostic capabilities. This shift towards digital health solutions is expected to revamp the healthcare sector, making it more efficient and accessible. The market also includes advanced technologies like magnetic fingerprints, RFID implants, and body sensors.

In addition, these items offer unique benefits, such as enhanced security and contact tracing, making them valuable additions to the wellness space. The market for cognitive enhancers, such as smart drugs and nootropic medications, is gaining significant traction as individuals seek to optimize their brain function. These substances, often derived from natural sources, have been shown to improve focus, memory, and cognitive performance. However, their long-term effects and potential risks are still under investigation. Another area of interest In the market is genetic modification kits, which allow individuals to explore their genetic underpinnings and make informed decisions about their health.

Furthermore, these kits offer insights into various aspects of an individual's genome, including predispositions to chronic diseases and responses to medications. The market is not without its challenges. Cybersecurity concerns, patient safety information, and medical insurers' regulations are some of the issues that need to be addressed as this sector continues to grow. The technological innovations In the market are vast and varied, from smart pills technology to robotics and artificial intelligence. These advancements are transforming the medicinal industry, making healthcare more accessible and personalized.

In addition, it encompasses various domains, from cognitive enhancers and body sensors to smart devices and medical apps. The integration of technology in healthcare is revolutionizing the sector, offering new opportunities and challenges. As this market continues to grow, it is essential to address the ethical, safety, and regulatory implications to ensure its long-term sustainability and success.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.1% |

|

Market growth 2025-2029 |

USD 149.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

25.6 |

|

Key countries |

US, China, Canada, Germany, UK, Japan, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biohacking Market Research and Growth Report?

- CAGR of the Biohacking industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biohacking market growth of industry companies

We can help! Our analysts can customize this biohacking market research report to meet your requirements.