Bipolar Forceps Market Size 2024-2028

The bipolar forceps market size is forecast to increase by USD 273.1 million at a CAGR of 5.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing volume of surgeries due to the rising prevalence of chronic diseases and an aging population. This trend is particularly noticeable in developed regions, where an aging demographic and advanced healthcare systems are leading to increased demand for surgical instruments like bipolar forceps. However, market expansion is not without challenges. Regulatory hurdles impact adoption, as stringent regulations require extensive testing and approval processes for new medical devices. Furthermore, the lack of skilled expertise in using advanced surgical instruments can limit market penetration, especially in developing regions.

- Additionally, the rise of online sales channels is disrupting traditional distribution models and intensifying competition, requiring companies to adapt their sales and marketing strategies. To capitalize on market opportunities and navigate challenges effectively, companies must focus on regulatory compliance, invest in training and development programs, and leverage digital technologies to enhance their sales and marketing efforts.

What will be the Size of the Bipolar Forceps Market during the forecast period?

- The market is a significant segment of the surgical equipment market, intersecting with healthcare technology and medical technology to enhance surgical precision and patient safety. Surgical robotics and computer-assisted surgery are driving trends in this sector, enabling faster recovery time, reduced bleeding, and minimal tissue damage. Materials science and biomedical engineering innovations contribute to the development of advanced surgical techniques and improved surgical outcomes. Healthcare trends prioritize enhanced patient safety and operating room efficiency, fueling the adoption of surgical equipment that facilitates precision medicine. Radiofrequency ablation and electrothermal coagulation are emerging surgical technologies that offer minimally invasive solutions for tissue approximation, contributing to the overall growth of the market.

- Surgical skills training and surgical technique refinement are essential aspects of the medical device industry, as surgical efficiency and surgical workflow optimization remain key priorities. The integration of healthcare innovation and surgical equipment market developments is crucial for addressing the evolving needs of the healthcare sector.

How is this Bipolar Forceps Industry segmented?

The bipolar forceps industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Disposable bipolar forceps

- Reusable bipolar forceps

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The disposable bipolar forceps segment is estimated to witness significant growth during the forecast period.

The market is characterized by the significant demand for disposable forceps, driven by the prioritization of hygiene and sterility in medical procedures. Disposable bipolar forceps offer a cost-effective and convenient solution, particularly in high-volume healthcare settings. These single-use instruments minimize the risk of cross-contamination and infections, aligning with stringent safety protocols. Advancements in material technology have led to the production of high-quality disposable forceps, enhancing their appeal. Titanium forceps, with their strength and durability, continue to be popular in various surgical applications, including cardiovascular, thoracic, and general surgeries. Forceps length, handle design, and jaw design are essential factors influencing the choice of forceps for specific procedures.

Forceps training and certification ensure the proper usage of these surgical instruments, contributing to improved patient safety. Bipolar coagulation technology, used in forceps for tissue sealing during minimally invasive surgeries, has led to the innovation of insulated and non-insulated forceps. Forceps manufacturing adheres to stringent quality control measures to ensure reliability and safety. Medical devices, including forceps, undergo rigorous regulation to maintain performance, precision, and adherence to safety standards. The market for forceps is diverse, encompassing applications in gynecological, urological, orthopedic, and plastic surgeries. Forceps maintenance and calibration are crucial for ensuring the longevity and effectiveness of reusable forceps.

Overall, the market is dynamic, with ongoing advancements in technology and evolving surgical procedures driving growth.

The Disposable bipolar forceps segment was valued at USD 429.70 million in 2018 and showed a gradual increase during the forecast period.

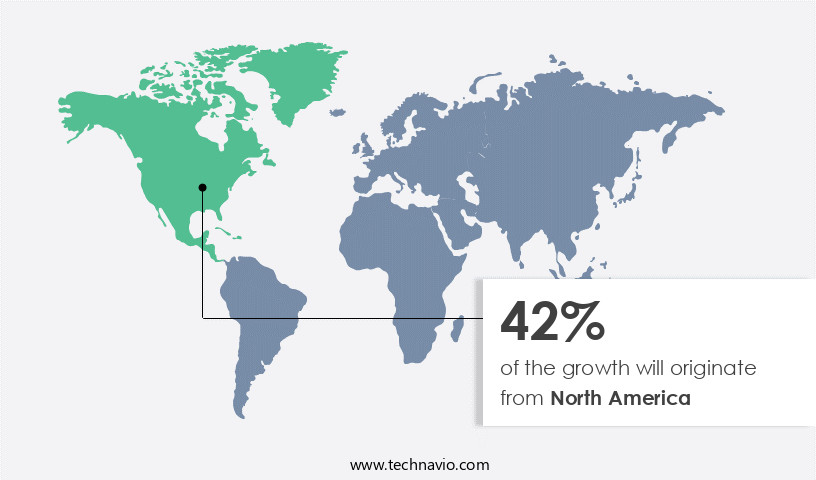

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the rising prevalence of chronic diseases and an increasing number of surgeries. According to the Centers for Disease Control and Prevention (CDC), approximately 133 million Americans had one or more chronic conditions in 2020, with cardiovascular diseases and chronic respiratory diseases being the most common. The high incidence of colorectal cancer, ulcerative colitis, orthopedic surgeries, and gynecological surgeries further contributes to the market's expansion. Bipolar forceps are essential surgical instruments used in various procedures, including laparoscopic, thoracic, cardiovascular, gynecological, and urological surgeries. These forceps come in different sizes, materials, and designs, such as titanium, stainless steel, insulated, and disposable.

The market's growth is driven by the benefits of bipolar forceps, including precise tissue sealing, minimally invasive procedures, and improved safety protocols. Manufacturers prioritize quality control, certification, and innovation to meet the growing demand for bipolar forceps. The market is also subject to regulations and guidelines to ensure the safety and performance of these surgical instruments. Training and maintenance are crucial to ensure proper usage and calibration of bipolar forceps. Bipolar forceps play a vital role in minimally invasive surgeries, such as laparoscopic and endoscopic procedures, where precision and safety are paramount. The market's growth is expected to continue as the need for advanced surgical instruments increases to address the complexities of various surgical procedures.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Bipolar Forceps market drivers leading to the rise in the adoption of Industry?

- The surge in the number of surgeries, driven by the prevalence of chronic diseases and an aging population, is the primary factor fueling market growth.

- The market is experiencing significant growth due to the increasing number of surgeries, particularly in the areas of laparoscopic gynecological and general surgery. The demand for these instruments is driven by the prevalence of chronic diseases and an aging population, leading to a higher need for surgical interventions. Delicate procedures, such as spine, neuro, and cranial surgeries, require advanced, precise, and reliable instruments. According to the Centers for Disease Control and Prevention (CDC), approximately 57% of surgeries were performed in hospitals, while 43% took place in freestanding ambulatory surgery centers in 2020. Ensuring forceps safety and durability is crucial in surgical procedures, leading to an increased focus on manufacturing high-quality bipolar forceps.

- Additionally, the adoption of endoscopic surgery and thoracic procedures is further fueling the market growth. Insulated bipolar forceps are gaining popularity due to their enhanced safety features, making them an essential tool for surgeons. Regulatory bodies play a crucial role in ensuring the safety and effectiveness of these instruments, maintaining strict guidelines for their manufacturing and usage.

What are the Bipolar Forceps market trends shaping the Industry?

- Online sales represent the current market trend, with an increasing number of consumers preferring to shop digitally.

- In the medical devices industry, the use of forceps in various surgical procedures continues to be a popular technique for precision and performance. Forceps come in different designs, including non-insulated stainless steel forceps, which are widely used in urological and orthopedic surgeries. The jaw design of these forceps allows for better grip and control during procedures. Companies in this market are increasing their online presence to expand their reach and enhance sales. Selling medical disposables online offers companies cost savings on setup, distribution, and operational expenses. Major e-commerce platforms, such as Amazon, Collateral Medical, Surgical Shop, MedicalExpo, and IndiaMART, provide a wide range of disposable forceps for purchase.

- These companies offer discounts and promotional deals, making online platforms an attractive option for consumers. Manufacturers like Armstrong Medical and MedPlus sell disposable forceps through their online platforms, catering to the convenience of consumers, particularly those undergoing post-operative care and requiring home delivery. This trend is beneficial for both companies and consumers, as it offers cost savings, increased accessibility, and improved convenience. Proper forceps calibration and maintenance are essential to ensure optimal performance and patient safety.

How does Bipolar Forceps market faces challenges face during its growth?

- The absence of adequately skilled professionals poses a significant challenge to the industry's growth trajectory.

- The market is driven by the growing demand for minimally invasive surgeries and the benefits they offer, such as reduced recovery time and minimal scarring. These forceps, which include titanium handles and various lengths and tip designs, are essential tools for these procedures. However, the supply of skilled professionals to operate and use these forceps effectively is becoming a concern. Developed and developing economies, including the US, Canada, India, Brazil, and Iran, are experiencing a shortage of highly skilled surgeons, physicians, and technicians.

- This shortage can lead to increased complications and risks during surgeries. To mitigate this issue, there is a growing emphasis on forceps training and certification programs. Quality control measures and adherence to certification standards are also crucial to ensure the safety and efficacy of bipolar forceps.

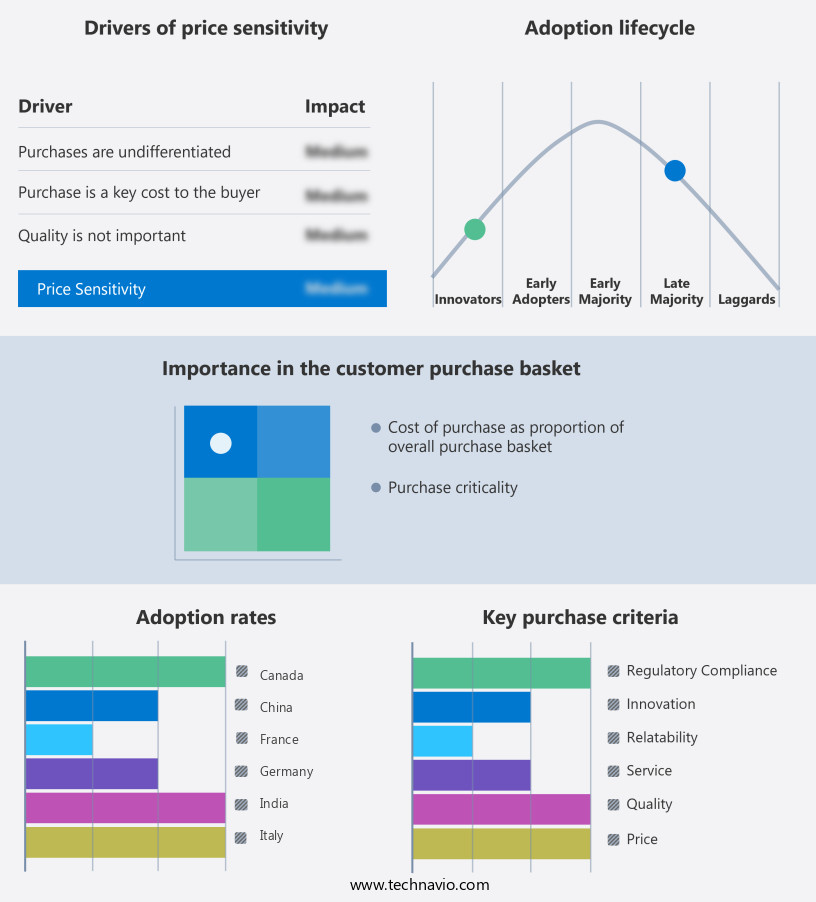

Exclusive Customer Landscape

The bipolar forceps market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bipolar forceps market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bipolar forceps market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASICO LLC - The company specializes in providing advanced bipolar surgical instruments, including the MIV Pivot Point Forceps and Special Bipolar Forceps.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASICO LLC

- B.Braun SE

- Becton Dickinson and Co.

- BOWA Electronic GmbH and Co. KG

- Conmed Corp.

- Erbe Elektromedizin GmbH

- Faulhaber Pinzetten OHG

- Gebruder Martin GmbH and Co. KG

- Gunter Bissinger Medizintechnik GmbH

- Integra LifeSciences Holdings Corp.

- Johnson and Johnson Inc.

- Medtronic Plc

- OPHMED CO. LTD

- Opmic Perkasa Mandiri. PT

- P.W. Coole and Son Ltd.

- Stingray Surgical Products LLC

- Stryker Corp.

- Sutter Medizintechnik GmbH

- Symmetry Surgical Inc.

- Teleflex Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bipolar Forceps Market

- In February 2024, Medtronic, a leading medical technology company, announced the launch of its new bipolar forceps, the HydroMaze X10, designed for the ablation of atrial fibrillation. This innovative product features a hydrophilic tip for easier navigation and improved contact force (Medtronic Press Release, 2024).

- In June 2025, Stryker Corporation entered into a strategic partnership with NeuroOne medical technologies to integrate NeuroOne's Sphenopalatine Ganglion Stimulation (SPG) System with Stryker's bipolar forceps. This collaboration aims to expand Stryker's neurostimulation portfolio and offer a more comprehensive solution for treating various neurological conditions (Stryker Corporation Press Release, 2025).

- In October 2024, Ethicon, a subsidiary of Johnson & Johnson, received FDA approval for its new EnSeal Advanced Bipolar Forceps. These forceps offer enhanced sealing capability and improved hemostasis, addressing the need for efficient and effective surgical procedures (FDA Press Release, 2024).

- In March 2025, AngioDynamics, a leading provider of innovative, minimally invasive medical devices, acquired BioTelemetry, a leading remote monitoring services company. This acquisition enables AngioDynamics to expand its product offerings and enter the remote monitoring market, enhancing the company's bipolar forceps portfolio with advanced diagnostic capabilities (AngioDynamics Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in medical technology and the expanding scope of surgical applications. This dynamic market encompasses various entities, each contributing to the ongoing unfolding of market activities. Bipolar forceps technique, a minimally invasive procedure, has gained significant traction in recent years due to its precision and performance. The technique's popularity extends across multiple sectors, including urological, orthopedic, and cardiovascular surgeries. Forceps precision and performance are crucial factors influencing market growth. Stainless steel forceps, with their durability and reliability, remain a preferred choice for many surgeons. However, the advent of disposable forceps offers advantages such as reduced infection risk and easier sterilization.

Forceps calibration and maintenance are essential for ensuring optimal performance and safety. Medical devices manufacturers prioritize innovation, focusing on improving forceps design, such as jaw design and insulated forceps, to enhance surgical outcomes. Market dynamics are shaped by various factors, including regulatory requirements, safety protocols, and tissue sealing technology. The ongoing development of bipolar forceps technology continues to reshape the landscape of surgical procedures, from laparoscopic to open surgeries. In the ever-evolving market, the focus on forceps safety, quality control, and certification remains paramount. The market's continuous growth is fueled by the increasing demand for advanced surgical instruments that cater to the diverse needs of medical professionals and patients alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bipolar Forceps Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2024-2028 |

USD 273.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.2 |

|

Key countries |

US, Germany, China, Japan, UK, Canada, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bipolar Forceps Market Research and Growth Report?

- CAGR of the Bipolar Forceps industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bipolar forceps market growth of industry companies

We can help! Our analysts can customize this bipolar forceps market research report to meet your requirements.