BLDC Motor Drivers Market Size 2025-2029

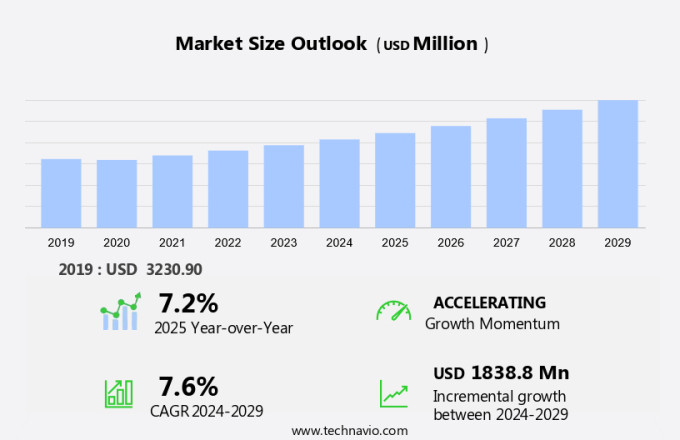

The BLDC motor drivers market size is forecast to increase by USD 1.84 billion, at a CAGR of 7.6% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing demand for energy-efficient solutions. One of the key trends in this market is the introduction of new products, which are designed to offer improved efficiency and power density. However, the market is also facing challenges such as volatility in raw material prices, which can impact the cost structure of BLDC motor drivers. Energy efficiency is a major concern for industries and consumers alike, leading to a rise in demand for BLDC motor drivers. Manufacturers are responding to this trend by launching new products that offer higher efficiency and better performance. Despite this, the market is not without its challenges. Raw material prices, particularly for rare earth elements, can be volatile, leading to cost pressures for manufacturers. Overall, the market is expected to grow steadily, driven by the need for energy-efficient solutions and continuous innovation in product offerings.

What will be the Size of the Market During the Forecast Period?

- The market specifically those used in energy-efficient motors for sunroofs, doors, thermal comfort systems, safety fittings, and other automobile features, is experiencing significant growth. This trend is driven by the increasing demand for eco-friendly electrical vehicles and the need for improved thermal comfort and energy conservation in both industrial and consumer applications. Electric DC motors, including brushless DC motors, are at the forefront of this market. These motors offer reduced noise, increased efficiency, and longer lifespan compared to their brushed counterparts. The automotive industry's adoption of these motors in HVAC systems, massaging seats, adjustable mirrors, and other vehicle powertrain systems is a major factor in their growing popularity. Moreover, advancements in battery technologies and HVAC systems have led to increased energy efficiency and improved air quality in vehicles. Motorized seats and adjustable mirrors, for instance, are becoming increasingly common in modern cars, further driving the demand for motor drivers. The market for motor drivers is not limited to the automotive industry, however. They are also used extensively in industrial robotics, consumer electronics, laptops, and power tools, among other applications.

- The focus on energy conservation and automation in various industries is expected to boost the profitability of motor driver manufacturers in the coming years. Despite the numerous benefits of motor drivers, energy consumption remains a critical concern. Electric controllers, which regulate the speed and direction of motors, play a crucial role in minimizing energy waste and optimizing performance. As such, advancements in controller technology are a key area of research and development in the motor driver market. In conclusion, the market for motor drivers is poised for significant growth due to the increasing demand for energy-efficient motors in various industries. The focus on eco-friendly electrical vehicles, thermal comfort, and energy conservation is driving innovation and investment in this sector. Motorized features such as sunroofs, doors, and HVAC systems, as well as industrial automation and consumer electronics, are expected to remain key applications for motor drivers in the coming years.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Sensorless BLDC drivers

- Sensored BLDC drivers

- Application

- Three-phase BLDC motors

- Single-phase BLDC motors

- Two-phase BLDC motors

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

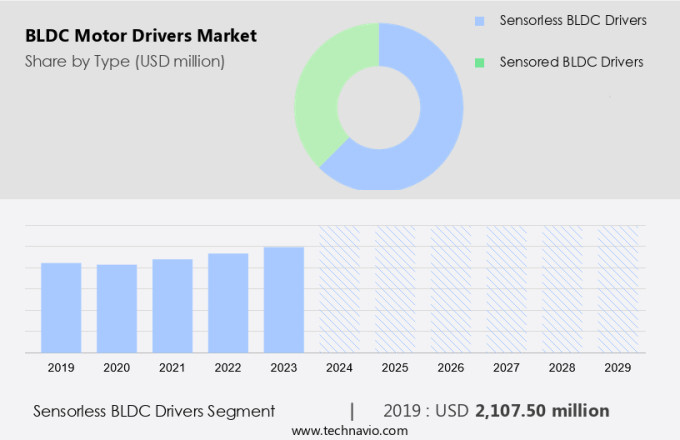

- The sensorless BLDC drivers segment is estimated to witness significant growth during the forecast period.

BLDC motor drivers with sensorless design are gaining significant traction in the global motor drivers market. These drivers eliminate the requirement for external sensors to detect rotor position, instead utilizing the back electromotive force (EMF) generated by motor rotation to estimate the rotor position. This design choice results in a cost-effective and simpler product, enhancing reliability by reducing the number of components. Sensorless BLDC motor drivers are particularly suitable for applications where precise rotor position control is not essential, such as fans, pumps, home appliances, and various automation systems. In the realm of sustainable mobility and smart manufacturing, the integration of advanced materials and weight reduction strategies further bolsters the demand for these motor drivers. Additionally, their application in renewable energy systems, such as wind and solar power, underscores their importance in promoting automotive efficiency and overall energy sustainability.

Get a glance at the market report of share of various segments Request Free Sample

The sensorless BLDC drivers segment was valued at USD 2.11 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

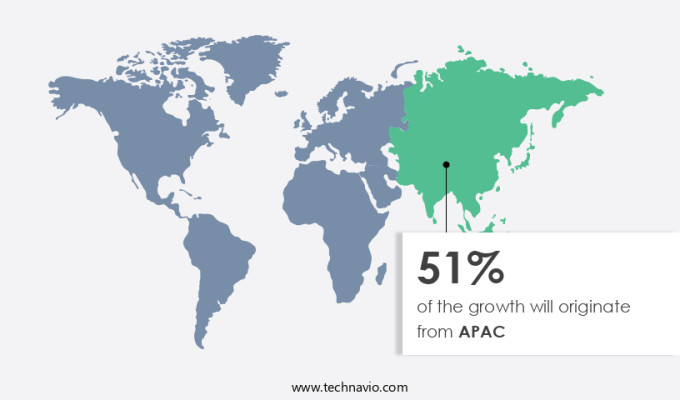

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is a major contributor to The market, fueled by the expansion of the electric vehicle (EV) industry and the adoption of green technology in various sectors. In China, the EV sector experienced significant growth, with over 8.1 million new registrations in 2023, representing a 35% increase from the previous year. This growth is driven by the Chinese government's commitment to reducing carbon emissions and promoting sustainable transportation solutions. Additionally, the country's manufacturing sector is rapidly adopting Industry 4.0 technologies, modernizing processes and promoting high-tech industries, leading to increased demand for advanced BLDC motor drivers. The APAC region's focus on renewable energy vehicles and motor efficiency is expected to continue driving market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of BLDC Motor Drivers Market?

Increasing demand for energy efficiency is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for energy-efficient motor solutions across various industries, including vehicle interior design, HVAC design, and sustainable transportation. BLDC motors, which stand out for their superior energy efficiency compared to traditional brushed motors, offer numerous benefits. The absence of brushes in BLDC motors eliminates frictional losses, resulting in better energy utilization and reduced wear and tear, ultimately extending motor life and lowering maintenance costs. Moreover, BLDC motors' electronic commutation enables precise control over motor operation, optimizing energy consumption and making them an excellent choice for applications where energy efficiency is paramount. The automotive industry, for instance, is increasingly adopting BLDC motors for electric vehicle range extension, automotive safety features, and vehicle comfort features. In the industrial sector, BLDC motors are being employed in HVAC equipment, industrial machinery, robotics, and automation systems, among others.

- The renewable energy vehicles segment is also witnessing a rise in the adoption of BLDC motors due to their energy-saving capabilities and high motor performance. As the trend towards green technology and sustainable mobility continues, the demand for energy-saving solutions, including motor control systems, is expected to increase. Motor suppliers are focusing on product innovation and motor design to meet the evolving needs of various industries. The future of motor technology lies in high-performance motors, advanced materials, weight reduction, powertrain optimization, and reduced emissions. In conclusion, the market is poised for growth due to the increasing demand for energy-efficient motor solutions across various industries. The advantages of BLDC motors, such as energy efficiency, motor reliability, and precise control, make them an ideal choice for applications where energy savings and motor performance are critical.

What are the market trends shaping the market?

The introduction of new products is the upcoming trend in the market.

- The market is experiencing substantial growth due to the integration of energy-efficient motor technologies in various industries. Motor suppliers are introducing innovative motor control systems, such as the MLX90416 by Melexis, which is a 60W single-coil sensorless BLDC driver. This motor driver, launched on October 17, 2024, operates on a 24V power supply and eliminates the need for a feedback sensor, offering cost savings and improved efficiency compared to traditional three-phase BLDC motors and AC induction motors. The MLX90416's integrated drive and feedback algorithms ensure quiet and vibration-free operation, simplifying manufacturing complexities and reducing the bill of materials (BOM) costs. This motor driver is suitable for motor, fan, and pump applications across consumer electronics and industrial sectors, including vehicle interior design, HVAC design, and green technology for sustainable transportation. Its high motor performance and energy efficiency contribute to electric vehicle range and renewable energy vehicle integration.

- Moreover, motor reliability and advanced materials, such as lightweight design and powertrain optimization, are essential aspects of the market. Motor technology advancements in smart car technology, automation systems, HVAC equipment, industrial machinery, robotics industry, and precision engineering have led to increased demand for high-performance motors and energy-saving solutions. As the market continues to evolve, motor selection, HVAC maintenance, and motor repair will remain crucial factors for manufacturers seeking to optimize performance and reduce emissions.

What challenges does the market face during the growth?

Volatility in raw material prices is a key challenge affecting the market growth.

- The market is experiencing notable growth due to the increasing adoption of energy-efficient motor technology in various industries. This includes battery technology for electric and renewable energy vehicles, vehicle interior design, HVAC design, and green technology for sustainable transportation. Motor efficiency and energy saving technologies are key priorities in automotive safety features and electric vehicle efficiency. Motor control systems and automation systems are essential components of smart car technology, high-speed motor performance, and motor technology innovation. The integration of renewable energy vehicles into building infrastructure and the development of smart home technology require advanced motor design and motor selection for HVAC equipment.

- The motor reliability and motor performance of industrial machinery are crucial for precision engineering and robotics industry applications. Motor repair and motor drive maintenance are essential for ensuring the longevity and efficiency of electric motors in various industries. The global market for BLDC motor drivers is influenced by several factors, including the cost of batteries, motor control systems, and the automation trends in industries such as automotive, industrial machinery, and robotics. The production of BLDC motor drivers relies on various raw materials, including semiconductors, copper, aluminum, silicon, iron, and rare earth elements. Fluctuations in the prices of these materials can significantly impact manufacturing costs and market dynamics.

- According to the World Bank 2024 Commodity Market Outlook, prices for key materials such as copper and aluminum are expected to see modest growth, with copper prices forecasted to rise by 5% and aluminum prices anticipated to increase by 2%. In summary, the market is driven by the increasing demand for energy-efficient motor technology in various industries, including electric vehicles, HVAC equipment, and robotics. The market dynamics are influenced by factors such as raw material prices, battery costs, and automation trends. The integration of renewable energy vehicles and smart technology into various industries requires advanced motor design and motor selection for optimal performance and energy savings.

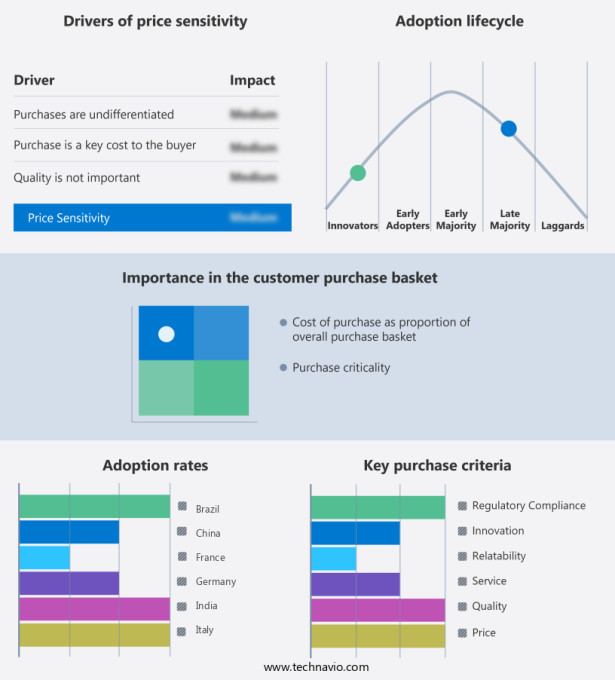

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd - This company offers BLDC motor drivers through its extensive range of drives and motor control solutions.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Danfoss AS

- Eaton Corp plc

- Fuji Electric Co. Ltd.

- General Electric Co.

- Hitachi Ltd.

- Infineon Technologies AG

- Johnson Electric Holdings Ltd.

- Microchip Technology Inc.

- Mitsubishi Electric Corp.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Schneider Electric SE

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for energy-efficient motor solutions across various industries. BLDC (Brushless Direct Current) motor drivers are crucial components in the operation of BLDC motors, which are known for their high efficiency, reliability, and precision. BLDC motor drivers play a vital role in optimizing motor performance by controlling the current flow to the motor windings. These motor drivers are widely used in applications where energy efficiency and high performance are essential, such as HVAC (Heating, Ventilation, and Air Conditioning) systems, industrial machinery, robotics, and electric vehicles. The growing focus on sustainability and green technology is driving the demand for energy-efficient motor solutions. BLDC motors and their drivers are increasingly being adopted in electric vehicles to enhance range, reduce emissions, and improve overall vehicle efficiency. In addition, the integration of renewable energy sources into the power grid is leading to the increased use of BLDC motor drivers in renewable energy vehicles. The automotive industry is another significant market for BLDC motor drivers.

Additionally, with the rise of smart car technology and the increasing popularity of electric vehicles, there is a growing demand for advanced motor control systems. These systems enable improved motor performance, energy savings, and enhanced safety features. In the industrial sector, BLDC motor drivers are used in precision engineering applications, automation systems, and high-speed motor applications. The use of these motor drivers helps in reducing energy consumption, improving motor reliability, and optimizing motor selection for specific applications. The robotics industry is another major market for BLDC motor drivers. The increasing adoption of industrial robots and the trend towards automation are driving the demand for high-performance motor drivers. These motor drivers enable precise motor control, sensorless control, and advanced motor design, leading to improved motor efficiency and reliability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market Growth 2025-2029 |

USD 1.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Key countries |

China, US, Japan, Germany, South Korea, India, Italy, UK, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.