Motor Driver Board Market Size 2025-2029

The motor driver board market size is forecast to increase by USD 2.07 billion, at a CAGR of 8.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for electric vehicles (EVs). The adoption of EVs is escalating due to increasing environmental concerns and government initiatives to reduce carbon emissions. This trend is resulting in a surge in demand for motor driver boards, which are essential components in the electric propulsion systems of EVs. However, the market is not without challenges. Supply chain disruptions pose a significant threat due to the dependence on rare earth materials and components sourced from various regions.

- Additionally, new product launches by competitors intensify the competition, necessitating continuous innovation and improvement to maintain market share. Companies in the market must navigate these challenges effectively to capitalize on the growing opportunities in the EV market. By focusing on research and development, supply chain resilience, and strategic partnerships, they can differentiate themselves and stay competitive in this dynamic market.

What will be the Size of the Motor Driver Board Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and dynamic market activities. Brushless DC motors, servo motors, and stepper motors are integral components of various sectors, including industrial equipment, precision positioning in CNC machining, 3D printing, and motion control applications. Real-time control, torque control, and position control are essential features in these applications, enabling high-performance operation and seamless integration of motion control algorithms and embedded software. Fault detection, closed-loop control, and current sensing are critical elements for ensuring optimal motor performance and preventing damage due to overcurrent or overvoltage. Size and weight considerations, power consumption, and operating temperature are essential factors influencing the selection of motor driver boards for various applications.

Motion control applications extend to linear actuators, medical devices, and industrial automation, necessitating various interfaces such as SPI, USB, I2C, CAN bus, and Ethernet. Overcurrent protection, thermal protection, and PWM control are additional features that enhance motor driver board functionality. The ongoing development of firmware and motion control algorithms continues to expand the capabilities of motor driver boards, enabling more efficient and precise motor control across diverse industries.

How is this Motor Driver Board Industry segmented?

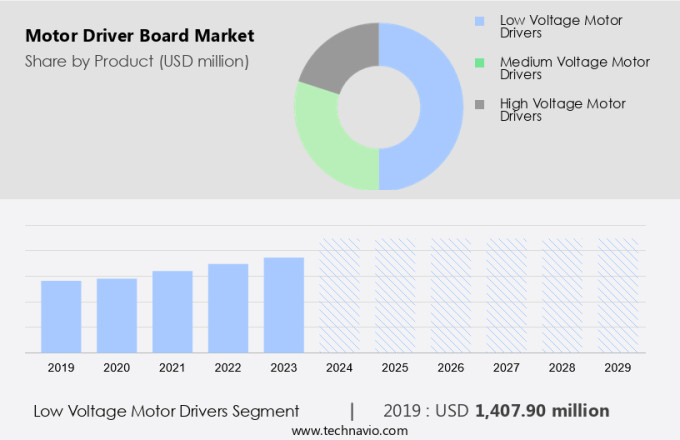

The motor driver board industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Low voltage motor drivers

- Medium voltage motor drivers

- High voltage motor drivers

- End-user

- Automotive and electric vehicles

- Robotics

- Industrial automation

- Consumer electronics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Product Insights

The low voltage motor drivers segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the low voltage motor driver segment. These drivers, designed for small motors and devices, are increasingly used in consumer electronics, toys, and light industrial equipment. Operating within a voltage range of 2.4V to 48V, low voltage motor drivers offer precise control and energy efficiency for compact and portable devices. In the consumer electronics sector, these drivers play a crucial role in powering various household appliances and gadgets. Washing machines, vacuum cleaners, air conditioners, and blenders, among others, rely on low voltage motor drivers for efficient motor control.

Additionally, these drivers are integral to the operation of 3D printers, enabling precise positioning and motion control through SPI interface and firmware development. High-performance control is another key trend in the market, with applications in CNC machining and industrial equipment. Brushless DC motors, servo motors, and linear actuators benefit from real-time control, torque control, and closed-loop control, which are facilitated by motor driver boards. Motion control algorithms, embedded software, and size and weight considerations are essential factors driving innovation in the market. Power consumption, operating temperature, and thermal protection are also critical aspects, particularly in medical devices and other applications where safety and reliability are paramount.

Motion control applications extend beyond industrial and consumer electronics, with ethernet interface, CAN bus, and I2C interface enabling integration into complex systems. Overcurrent protection, overvoltage protection, and current sensing are essential safety features, while PWM control and voltage sensing optimize motor performance. The market is evolving to accommodate various motor types, including stepper motors and DC motors, as well as advanced control techniques like open-loop control and position control. With the increasing demand for automation and real-time control, motor driver boards are poised to play a vital role in the future of motion control technology.

The Low voltage motor drivers segment was valued at USD 1.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by various applications in industries and consumer electronics. In motion control applications, motor driver boards play a crucial role in precision positioning for CNC machining and 3D printing. The SPI interface facilitates seamless communication between microcontrollers and driver ICs, enabling real-time control of stepper motors, servo motors, and brushless DC motors. Firmware development and embedded software are essential for high-performance control, ensuring smooth operation and efficient power consumption. Industrial equipment, including linear actuators and medical devices, rely on motor driver boards for torque control, current sensing, overcurrent protection, and fault detection.

Size and weight considerations, along with motion control algorithms, are essential factors for designing motor driver boards for various applications. Power consumption and operating temperature are also critical aspects, especially for battery-operated devices. Advancements in communication interfaces, such as USB, I2C, CAN bus, and Ethernet, enable seamless integration of motor driver boards into complex systems. Overvoltage protection, thermal protection, and PWM control further enhance the reliability and safety of these components. The Asia-Pacific (APAC) region is a significant contributor to the market, driven by rapid industrialization and technological advancements in countries like China, India, Japan, and South Korea.

China, in particular, is leading the way with a substantial increase in electric vehicle registrations and the expansion of its manufacturing sector towards Industry 4.0. Motion control applications, including CNC machining, 3D printing, and industrial automation, are expected to continue fueling the demand for motor driver boards, as technology advancements and increasing automation drive growth in these sectors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motor Driver Board Industry?

- The surge in demand for electric vehicles (EVs) serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing demand for electric vehicles (EVs). In 2023, electric car sales reached 14 million units, accounting for 18% of all cars sold, marking a notable increase from 14% in the previous year. This growth is driven by the shift towards sustainable transportation options and supportive government policies in key markets. China remains a significant player, contributing 60% of global electric vehicle sales in 2023. The market is expected to continue growing as the adoption of EVs increases and charging infrastructure expands.

- The year-on-year growth in electric car sales was substantial, with an additional 3.5 million units sold in 2023 compared to the previous year, representing a 35% increase. This trend is expected to continue as the world moves towards more sustainable transportation solutions.

What are the market trends shaping the Motor Driver Board Industry?

- The trend in the market is toward new product launches. As a professional, I am well-informed about this developing trend.

- The market is experiencing significant growth due to the increasing demand for precision positioning in various industries. New product launches, such as STMicroelectronics' EVLDRIVE101-HPD, showcase the industry's dedication to innovation and versatility. Introduced on August 6, 2024, this compact 750W motor-drive reference board integrates the STDRIVE101 3-phase gate-driver IC, STM32G0 microcontroller, and high-efficiency MOSFETs on a 50mm circular PCB. Designed for home, industrial, and battery-powered equipment applications, the EVLDRIVE101-HPD supports flexible motor-control strategies and boasts advanced features like UVLO and overtemperature safeguards.

- With energy efficiency being a critical factor, this product consumes less than 1 microampere in sleep mode. The SPI interface, 3D printing compatibility, and support for a microSD card further enhance its functionality in modern applications. Firmware development is also facilitated by the high-performance control offered by the EVLDRIVE101-HPD, making it an attractive solution for CNC machining and other industries requiring fine motor control.

What challenges does the Motor Driver Board Industry face during its growth?

- Supply chain disruptions pose a significant challenge to the industry's growth trajectory, necessitating robust contingency plans and effective risk management strategies.

- The market experiences challenges due to supply chain disruptions, specifically concerning critical components such as semiconductors. These disruptions can significantly impact production and delivery schedules, as demonstrated during the COVID-19 pandemic and subsequent semiconductor shortages. Fluctuating availability and escalating material costs pose major concerns, potentially hindering market growth. A recent instance of such disruption occurred on September 26, 2024, when Hurricane Helene caused extensive damage to quartz mining operations in Spruce Pine, North Carolina. This region is essential as it provides 70-90% of the world's high-purity quartz, a crucial material for semiconductor manufacturing. Real-time control, torque control, and position control are vital features in motor driver boards, particularly for brushless DC motors and servo motors.

- Fault detection, closed-loop control, current sensing, and overcurrent protection are essential safety features. Ensuring a steady supply of these boards is crucial for industries reliant on motor control technology, including automotive, aerospace, and manufacturing.

Exclusive Customer Landscape

The motor driver board market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motor driver board market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motor driver board market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in the production of motor driver boards, encompassing a range of options including low voltage AC drives, medium voltage AC drives, DC drives, and controllers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Actuonix Motion Devices Inc.

- Adafruit Industries LLC

- Allegro MicroSystems Inc.

- Allied Motion Technologies Inc.

- Analog Devices Inc.

- CUI Inc

- Emerson Electric Co.

- Kollmorgen Corp.

- Lin Eng. Inc.

- maxon

- Nanotec Electronic GmbH and Co. KG

- Parker Hannifin Corp.

- Power Integrations Inc.

- Siemens AG

- SparkFun Electronics

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motor Driver Board Market

- In February 2023, Infineon Technologies AG, a leading provider of semiconductor solutions, introduced its new 650V and 100V automotive motor driver boards, expanding its portfolio for electric and hybrid vehicles (Infineon Press Release, 2023). These motor driver boards offer high efficiency, compact design, and integrated safety features, catering to the increasing demand for electric vehicles.

- In May 2024, Texas Instruments (TI) and ON Semiconductor announced a strategic collaboration to develop motor driver solutions for industrial applications (TI Press Release, 2024). This partnership aims to combine TI's power management expertise and ON Semiconductor's power discrete and logic offerings, creating innovative and efficient motor driver solutions for various industries.

- In October 2024, STMicroelectronics raised â¬200 million in a share issuance to finance its expansion in the motor driver market (STMicroelectronics Press Release, 2024). This investment will support the development of new motor driver products, manufacturing facilities, and research and development activities, strengthening STMicroelectronics' position in the market.

- In January 2025, NXP Semiconductors received regulatory approval for its new motor driver IC, the MCP-1720, in the European Union (NXP Semiconductors Press Release, 2025). This approval marks a significant milestone for NXP, as the MCP-1720 is a key component in electric vehicle powertrains, and the European market represents a significant portion of the global electric vehicle market. This approval further solidifies NXP's presence in the automotive semiconductor industry.

Research Analyst Overview

- The market encompasses various applications in industrial automation systems, motion control systems, and embedded system design. Data processing and testing & validation are crucial aspects of motor driver board design, ensuring fault tolerance and feedback control. PCB design plays a pivotal role in hardware selection, while system integration involves data acquisition and real-time operating systems. Motion control software, including PID control, BLDC motor driver, and servo motor controller, enables precise motion control. Compliance with safety standards and EMC regulations is essential, as is sensor integration for position feedback. Linear actuator drivers and stepper motor drivers cater to diverse actuation requirements.

- Remote control and wireless communication facilitate flexibility and ease of use. Human-machine interface (HMI) integration enhances operator interaction, while component selection and hardware design optimize performance. Hall effect sensors and industrial ethernet enable advanced features and seamless connectivity. Overall, the market continues to evolve, driven by advancements in technology and the growing demand for efficient and reliable automation solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motor Driver Board Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 2071.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.0 |

|

Key countries |

US, China, Japan, Germany, France, UK, India, Canada, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motor Driver Board Market Research and Growth Report?

- CAGR of the Motor Driver Board industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motor driver board market growth of industry companies

We can help! Our analysts can customize this motor driver board market research report to meet your requirements.